It’s simple to believe that everything has increased in value given the focus on social media and its impact on the stock market. The reality is much more complicated than that, though. Bargain traders can pick up a lot of undervalued stocks even while particular names have skyrocketed.

Even though social media is one of the hottest subjects of the current year, it’s vital to remember that traders who base their decisions on internet rants cannot bet enthusiastically on every trend. The current state of affairs doesn’t seem very favorable if you look at the most well-liked stocks. And if you consider alternative strategies, you’ll see that there are a number of undervalued stocks that can be profitable.

On that note, we’ve listed the Best Undervalued Stocks You Should Buy in the UK by 2022 in this guide, along with information on how to invest in stocks.

What are Undervalued Stocks?

Undervalued stocks are those that trade for less than their fair market price, which is the price that the business’s cash flow and return on capital warrant. Securities that are now undervalued are projected to rise quickly and represent excellent “buy” chances.

Due to dwindling investor confidence or consensus expectations, undervalued assets have a market price that is much less than their fair value. Financial analysts can calculate a company’s rate of growth or use the P/E ratio to determine if a stock is undervalued.

When investor confidence declines and demand declines, or when a company’s fundamental analysis suddenly improve while the market price stays the same, stocks are said to be undervalued. In either situation, the stock may be undervalued if the company’s fundamentals and analyst growth expectations do not support a drop in the market price.

Best Undervalued Stocks 2022

The following is a list of the top undervalued stocks available in the UK right now:

- Scottish Mortgage Investment Trust (LON: SMT)

- Barclays (LON: BARC)

- easyJet (LON: EZJ)

- Wise (LON: WISE)

- ITV (LON: ITV)

- BAE Systems (LON: BA)

- Imperial Brands (LON: IMB)

- Greggs (LON: GRG)

- Dunelm (LON: DNLM)

- Watches of Switzerland (LON: WOSG)

Best Undervalued Stocks Analysis

Scottish Mortgage Investment Trust (LON: SMT)

Scottish Mortgage Investment Trust is the first option that we recommend as the best-undervalued stock to buy in 2022. The UK stock fell by 6.6 percent on Friday alone, bringing its annual decline to 39 percent.

The company buys other stocks. You, therefore, gain exposure to all of the equities that are held by the fund when You purchase shares of the company. The most recent update reveals that Moderna, Tesla, and Amazon are among the top holdings, with the majority of the assets coming from the US.

It’s simple to blame the recent bad performance on the declining Nasdaq and well-known tech stocks. But We believe this is the place to look if I’m looking for good value. For example, Amazon’s Q1 profits fell short of forecasts, although this was partially attributable to a one-time charge related to the value of exposure to Rivian. If looked at net sales, they went up by 7% to an enormous $116.4 billion. Overall, We believe that Amazon will maintain its position as the leading tech stock. Due to Scottish Mortgage’s ownership of Amazon, a recovery in its share price later this year may be indirectly aided by this.

We view the overexposure of SMTs to the US in particular as dangerous. Given the high inflation and worries about an impending recession, we’d want to see a wider variety of businesses held globally.

Barclays (LON: BARC)

Barclays is another UK stock that we believe is currently undervalued. Presently, the share price was whacked once more and dropped more than 3 percent. Within the last year, it has dropped by 10%.

Based mostly on anticipated interest rate increases for the remainder of the year, we are currently considering investing in Barclays. It has benefited from the increase in interest rates, which have gone from 0.1% a year ago to 1% right now. Cash flow is increased since there may be a large interest rate difference between the interest imposed on loans and the interest on deposits.

The Bank of England is expected to raise the standard rate by 0.25 percent once more. In fact, some analysts believe the committee will raise rates three more times this year. If the rate is 1.75 percent by the end of the summer, Barclays should see a considerable rise in net interest income. The share price should rise as a result, with our first objective being to erase the year-to-date price losses.

One thing to keep in mind is that Barclays shares may struggle if the UK enters a recession shortly. Since the business owns a sizable retail bank, more loan defaults and a decline in consumer spending could put pressure on this UK stock.

