In 2022, the stock market has a shaky tendency. Due to worries about consistently rising inflation, accelerated Federal Reserve interest rate increases, and geopolitical tension due to the war in Ukraine and Russia, the S&P 500 is down 4.9 percent through the end of March. Fortunately for investors, the only remaining option is to invest in the most traded stocks, which, even during a market collapse, will almost surely increase in value.

This guide will not only cover the most traded stocks in the UK but also some of the most traded stocks worldwide. We will also include advice on how to invest in them.

Most Traded Stocks in UK 2022

The most traded stocks in the UK in 2022 are listed below:

| RANK | COMPANY |

| 1 | BP plc (LON: BP) |

| 2 | Rolls Royce (LON: RR) |

| 3 | International Consolidated Airlines Group (LON: IAG) |

| 4 | Lloyds Banking Group (LON: LLOY) |

| 5 | Polymetal (LON: POLY) |

| 6 | Darktrace (LON: DARK) |

| 7 | EasyJet plc (LON: EZJ) |

| 8 | Barclays (LON: BARC) |

| 9 | Cineworld Group (LON: CINE) |

| 10 | N Brown Group (LON: BWNG) |

| 11 | Evraz (LON: EVR) |

| 12 | Vodafone Group (LON: VOD) |

| 13 | Glencore (LON: GLEN) |

| 14 | Petropavlovsk (LON: PHZ) |

| 15 | Unilever (LON: ULVR) |

| 16 | Chariot (LON: CHAR) |

| 17 | Royal Mail (LON: RMG) |

| 18 | Legal & General Group (LON: LGEN) |

| 19 | ITM Power (LON: ITM) |

| 20 | Persimmon plc (LON: PSN) |

Most Traded Stocks Analysis

For many years now, UK stocks like Lloyds Bank and Rolls-Royce have enjoyed tremendous popularity. On listings of the London Stock Exchange’s trading volume, they consistently score well. In reality, the UK market’s banking and tourism sectors are evergreens, and stocks like IAG, easyJet, Legal & General, and Barclays often enjoy consistently strong levels of investor interest. These are not unexpected additions and show how well-liked these businesses are.

The value of Unilever shares has increased recently, rising 12% since March 2022. We believe it is worthwhile to keep an eye on this rapidly expanding consumer products giant’s resurgence as a potential addition to your portfolio in the near future.

However, it should be remembered that a high trade volume does not ensure market expansion. The share price of Rolls-Royce has fallen by a staggering 31% this year, while that of IAG, Barclays, and Lloyds Bank has fallen by 26%, 17%, and 12%, respectively. The market drop following the pandemic is largely to blame for this. The bright side of this situation, however, is that these UK shares may climb quickly if the market has an uptrend given the volume of activity.

Recent trends

In response to the invasion of Ukraine, the UK government has imposed strict restrictions on Russian businesses doing business there. Shares of Russian-based companies Petropavlovsk, Polymetal, and Evraz have dropped by more than 80%.

The growth of IT UK shares and the push for green energy are the two patterns that we have discovered using this data from Fineco Bank. Over the next ten years, We believe both sectors will grow significantly in importance. After a dramatic LSE launch, Darktrace’s share price soared by almost 300% in just six months. Trading prices are currently very similar to the listing price. However, We remain bullish about the UK sector. It’s encouraging to see how many tech companies are starting up and expanding in the nation.

However, ITM Power’s continuous position in the list of the most actively traded stocks for the past two years is evidence that shares of renewable energy companies are here to stay. We are encouraged by this growth even if it will be laborious given the unstable market conditions. Over the coming months, we’ll pay special attention to UK shares in this industry and choose one with solid fundamentals for my portfolio.

Most traded international stocks

Tesla (NASDAQ: TSLA)

The most traded stock, Tesla, was established in 2003. The business creates, produces, rents, and sells electric vehicles. Tesla also manufactures energy storage devices, generators, and other things. The most well-liked goods from Tesla include popular EVs like the Model S, X, 3, and Y.

The company also sells Solar Roof, Tesla Energy Software, Megapack Solar Panels, Powerpack, and Powerwall, an integrated battery system. Additionally, in 2021, Tesla inked a supply contract with Arevon, a well-known provider of renewable energy.

