The maximum leverage available to UK traders is typically 1:30; however, larger limits are available if you’re a professional user or use an international platform should you decide to access high leverage brokers.

In this article, we examine the top high leverage brokers available right now, taking into account not only their limits but also their costs, supported assets, account minimums, and other factors.

Best High Leverage Brokers 2022

A number of brokers offer the chance to trade with high leverage. But each of these brokers is best suited for a particular kind of trader. Here is a thorough evaluation of high leverage brokers in the UK:

1. Capital.com

The greatest high-leverage broker to take into consideration right now is Capital.com. The features offered by this top scalping broker are compliant with EU and AU rules, which entails a maximum spread of 1:30 on main forex pairs and 1:20 on minor/exotic and gold.

On other asset classes, such as stocks, ETFs, and cryptocurrencies, lower limitations will be available. Users classified as professionals will have access to higher limitations.

Additionally, we discovered that Capital.com is the finest high leverage broker due to its zero percent commission policy, which is applicable to all of the markets it supports. Capital.com provides more than 5,400 shares, 491 cryptocurrency marketplaces, and approximately 140 forex pairings as examples of how extensive its trading platform is. One of the top online brokers with the best margin rates on the market is said to be Capital.com.

Spreads on this platform ought to be relatively affordable for traders. Major currency pairings like EUR/USD, for example, can be traded starting at just 0.6 pips. The fact that Capital.com supports low account minimums is another benefit. For instance, $20 is the minimum amount needed to fund an account using a debit/credit card or an e-wallet.

On the other side, bank wire transactions call for $250. Capital.com does not charge deposit fees, which is an added benefit. We also value that Capital.com offers a user-friendly mobile app for cellphones running iOS and Android. The FCA, CySEC, NBRB, ASIC, and are in charge of overseeing the platform. Finally, Capital.com’s automated KYC procedure makes opening an account quick and easy. Capital.com is also one of the top MT4 brokers available.

2. eToro

When comparing the top high leverage brokers, eToro placed in second place, according to our research. Over 25 million customers utilize this low spread broker, which handles thousands of financial instruments. More than 2,500 commission-free stocks and ETFs are included in this.

Those searching for places to buy stocks on margin may want to think about trading CFDs at eToro. This will allow for up to 1:5 leverage and support both long and short bets. As an alternative, qualified customers will be able to purchase bitcoin CFDs using leverage up to 1:2.

The maximum leverage limit for retail consumers is 1:30, the same as Capital.com, and it is only available on significant FX pairs. In light of the foregoing, eToro provides professional accounts with a maximum leverage ratio of 1:400. The trader will nevertheless need to be eligible for this, which includes possessing a minimum investment portfolio of €500k.

The fact that eToro offers a Copy Trading tool with thousands of certified traders is something we really appreciate. The user has the option to choose to automatically copy all future positions after a trader has been chosen. Additionally, Smart Portfolios from eToro provide passive access to a variety of investment techniques.

One of the best social trading brokers to start trading is eToro. Using this function, eToro traders can comment on and “Like” postings as well as discuss investment ideas. In regards of security, eToro has been in operation since 2007 and is overseen by the SEC, FCA, ASIC, and CySEC. Consider using the demo stock trading account if you’re interested in trying out eToro for the first time.

3. Libertex

Libertex is among the finest high leverage brokers to use while on the go, according to our research. Both novice and experienced traders were taken into consideration when designing its iOS and Android apps. The former will value the app’s sleek user interface and the simplicity of finding assets and marketplaces.

The Libertex app’s sophisticated trading capabilities and real-time pricing will appeal to seasoned users. In either case, Libertex provides leverage on each and every CFD market it serves. Libertex is constrained in the amount of leverage it can provide to individual investors as a result of its excellent regulatory status across numerous locations.

Once more, the bulk of accounts will have a 1:30 maximum on the most popular forex pairs and fewer on other markets. Also supported are professional clients, resulting in significantly greater limits. Although many assets can be traded commission-free, fees are frequently dependent on the specific instrument.

Additionally, tight spreads are available. Libertex, for instance, offers a spread of just 0.3 pips when buying and selling EUR/USD, which is appealing to forex traders. Libertex only requires a $10 minimum deposit, making it suitable for casual traders. Debit and credit cards are among the several deposit options that are accepted.

