Investors are drawn to casino stocks for a variety of reasons. Isn’t gambling stocks the best stocks industry there is? In fact, the space always comes out on top.

In most cases, these companies are experiencing rapid earnings growth. Furthermore, the majority of these equities distribute dividends to investors.

In light of the foregoing, we have included information on where and how to invest in casino stocks in this article, along with a selection of the Best Casino Stocks You Should Buy in the UK by 2022.

Best Casino Stocks 2022

It is challenging to decide which casino stocks to invest in because there are thousands of casino stocks listed on the NYSE, LSE, and NASDAQ stock exchanges. The top 10 casino stocks to buy in 2022 are listed below:

- MGM Resorts (NYSE: MGM)

- Las Vegas Sands (NYSE: LVS)

- Wynn Resorts (NASDAQ: WYNN)

- Penn National Gaming (NASDAQ: PENN)

- DraftKings (NASDAQ: DKNG)

- Caesars Entertainment (NASDAQ: CZR)

- International Game Technology (NYSE: IGT)

- Melco Resorts & Entertainment (NASDAQ: MLCO)

- Red Rock Resorts (NASDAQ: RRR)

- Boyd Gaming Corporation (NYSE: BYD)

Best Casino Stocks Analysis

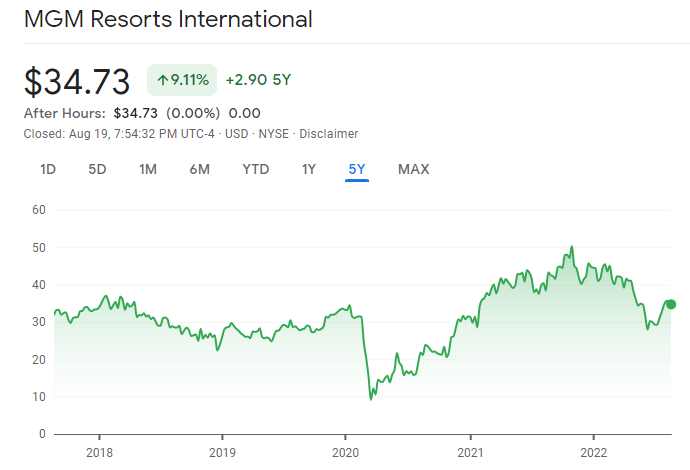

MGM Resorts (NYSE: MGM)

One of the most spectacular portfolios of properties in the casino sector belongs to MGM. The Bellagio, MGM Grand, The Mirage, Luxor, and New York-New York are just a few of the well-known casino resorts it owns. It also has properties in Atlantic City, Detroit, and Mississippi. Additionally, it owns 56% of each of the MGM Macau and MGM Cotai casinos in Macau.

In comparison to many of its competitors, it is more vulnerable to Las Vegas tourism because almost two-thirds of its 45,000 hotel rooms are on the strip.

When the pandemic initially hit in March 2020, MGM’s stock crashed, but thanks to an investment from IAC and a shift to internet gaming via BetMGM, it has since recovered to post-financial crisis highs. It opened sportsbooks at a number of its locations in 2021 and began offering online betting in a number of states. Adjusted EBITDA is already higher than pre-pandemic levels as of the third quarter of 2021, creating momentum for the post-pandemic era.

Las Vegas Sands (NYSE: LVS)

The best place to place your wagers on Macau is at Las Vegas Sands. The firm is only interested in the Asian market, and has five casinos in Macau as well as the Marina Bay Sands resort in Singapore. It compensated a private equity firm $6.25 billion in March 2021 to purchase its Las Vegas businesses, comprising the Venetian.

Unfortunately, the pandemic strategy of concentrating on Asia backfired as traffic to Macau plummeted as a result of stringent lockdowns in China and other Asian nations. The stock’s 2021 close was far below its pre-pandemic levels. As the world rebounds from the epidemic, Macau will likely to be the world’s largest gaming market because to its proximity to large populations and the shared culture for casino in China and other Asian countries.

Las Vegas Sands has been slower to enter the online gambling business due to its focus on the global market, but it announced ambitions to become a strategic investor in digital gaming technologies in July 2021. The corporation does not, however, currently operate an online gambling business.

