Investors are looking for defensive stocks that provide stability and returns as a number of dangers threaten the prospects of the global economy. A key element of effective investing is spotting trends and trading in the same direction. Even the finest defensive stocks may not necessarily see a price explosion, but they can safeguard the gains made during the boom years.

This guide lists the best 10 defensive stocks for 2022 using fundamental research criteria including dividend income and P/E ratios. It also explains how to buy defensive stocks without paying a fee.

Best Defensive Stocks 2022

Here is a list of the best defensive stocks for 2022:

- Berkshire Hathaway (NYSE: BRK.B)

- Direct Line Insurance Group (LON: DLG)

- General Dynamics (NYSE: GD)

- Uranium Energy (NYSEAMERICAN: UEC)

- Apple (NASDAQ: AAPL)

- Unilever (NYSE: UL)

- British American Tobacco (LON: BATS)

- J Sainsbury (LON: SBRY)

- Coca-Cola Company (NYSE: KO)

- PepsiCo Inc. (NASDAQ: PEP)

Best Defensive Stocks Analysis

Berkshire Hathaway (NYSE: BRK.B)

Because of its investment philosophy and long history of upholding its objectives, Berkshire Hathaway shares stand out as one of the finest defensive stocks. Purchasing shares in BRKB entails investing in both a diverse portfolio of hand-selected cheap stocks with excellent long-term potential and the investment philosophy of renowned investment guru Warren Buffet.

In his flagship investment vehicle, a $1,000 investment made in May 1992 would be worth $15,820 in April 2022. In addition, the standard deviation of price volatility was lower than the market average for the previous 30 years (13.10% vs. 14.94%), indicating less volatility overall.

During market downturns, that standard deviation’s comparatively low value is useful. For instance, Berkshire Hathaway saw a peak-to-trough price decline of 28.6% during the Covid pandemic in March 2020, which is far less than the +34% price decline the S&P 500 index experienced over the same time period.

With a beta of 0.83, BRKB has less price volatility than the S&P 500 and any passive “tracking” funds that attempt to mimic the performance of the index.

Direct Line Insurance Group (LON: DLG)

Investors may profit from a potential triple-whammy by purchasing the insurance company, Direct Line. The first is the incredibly alluring 7.85% dividend yield. The business fundamentals imply that income distributions to shareholders will remain stable regardless of the status of the economy, and passive income on that scale simply cannot be disregarded. The legal obligation for car insurance in the UK, which can only be avoided by turning over the keys, is the second appealing aspect of DLG stock. As a matter of fact, the insurance sector is prepared to withstand a rise in living costs.

The third possible driver for Direct Line Group is the upcoming insurance market reforms, which also contribute to the company’s reputation as one of the top defensive stocks in the UK. Winners and losers will be affected by the changes to the pricing of policy renewals, and Direct Line, one of the strongest brands in the insurance industry, already has a solid reputation for upfront pricing. As a result, the business might seize the opportunity to grow its market share.

Even in the best of circumstances, investors are attracted to opportunities with the potential for capital development and a steady source of passive income. Given the increased likelihood of an economic crisis, Direct Line’s defensive qualities make it a stock that might be too excellent to pass up.

General Dynamics (NYSE: GD)

One of the finest defensive stocks takes into account governments increasing spending on military gear given the spike in geopolitical risk since the beginning of 2022. General Dynamics, a US-based stock, is involved in the production of tanks, defense IT, and ships. Even in the absence of further political ambiguity, the share price history suggests that it would be a wise investment.

In the first quarter of 2022, although worldwide stock indices were falling, the price of GD shares was rising. As of August 20, 2022, General Dynamic stock had increased 13.43% year to date, while the Nasdaq 100 index had declined 21.07%.

Uranium Energy Corp (NYSEAMERICAN: UEC)

One of the best methods to survive a recession is to invest in utility companies, such as those related to the delivery of energy. Consumer spending can be significantly affected by inflationary pressures, although heating, lighting, and electric vehicles are some of the last purchases to be reduced.

A US-based corporation called Uranium Energy Corp. mines uranium and supplies the fuel for nuclear power reactors, which generate 19.8% of the nation’s electricity. Nuclear energy has become more popular once again as a result of the move away from carbon-based energy sources since it provides the base-load capacity to supplement solar, wind, and tidal energy sources.