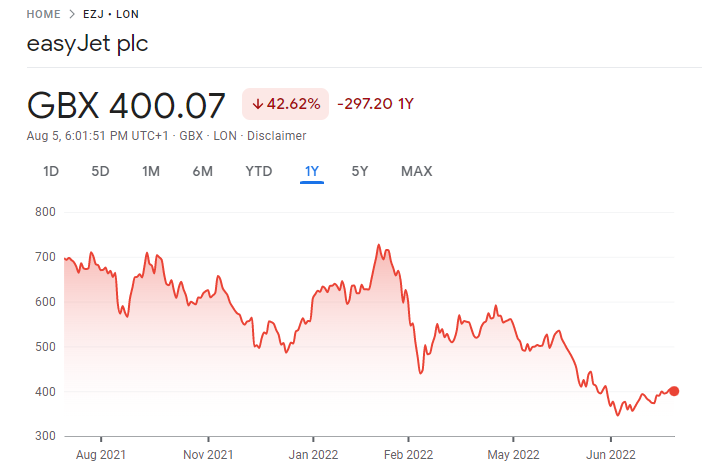

easyJet (LON: EZJ)

We believe we may actually be approaching the end of the tunnel if claims that Omicron actually does cause lesser symptoms are accurate. And if that’s the case, we’ll start by making vacation plans.

It was initially thought that we should invest in airlines in 2022. We believed that many investors had overestimated the likelihood of things getting back to normal and had been let down by lockdown after lockdown. However, the share price of easyJet has dropped to 621p from this summer’s high of 921p, a reduction of 32%. Its price-to-earnings ratio (P/E) is 12.8, just slightly over the median for the previous 13 years of 12.69. We believe that when winter approaches, there could be a considerably higher increase in value if the epidemic continues to lessen in severity.

But there is no denying that the outbreak has greatly impacted easyJet. In the upcoming years, it will need to devise creative strategies to maximize earnings. However, despite all odds, it has managed to minimize losses at every stage and has survived. Cash burn was unavoidable, but easyJet managed to reduce it to £36 million a week, which is £4 million less than what was anticipated. We were quite impressed by the company’s fortitude in the face of the calamity, and we look forward to seeing what it accomplishes in more prosperous times.

Read: Best Airline Stocks You Should Buy in UK 2022

Wise (LON: WISE)

Wise makes it easy and affordable to transfer money across different currencies and bank accounts. Early in 2021, this UK IT company went public, and in September of that year, its stock price rose to 1,150p before tumbling to 427p at the time of writing. Since it takes time for the market to determine a share’s true value, this is very typical for a firm after an IPO. The stock currently has a relatively low P/E ratio of 5.16, which indicates that the price of the shares is closely correlated with the company’s earnings.

We simply need to look at the customer and revenue growth over 2021 if we had any lingering concerns about the company’s state. With 10 million customers, an increase of four million from 2020, Wise saw a nearly quadrupling of revenue.

We are worried about the company’s low-profit margins, nevertheless. As the business sought to enter new markets, earnings decreased. Naturally, Wise is in a weaker position because of the narrower margins. A major “black swan” occurrence could throw off the stability of the global economy. However, despite this, the pandemic was the greatest example of a black swan occurrence, and Wise has not only survived but rather flourished. We believe that Wise, like easyJet, has the ability to greatly profit from the travel demand that has been stifled once life returns to normal.

ITV (LON: ITV)

ITV stock is currently trading at 72p. Shares were trading at 95p a year ago, representing a 15% increase. We believe that shares are currently being sold for significantly less than they are worth, with a price-to-earnings ratio of just 12.

ITV was harmed by the pandemic, but it has also been declining for a while. ITV’s once-dominant market share was eaten away by growth in digital disruptors and rivals. ITV has experienced something of a revival as a result of the recent shift toward digital transformation. In the long run, we think ITV might be a great recovery play.

ITV reported strong results for the first nine months of its fiscal year in its Q1 update, which was released to the market earlier this month. The revenue comfortably exceeded post-pandemic levels from 2021 by 28%, but more amazingly, it exceeded levels from the pandemic of 2020. The digital revolution appears to be working, as seen by the 39 percent increase in online watching statistics.

ITV continues to be one of the largest media companies in the UK. 13 of the 15 regional TV licenses are held by it, and it is now affordable. Over the FTSE 100 average dividend yield of 3 percent, it has a dividend yield of about 4 percent.

