AstraZeneca is a worldwide pharmaceutical and biotechnology business with British and Swedish roots. The business creates treatments for serious illnesses including inflammation, cancer, cardiovascular, gastrointestinal, and respiratory conditions. One of the biggest pharmaceutical businesses in the world is known as AstraZeneca.

Additionally, it manufactures the COVID-19 vaccination. The price of AstraZeneca shares has risen sharply since the COVID-19 vaccine was developed. As a result, it has drawn a lot of investors because they see a chance to purchase AstraZeneca shares.

This article will guide you step-by-step through the purchase of AstraZeneca stock. The outlook for AstraZeneca’s stock price in the present and the future will also help you decide if it is a sensible investment.

How to Buy AstraZeneca Shares: A Step-by-Step Guide 2022

If you take the quick actions outlined below, you can buy AstraZeneca stock in no time.

- Examine AstraZeneca Shares- This step is crucial, particularly when trading stocks because it will let you determine whether AstraZeneca is a sensible investment or not.

- Choose a Stock Broker- Before you can start trading, you must select a platform. There are a variety of brokers, each with their own features and fee structures, that provide access to UK shares. You can become confused as a result because you won’t know which side the finest to trade is with.

- Open an account– Make an account on your broker’s homepage. To register, you’ll need a working email address, username, and password.

- Verification– You must then upload any official documents you possess, like your passport or driver’s license.

- Deposit Funds – Use any way you like to add money to your account.

- Buy AstraZeneca Shares– In the search bar, type the ticker symbol or company name. Complete the transaction by entering the amount of your selected investment.

Examine AstraZeneca shares

The pharmaceutical business AstraZeneca is well-known. Its popularity has grown worldwide after it developed an effective COVID-19 vaccination. It is now motivating many investors, particularly UK investors, to purchase AstraZeneca stock.

This article includes a thorough analysis of the firm and its share price to assist them with the process. Providing a background check will assist investors in determining whether AstraZeneca shares are enticing enough to invest in. Furthermore, it will give suggestions regarding the company’s potential.

AstraZeneca Overview

Swedish Astra AB and the British Zeneca Group, two separate businesses, were combined to form AstraZeneca in 1999. Prior to the merger, Zeneca was the pharmaceutical branch of UK-based ICI, an agrochemical firm, and Astra AB was a Swiss pharmaceutical company. But in 1993, it separated from its parent firm, and in 1999, it merged with Astra AB. The goal of the merger was to increase the merged companies’ capacity for sustainable growth. The R&D headquarters of AstraZeneca are located in Sweden, the UK, and the USA, but the company’s headquarters are in London, United Kingdom.

Since the merger, AstraZeneca has ranked among the top healthcare firms in the world. In addition, it has acquired a number of businesses, including Cambridge Antibody Technology, MedImmune, Spirogen, and Definiens. Additionally, the business has invested a significant amount of money in research and development to produce drugs for conditions like cancer, infections, respiratory illnesses, cardiovascular disease, and digestive issues.

AstraZeneca Share Price History

AstraZeneca’s shares are principally traded on the London Stock Exchange and are included in the FTSE 100 Index. AstraZeneca has a market valuation of over $182.27 billion, ranking it as the 68th most valuable corporation in the world.

According to AstraZeneca’s share price history, the price has increased significantly over the previous 20 years. The shares were sold for roughly 2500 GBX when the company was first listed on the London Stock Exchange in 2004. The share price has since risen to nearly 8500 pence, nevertheless.

Given the rising popularity of AstraZeneca’s creation of the coronavirus vaccine, the share price reached an all-time high above 10,000 pence in July 2020. The business announced a collaboration with Oxford University to create a potential coronavirus vaccine candidate in late April 2020. The vaccine entered phase-2 and phase-3 trials by July. It increased the price to a record high of more than 10,000 pence. The business gained regulatory approval from European authorities for its coronavirus vaccine in January 2021.

The early months of 2021 saw pressure on AstraZeneca’s stock price as EU regulators halted the vaccine’s distribution out of concern for blood clots. However, in March, EU authorities authorized the vaccine’s distribution after concluding that there was no link between the shot and blood clots.

