In search of the best Forex trading app? Libertex is then deserving of your attention. It is simpler to predict your trading costs with this online trading platform because it uses flat commissions rather than variable spreads.

Customers in the UK can trade CFDs as well as traditional investments with award-winning trading platform Libertex. Through several trading platforms, the broker, which has been in business for 25 years, provides more than 250 tradable assets. Continue reading our in-depth analysis to fully understand Libertex’s features and assess whether it satisfies your trading requirements.

Libertex Overview

By Indication Investments Ltd., Libertex is an online trading platform. This service provider is managed by The Libertex Group, which is in charge of numerous internet trade brokerages. Since 1997, the “Libertex” brand has been in use. Libertex, on the other hand, increased its trading services over the previous ten years and attracted more than 2 million customers worldwide. Libertex currently welcomes users from 11 different nations.

The trading activities of Libertex are supervised and controlled by the CySEC. Indication Investments Ltd., the parent firm, is situated in Cyprus as well. Therefore, the Cyprus Securities and Exchange Commission is in charge of overseeing the entire corporate body.

Libertex is both a regulated company and a leader in its field. This organization has more than 30 years of experience in the financial brokerage sector and is renowned for its reliable platform. It elevates the trading experience to a new level and is a top market maker. According to this Libertex review, the platform is renowned for its cheap commission rates when compared to profitable spreads. According to a number of online Libertex reviews, this fully licensed online broker is trustworthy and a reliable way to trade more than 200 different assets. As a result, Libertex becomes a popular option for retail investor accounts across numerous industries and nations worldwide.

Assets offered by Libertex

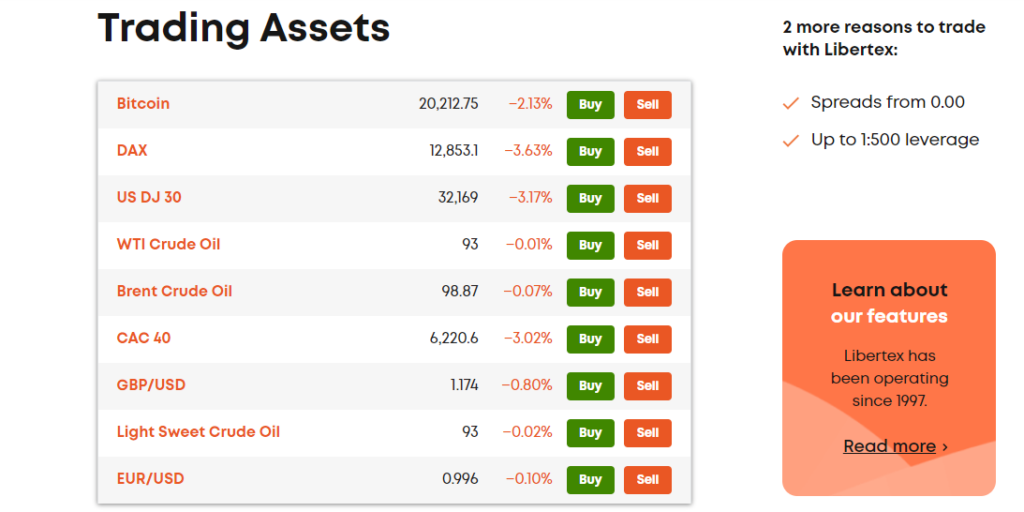

More than 250 CFD assets from different markets are available through Libertex:

- Forex CFDs: Currency CFDs: Customers of Fx CFDs have access to more over 50 currency pairings, comprising 7 majors, 23 minors, plus 21 exotics.

- Stock & ETF CFDs: CFDs on 140+ shares and ETFs, including the top US technology equities and the most popular securities from Europe and Latin America, are also available for stocks and exchange-traded funds (ETFs). Additionally, they can be categorized into a wide range of industries, such as energy, healthcare, and finance, giving you fantastic alternatives for market speculation.

- Index CFDs: Index CFDs Libertex offers more than 25 index CFDs for traders to pick from if they wish to wager on the state of an entire industry or region’s economy. Customers have a selection of futures markets with different expiration dates as well as cash markets.

- Commodities CFDs: Over 15 different precious metals, agricultural commodities, and energy contracts are available through Libertex. Although Brent crude oil, gold, and silver are available for spot speculation, the majority of commodities CFDs are based on futures markets.

- Options Contracts: Libertex also provides options contracts on a variety of assets, notably Cryptocurrencies, the S&P 500 index, and oil.