Also read: Best Value Stocks You Should Buy in UK 2022

Wynn Resorts (NASDAQ: WYNN)

In October 2020, the business also introduced Wynn Interactive, in which it holds a 72% share, and collaborated with BetBull to build an online sportsbook and an online casino. Last year, Wynn came close to selling Wynn Interactive to a SPAC, but ultimately decided against it in November 2021. According to media reports from January 2022, the company was once more looking for a buyer. According to former Chief executive Matt Maddox, the fundamentals of online sports betting are adverse since competitors are paying excessive amounts on acquisition costs.

Wynn is still coping with the pandemic’s impacts. As of the third quarter of 2021, the business was still losing money, but it continued to pursue the development of substantial luxury residences and recently unveiled plans for a resort to be built close to Dubai in 2026. Future investors may benefit from Wynn’s attention on neglected locations like Dubai and the Boston region.

Penn National Gaming (NASDAQ: PENN)

Early in the pandemic, Penn National Gaming shares soared as a result of investors being impressed with the company’s expansion into internet gaming. The company is still much higher than it was prior to the epidemic, albeit cooling off since its peak.

Despite owning 44 facilities across 20 states, the company’s stock has largely come to be identified with online gambling. An online sportsbook and casino are both operated by Penn Interactive. Additionally, it owns a 36% ownership in Barstool Sports, in which it entered into a strategic alliance in order to market only its own sportsbooks, namely Barstool Sportsbook.

Following the Barstool acquisition, the business strengthened its position in the online gaming industry by acquiring theScore, another digital media and gaming platform.

The company recorded strong growth through 2020 and 2021 and was even profitable on a GAAP basis, unlike many of its competitors, despite challenges from the pandemic on its gaming assets. Penn is in a good position to profit if online sports betting keeps growing.

DraftKings (NASDAQ: DKNG)

On this list, DraftKings is the only pure-play online gambling business. It went public through a SPAC in 2020. Together with FanDuel, it essentially controls the online sports betting market. As of September 2021, DraftKings maintained a 29% market share in the three top states for online sports betting—New Jersey, Pennsylvania, and Michigan—while FanDuel claimed 40%.

Like many of its rivals, DraftKings has grown through acquisitions. It spent $1.5 billion in August 2021 to acquire Golden Nugget Online Gaming, boosting its dominance in online casino games and extending its reach beyond daily fantasy sports and sports betting.

As a consequence of social isolation and stay-at-home demands throughout the epidemic, digital sports betting and gambling soared, and DraftKings’ revenue roughly doubled in 2020 to $614.5 million. It had anticipated close to 50% top-line growth in 2022, indicating excellent momentum, and was on course for sales to double once more in 2021.

During the third quarter of 2021, the company attained 1.3 million paying subscribers on a monthly basis. Even though it’s currently not profitable at all, DraftKings has a lot of potential for expansion in the gaming sector.

Also read: Best Undervalued Stocks You Should Buy in UK 2022

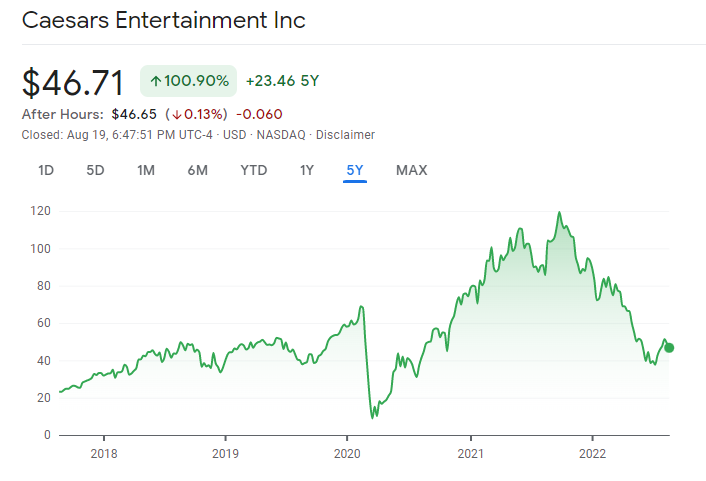

Caesars Entertainment (NASDAQ: CZR)

In 2020, Eldorado Resorts purchased Caesars Entertainment; Caesars continued to operate under that name following the transaction. After the merger, Caesars expanded to operate 54 facilities globally, including eight on the Las Vegas Strip, making it the largest casino operator in the country. In 16 states, Caesars runs casinos.