As a result of supply constraints and a finite amount of manufactured doses, the corporation was under some pressure. As a result, during that time, it caused a bearish correction in the price of AstraZeneca shares. The share price thus decreased from 10,000 GBX to 7000 GBX.

AstraZeneca Share Price 2022

However, in March of this year, the company’s share price began to rise. Since then, it has been increasing as a result of the growing demand for its vaccine candidate. Worldwide demand for vaccine shots has increased as a result of the rapid immunization deployment. The price of AstraZeneca shares ultimately grew as a result of the increased demand, which also increased vaccine sales and profit. Currently, the share price is 10,968 GBX.

AstraZeneca dividends

AstraZeneca has a fairly progressive dividend firm that is well-liked by UK dividend investors. The blue-chip stock typically distributes a generous dividend of 218 pence or a yield of over 2.8%. Even if AstraZeneca’s share price has increased, the dividend % is still quite high when compared to other UK corporations that pay larger dividends.

Many businesses all throughout the world cut back on their dividend payouts during the coronavirus outbreak. However, AstraZeneca is one of the select few businesses that has increased its dividend yield during the coronavirus pandemic. It implies that dividend-seeking investors may find AstraZeneca shares to be highly alluring as a purchase

AstraZeneca Shares P/E Ratio

Investors can use the P/E ratio to compare the market value of AstraZeneca’s shares to its earnings. A high P/E ratio suggests that a stock may be overvalued because its price is high relative to its earnings. On the other side, a low P/E ratio may suggest that the current stock price is reasonable in light of earnings.

To put it simply, you can find out how much the market is prepared to pay for AstraZeneca stock based on the company’s past and future earnings.

The “trailing price/earnings ratio” for AstraZeneca is approximately 1687.58 when the company’s current share price (10594.80) is divided by its per-share earnings (EPS 0.06) over a 12-month period. In other words, the share price of AstraZeneca is currently 1687.58 times recent earnings. For example, the trailing 12-month P/E ratio for the NASDAQ 100 at the end of 2022 was about (37.69).

Investors can use the P/E ratio to estimate a stock’s market value in relation to its earnings. A high P/E ratio suggests that a stock may be overvalued because its price is high in relation to its earnings. On the other hand, a low P/E may suggest that the current stock price is reasonable given the company’s earnings.

Market Capitalization

The total number of outstanding shares multiplied by the share price of AstraZeneca yields the AstraZeneca market capitalization of a particular AstraZeneca stock. A company’s market value is $50 million if it has one million outstanding shares with a price of $50 each. Market capitalization for AstraZeneca is $200 Billion.

Knowing AstraZeneca’s market cap enables you to evaluate the company in relation to other businesses of a similar size in its sector; market cap has more significance than the share price. It is inappropriate to compare a large-cap corporation with a market value of $10 billion to a small-cap company with a market capitalization of $500 million.

Best Trading Platforms for AstraZeneca Shares

The simplest way to purchase or sell AstraZeneca shares in the UK is by signing up with an online stock broker.

But picking the appropriate stockbroker is important because it will affect your investment.

The two stock brokers listed below are the best in the UK and come highly recommended for online purchases of AstraZeneca shares because they are registered with the Financial Conduct Authority (FCA).

1. eToro

From its base in the UK, eToro is a broker that never charges any commissions. With more than 800 equities available from across the world, it is one of the leading brokers in the UK. Since its first introduction in 2007, it has increased the scope of its operations across the UK. In the UK, eToro is a well-known stockbroker with over 13 million active traders.

Shares of businesses that are listed on the London, New York, and Tokyo Stock Exchanges are available on eToro. Additionally, it doesn’t charge its investors any commission fees. eToro is affiliated with the FSCS and has licenses from FCA, ASIC, and CySEC. This platform enables leveraged trading with low margin requirements through CFDs as well as a conventional method of purchasing shares.

It means that by utilizing eToro, investors can save monthly/annual fees in addition to the advantages of commission-free trading. The broker offers trading on more than 1700 stocks across 17 international stock exchanges, including the London Stock Exchange (LSE), making it possible to purchase AstraZeneca shares online in the UK.

eToro gives investors the option to trade shares using CFDs in addition to the conventional mode of purchase. They are able to leverage up to a 5:1 ratio. By using this strategy, investors can trade with a volume that is up to five times bigger than the account’s actual balance.

