Marketable securities that can be quickly turned into cash, often within five years, might be considered short-term investments. The extremely liquid assets known as short-term investments were created with the explicit purpose of offering a secure, short-term location to store the extra cash.

Not everyone should invest in the short term. They can occasionally be an attractive opportunity to make significant financial profits quickly, but they can also greatly test the emotions of traders and investors.

In this guide, we have mentioned the best short-term investments you can make in the market right now. Additionally, we will walk you through the process of beginning a short-term investment and go over the top UK brokers you can use.

What is Short Term Investments?

Short-term investments are intended to provide sizeable profits in a period of time as little as a year or a few months. These programs are primarily concentrated on covering the anticipated short-term expenses.

Most often, investors who favor short-term investments aren’t very interested in waiting years to see their money multiply several times over. They want rapid and efficient outcomes instead. Plans for short-term investments can save them in this situation.

One can anticipate the best returns possible with short-term investment plans to help them achieve their financial goals, but not the kind of significant returns possible with long-term investment possibilities. Short-term investment plans frequently top experienced investors’ popularity lists due to the decreased risks they carry.

Best Short Term Investments 2022

1. Stocks and shares

The stock market can still produce short-term benefits if the correct stocks are chosen, even if it may be thought of as a riskier investment than the others on this list. These are often purchased and held for less than a year, and their prices may change in response to seasonality, political unrest, or general economic conditions.

For instance, investors might profit from the Covid-19 problem by purchasing defensive stocks like Costco, Reckitt Benckiser, and AstraZeneca that have seen their value increase. As they all offer consumers necessary services and goods, their worth all increased quickly after the virus first appeared. Additionally, stock market revolutions like the rise of meme stocks like AMC Entertainment, BlackBerry, and GameStop in 2022 may benefit investors. These frequently experience erratic price changes and, with diligent monitoring, can bring investors consistent gains.

2. Short-term bond funds

Investing in corporate bonds with maturities of under five years is the major focus of a short-term bond fund. These accrue interest on a regular basis, typically twice a year. Any financial institution, including governments and organizations with a credit rating below investment grade, is permitted to issue short-term debt.

These types of bonds have a lower interest rate volatility than medium or long-term investments, yet they all react differently based on what they are made of. Some of them contain high-yield bonds, for example, which have a greater risk of default.. The Vanguard Short-Term Bond ETF, however, has proven that they historically outperform other bonds during market downturns.

3. Online savings account

Regular interest payments are typically made to savings account holders with online banks. According to estimates, the average interest rate is around 0.5 percent, which is a little more than a traditional bank or credit union, which may only offer rates as low as 0.01 percent.

You should look into which banks give the best interest rates and choose one that is simple to set up before beginning your investment adventure. The Financial Services Compensation Scheme (FSCS)* in the UK typically provides protection for savings accounts up to £85,000 per financial institution, not each account. In the event that your bank ended in failure, you would be reimbursed for any savings you had up to this sum.

4. Cash management account

If you own a cash management account (CMA), which is kept within a banking institution but is frequently not a bank or credit organization, you can control all of your short-term investments through one portfolio. This can apply to investments that are taxed, such as stocks, bond funds, mortgage payments, and other kinds of investments. Investors may complete all of these tasks simultaneously with cash management accounts without changing platforms or apps.

CMAs are frequently viewed as a substitute for regular checking accounts and online savings accounts. Given that they solely offer online services, some even offer higher interest rates and reduced fees. Due to this, some investors would like this kind of account while others might favor a more conventional strategy involving in-person meetings.

5. Certificates of deposit

A certificate of deposit is another type of savings account provided by a bank, credit organization, or other financial organisation. These are given to those who deposit money for a predetermined period of time at a predetermined interest rate, which may range anywhere between six months and five years. Interest is paid by the issuing bank in exchange. Investors may receive their initial investment plus any income generated when they finally cash in or redeem their CD.