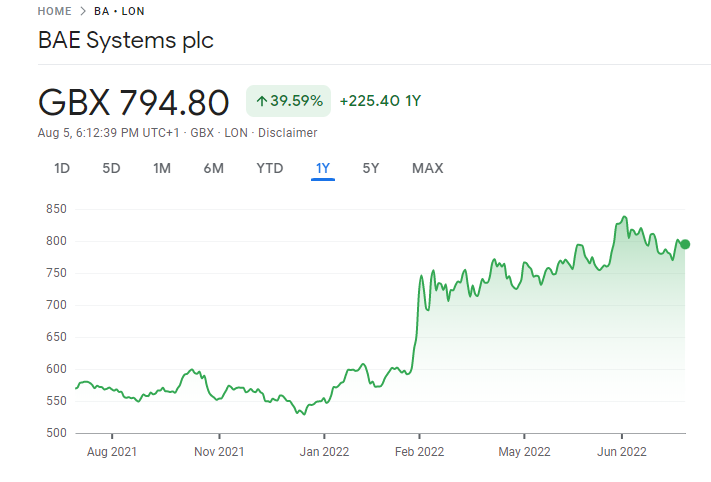

BAE Systems (LON: BA)

When you consider the different geopolitical considerations around the world, the sectors of defense, security, and aviation are highly broad and lucrative. Given that BAE Systems is one of the industry’s major participants, we are both astonished and encouraged by the company’s present undervaluation. Over 80 nations are home to BAE, with the UK, US, Saudi Arabia, and Australia being the most prominent.

A year ago, shares were trading for 569p, whereas they are currently trading for 787p, representing an 8 percent return. The price-to-earnings ratio for BAE is slightly over 10, which, in our opinion, is low for a business of this caliber.

Given that governments all over the world spend a lot of money on defense, which is where BAE comes in, we think BAE has defensive qualities. Up until 2030, BAE’s order book is worth several billion dollars. Additionally, BAE is a reliable dividend producer with a dividend yield of nearly 4%. The present yield for BAE is greater than the FTSE 100 standard of 3%, similar to ITV.

Overall, at present prices, we would purchase BAE Systems stock for our investment portfolio. It continues to win new business, provides a good dividend, possesses defensive qualities, has a successful track record, and a healthy forward-looking order book. Additionally, it keeps acquiring smaller companies to expand its portfolio.

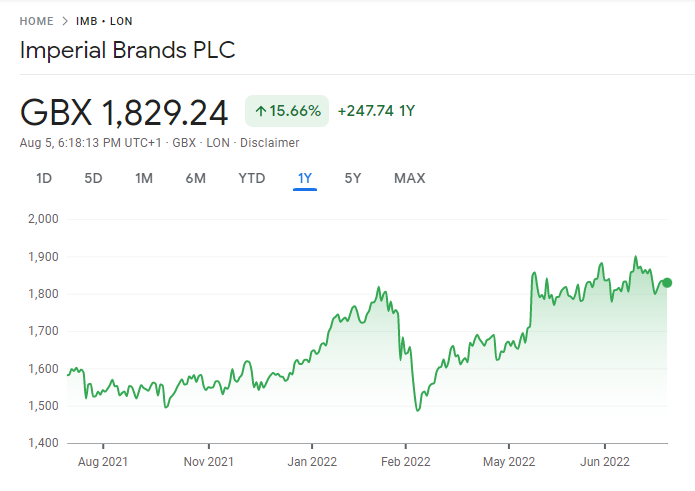

Imperial Brands (LON: IMB)

The leading provider of tobacco, cigarettes and other smoking-related products is Imperial Brands. Davidoff, Winston, and West are a few of its brands.

It is important to remember that smoking businesses occasionally don’t have the best reputations. This is due to smoking’s inability to keep up with changing consumer tastes. In industrialized nations, this viewpoint has been more common. In less developed nations, smoking rates are actually rising. Additionally, companies like Imperial are losing favor with certain investors due to the growth of environmental, social, and corporate governance (ESG) investing.

At the time of writing, shares are trading for 1,834p, compared to 1,581p one year ago, a 9 percent increase. Imperial’s price-to-earnings ratio currently stands at a little over five, which is, in our opinion, incredibly low.

Imperial is a top investment for anyone looking for passive income because it offers a generous dividend yield of 9%. We appreciate a lot of things about this stock, including its low price right now and its high dividend yield.

Imperial is one of the best-undervalued stocks right now, in our opinion.