2. Plus500

AstraZeneca Shares with a spread of 1.25 or 0.07 percent and a 0.5 minimum deposit available through the CFD trading platform Plus500.

You can access the shares of about 500 firms on this site. Additionally, it permits you to use a leverage ratio of up to 5:1 on AstraZeneca Shares. Advanced charting software, an economic calendar, a risk management instrument, and a pricing alerts feature are all included in the platform.

The FCA oversees the platform. As a result, it ensures that none of the cash belonging to its traders is ever compromised. The London Stock Exchange lists its parent business. On this platform, creating an account takes very little time. You only need to input a few simple pieces of information, go through a verification process, and make a deposit. You can use PayPal, debit/credit cards, bank transfers, or this platform to make deposits.

How to buy AstraZeneca Shares?

You have made the decision to buy AstraZeneca AZN stocks. Since eToro is our preferred trading platform for a variety of reasons despite the fact that there are thousands of trading platforms available, we are using it as an example to help you learn how to purchase AstraZeneca shares. The step-by-step instructions that are provided here will help you understand exactly how to buy AstraZeneca Shares with eToro.

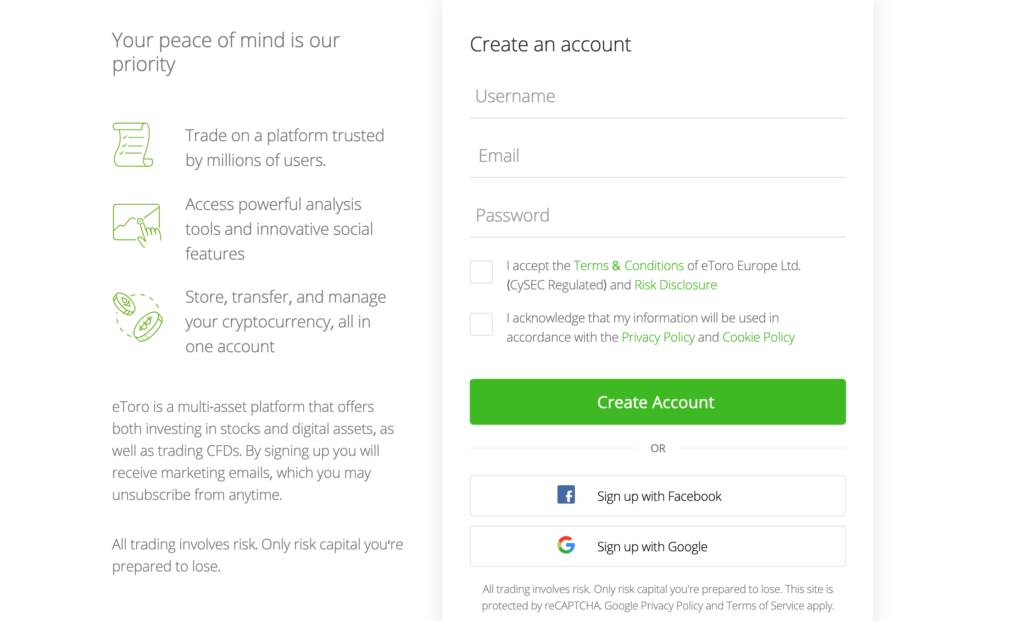

Step 1: Open an account

The first step in purchasing AstraZeneca stock is to register for an account on the official eToro website. You must first register by completing a registration form with your basic information, including your name, phone number, and email address, as well as choosing a secure password. Make sure you accept the terms and conditions after entering all of your information.

eToro will request that you verify your identity by uploading some of your documents; but, don’t worry, your documents are completely secure on this platform. However, you will not be required to go through verification until you deposit more than $2,250 or seek a withdrawal.