The main differences between a certificate of deposit and a typical savings account are that a CD has a defined term and fixed interest rate. Additionally, they are insured for up to $250,000 in the US or £85,000 in the UK (thanks to the FSCS scheme*) (due to the FDIC scheme). They are among the safest ways to save money, but you should keep in mind that all investments have risks and shouldn’t be relied upon.

6. Government bonds

Government bonds are government-issued debt securities that provide a fixed rate of return for short-term investments in the United Kingdom. Until the bond expires, the issuing government provides the investor a fixed interest rate. When this mark is reached, the government gives the bondholder the bond’s face amount. Government bonds are referred to as treasuries in the United States, OATs in France, and bunds in Germany.

In terms of risk, this sort of investment can be positioned between shares and cash and may be more suitable for less risk-tolerant clients. Even though the FSCS does not cover govt bonds, some people could consider them to be similarly safe due to the government’s backing. One of the financial markets with the most liquidity is the bond market.

7. Money market account

An investor must make a minimum deposit in order to open a money market account (MMA), a form of deposit account. It varies from a conventional savings account in this way. These also frequently have higher interest rates, which some investors may find concerning owing to the danger of inflation, even though this risk is not the same for short-term investors as it may be for long-term ones.

A money market fund (MMF) is another class of short-term investment that bears the same term, despite the fact that the products differ substantially. This mutual fund makes short-term investments in corporate, municipal, and government bonds. Due to the lack of FSCS insurance, investors don’t typically view these as being as secure as MMAs, despite the fact that they do assist in diversifying your investment portfolio over a variety of securities.

8. Peer To Peer Lending

An alternative to traditional personal loans is peer-to-peer lending. By making loans available to people who wouldn’t otherwise be eligible for one, P2P lenders basically take over the role of banks. P2P lenders pick borrowers and offer them microloans, which they will subsequently return with interest.

Peer-to-peer lending offers a higher return on investment, but there is a chance that the borrower company won’t repay the loan, which could result in financial loss. Many savvy peer-to-peer lenders spread their capital across a significant number of loans. If someone is thinking about the best ways to invest money then they might invest $50 per loan among 20 separate loans as opposed to $1,000 in just one loan. So, even if one loan defaults, there are still 19 other loans to cover the shortfall.

One fantastic feature of peer-to-peer financing is that you receive monthly payments, which are made up of both principal and interest. In order to increase your prospective return, you’ll often have enough money after a few months to invest in other loans right away.

Advantages of investing in Short-term investments

Many short-term investments are safeguarded in a reputable bank or credit union and covered by financial organizations like the FSCS.

Government bonds and short-term bond funds trade on a market that is very liquid, with lots of buyers and sellers available to trade assets. This would imply that an investor might get the profits from their short-term cash investments more quickly.

You usually don’t need to make a big deposit to start a savings account, for instance, as they usually cost zero or very minimal to do so.

Disadvantages of investing in Short-term investments

Investing over the long term typically yields better rates of return. Long-term investors favor value stocks, growth stocks, and index funds or ETFs because of their ability to provide significant returns over a number of years, particularly when investing in hot stock market themes.

Some investors may instead opt to have a mix of short-term and long-term assets since they believe that a short-term plan may make it difficult to increase your total portfolio. This promotes a healthy balance between risk, asset diversity, and income frequency.

Best brokers to invest in Short-Term Investments

You need to register for an account with an internet broker before you may invest in short-term investments. There is a tonne of online trading platforms on the market. Before choosing a platform for a short-term investment, it is important to inspect it.