Prior to the transaction, Eldorado was one of the top casino stocks; as a result of Eldorado’s aggressive acquisition strategy, Caesars has generated gains of almost 1,700% since its IPO in 2014. In April 2021, the business paid $4 billion to acquire William Hill Group, a British online gaming corporation.

The majority of the company’s revenue still comes from its regional and Las Vegas casinos, despite the company’s advancements in internet gambling. In the third quarter of 2021, Caesars recorded a healthy profit from their casinos. Caesars Casino, like other casino companies, aims to use its nationwide network by promoting visits to various properties through a reward program.

Caesars appears to be well-positioned for future growth with a strong focus on online gambling, a reputable sportsbook, and a balanced casino operation between Las Vegas and regional locations, especially if you want to avoid the unrest in Macau.

International Game Technology (NYSE: IGT)

International Game Technology is the top producer of gambling machines and many other gambling equipment. Additionally, it provides interactive/social games and lotteries. IGT is ranked sixth among the top casino stocks to buy.

International Game Technology saw revenue increase by 25% year over year to $1.01 billion in the first quarter of 2021, from $814 million. EPS for the quarter was $1.18, exceeding the $0.09 market expectation. The company saw an uptick in business after the government lifted the Covid-19 limits.

Lottery sales worldwide increased by 31% in Q1, amounting to $749 million in gross income, including an increase of 52% in Italy. Digital and gambling income increased by 85% as well, and the company’s iGaming division still holds a 30%+ market share in the United States. Additionally, during the past year, the IGT stock increased by nearly 137.5%. Numerous investment banks, including Credit Suisse and Deutsche Bank, increased their price targets for the IGT stock as a result of the positive results. IGT’s price objective was likewise increased by Truist to $32 with a “Buy” recommendation.

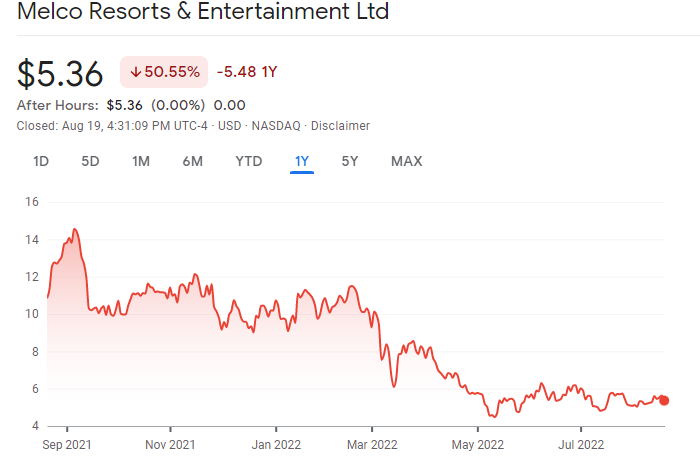

Melco Resorts & Entertainment (NASDAQ: MLCO)

An entertainment business with integrated resorts and casino gaming facilities is situated in Hong Kong and is called Melco Resorts & Entertainment Limited. The business owns resorts in both Asia and Europe. Over 21,000 individuals are currently employed by the 2004-founded company. In the last seven years, gross gaming revenue has increased by 64%, according to Melco Resorts & Entertainment Limited.

In the first quarter of 2022, Melco Resorts & Entertainment generated $518.9 million in revenue. Of the overall income, the casino segment contributed $433.7 million, while the lodging and food segments each contributed $39.6 and $26 million. Through dividends and share repurchases, the corporation has given back to stockholders about $3.4 billion. A $500 million share repurchase program was also recently approved by the company’s board in June. In the second quarter, Citigroup anticipates an increase in EBITDA among the Macau gambling operators and has assigned the stock of MLCO a “Buy” rating. Additionally, MLCO has recently received a “Buy” rating at CLSA.

