Holding onto your chosen investments for years or even decades is what it means to invest for the long term. What long-term investments are the best? The answer is totally based on your objectives and level of risk tolerance.

We will outline the top long-term investments in this guide for 2022. Additionally, we will walk you through the process of beginning a long-term investment and go over the top UK brokers you can use.

Best Long-Term Investments 2022

The key to long-term investing is choosing the correct investments and patiently holding them until you are ready to sell them to achieve your financial objectives. Below are our top picks:

1. Real Estate

In terms of sheer potential return, investing in real estate may be among your best long-term investments. Naturally, the market environment must be favorable, to begin with; despite the fact that the market as a whole is moving in the right direction, some places have experienced dramatic drops in property values.

The ability to use one property as leverage to purchase another is a wonderful feature of real estate transactions. Let’s say you’ve already paid off one rental property. You may obtain a second mortgage and utilize the proceeds to make down payments on numerous additional properties. You can quickly increase the number of rental properties you own, provided you have the financial means to pay all of those mortgages.

2. REITs

Investing in real estate can be costly. Even for a small house, you must put money aside for a down payment. Additionally, there can be unanticipated costs and repairs. If it transpires that you have problems renting a specific apartment, you can also go for a while without making any money.

An effective strategy for individual investors to benefit from the real estate market while reducing risk is through a real estate investment trust (REIT). Investing in a REIT is purchasing shares of a larger holding company that owns and manages properties, usually businesses. Although you won’t have the same level of control over your own private homes, you also won’t have any of the hassles.

3. Real Estate Crowdfunding

Real estate crowdfunding entails a community of investors pooling their funds, much like a real estate investment trust. Crowdfunding lets you choose the precise properties you wish to invest in, unlike REITs, which manage a variety of assets. But unlike REIT shares, which you can buy and sell whenever you choose, your investment in a crowdfunding project is often locked up for years.

You support the repayment of a private real estate loan through crowdsourcing. You receive recurring annual payments in exchange, which might equal up to 14% of your initial capital. In some cases, you may need to be an authorized investor. On the bright side, some platforms enable anyone to fund a real estate project with as little as a $500 investment.

4. High-yield Savings Accounts

Most alternative long-term investments will produce higher returns than a high-yield savings account. However, unlike stocks, bonds, and other financial products, the performance of a savings account is guaranteed. As a result, investing some money in savings is a sensible approach to protect yourself from sudden market declines and maintain an accessible emergency fund.

Choose an online bank when selecting a savings account. These banks are able to provide higher rates than traditional brick-and-mortar banks because they have reduced overhead.

5. Growth Stocks

Growth stocks are those with the best potential for substantial profits. These have typically been tech equities in recent years, although that isn’t always the case. For instance, recent years have been quite successful for healthcare equities. These are rapidly expanding companies that don’t pay dividends because they are too busy investing their profits back into the company.

Growth stocks carry greater risks than those of more established businesses along with higher potential returns. It’s possible that the stock is overpriced compared to what the company is currently worth. Even if the fundamental idea behind the business is sound, if growth stops, the stock price will fall.

Read: Best Growth Stocks you should buy in UK 2022

6. Stock Funds

Individual stock transactions need a lot of work. You must continually research the markets and the sectors in which you have investments. Additionally, you run a great deal of risk. You could lose money if the particular business you’re buying doesn’t succeed.

A straightforward answer to that issue is a stock fund. By pooling your funds with those of other investors, you can buy a range of equities through a stock fund. Some of these funds have a specific industry emphasis, while others are linked to an index, such as the S&P 500. This helps diversify your risk among a variety of investments, preventing you from placing all your financial eggs in one basket.

7. Bond Funds

In many ways, a bond fund and stock fund are comparable. The primary distinction is that you’re investing in a pool of bonds rather than a pool of stocks. You will receive a regular dividend as different bond payments come in for as long as your money is invested in the fund.

Bond funds and stock funds can be separated into two primary categories. A financial manager oversees mutual funds, which have a high minimum investment requirement. Exchange-traded funds (ETFs), which are exchanged on an exchange like normal stocks, are another option. According to your financial condition, you should choose the appropriate sort of fund.