Libertex Fees

With regard to commissions, Libertex continues to hold a competitive advantage. Charges begin at just 0.0006% for each trade, including 0.0003% entry and exit commission fees. These commission rates, however, are based on the leverage multiplier you choose.

The underlying asset, international rate of interest, and trade position (long or short) all have an effect on overnight exchange charges in other marketplaces. As is customary in the market, Wednesday night FX and Friday night CFD swaps are quadruply charged.

In terms of additional account fees, accounts that haven’t executed an active trade in 180 days are subject to a £10 monthly inactivity fee. But only accounts with a balance of less than £5,000 are covered by this.

Accounts Offered

Based on the unique objectives, financial resources, and trading volume of each client, the Libertex firm supports a variety of trading accounts.

Regular Account

The retail trader CFD account is the first of these accounts. This account, which allows CFD trading with a maximum leverage of 1:30, is open to any verified trader over the age of 18 in a supported jurisdiction. The smallest trade size is £20.

Professional Account

If a trader meets certain requirements, they can open a professional trading account and gain access to greater leverage rates of up to 1:500. You must have over a year of professional experience in the financial services sector, a minimum trading frequency of 10 lots each quarter, and a total financial portfolio worth more than £500,000 in order to be eligible for a pro account.

Libertex Invest

An investment platform for zero-commission stock trading has just been released by Libertex. As a result, you are able to put together an investment portfolio that includes both real stocks and ETFs and earn cash dividends.

There are hundreds of equities available on various US markets, but at the present, stocks from non-US markets are not available. Additionally, although it is being developed, the Invest facility does not permit trading in fractional shares.

Demo Account

For customers who want to practice trading with Libertex without taking any risks, the broker also offers a demo account. Without needing to deposit real money, one can speculate on CFDs like Amazon, Cryptocurrency, and gold with this fake trading account. It is funded with up to £50,000.

This demo account only allows for forex and CFD trading; Libertex Invest is not an option. Three platforms, including the web platform, MT4 and MT5, are available for testing.

Platforms Offered

Libertex supports three different online trading platforms: a customized platform, MetaTrader 4, and MetaTrader 5. For a trading while on the go, all three of these platforms include mobile apps for iOS and Android.

Libertex Native Platform

Functionality is seamless on the native platform. It works with all web browsers. It is a web application with an easy-to-use interface for placing orders. For day traders, quick trade execution is more practical and gives them a competitive edge.

Although already-existing platforms like cTrader are not supported, Libertex has developed a proprietary trading interface with specialized tools and trader insights. The MetaTrader platforms’ services are also integrated into this platform. Libertex Broker offers its own unique platform with a range of features and functionalities for customers that use MT4 and MT5 for trading.

Libertex MetaTrader 4

MT4 is a ground-breaking trading platform. The most well-liked trading tools in the world are available to Libertex clients through MT4. With the help of the MT4 tools, experienced trader can increase their trading knowledge and make significant gains on currency exchanges.

MT4 offers real-time accessibility to all market rates as well as details on their volatility. The platform does numerous technical and fundamental analyses at different levels of the market. Additionally, MT4 aids in the execution of numerous trading orders to give Libertex customers greater freedom.

The MT4 platform’s strong security contributes to keeping Libertex’s reliability score high. Similar to that, this platform is renowned for providing its traders with excellent stability.

Libertex MetaTrader 5

The following edition of MetaTrader is MetaTrader 5. This forex trading program is most effective when used to assess the profitability of different currency pairs. Customers of Libertex can also trade stocks, oil and gas, indices, cryptocurrencies, agricultural products, metals, and ETS using MT5.

With MT5, you may trade stocks and currencies from any web browser application. The MT5 web platform provides allows for trading in indices and futures. This platform can be utilised on its own as well. No other software or browser extensions are required to be installed.

On Linux, Mac, and Windows operating systems, MetaTrader 5 operates without any issues. It has a reliable data security measures.

Libertex App

Every Libertex platform user has access to the Libertex app. It may be downloaded for use on smartphones from the Google Play Store and the Apple App Store, accordingly.

APK downloads are available on the Libertex website as well. The program is frequently updated with new user interfaces and security features. For traders who are always on the go, the Libertex app offers a great trading experience. It runs its operations smoothly and has a well-designed user interface. This app’s trading signals assist mobile traders in obtaining the most important financial news.

Some other innovative feature of this Libertex smartphone application is its ability to toggle between a demo mode and a real account. This makes using the Libertex mobile app for on-the-go trading to carry out simulated trades in actual marketplaces quite simple.