4. AvaTrade

AvaTrade may be a good option for retail clients looking for the finest high-leverage broker. This is because AvaTrade provides leverage up to 1:400. However, this depends on the trader’s location and the relevant asset class.

For instance, users living in the UK, Europe, or Australia will only be allowed to use the normal 1:30 time. However, it’s likely that traders in countries where leverage caps don’t apply will be given even greater limits. At AvaTrade, professional clients are also catered to, and there are frequently triple-digit leverage ratios.

AvaTrade is a CFD broker in terms of the supported markets. Account holders will have access to equities, indices, cryptocurrencies, commodities, and more across more than 1,200 financial instruments. AvaTrade has a reasonable $100 minimum first-time deposit requirement and provides free sample accounts to all registered consumers.

5. Skilling

When looking for the finest high leverage broker, retail consumers should also take skilling into account. On a handful of significant FX pairs, this user-friendly trading platform provides a maximum leverage ratio of 1:500. This indicates that the required advance margin is only 0.20%.

Here, some examples include EUR/USD, GBP/USD, and AUD/USD. The maximum leverage ratio for accessing minor FX pairs and gold is 1:200, while the maximum leverage ratio for accessing other commodities is 1:100. Leverage of up to 1:50 is permitted when trading cryptocurrencies, but only up to the first $1,000. Leverage is limited to 1:5 after that.

Skilling is a regulated trading site, so certain limitations will be in effect. For instance, unless they are a professional customer, people in the UK and Europe will be restricted to the standard 1:30 time limit. At Skilling, MT4 and cTrader are supported trading platforms in addition to the company’s own proprietary browser-based user interface.

6. Pepperstone

Pepperstone is the next choice from our list of the top high-leverage brokers that you should take into account. More than 1,200 trading instruments are available from this supplier, and CFDs are the only way to access them all. This includes ETFs, equities, virtual currencies, foreign exchange, and more.

We appreciate that Pepperstone offers 24/7 client service in addition to quick execution times. The fact that Pepperstone provides raw spread accounts is another factor in its ranking as one of the finest high leverage brokers. This provides direct access to other market participants, allowing for the zero-spread trading of important products like the EUR/USD.

Raw spread account commissions are also extremely low, at just $3.50 for each currency lot traded. If the retail client is located in the UK, Europe, or Australia, Pepperstone’s leverage offering is restricted to 1:30. The platform does, however, provide retail clients in a few additional jurisdictions with limits of up to 1:200. Access for professionals is up to 1:500.

7. Forex.com

Without using CFDs, Forex.com provides direct access to the currency markets. As a result, we discovered that one of the top UK brokers with high leverage is Forex.com.

When trading a few key currency pairings, UK clients have access to leverage of up to 1:50. This includes the EUR/USD, USD/JPY, and USD/CAD exchange rates. Lower leverage limitations are available for other forex pairs from the minors and exotics.

We appreciate the variety of account kinds that Forex.com provides. Casual investors may want to think about the ordinary account, which has spreads that start at 1 pip and 0% commission. Additionally, there is a commission account with spreads beginning at 0.2 pip and a cost of $5 for every $100k traded. Spreads as low as 0.1 pip are available with the STP Pro account.

8. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

Another trading site that provides leverage to UK clients is Interactive Brokers. This platform will be appealing to currency traders who want to use interbank currency quotes to reach the wholesale markets. This indicates that Interactive Brokers has some of the most competitive rates available.

Spreads on popular currency pairings, for instance, can be obtained for as little as 1/10 of a pip. Additionally, a competitive commission of 0.20 basis points will be charged to individuals who transact less than $1 million in a 30-day period. The best fee rate is 0.08 basis points, but it necessitates at least $5 million in monthly trade volume.

Leverage is limited by regulation, therefore Interactive Brokers can only give 1:50 on major currency pairings and less on minor currencies. We also appreciate Interactive Brokers since it offers futures and options markets for currency trading. Although Interactive Brokers does not have a minimum deposit requirement, using leverage will trigger a margin need.