According to the arrangement, Tesla would give Arevon a record number of Megapack batteries, amounting to 2 GW/6 GWh. Several new energy storing technologies will make advantage of this. The Townsite Solar and Storage Facility is the newest joint venture between Tesla and Arevon.

This installation has more than 500,000 solar panels and is situated in Nevada. To help maximize the usage of solar energy, this will deliver 360 MWh of Megapacks. Sixty thousand homes will be powered by the Megapack initiative.

The main driver that raised its market valuation past $1 trillion appears to have been online speculations of a deal with the rental car company Hertz. This was followed by a 13% gain to $1,025 per share within one day. Hertz plans to electrify its fleet in conjunction with the EV company by 2030.

However, Elon Musk noted on Twitter that because demand continues to outstrip supply, the acquisition won’t have much of an effect on Tesla’s economy.

Learn more: How to Buy Tesla Shares UK- Complete Guide 2022

Apple (NASDAQ: AAPL)

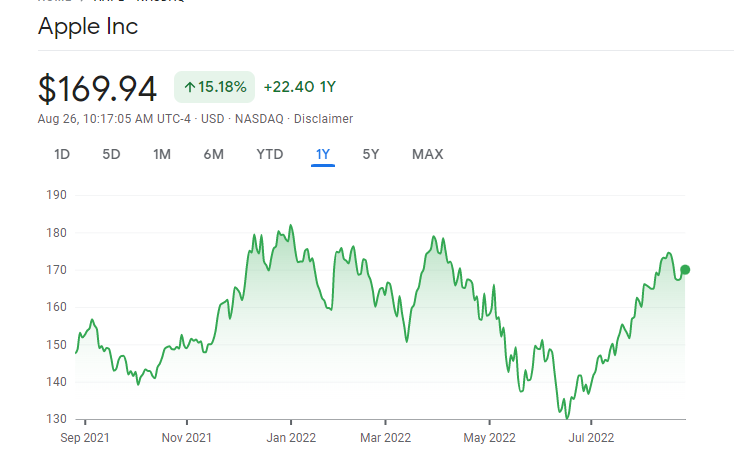

Apple is a titan in the smartphone market that continues to post excellent growth, as you are well aware. The business reported record sales for the first quarter of 2022 of $97.3 billion, an increase of 9% from the previous year. This most traded stock has seen its value rise by approximately 290% over the last five years.

Apple has gained a lot from the increasing popularity of 5G cellphones. The corporation sold more than $190 billion worth of iPhones in 2021, accounting for more than half of its overall sales. The comparatively low pricing of the iPhone SE model for 2022 is anticipated to increase sales even more.

The price of Apple shares has decreased by around 19% since the year 2022 began. Apple’s company is still strong in spite of general stock market volatility. Apple is currently trading at approximately $150, which is about 20% less than its 52-week high. Apple has consistently been successful in developing cutting-edge goods that generate billions of dollars in revenue.

Additionally, it provides a running dividend yield of about 0.60 percent.

Learn more: How to Buy Apple Shares UK- Complete Guide 2022

Alphabet (NASDAQ: GOOGL)

Google’s parent business, Alphabet, is a well-known technology multinational holding company with its headquarters in California. It goes without saying that this company, which owns a number of current digital giants including Waze, Nest, YouTube, and Fitbit, was once a subsidiary of Google. One reason Alphabet is one of the most popular tech stocks is that it is always growing and is even considering developing a blockchain solution for Web3.

Two companies owned by Alphabet are industry leaders in their respective fields. Sponsors spend a significant amount of money on both platforms since Google and YouTube are industry leaders in their respective fields. On just these two platforms in 2021, sponsored adverts accounted for more than 80% of Alphabet’s income.

Only 11% of the company’s overall revenue was generated by its other businesses, which include subscriptions, Google Pay, and Pixel smartphones. Although it continues to be unprofitable, Google Cloud made up 7% of the company’s overall revenue. As you can see, Alphabet’s portfolio of tech companies is diverse.