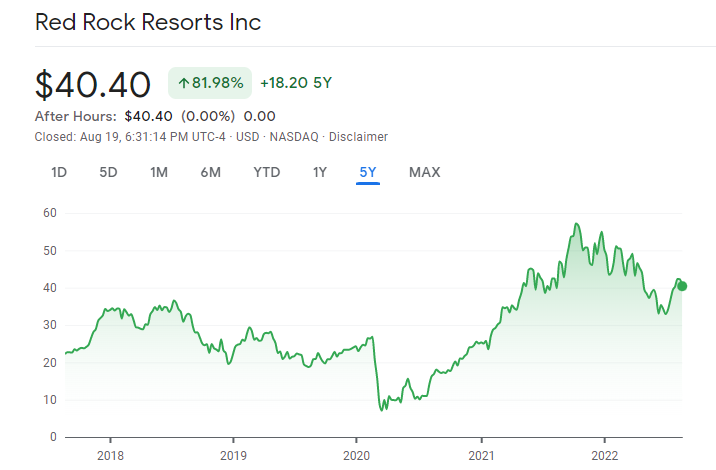

Red Rock Resorts (NASDAQ: RRR)

A hotel and casino business called Red Rock Resorts, Inc. is situated in a Las Vegas, Nevada, suburb. It is the company’s flagship property and is owned by Station Casinos. It is most recognized for its unrivaled casino experience and award-winning accommodations.

Red Rock Resorts, Inc. outperformed the market expectation by $19.2 million in Q1 2022, generating over 352.6 million in sales. The Las Vegas operations generated $343 million in revenue. The gross revenue came from the casinos, which totaled $259.9 million, and from lodging, which brought in around $22 million. The RRR stock has had an outstanding year, rising 314% over the previous 12 months and 70% year so far. Many investment banks, including JP Morgan, Truist, and KeyBanc, have raised their price targets for the RRR stock as a result of the outstanding quarter and growth possibilities. RRR continues to get an “Overweight” rating from JP Morgan due to its dominant position in the local Las Vegas casino market.

Boyd Gaming Corporation (NYSE: BYD)

One of the top casino corporations in America, Boyd Gaming Corporation was established in 1975. The corporation owns more than 28 gambling establishments spread across ten states, including Nevada, Indiana, Kansas, and Ohio. Recently, it joined together with Hawaiian Airlines to introduce a loyalty program that allows users to gain advantages and incentives.

Boyd Gaming Corporation recorded a net income of $105 million for the first quarter of 2022, up from $2.4 million for the same period in the previous year. The $0.93 EPS for the quarter exceeded the $0.49 market forecast. Revenue for the company came up at $753 million, up from $680 million in Q1 2021. Of the gross revenues, $618 million came from the gaming industry, while over $25 million came from lodging. The BYD stock has increased by almost $204% over the last year and by 32.9% so far this year. In addition, BYD has been upgraded by BofA to “Buy,” making it one of the investment bank’s top picks in the gaming industry, along with Churchill Downs Incorporated and Penn National Gaming, Inc. Additionally, Truist increased the ‘Buy’ rating and price objective for BYD stock from $65 to $78.

How to buy Casino Stocks?

We’ll demonstrate how to invest in casino stocks in the sections below.

Step 1: Choose a broker

To purchase the top casino stocks in the UK, a stockbroker is necessary. The LSE, NYSE, and NASDAQ are the three markets where the top casino stocks are traded, so choosing a broker with a wide selection of stock alternatives is essential.

Let’s look more closely at two of the best no-cost UK brokers for buying casino stock:

1. eToro

We advise using eToro to invest in casino stocks in the United Kingdom. Almost 2,000 equities from the United Kingdom, the United States, Europe, Singapore, Hong Kong, and other nations are available for trading with this broker. Additionally, you have the choice of buying all of the shares or trading stock CFDs with a leverage ratio of up to 5:1.

The fact that all trades on eToro are commission-free, even if you buy stocks in bulk, is an additional benefit. The broker levies nominal inactivity and withdrawal costs, although it is simple to avoid these.

A social trading network that is embedded into this software allows you to follow and exchange ideas with other traders. You can watch what other casino stock dealers are buying and selling, which is quite handy. Even better, eToro has a copy portfolios tool that lets you duplicate the existing casino stock portfolios of experienced traders or automatically copy their trades.

eToro is governed by the FCA in the UK and provides email and phone help twenty-four hours a day, seven days a week. To access all of eToro’s capabilities, use the web-based platform or a mobile trading app for iOS or Android. At eToro, payment methods including PayPal, Skrill, Neteller, and credit and debit cards are all accepted.