Government support for these more compact nuclear power facilities is expected to lead to an increase in the number of Advanced Small Modular Reactors (SMRs). SMRs employ technology that is comparable to that of nuclear submarines, which have been in operation for many years. While there will always be opponents of nuclear power, SMRs are less well-known than large-scale pressurized water reactors (PWRs). Due to the weather dependence of renewable energy sources and the ability to guarantee continuous power supplies provided by SMRs, uranium consumption is expected to rise. The US Office of Uranium Management and Policy, which designates domestic uranium supply as a key resource, offers protection to UEC, making it particularly alluring.

Apple (NASDAQ: AAPL)

Apple shares had a spectacular 360% value increase in the three years between December 2018 and December 2021, demonstrating that defensive companies aren’t always underperformers. A barrier to entry for potential competitors is created by the power of the Apple brand and the ecosystem in which its numerous products are interconnected, leading to the firm’s income streams continuing to grow.

The annual sales growth was 5.49, 34.14, and 29.53 percent in 2019, 2020, and 2021, respectively. Sales of Apple’s high-end products, like iPhones, are at risk due to inflationary pressures and a squeeze on living expenses. However, because of intelligent design, it can be challenging for Apple users to abandon the widely used selection of products bearing the i-brand. As a result, Apple has a very amazing 92% customer retention percentage compared to Android consumers’ 72% retention rate.

Learn more: How to buy Apple Shares UK – Easy Guide

The P/E ratio of 28.9 for Apple is relatively low for the technology sector, and the 0.541% dividend yield is a pleasant bonus for investors, but the company’s $2.6 trillion market capitalization and status as the largest listed company in the world solidify its spot on any list of defensive stocks.

Unilever (NYSE: UL)

Unilever, a maker of consumer goods, is one of the top defensive stocks in the United Kingdom. The multinational is impressively valued at £93 billion, and its clientele is diverse in terms of industry and geography. 3.4 billion people every day use the company’s 400+ brands in more than 190 nations.

Although Unilever is not immune to the prospect of a worldwide recession, the market for essentials like food and cleaning supplies is generally stable. The company has solid sales and distribution networks as well as a portfolio of premium brands, including Lipton’s tea and Domestos.

Lack of growth opportunities is one of Unilever’s biggest problems, and the market was alerted by the company’s unsuccessful £50 billion bid for GlaxoSmithKline. The high-profile nature of that failed bid put downward pressure on the price of UL stock, but the negative information has since been factored in. An opportunity to purchase a large-cap multinational in a safe industry with a P/E ratio of just 15.6 and a dividend yield of 4.06% is currently presented by investing in Unilever.

Also read: How to Buy Unilever Shares UK- Complete Guide 2022

British American Tobacco (LON: BATS)

British American Tobacco, with headquarters in the UK, has endured many difficulties over the years, but it still provides investors with a foolproof means to manage volatile markets. The company expanded into vaping and glo-related products as a result of the long-term trends away from smoking, and not even the Covid-19 pandemic could sway BAT from its course. Despite widespread expectations that revenues will decline in 2021 due to growing health concerns, the company was nonetheless able to boost shareholder dividends by 2.5%.

BAT is known for growing its dividend payout every quarter for the past ten years, which is tempting to investors trying to lock in consistent income gains. BAT distributes its dividend once every three months.

The fundamentals of a £74 billion market cap, a P/E ratio of 10.7, and profit margins of 26.7% are ones to strive for, and they are largely the result of institutional investors having to take into account the “political sensitivities” related to investing in tobacco companies. Purchasing BAT shares look like an obvious approach to protect wealth for retail investors facing the possibility of a recession without being constrained by corporate governance duties.

J Sainsbury (LON: SBRY)

Although the grocery/supermarket industry is a safe refuge in any economic storm, the second-largest retailer in the UK confronts many issues. The stock was trading close to the bottom of its 222p–342p 52-week trading range during the first trading sessions of May. Consequently, investing in Sainsbury’s provides exposure to a generally stable industry and provides a company with a P/E ratio of 13.8 and a dividend yield of 3.98%.

As household budgets become more constrained, discount shops appear likely to thrive, but J Sainsbury PLC has a historical record of avoiding that threat. That is large because the business resisted the urge to compete on price alone. Sainsbury is the largest Fairtrade retailer in the world and reflects the culture’s present emphasis on CSR and ESG.

The difficulties Sainsbury’s faces are real, but they appear to have already been factored in, making it one of the best defensive stock buys in the UK.