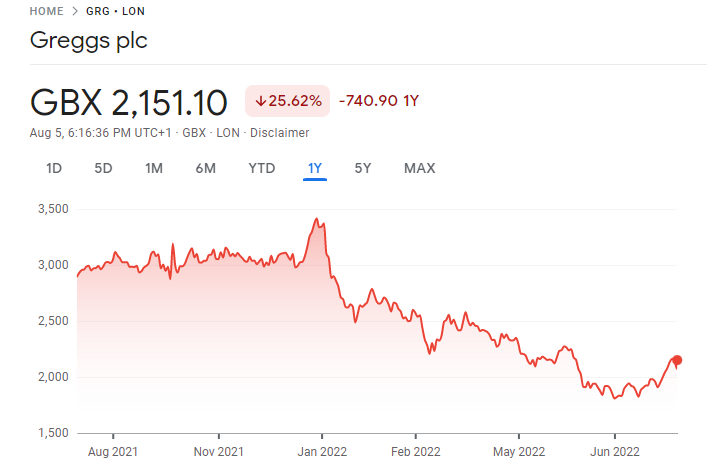

Greggs (LON: GRG)

Greggs is the next undervalued stock we’d purchase right now. The firm was not previously considered to be a stock that generated passive income. However, the share price has decreased by nearly 45% since the start of the year.

Because of this, Greggs shares currently pay a dividend that is a little over 3%. We have begun to view it as an intriguing undervalued stock as a result of this.

We also believe that the stock has substantial passive income potential. The price-to-earnings ratio (P/E) for Greggs shares at the moment is around 16. We believe that is highly acceptable in light of the current situation of the underlying business. After experiencing a pandemic-related slowdown, revenue and income have recovered well.

The potential for a recession is the risk with Greggs. But despite the challenging economic climate, we believe Greggs will continue to prosper.

In our opinion, customers may choose to put off costly purchases like a new car or home addition. However, we believe regular, modest purchases—like having lunch at Greggs—will last well.

If we’re right about that, the stock is currently significantly undervalued. We’d be content to invest half of a $1,000 investment in Greggs stock if we had $1,000 to invest in passive income stocks.

Dunelm (LON: DNLM)

Leading home goods shop Dunelm has a longstanding reputation for providing premium goods at competitive prices. Sales have continually increased thanks primarily to increases in market share. The organization distinguishes itself through its size, knowledge, and extensive supply network. Its customer service offerings were further improved by the 2019 update to its web platform, which also helped it perform well throughout the pandemic.

The company is growing into complementary areas like furniture while also maintaining market share throughout its omnichannel offering. This should allow it to continue boosting the topline for many years to come, along with a retail rollout program. The financial sheet of Dunelm shows net cash and it generates a lot of cash. Due to this, shareholders have received two special dividends in the past year alone, and we anticipate this trend to continue.

Watches of Switzerland (LON: WOSG)

Despite a decline in foreign sales during the pandemic, premium manufacturer Watches of Switzerland finished 2021 as one of the biggest beneficiaries in the FTSE 250, having gained approximately 140% and trading for more than 4 times its 2019 offer price. According to consensus projections, revenue will more than double from its pre-pandemic peak and earnings will almost quadruple in the upcoming year. The brand’s ability to resist inflation serves to support this. Since the demand for luxury timepieces is greater than the supply, merchants can pass cost pressures on to their mostly price-insensitive clientele.

The retailer’s chances for long-term expansion appear promising. Given that luxury watch sales in the US are 40% fewer per capita than in the UK, Watches of Switzerland may have room to develop. The company also just approached the $14 billion European premium watch industry, in part because of its strong supply chain operations.

How can I buy undervalued stocks?

The following is a complete guide to buying undervalued stocks:

Step 1: Choose a stock broker

When choosing the best UK stock to invest in, the first step is to choose a reliable stockbroker. You must select a platform among the several that are offered in the online environment that best suits your needs.

To assist you, we’ve put together a list of the top two trading platforms that provide some of the best stocks to buy:

1. eToro

Buying undervalued stocks is all about increasing your prospective return. As a result, you should engage with a stockbroker who can assist you in purchasing shares at a reasonable price and in that case eToro is best.

More than 800 shares, including many of the greatest stocks to buy, are purchased commission-free through the broker, which has more than 12 million customers today. This comprises shares listed not just in the United Kingdom but also in 16 other nations. Due to its $0 fees, eToro stands out as the best online broker for novices.

Once you’ve identified an undervalued stock that you like, you can start investing with as little as $50. This is great since it makes it simple to diversify. One further noteworthy aspect is the eToro Copy Trading tool. You can duplicate the stock trades and portfolios of seasoned investors.

A debit/credit card, an electronic-wallet, or a United Kingdom bank account are all acceptable methods of depositing funds into an eToro account. A $50 minimum deposit is required, plus a 0.5 percent exchange rate fee. The platform is highly regulated and has a Financial Conduct Authority license. The Financial Services Compensation Scheme and eToro have a partnership that guarantees your savings up to £85,000 in protection.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

A well-known broker, IG, provides more than 10,000 equities for customers to choose from in the UK. This comprises stocks traded in the United States, Australia, Canada, and other countries, in addition to hundreds of UK-based companies. This raises the likelihood that you’ll find an undervalued stock.