2. Capital.com

Over 3,000 equities and ETFs from the UK, the US, and Europe are traded by Capital.com, a CFD broker with headquarters in the UK. Plenty of casino stocks are available on the platform, which allows you to trade with leverage up to 5x.

What’s even better is that Capital.com doesn’t impose commission fees on any trades. For purchasing casino stocks, the broker offers some of the smallest spreads we’ve observed and charges no charges for deposits, withdrawals, or inactivity.

The superiority of this broker’s technical trading platform makes it stand apart. To control risk, you can utilize a variety of technical indicators, drawing tools, stop-loss orders, and limit orders. Only the Capital.com mobile app and not the desktop platform offers price alerts, however, this is a minor drawback.

Capital.com does not belong to the Financial Conduct Authority, although it does have a license from the CySEC. All UK accounts are, however, protected by the FSCS. Telephone, email, and live chat are all available twenty-four hours a day, seven days a week for customer service.

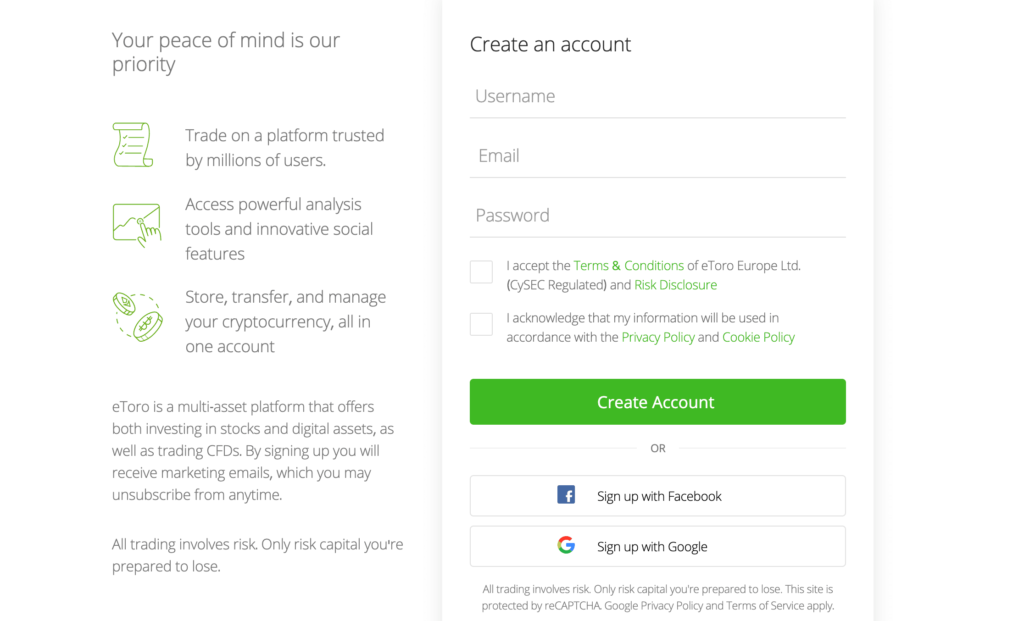

Step 2: Create an Account

We’ll be using eToro for this step, so visit their website and click “Join Now” to create a new account. Use your email address, Facebook login, or Google credentials to sign up.