Also read: Best Supermarket Stocks You Should Buy In UK 2022

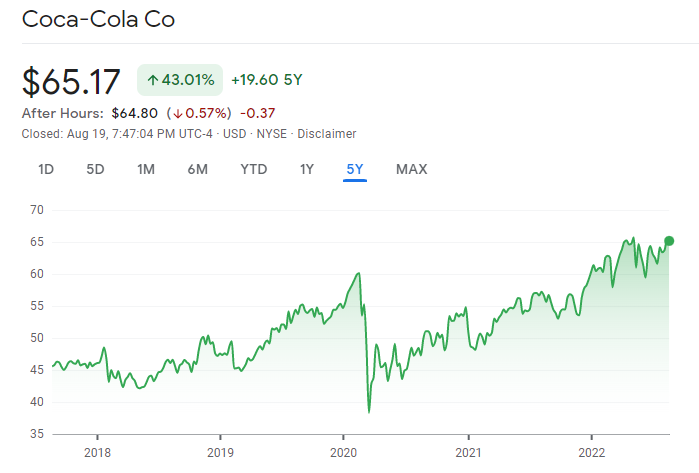

Coca-Cola Company (NYSE: KO)

The Coca-Cola Company has long been a well-liked investment in the consumer defense sector. Top brands of the company, like Coca-Cola itself, are well known worldwide and don’t quickly lose value when the market swings lower.

The third-largest defensive stock on our list, Coca-Cola has a market capitalization of roughly $221 billion. With a current dividend yield of 3.27%, it is a desirable income investment. Notably, Coca-Cola had nearly enough cash on hand to cover the entire year’s payout when the COVID-19 pandemic struck.

Additionally, Coca-Cola has paid dividends on time for 58 straight years. So, even during a recession, you can relax knowing the dividend is secure.

PepsiCo Inc. (NASDAQ: PEP)

Volatility typically works against defensive stock investors. Due to this, PepsiCo stands out as one of the US defensive stocks with some of the lowest monthly volatility. Since PepsiCo’s monthly volatility is only 1.63%, it rarely experiences monthly price changes of more than 2% either way.

Additionally, this stock has a dividend yield of 3%. The fact that PepsiCo resembles a bond more often than a stock makes its shares an extremely appealing low-risk investment.

In the long run, PepsiCo has also produced growth. The shares have increased 60% over the last five years, or 10% annually on a compound basis.

How to buy Defensive Stocks?

In the sections below, we’ll show you how to invest in defensive stocks.

Step 1: Choose a broker

Anyone can acquire shares in any of the business on this list of reputable defensive stocks to purchase in the UK by using the facilities of one of the two below listed top rated stock brokers.

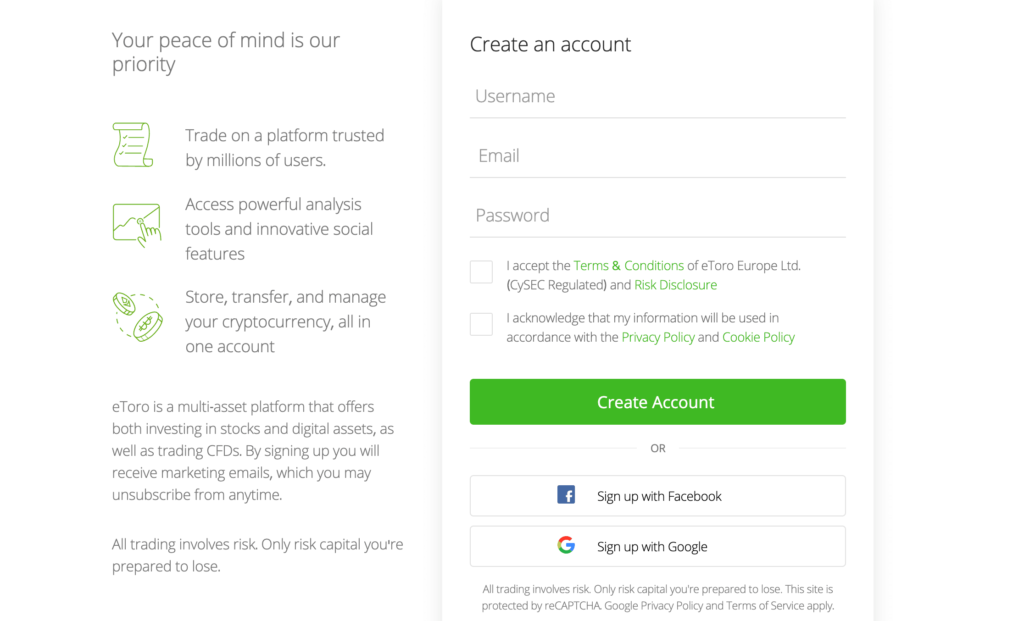

1. eToro

A well-known social trading platform, eToro, was established in 2007 and offers access to thousands of various financial assets, including stocks, cryptocurrencies, indices, and ETFs. Any of the best defensive stocks in our list, as well as almost 2,000 other kinds of shares, can be purchased instantly on eToro. Another benefit is that you can invest directly by buying shares or indirectly by using contracts for difference (CFDs).