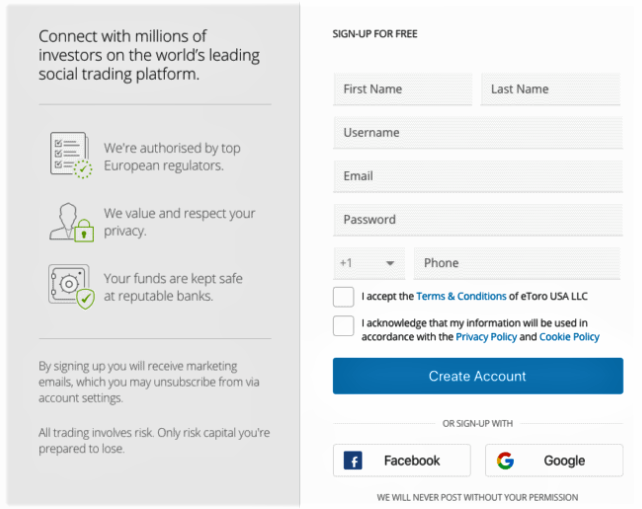

1. eToro

eToro has made a name for itself as a reliable, affordable, and user-friendly investment platform in the UK and across the globe. It serves as a one-stop shop for all kinds of short-term investment requirements. On eToro, you may find brokers for stocks, ETFs, commodities, forex, and cryptocurrencies all in one place. As a short-term investment strategy, you can wager on and invest in Deliveroo stocks. Some will probably be bought by eToro when they debut on secondary markets.

One fantastic aspect of eToro is that there are no fees associated with investing in some short-term investment options, such as stocks and ETFs. It also provides an excellent iPhone and Android attachments app.

2. Plus500

The London Stock Exchange lists Plus500, which has experienced rapid development. Insofar as it makes use of this product to get access to listed markets, Plus500 is a CFD broker. The programme offers modest transaction fees and is user-friendly. Deposits and rollovers on past due positions, such as futures contracts that are about to expire, are free. There are various short-term instruments listed on Plus500. This category includes a wide range of short-term investments, including equities, ETFs, and cryptocurrencies.

Also read: eToro vs Plus500- Which is better in UK 2022?

How to invest in Short-Term Investments?

It’s time to talk about how to invest in short-term funds now. You need to register for an account with an internet broker before you may invest in short-term funds. Since eToro seems to be the most all-inclusive broker overall, we decided to use it for investing in short-term investments.

Step 1: Open an account

It is a really easy process. You must first register for an eToro trading account in order to open the account. You must enter personal details such as your name, email address, and phone number in order to create an account. Every trader in the UK must comply with a legal requirement and complete KYC.

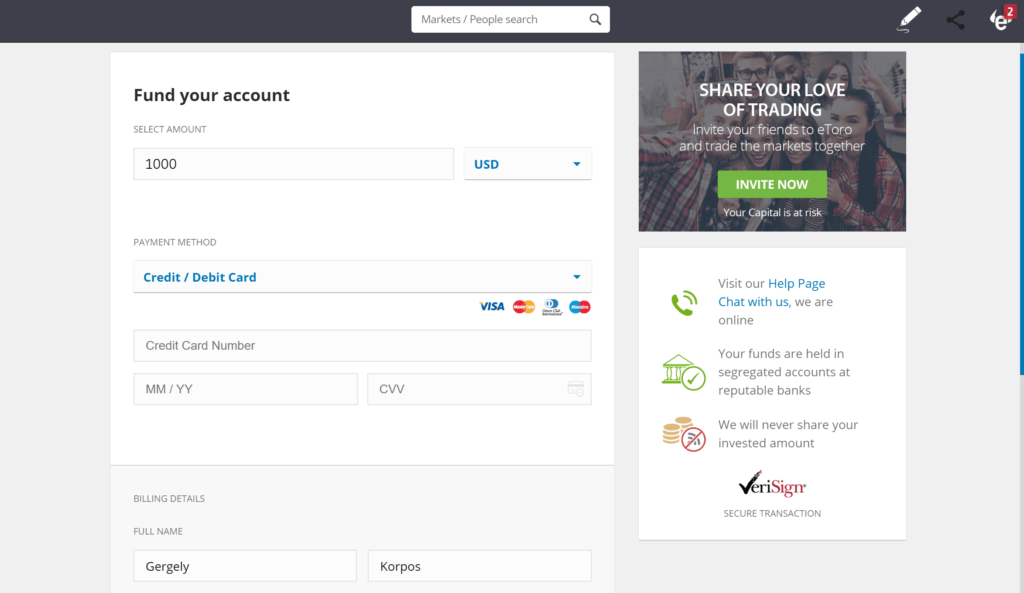

Step 2: Deposit the funds

You can make deposits once your account has been validated. The next step is to fund your account using one of the several payment options that eToro provides, including PayPal, bank transfer, Neteller, credit or debit card, or bank account. The deposit of the monies is free of charge.