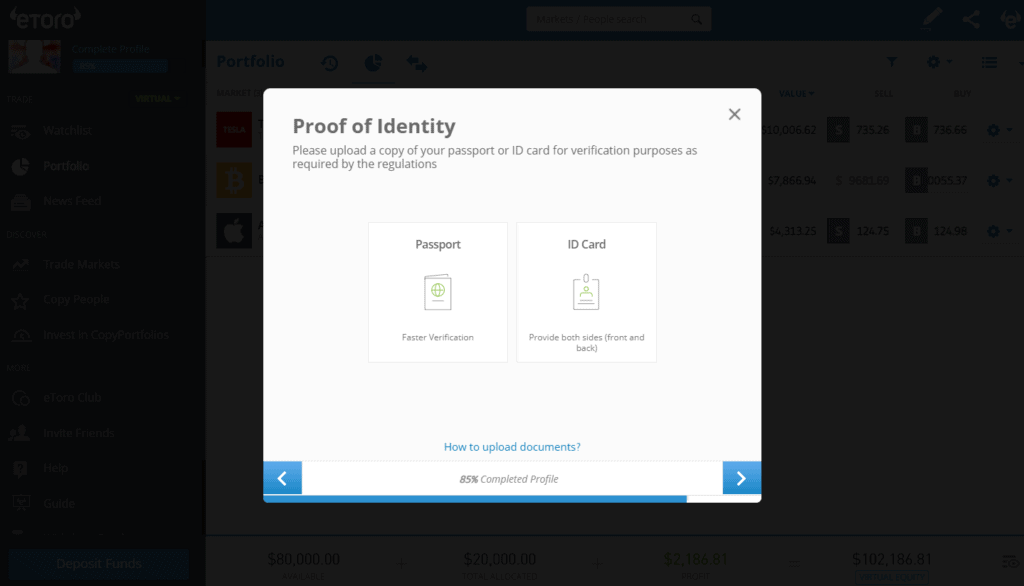

Step 3: Verify Your Identity

To abide by the FCA’s anti-money laundering regulations, eToro requires you to verify your identity when creating a new account. Include a copy of the photo page from your passport or driver’s license as well as a recent utility bill or bank statement that shows your current address.

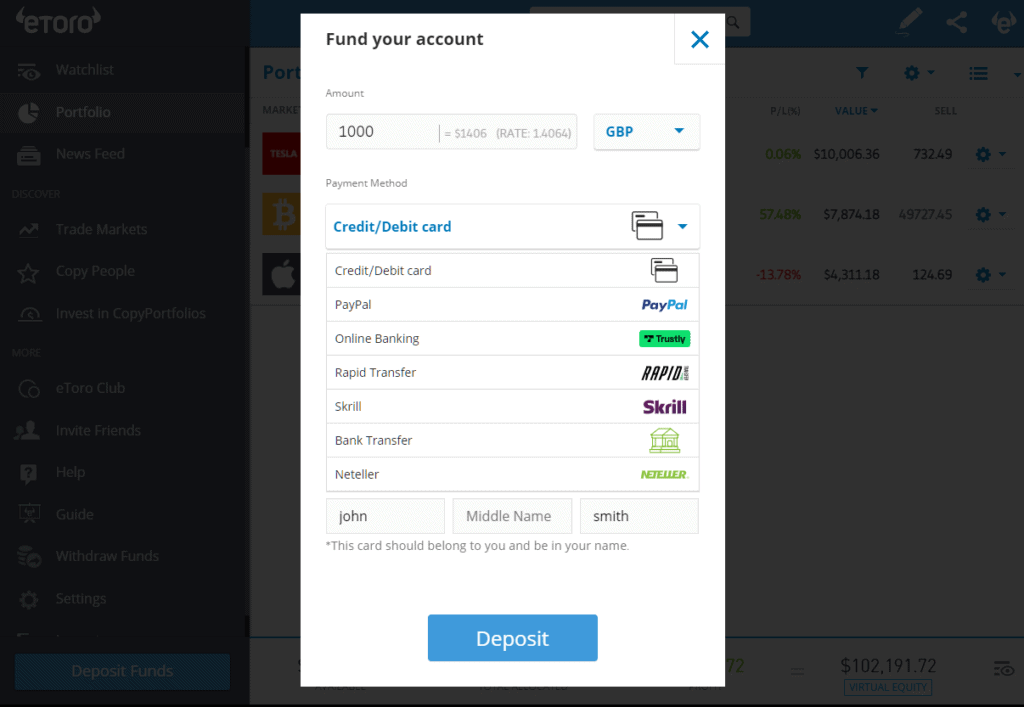

Step 4: Deposit Funds

Getting money into your eToro account is the next step. eToro requires a minimum investment of £140, which can be made through bank transfer, credit/debit card, PayPal, Neteller, or Skrill.