9. FXTM

More leverage is offered by FXTM, a high leverage broker, than by any other platform we’ve examined so far. This is an alternative if you want to trade CFDs or Forex market with a 1:1000 leverage. Since FXTM does not distinguish between retail and expert investors, everyone can use the 1000x leverage.

For major FX pairings, they offer up to 1:1000 leverage; for minor pairs, 1:500; and for exotic pairs, 1:50; and for spot commodities, 1:500. In addition, they feature some of the lowest spreads in the industry. Some of their pairs have spread as little as 0.1 pip. Because of its high cost-effectiveness, it is one of the platforms of choice for people looking for high-risk, high-reward options.

10. HotForex

HotForex is the last choice from our list of the top high-leverage brokers. This trading website concentrates on currency, as the name would imply. More than 50 pairs in majors, minors, and exotics are supported by the platform.

There are numerous account kinds available, so traders of all experience levels should be able to find one that works for them. Absolute beginners might want to think about the micro account, which has a maximum leverage ratio of 1:1000 and only requires a minimum investment of $5.

Spreads begin at 1 pip, however there are zero commissions connected with this account. The zero-spread account, which offers spreads starting at 0 pip on popular forex pairs and a normal cost of $3 per traded lot, may be worth considering for more seasoned traders. This top-rated broker offers CFDs on a variety of assets in addition to FX, including equities, indices, commodities, and more.

How to begin with High Leverage Brokers?

The instructions in the guide below describe how to begin trading assets right away with a broker offering high leverage. Capital.com is used to demonstrate the processes in this section.

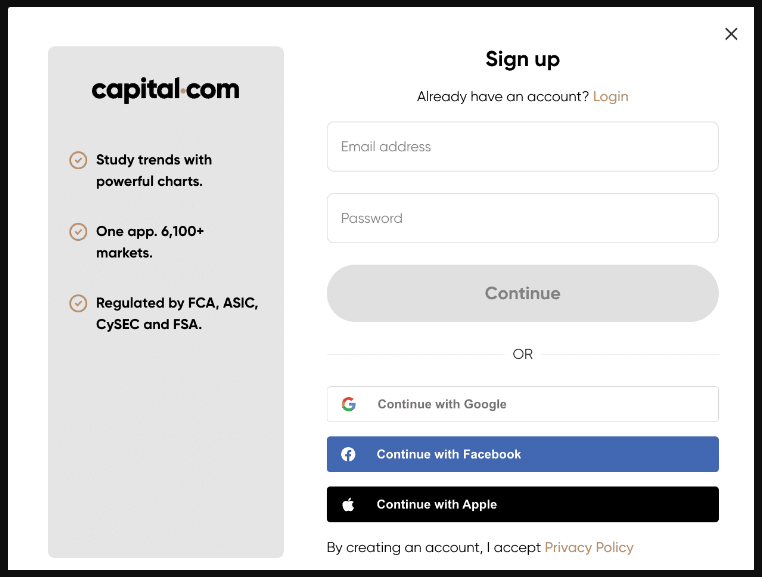

Step 1: Open an account

Visit the main website of Capital.com to registering for a new trading account. Some personal information and contact information will be needed for this.

For the purpose of verification, Capital.com will also request a copy of a passport or a driver’s license.

Step 2: Deposit Funds

Next, fund the newly formed Capital.com account with some cash.

- When using a debit/credit card or an electronic wallet, a minimum of $20 is needed.

- The minimum amount needed to use a bank wire transfer is $250.

Capital.com does not charge any fees for deposits or withdrawals.