One of eToro’s key benefits is the absence of commission fees for stock purchases and sales. As a direct consequence, creating a portfolio of diversified defensive stocks is far less expensive. The broker will charge a spread, but it is typically not very high.

To observe what other savvy investors are doing, you can use the program’s social trading features. With eToro’s copy trading feature, you may even mimic the actions of more seasoned stock traders.

eToro is governed by the FCA of the United Kingdom.

2. Libertex

A CFD brokerage with headquarters in Cyprus, Libertex provides a range of products, comprising stocks, currency, exchange-traded funds, indices, and commodities. This firm distinguishes out due to the minimal spreads it offers for CFD trading.

Libertex offers the best MetaTrader 4 trading platform, which more seasoned traders frequently prefer due to its challenging learning curve. You may follow price changes and keep an eye on the whole stock market with the help of a news feed and an economic calendar.

One drawback of Libertex is that there are just roughly 50 stocks available for trading, with the majority coming from the United States. Although several of the defensive stocks we found are tradeable with Libertex,

Libertex is governed by the CySEC, one of Europe’s top regulators.

Step 2: Open an Account

We’ll assist you in acquiring defensive stocks by guiding you through the procedure with eToro, our top stock broker choice.

The very first step in signing up for eToro is to select the “Join Now” button located in the upper right corner of the firm’s official website.

The next step is to register with the platform by giving personal details such as your first and surname name, email address, and password.

Step 3: Verify Your Identity

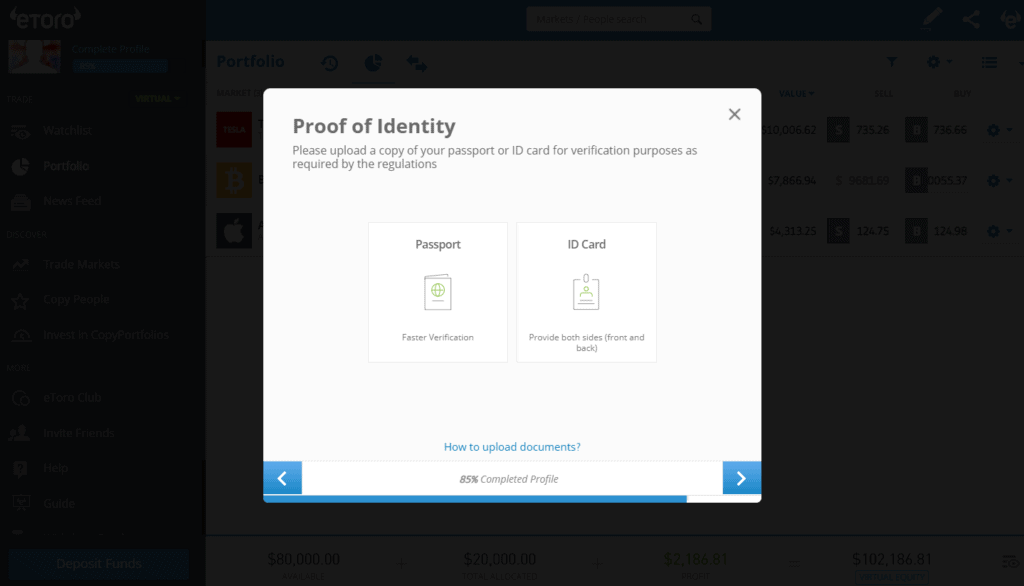

You will need to provide a valid ID and either a utility bill or a bank statement to verify your address after opening an account with eToro.

If your total deposit will be less than £1,800, you can complete this step after enrolling. However, you must complete it before you can request your first withdrawal, so it would be wise to do it right away.