Step 5: Buy Casino Stocks

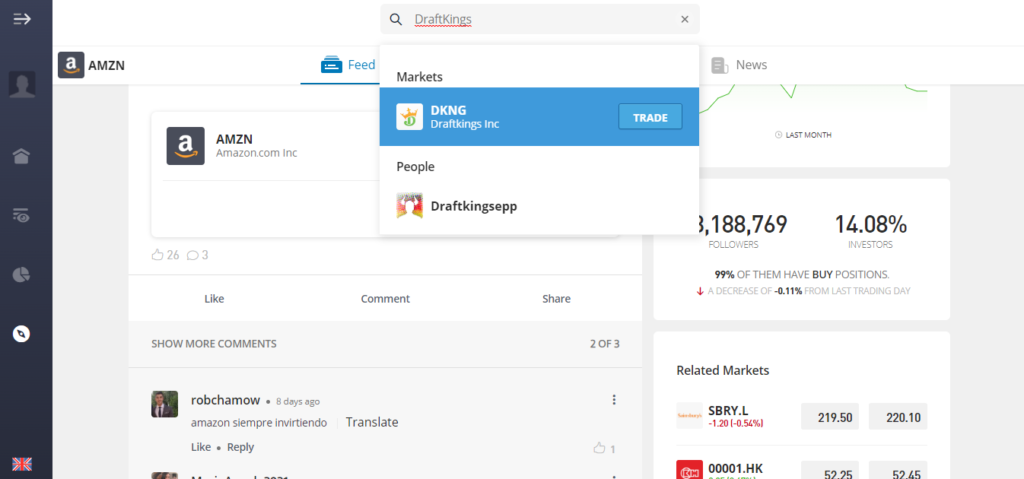

You are now ready to start buying casino stocks. In the eToro dashboard, look for the shares you want to purchase. Choose “Trade” from the drop-down option when it appears to launch a new order form.

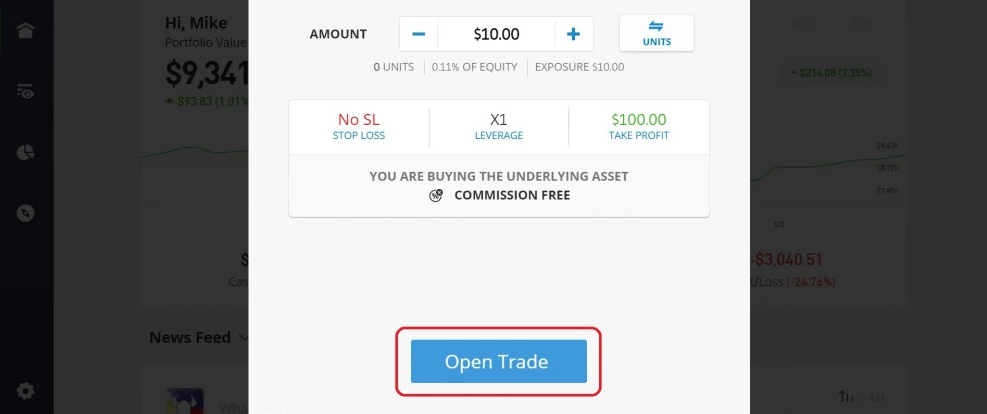

Enter the amount of money you wish to invest in your preferred casino stock and decide whether to buy the stock outright or trade CFDs with leverage up to 5:1.

When you’re prepared to buy your first casino stock in the UK, click “Open Trade.”

Conclusion

Over the past ten years, the casino industry as a whole has underperformed the market, but there have been notable exceptions, such as Caesars and internet gambling companies like DraftKings and Penn National.

The next ten years will likely be very different from the last ten due to the growth of online gambling in the UK, and a post-pandemic reopening might result in a spike in foot traffic at land-based casinos. Even though the industry still faces a lot of uncertainty, risk-tolerant investors may discover a significant reward waiting in the casino sector.

All of the top casino stocks are currently available for buy on eToro if you do decide to invest. You can buy casino stocks without paying any commissions by making a quick deposit with your UK debit or credit card.

Frequently Asked Question

Are casino stocks dividend-paying stocks?

Dividends on casino stocks are frequently paid. In actuality, the dividend yield on shares of Las Vegas Sands is close to 5%. Numerous casinos reduced their dividends as a result of the pandemic, but they might grow once more in the future.

Is it feasible to use an ETF to invest in casino stock?

Yes, you can invest in the gambling industry using ETFs like the VanEck Vectors Gaming ETF. There aren’t many ETFs that are simply invested in casino stocks.

Which gambling company is the biggest publicly traded one in the world?

The largest casino company in the world is Las Vegas Sands, which has a market capitalization of $28.09 billion.