A free trading platform does not exist in IG. There is no free stock trading available. Still, stocks can be traded for a fair price. You will pay this starting price of £8 per order both when you acquire and when you sell your shares. This is particularly advantageous if you trade frequently because commissions calculated as a percentage might be very pricey.

You can set up an IG account online or on your phone in a matter of minutes. A £250 minimum deposit is needed. Payment can be made using a UK bank account or debit/credit card. IG is subject to strict regulation, with the FCA license playing a crucial role.

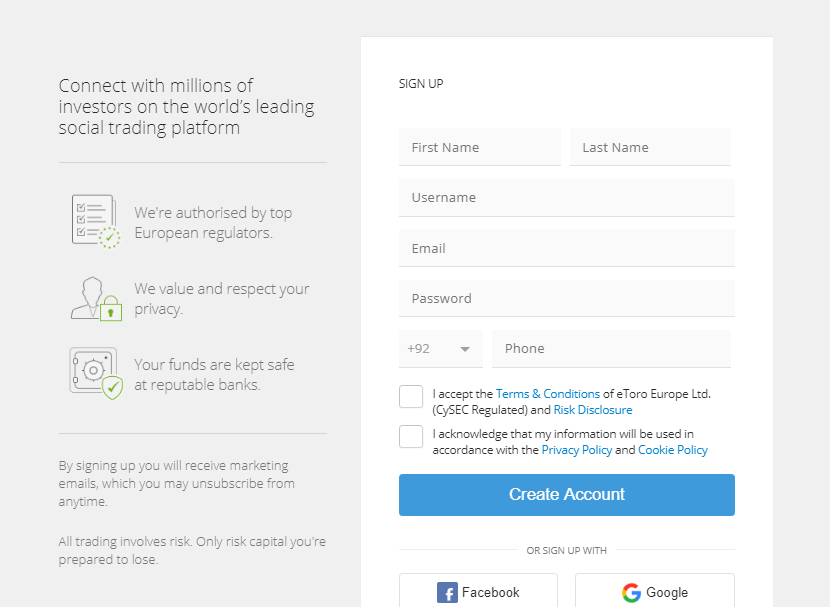

Step 2: Create an Account

After we’ve investigated the two best stock trading websites, we can buy undervalued stocks with any of them but we recommend eToro.

Visit the eToro website and click the “Sign Up” link. A few personal facts, such as your name, address, and contact information, are all that is needed for registration.