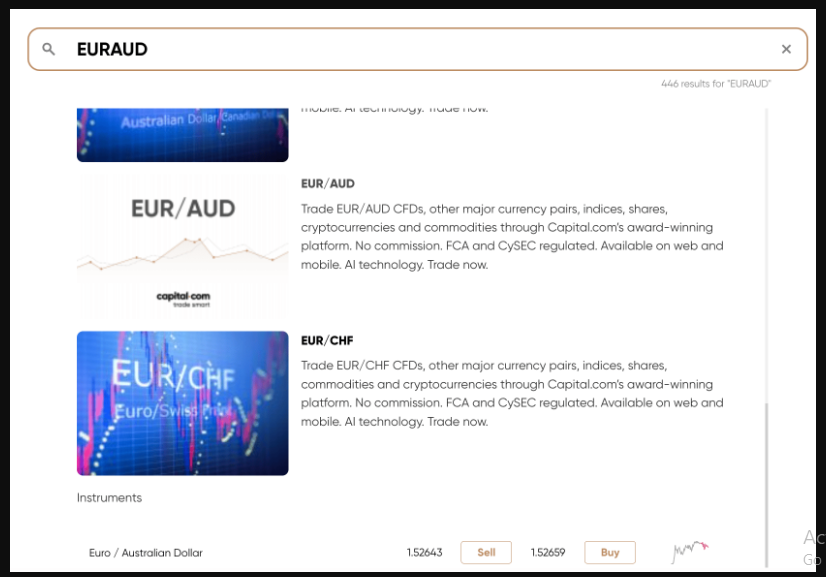

Step 3: Search for Asset

Then, use the search bar at the top of the screen to hunt for an item to trade.

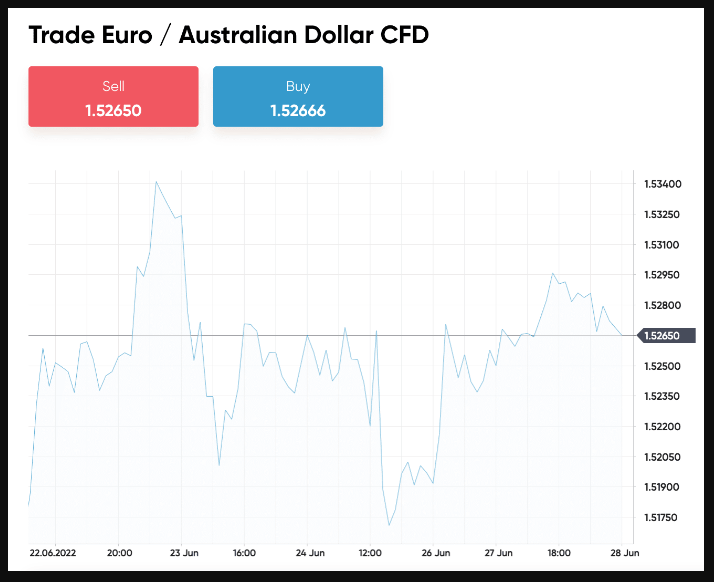

The aforementioned picture depicts how to search for the EUR/AUDcurrency pair.

Step 4: Trade forex

Finally, based on whether the trader believes the item will increase in value or decrease, choose a buy or sell order.

Stake your bet and approve the order. The order will be quickly carried out by Capital.com.

Conclusion

Leveraged trading is a high-risk, high-reward trading method that, when executed properly, can be profitable. Although it is hazardous, you should conduct your study to find the best broker before you begin because of this.

It’s crucial to pay attention to measures other than merely maximum leverage limits while selecting an appropriate platform. The investor should investigate fees, supported markets, customer service, regulation, and more, on the other hand.

To sum up, we discovered that Capital.com is the top high leverage broker overall. The platform provides thousands of markets in a fully regulated trading environment, in addition to narrow spreads and 0% charges.

Frequently Asked Questions

What is the max amount of leverage available to traders in the UK?

Regulations set down by the FCA restrict UK retail clients’ use of leverage on CFDs to a maximum of 1:30. Certain classes will have lower restrictions. For instance, equities can only be leveraged up to 5x, whereas gold can be traded with a leverage of up to 20x.

How does leverage operate with brokers?

Most brokers just serve as intermediaries between the trader and the market. Brokers are able to offer high leverage while still limiting their own risks and exposure because the value of FX pairings does not move much on a daily basis.

With UK brokers, is there a cost for using leverage?

Most brokers do demand a charge for providing leverage. The overnight charge is the rate of interest they assess you for getting additional funds. Some brokers may charge margin fees.

Which high leverage brokers are the best?

Capital.com and eToro are the top high-leverage brokers overall. Both provide thousands of leveraged financial markets with affordable costs and spreads.

Is trading with high leverage secure?

The likelihood that the position will be liquidated increases with increasing leverage. The trader will forfeit their initial bet if this occurs.