8. Dividend Stocks

Growth equities contrast with dividend stocks. These are not rapidly expanding businesses, but rather well-established industry leaders with little room for expansion. Consider firms like Edison International, 3M, and Cheveron. These businesses are able to pay dividends to their shareholders because they don’t reinvest a large portion of their revenues.

Remember that no investment is risk-free. Despite being regarded as being safer than growth stocks, dividend stocks’ values can nevertheless rise or fall with the market.

Also read: Best Dividend Stocks You Should Buy in UK 2022

9. Value Stocks

Value stocks are securities that, when compared to particular valuation metrics, are undervalued. For instance, a company’s stock may be marked up much above where it ought to be given its price-earnings ratio. On the other side, growth stocks are typically expensive.

Value stocks typically do well during rising interest rates and typically outperform during recessions since they were initially discounted. These two elements make them a desirable investment for 2022.

Read: Best Value Stocks you should buy in UK 2022

10. Roth IRA

An exceptional kind of individual retirement account called a Roth IRA can help you save a tonne of money on taxes. Your contributions to a 401(k) or conventional IRA are made before taxes, which allows you to immediately save money. However, you are taxed on your withdrawals when you retire, including all of the profits you have accumulated over the years.

On the other hand, if you contribute to a Roth IRA with after-tax money, your immediate tax burden would be larger. However, your withdrawals will be tax-free until you retire. As a result, you can accumulate tax-free gains totaling hundreds of thousands of dollars over the course of your lifetime.

11. Small-Cap Stocks

Small-cap stocks, having a valuation of under $2 billion, are the smallest publicly traded businesses. Compared to equities of bigger, more established companies, these investments carry greater risks. Small-cap stocks, however, also offer tremendous growth potential. Apple and Amazon were both young, small-cap enterprises.

Read: Best Small-cap Stocks you should buy in UK 2022

12. Annuities

Annuities, that are insurance products, promise a certain payout sum after retirement. You make payments totaling a specified sum of money, typically over a number of years. After that, you start receiving a guaranteed annual income when you age 65. The fact that the money is guaranteed is a plus.

13. Robo-Advisor Portfolio

An AI-powered service called a robo-advisor manages your assets on your behalf. They work to maximize your earnings for a fee that ranges from 0.06 percent to 0.15 percent of your investment, much like a human financial manager would. Depending on how their software is developed, robo-advisors might be more or less aggressive.

14. Cryptocurrency

Without mentioning cryptocurrencies, any discussion of investments in 2022 would be incomplete. Few individuals would suggest investing in cryptocurrency as a short-term plan because of its infamously high volatility. However, the “big” cryptocurrencies have the potential for enormous growth in the long run.

Here are several methods for investing in this new asset if you’re interested:

- Crypto ETFs: These operate in a manner similar to conventional ETFs, but instead of buying a pool of stocks, you buy a collection of cryptocurrencies. Although it should be noted that this is not the same as owning the currency physically, the value of the ETF will fluctuate along with the value of the underlying cryptocurrencies.

- Crypto-related assets: Why not invest in stocks for cryptocurrency exchanges and other blockchain companies if you want to profit from cryptocurrencies without purchasing any yourself? They are less volatile than the actual coin, at the very least.

- Cryptocurrency itself: Purchasing a single coin is similar to purchasing a single share of stock. While you get the benefits of development, your risk is also centralized in one location. Positively, more and more businesses are now accepting cryptocurrency payments. You can even consider your crypto wallet as a second saving account if you don’t mind the danger.

15. Target Date Funds

Target-date funds are a great solution if you don’t want to manage your own portfolio. These funds become more conservative as you age, protecting your portfolio as you get closer to retirement and will need the cash. These funds progressively transfer your assets from riskier stocks to safer bonds as your target date approaches.

Target-date funds are a common choice in many employer plans, even though you can buy them outside of 401(k) programmes. When you select the year of retirement, the fund takes care of the balance.