Step 4: Deposit Funds

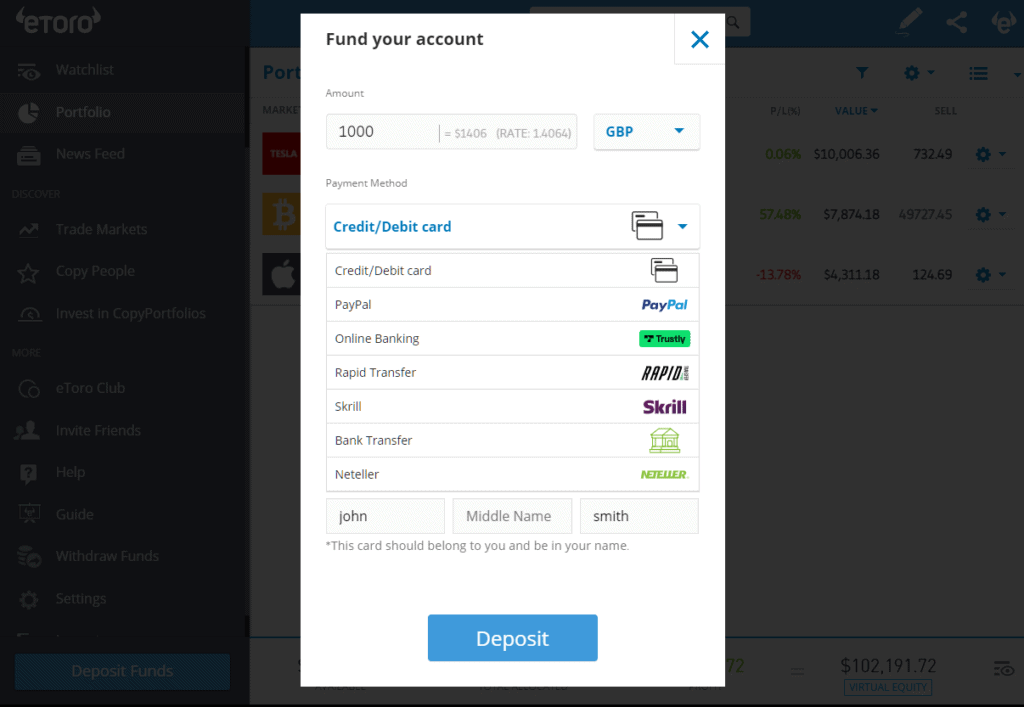

Make a deposit into your account following that. With eToro, you can fund your account in any of the supported methods which include Debit/Credit card, E-wallets like PayPal, Neteller, and Skrill, and also Bank transfers.

Step 5: Buy Defensive Stocks

Enter the identity of the defensive stock you want to buy in the search box in the trading interface’s top corner.

You will be sent to the stock’s particular page after selecting on the company name, where you can learn more regarding it, its financial results, and use a charting feature to see the most latest price movement.

To complete the purchase, enter the desired investment amount after clicking the blue “Trade” button in the interface’s upper right corner. To complete the purchase of your first defensive stock, click “Open Trade.”

Conclusion

Although defensive stocks may not have the same high potential for returns as some of the finest growth stocks, “moon shot” stocks have their own set of dangers. The finest defensive stocks have a place in any portfolio due to their relative security. As there are fewer shocks, investing in them might provide a more hands-off approach to investing. This also helps cultivate a good trading mentality by removing some of the emotion from trading.

The primary potential drawback of building your portfolio around the defensive sector if you’re new to trading is FOMO, but caution is a virtue, especially in uncertain times. With the outlook for the global economy dimming, making an investment in a field that promises higher returns than holding cash seems like a wise choice.

Utilizing one of the platforms from our list of reputable brokers will help you work with a company that prioritizes client protection; operational risk must also be taken into account. The best place to start investing in defensive stocks is on eToro.

Frequently Asked Questions

How can defensive stocks aid in my financial success?

There are two methods to make money with defensive stocks. Price growth is the first, and dividends are the second. In the meanwhile, you can make money if the value of your stock increases. However, such earnings will be regarded as unrealized gains up until the point at which you sell your shares and end your position.

How much will building a defensive stock portfolio cost?

The good news is that eToro allows you to build a defensive stock portfolio free of trading commissions. This is why we suggest it.

Are defensive stock investments worthwhile?

To diversify their portfolios and lessen the risks associated with more growth-oriented investments, many investors choose defensive stocks. Additionally, it can help with portfolio diversification. Although no stock, no matter how reliable it might seem to be, can guarantee a profit, all investments are risky.