Margin & Leverage

For retail clients, Libertex offers the highest leverage permitted by ESMA rules on each asset type. Due to the fact that they follow FCA standards, these margin amounts will be familiar to UK clients.

Trades can use leverage at a ratio of 10x on minor indexes and certain other commodities, 30x on major Currency pairs, 20x on minor and exotic currency pairs, gold, and massive international indices, and 5x on equities and ETFs.

Professional traders are exempt from these limitations and are permitted to use leverage rates on all CFD trades of up to 1:500.

Payment Methods

A debit card, credit card, PayPal, Skrill, Neteller, or bank wire transfer can all be used to fund a Libertex account. Transfers take place instantly with PayPal but they can be delayed up to five working days with wire transfers.

While PayPal payments must be greater than £10 and other methods require a minimum deposit of £100, bank transfers have no minimum requirements. Skrill deposits are also subject to a 1.9% commission from Libertex, however, all other payment options are free.

Except for the use of credit cards, all of the aforementioned methods are acceptable for withdrawals. Approval timeframes for card and bank transactions vary between one and five business days. £10 is the minimum withdrawal amount. A 0.2% commission fee that is maximum at £10 applies to bank transfers, while a 1% fee applies to Neteller withdrawals and a £1 fee applies to card withdrawals.

PayPal is the sole way to withdraw pounds.

Security & Regulation

Libertex takes extensive precautions to guard against fraud and data theft in the accounts of its customers. On the Libertex.com website and trading platforms, a devoted anti-fraud team actively checks accounts and trades for any suspicious activity. At the same time, powerful encryptions safeguard users’ personal information. Additionally, segregated bank accounts are used to hold customer funds, and separate login credentials for the MetaTrader 4 and 5 platforms increase account security.

As a FX and CFD stock broker operating in Europe, Libertex is approved and regulated by CySEC.

Controversies

In recent years, Libertex has twice violated CySEC rules. CySEC fined the broker €160,000 in the middle of 2020 for a number of infractions, including giving clients leverage larger than the maximum 1:30 EU regulations and carrying out deals under unfavorable conditions.

Following the resolution of these problems, CySEC again penalized Libertex in 2021, this time temporarily suspending its license. This violation involved promotional materials for prohibited giveaways and lower commission rates for clients in particular jurisdictions.

The broker has fixed these problems, and as a result, CySEC has given him a clean bill of health.

Customer Support

There are typically two options for assistance available to traders when they encounter problems on a trading platform: a website’s help section or direct customer care.

Libertex’s customer service offers assistance with segments on the Investment services, transfer of funds, verification procedures, and knowledge for new traders. With information like the inactivity fees and trading charges not disclosed here, the site is less transparent than other brokers.

Additionally, the broker does not provide a live chat facility, which is inadequate when compared to several rivals. Instead, traders must send an email to the broker’s support staff or pay for a long-distance call to the Cyprus-based company’s headquarters.

Educational Resources

On the Libertex website, there is a section devoted to trader education with a beginner’s trading course, many webinars, and particular material on CFD usage. Additionally, users can learn about the basics of leverage, how to use a stop loss or take profit, and how to use the Investing platform.

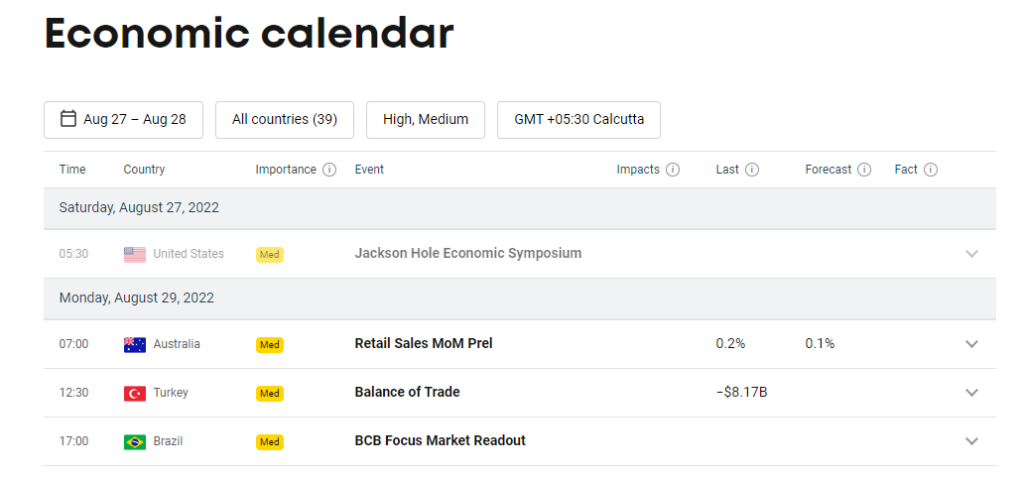

To better analyze the markets, the portal has added a section for research and market news as well as an economic calendar.