Alphabet has experienced a gain on the stock market of over 140% over the previous five years. The stock has moved significantly over the past three months, much like the rest of the industry. However, during the past 12 months, it has outperformed the S&P 500.

The business has announced a 20-for-1 stock split that will occur in 2022 if you wish to purchase Alphabet stock. As a result, the equity will be more affordable. Long-term investors in this most actively traded company are likely to profit from prospective buybacks and cash production. Nevertheless, reputable online brokers like eToro allow you to buy this stock in smaller amounts.

Learn more: How to Buy Alphabet Shares UK- Complete Guide 2022

Amazon (NASDAQ: AMZN)

In the past three decades, Amazon has evolved from a small online book store to a top e-commerce retailer. It is now essentially the standard online shopping platform and provides its services in more than 200 nations. However, Amazon’s e-commerce operations aren’t the only thing that makes it one of the most actively traded stocks to follow.

The company’s offering in the cloud computing sector, Amazon Web Services, dominates the worldwide digital infrastructure industry. Over time, this market category has grown stronger and in the first quarter of 2022, it experienced a 37% growth. Along with this, Amazon has a number of other notable divisions and acquisitions, including Whole Foods, Zoox, Twitch, and others.

As an investor, you stand to gain from this diversification, which is one of Amazon’s biggest assets. Additionally, Amazon disclosed that its shares would be divided 20 ways for 1 later in 2022. By doing this, Amazon might join the Dow Jones Industrial Average, which would help drive up the price of its stock.

The price of Amazon shares has increased by more than 179 percent in the last five years. With the help of its cloud computing and e-Commerce businesses, Amazon has created two of the most important global industries. This suggests that despite any near-term uncertainties, Amazon is positioned to dominate the tech sector in the years to come.

Learn more: How To Buy Amazon Shares UK – Complete Guide 2022

Nvidia Corporation (NASDAQ: NVDA)

In the world of computer chips, Nvidia is undisputedly the leader. The company is a market leader in cloud technology and AI and is well-known for its GPUs. It has been selling graphics cards that are used in video game consoles and personal PCs for more over twenty years.

Nvidia considers the gaming industry to be its primary source of revenue and has made significant investments there. In fact, in the fiscal year 2022, this division was responsible for almost 40% of the company’s top-line revenue. Nvidia’s management estimates that this sector offers a $100 billion possibility for revenue.

Additionally, Nvidia is expected to profit from the automotive industry, which might accelerate its long-term growth. Leading automakers have previously worked with Nvidia for its full-stack autonomous driving technology, including Hyundai, Mercedes, Tata Motors’ Jaguar, Volvo, and Land Rover.

Nvidia stock has given investors a return of more than 430% over the last five years. The stock has taken a hit since the year 2022 due to general IT industry difficulties. In any case, Nvidia’s long-term prospects appear to be highly promising, making it one of the most actively traded companies for 2022.

Also read: Best Tech Stocks You Should Buy In UK 2022

How to buy Most Traded Stocks?

We’ll explain to you how to buy the most traded stocks in the parts below.

Step 1: Choose a broker

You have to find a broker to invest in the most popular stocks. We examine two brokers who provide no commissions, rigorous regulation, and simple trading for the most popular stock in the UK.

1. eToro

With global broker eToro, all of the companies in our top most traded equities in the US and the UK are commission-free to trade. Starting with just $10, you can gradually increase your spending.

Since its launch in 2006, eToro has drawn more than 20 million investors because of its broad variety of international equities, 250+ ETFs, commodities, indices, and other assets. The design’s simplicity, which makes it simple to monitor both your portfolio and trading opportunities, is the most obvious example of that level of information.

Just as with other licensed brokers, you’ll have to present your ID and address. You can then make a deposit. eToro has a range of payment options in GBP. The deposit is free (but a 0.5 percent currency conversion applies).

When you have your money set aside, you may start looking for the stocks that are traded the most frequently. People can be found using their names, industries, or exchanges. You can look at a range of facts, newsfeed data, and graphing alternatives before you commit to your deal. With eToro, you can go short on a few equities and leverage some trades.

eToro prioritizes assisting new investors with its built-in social trading options. Smart Portfolios allow you to invest in strategic portfolio positions created by experts (minimum $500 investment). You may get in touch with eToro’s customer care staff using an email ticker system, and their sections are clearly labeled and easy to find.