Is it a good idea to invest in long-term investments?

A long-term investment is about wealth building, and a short-term investment is about capital preservation. It involves building an investment portfolio that will generate income for you over the long term, whether for retirement or achieving any other long-term financial objective. It’s crucial to build wealth to keep the level of income you’d need in the future if you want to live comfortably afterward.

Long-term investments do, however, come with a certain amount of risk in order to reap the benefits. It typically includes ULIPs, equities investments, etc. Riskier investment options, on the other hand, provide you an opportunity to recoup from market dangers as long as you stay invested for a longer period of time. In the following three or five years, it might decline by 20%, but in the following ten or twenty years, it might yield double-digit returns on investment. Assets also carry less risk, but the returns are either fixed or slow.

In order to achieve your long-term objectives and reap the desired benefits, you must give yourself the opportunity to overcome any short-term setbacks.

Best brokers to invest in Long-Term Investments?

The FCA brokers listed below can be used to invest in long-term investments to help you in the proper way.

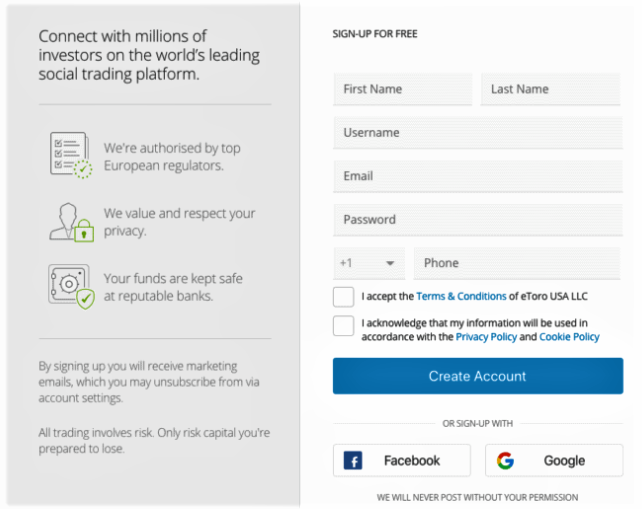

1. eToro

eToro is a trading platform with thousands of financial products that are governed by the FCA. With over 1,700 equities in their stock library, a sizable selection of CFDs, and a variety of cryptocurrencies, you can invest in mutual funds. The ETF sector of eToro is quite robust. In more than 150 markets, the site offers commission-free ETFs.

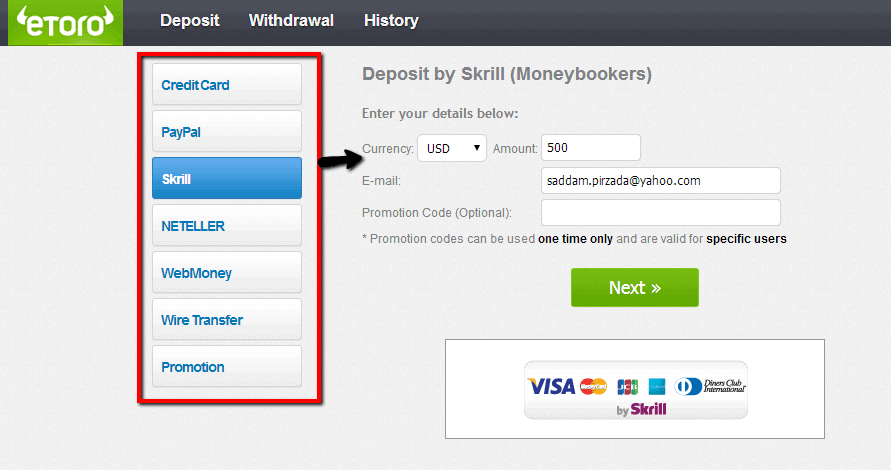

Simply give basic personal information while opening an account, and then deposit a meager $200. Making use of an e-wallet or UK debit/credit card, you can do this right immediately (Paypal, Skrill, or Neteller). The only charges to be aware of are a conversion cost of 0.5 percent and a withdrawal fee of $5.