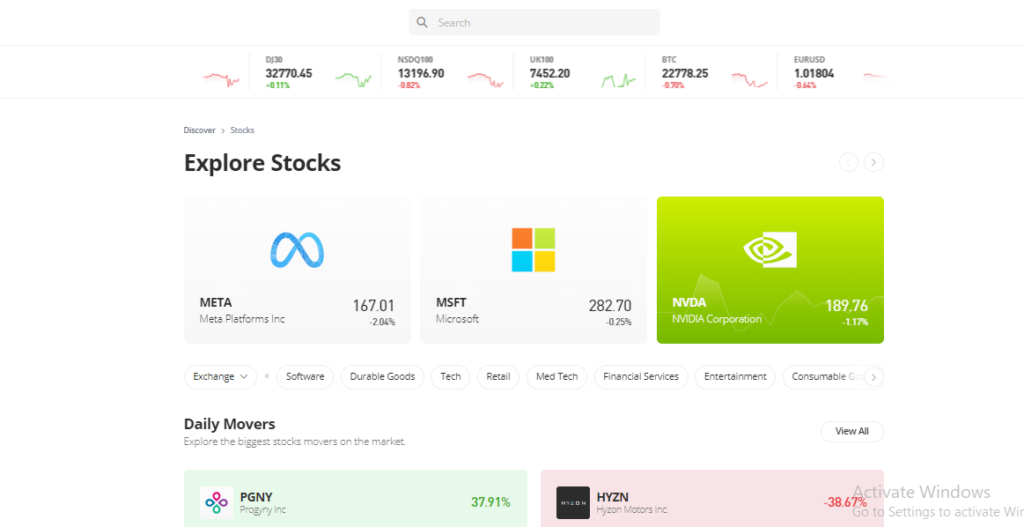

Step 3: Invest in Short-Term Investments

Once the capital has been deposited you can begin investing your money in investment instruments. Let’s say you invest in stocks.

To begin trading stocks, there are two options. The first is to simply look for the stock name using the search box at the top of the home page. Another choice is to choose all possibilities by selecting the “Markets” tab, followed by the “Stocks” sub-tab. You can further refine stocks at this level by sector or stock.

After selecting your stock, enter your desired amount, and then click “Open Trade.”

Conclusion

The finest investment is, above all, one that matches your profile and your goals. Additionally, it is a properly thought-out investment that takes into consideration some favorable aspects. The part of the asset you want to invest in that is closest to and furthest away. The asset type that has been chosen typically affects these factors. Always look through your investment and any potential risks.

Through an internet trading platform, investing in short-term funds is simple. Currently, eToro appears to be a really intriguing tool for investing in stocks, stock indexes, ETFs, forex, and commodities. This is your chance to create a portfolio that is incredibly diverse.

Frequently Asked Questions

Are short-term investments profitable?

As is frequently done by investors, short-term investing can be beneficial in a time frame of less than a year. However, compared to a long-term investing approach, it typically generates lower overall returns.

What makes a short-term investment?

Short-term investments are those having a time horizon of less than 5 years. Short-term investments are frequently made to be more solid, but in the end, timing is everything.

Are short-term investments risky?

They might be. There is no correlation between investment longevity and reduced risk. While some short-term investments (like savings accounts) are risk-free, others are very dangerous (like peer-to-peer lending).

Who should think about making short-term investments?

Anyone seeking a shorter investment period than five years. Even though it’s typical to believe those who are close to retirement may require a short-term investment, even young folks can profit.