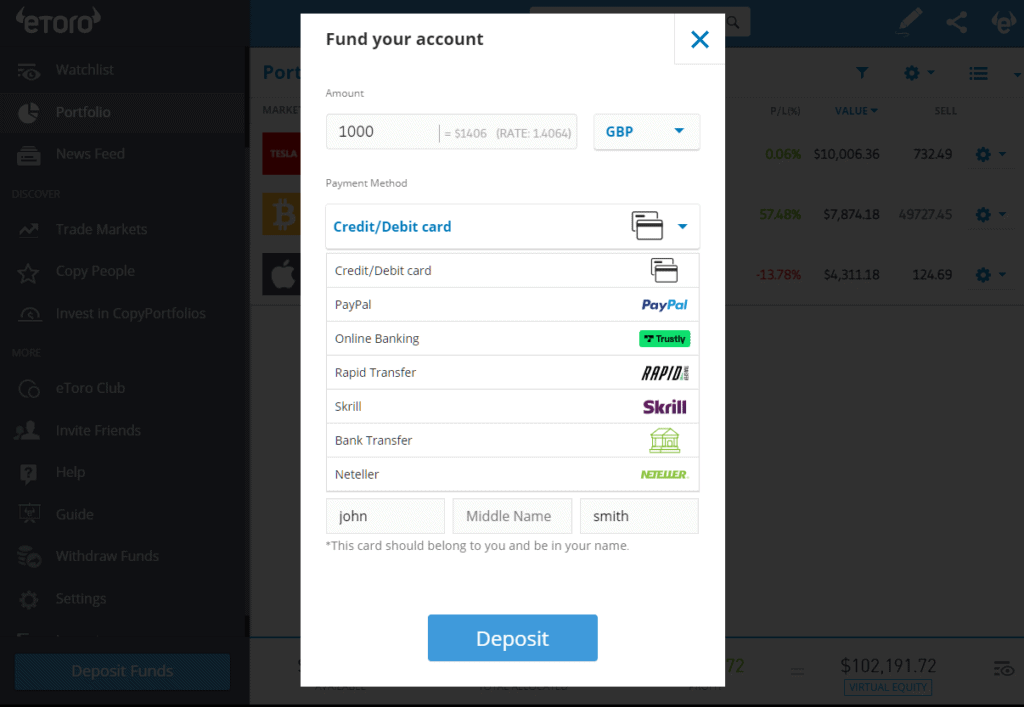

Step 2: Fund your account

Now that you’ve successfully registered on this site, you can fill your account with a minimum deposit of £160. This funding amount is not the robot’s charge, but rather the working money required by traders to execute transactions.

eToro provides many payment ways for the convenience of its traders, and you can use whichever option you like. eToro accepts Debit/Credit Card, PayPal, Skrill, Nettler, and Bank Transfer as payment methods.

Step 3: Place your order

You are now prepared to purchase AstraZeneca Shares after successfully registering and funding your trading account. Simply type “AstraZeneca” or “AZN” into the search bar at the top of the page to get started, and then click the result that pops up in front of you.

Then, to purchase your AstraZeneca shares, select the “Trade Button,” enter the required amount, and then click “Set Order.”

Conclusion

Shares of AstraZeneca have increased significantly during the previous 20 years. Investors, traders, and analysts have flocked to it. The industry titan in pharmaceuticals intends to create more medications. As a result, it has been increasing its R&D budget, which puts the position of the biotechnology company at greater risk.

The company has a great possibility of success in the future with 167 active projects. Its future is also well-represented by the expanding demand for its COVID-19 vaccination and the increased sales of cancer treatments. Additionally, eToro’s commission-free service makes it simpler for investors to make bigger gains with AstraZeneca. Investors can generate significant returns from their modest initial investments in this fashion.

Frequently Asked Questions

Is AstraZeneca stock a good investment for 2022?

One of the major businesses making COVID-19 vaccines is AstraZeneca. As a result, if you’re looking for a terrific investment opportunity in the healthcare sector, this might be it.

Is AstraZeneca a successful company?

Profitable business AstraZeneca has routinely posted net profits for many years. It most recently reported $3.22 billion in net profits for Q1 2022.

Can I profit from trading AstraZeneca shares?

Yes, AstraZeneca’s high level of daily volatility and trading activity are both positive. At the same time, given its consistent dividend payments, it can be a fantastic choice for long-term investing.

What time does the AstraZeneca stock trade?

The trading hours of the exchanges where it is listed are observed by AstraZeneca. For instance, its stock on the LSE is traded from 3 to 11 in the morning (ET).

Where is AstraZeneca listed on the exchange?

The London Stock Exchange and NASDAQ both list AstraZeneca.