How to begin with Libertex?

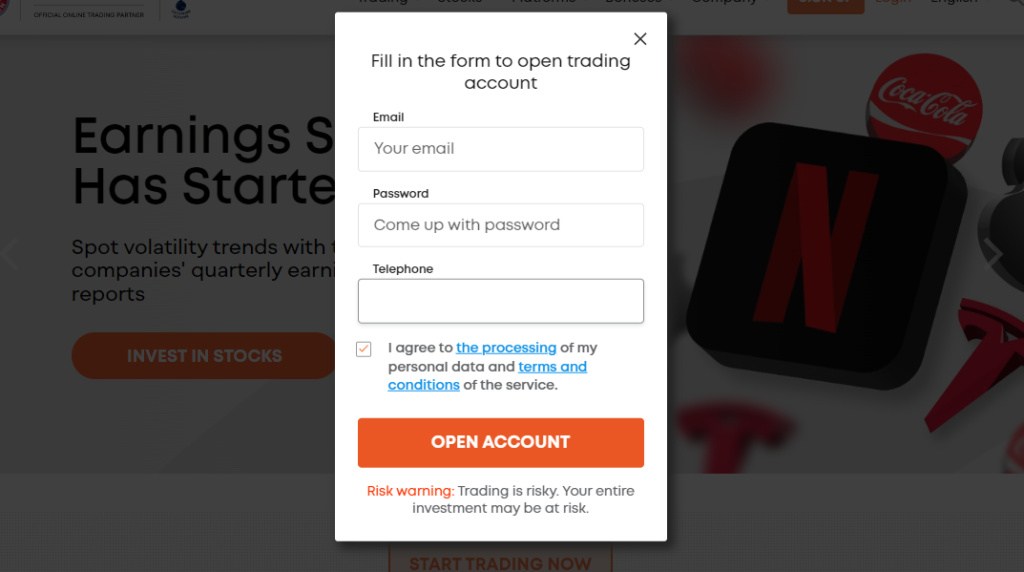

Step 1: Open an account

It’s simple to register for or create a new Libertex account. The user can register in a matter of minutes by just entering their email address. Additional personal information such as a home address and a national ID number were also necessary.

Step 2: Verification

Libertex conducts an online user identity verification process based on this. Libertex brokers adhere to international anti-money laundering regulations to ensure that all users are legitimate.. New Libertex customers must deposit at least €100 after creating their accounts in order to begin trading.

Step 3: Deposit funds

These deposits are also accepted by the broker platform via a number of different payment methods, including bank transfers, credit cards, debit cards, and electronic payment portals. Users can then begin trading all of the supported assets on Libertex at that point.

Conclusion

We investigated one of the best forex brokers in the globe in this Libertex review. For both new and seasoned traders, this platform offers the best services. For traders, lucrative spreads and inexpensive fees are also highly alluring. Libertex is the best trading platform for professional traders and investors. The commission structure on trading assets like metals and indexes, however, might be improved.

Overall, according to multiple Libertex reviews, this platform is a decent option for trading forex and CFDs. More instructional tools definitely need to be added, though. Additionally, the UI might be improved to facilitate quick trade execution. However, the Libertex forex broker offers many justifications for you to start a trading account right away.

Frequently Asked Questions

Is Libertex Legal?

Yes, CySec has full control over it. As mentioned previously, the trading platform is authorized in a number of nations.

Is Libertex A Money Withdrawal Site?

Yes, money can be withdrawn using e-wallets and e-payment gateways.

Is Scalping Allowed on the broker?

Forex brokers in Libertex support a number of trading techniques, including scalping.

What Is the Minimum Deposit?

Although deposits made with this broker are free, a minimum of €100 is required.

How Secure Is Libertex?

End-to-end multi-layered SSL encryption safeguards Libertex. Its traders’ funds are safeguarded and stored separately, as per Exchange Commission CySec requirements. The software securely protects deposits made by Libertex consumers under the ICF totaling €20,000.