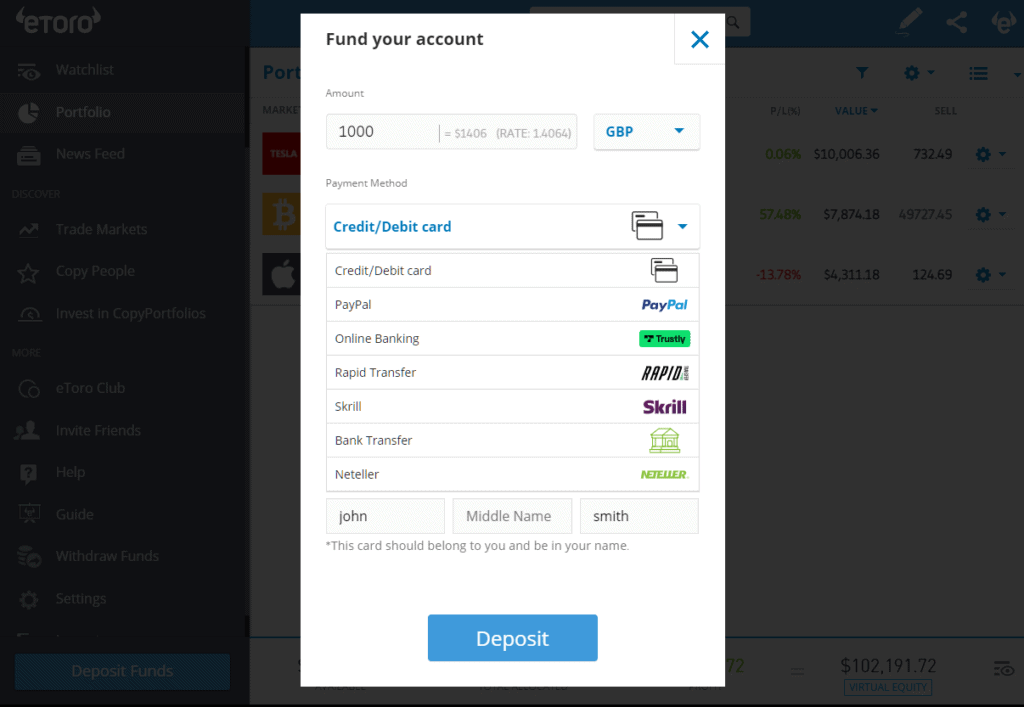

Step 3: Deposit Funds

Anyone can use debit/credit cards, an e-wallet, or a bank deposit to send the $50 initial payment.

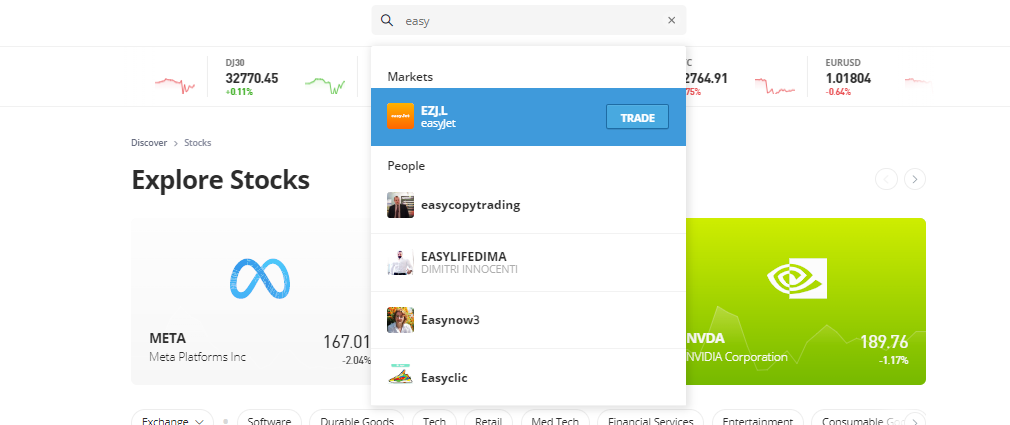

Step 4: Buy the Most Undervalued Stocks

Quickly after funding your eToro account, you may begin purchasing undervalued stocks. The company in which you want to invest must first be found. In this instance, we are buying easyJet, a well-regarded dividend stock.

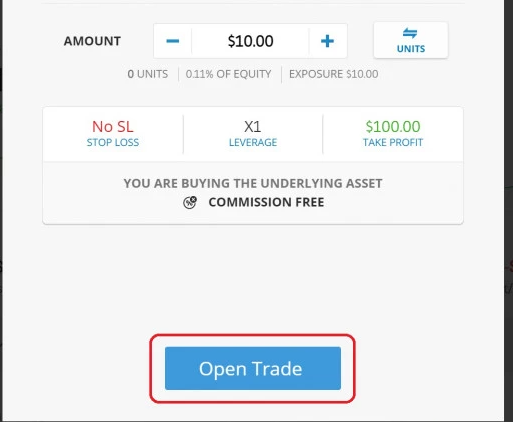

The next step is to choose “Trade.”

To finish your investment, just enter the amount of stocks you want to buy and click the Open Trade button.

Conclusion

Undervalued stocks have shown to be useful additions to diversified portfolios. In reality, few stocks provide investors the opportunity to access greater potential than those with lots of room for growth. However, traders must first know what signs to look for and which valuations reflect a good purchasing opportunity in order to invest in discounted stocks. With careful research, there are many undervalued stocks to be found in the market today, but for those of you who are unsure about what to invest in 2022 UK, the stocks stated above should be a good place to start.

You can buy a stock on eToro right away without paying any transaction costs if you have a certain stock in mind that you think is undervalued. By clicking the button below, you might complete your first undervalued stock buy in a matter of minutes!

Frequently Asked Questions

What are undervalued stocks?

If you acquire stocks for less than they are actually worth, you are essentially buying undervalued equities.

Which stock market is the best for locating undervalued stocks?

All financial markets, such as the LSE, AIM, NASDAQ, and NYSE, have undervalued stocks that are available to anyone.

What ratio should you use while searching for undervalued stocks?

Experienced traders employ a variety of statistics to identify undervalued companies. Examples of this include the P/E and P/B ratios.

How can I invest in UK undervalued stocks the best way possible?

You can purchase undervalued stocks on eToro without incurring any transaction costs.