2. Capital.com

A specialized CFD broker, Capital.com has 175,000 confirmed investors. The broker offers access to 3,800 markets in total, including exchange-traded funds, equities, cryptocurrencies, currencies, and commodities (ETFs). You can buy the most well-liked stocks or browse Capital.com’s portfolio of more than a thousand shares and one hundred exchange-traded funds (ETFs). Capital.com offers stock transactions with tight spreads and virtually no commission.

Because Capital.com complies with CASS regulations, it is assumed that consumer funds are kept apart from investment funds and are covered by the UK’s Financial Services Compensation Scheme.

The customer support is excellent, and this broker makes it simple to deposit GBP. All of Capital.com’s trades are CFDs because it is a CFD broker (Contracts-For-Difference). This suggests that even though you won’t be able to purchase the underlying stock, you will be able to short stocks and leverage your transactions. Certain overnight CFD fees apply.

The user interface on Capital.com is simple to use, and there are several graphing tools available. Although the trading process isn’t as simple as eToro’s, there are more sophisticated trading options and a wide range of currency and spread betting assets available.

Step 2: Registration

Having done your research, are you now prepared to begin investing in the most traded stocks? Let’s look at how using an eToro account can help you do this.

On the eToro website, enter your username, email address, and password. As an alternative, you may register using Google or Facebook.

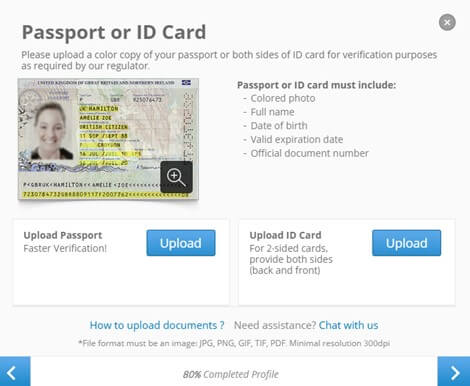

Step 3: Get verified

To get confirmed and trade substantial amounts with eToro, you must present Proof of Identity and Proof of Address.

- The quickest way to verify your Proof of Identity is to provide a copy of your passport.

- As proof of address, you may provide utility bills, council tax bills, bank/credit card statements, or a driver’s license.

Step 4: Deposit funds

Bank transfers, credit/debit cards, PayPal, Trustly, Rapid Transfer, Neteller, and Skrill are all acceptable methods of depositing Pounds with eToro. Remember that your eToro account will be processed in USD and that any payments made using GBP will incur a 50 pip (percentage point) currency conversion fee.

Step 5: Find your Most Traded Stocks

You can look up stocks using the top search box by name:

You may also choose “Stocks” from the center menu by clicking the “Discover” icon on the left toolbar. After that, you may browse all of eToro’s stocks in one location. You can also search by stock exchange or industry.

Step 6: Buy the most traded stock

Click on the stock’s name or logo to go to the page for that stock. On the site, you may access extensive graphing options as well as study key analytics and data. Click the blue “Trade” option in the top corner to go to the next stage.

The value of the shares you intend to purchase (in USD) must be entered in the corresponding box, together with your preferences for leverage and stop-loss.

Your trade will start as soon as you click “Open Trade.” You’ll receive a pop-up notification when your market order is filled.

Conclusion

We’ve examined today’s most traded stocks and found that the great majority of them have space to grow. We have no issues recommending eToro as your first stop when making investments in the most actively traded stocks. eToro offers a wide variety of stocks, a very user-friendly interface, and upfront pricing.

Frequently Asked Questions

Which Nasdaq stocks are most traded?

Apple Inc., Microsoft, and NVIDIA Corporation are the three stocks that are now most actively traded on the NASDAQ.

Which FTSE stocks are most traded?

The three equities that are now most actively traded on the FTSE are BP, Lloyds Bank Group, and easyJet.

What are most traded equities?

The world’s top-trading stocks are primarily from China and Russia, as well as other markets that are inaccessible to Western investors.