2. Plus500

Those that want to actively trade should consider Plus500. This is so because CFD platforms exceed traditional brokers in terms of the range of trading instruments and features they provide. In a mutual fund of your choice, for instance, you can decide whether to go long or short on CFDs.

A fee-free trading platform is Plus500. Also free are deposits and withdrawals of money. Start with a £100 deposit that can be promptly replenished with a debit/credit card or PayPal. FCA approval is required for Plus500.

How to invest in Long-Term Investments?

Investing in financial instruments offered through the online broker eToro is the simplest way to do so. In this section, we’ll walk you through the eToro process of investing in stocks.

Step 1: Open an Account

Initially, visit the eToro website and click sign up to access the eToro platform. Along with giving some fundamental personal information, you will also need to select a username and password. The General Conditions and Confidentiality Policy should then be reviewed. Then select “Create Account.” You can access your eToro sample account using this process. You can explore the site extensively and test it out before adoption with this account.

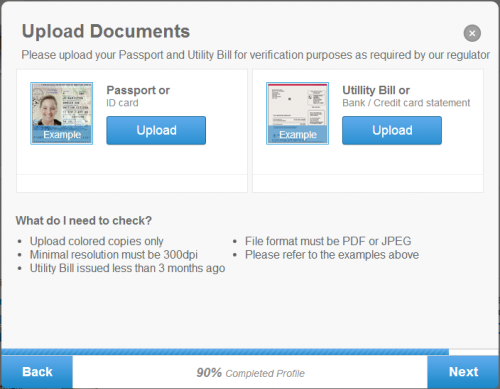

Step 2: Verify your account

For access to live trading, you must validate your account. Click “Full Profile” in the platform’s upper left corner to accomplish this. Many questions concerning your past experiences and goals in terms of trading and investing will be asked of you. Legal requirements force all regulated brokers in Europe to guarantee the suitability of the financial products they sell in relation to the customer profiles. Traders must present proof of photo ID.

Step 3: Deposit your funds

The amount for your investment must then be deposited. Click the Deposit Funds option to start the deposit process. Select the payment method, currency, and deposit amount that you want to utilize. then select “Submit” from the menu.

Step 4: Invest in Long-Term Investments

Your choice of long-term investment must now be made once your trading account has been fully funded. For instance, if you wish to buy stock, simply type its name into the page’s search field. As an illustration, we’re going to purchase Amazon stock.

Select the stock, enter your desired investment amount, and then click “Open Trade.”

Conclusion

For long-term wealth creation, you can invest in any of the aforementioned investment programs. It’s crucial to get guidance from a financial professional before you begin investing so they can assist you to keep track of your financial portfolio. To get to a decision, you may always conduct a search online, review market figures, examine historical returns, and read about other investors’ experiences. By doing so, you will be able to make well-informed investments and receive returns that will enable you to achieve your stated objectives.

Through the broker FCA eToro, you can invest commission-free in more than 3000+ tradable instruments with no recurring upkeep expenses. Alternatively, you could begin with a pre-funded $50 deposit. This is beneficial if you wish to begin modestly.

Frequently Asked Questions

What long-term investment is the best?

The elements that determine the optimum long-term investment are return expectations and risk tolerance. You should also be aware of whether this cash can be kept locked away for a long time or if you can quickly access them in an emergency.

What kind of investment carries the lowest level of risk?

The investment with the most diversified risk profile is the ETF. With this kind of investment, there is no chance of money loss. Due to the ECB’s long-standing policy of a 0% interest rate, the return is, nevertheless, minimal.

Which long-term investment offers the best chance of success?

Stocks offer the best return potential of any investment option, as we’ve shown in this guide. It is one of the riskiest investments, though. It takes significant understanding and extensive research to choose the best stock investment.

What is an investment fund?

A mutual fund usually referred to as an investment fund, is a collection of securities hand-picked by a management company to mirror a benchmark index. When you make an investment in a fund, you are actually buying the value of a collection of actively managed and hand-picked stocks or bonds.