Penny stocks are a cheap method to diversify your holdings and have the potential to increase in value over time. However, they are also relatively hazardous investments because the businesses are typically tiny, new, and facing stiff competition from other businesses in their area.

In this guide, we will not only discuss the best penny stocks for 2022 but also provide information on how to invest in them.

What are penny stocks?

The term “penny stocks” is used informally to refer to inexpensive, low-cost shares of small, frequently freshly listed companies. Despite the hazards, investors are frequently drawn to penny stocks because of their low prices and the possibility of considerable growth.

The meaning varies by country; in the UK, it often refers to stocks with a market value of less than £100 million or that trade for less than £1 per share. A penny share, as defined by the SEC, is a company that costs less than $5 per share.

Best Penny Stocks 2022

A list of the top penny stocks for 2022 is shown below:

- Hostelworld (LON: HSW)

- Severfield (LON: SFR)

- Renold (LON: RNO)

- Smiths News (LON: SNWS)

- Frenkel Topping (LON: FEN)

- Inpixon (NASDAQ: INPX)

- Gevo Inc. (NASDAQ: GEVO)

- Nano Dimension Ltd (NASDAQ: NNDM)

- Sunworks Inc. (NASDAQ: SUNW)

- Globalstar (NYSEAMERICAN: GSAT)

Best Penny Stocks Analysis

Hostelworld (LON: HSW)

Travelers can reserve inexpensive hostels all over the world using the online booking service Hostelworld. It houses the software and keeps a database of hostels throughout the globe that mostly caters to fans of low-cost lodging.

The price at which Hostelworld shares are currently trading, 84p, is comparable to the price at which they were trading at this time last year, 83p. But more recently, the shares dropped to 61p in March due to a decline in the stock market. This shows a 37 percent gain on the stocks during a five-month timeframe for the shares.

Many travel-related stocks, including Hostelworld, have benefited from pent-up demand. We think that restrictions that made many people forgo vacations for at least a few years have given customers, including us as frequent travelers, a fresh appreciation for traveling.

This month, Hostelworld released an interim trading report for the 6 months finishing June 30, 2022. The major conclusions were mainly encouraging, which supported our case for investing. It stated that revenue in this period outpaced revenue in the first half of 2019 by 866 percent, which is encouraging to see. Pent-up demand is a factor, it claimed. Net bookings increased as well. As prospective investors, we saw signals of improvement in the trade report.

Severfield (LON: SFR)

Severfield is an organization that specializes in the design, production, and installation of structural steelworks for the building industry. It is among the largest companies in its industry in the UK as well as throughout Europe depending on revenue, with a capacity exceeding 165k tonnes yearly.

They are currently trading at 61p. The stock was selling for 78p at this time last year, a 25% decrease from that point in time. The decline in its share price doesn’t worry us. In actuality, we see it as an opportunity to buy shares at a discounted price.

The popularity and visibility of Severfield are a big asset. Performance, growth, and returns should all be enhanced by their scale and scope. The global construction boom that is currently taking place is related to this. The epidemic knocked the global economy for a loop, but now that limitations look to be history, infrastructure investment in the building is soaring. We are also encouraged by Severfield’s exposure to the Indian market, a developing global economy that is undergoing significant infrastructural growth.

With a price-to-earnings ratio of just 11, Severfield shares currently appear to be a fantastic value. A ratio of < 15 is considered to be a good indication of value for money.

Renold (LON: RNO)

Renold is a manufacturer of industrial conveyor chains and other machine parts with headquarters in the UK. It supports numerous industries, including but not restricted to mining, energy, construction, and agriculture, and has a global footprint.

Shares of Renold are currently going for 23p. The stock was selling for 19p at this time last year, representing a 26% return over the previous 12 months.

The company has a long history dating back to the 1800s and has remarkably expanded to become a global company. In fact, it services the Chinese market in addition to getting the majority of its income from the Americas. The fact that Renold has diversified its business model by providing a variety of distinct flagship items is another benefit for us as potential investors. These goods all have several uses in numerous different industries. Over time, this diversification might enhance performance and prospective returns.

The price-to-earnings ratio for Renold shares at the moment is merely five, making them appear absurdly cheap. We wouldn’t be risking a lot of my money if we opened a small position in the penny stock.

We wouldn’t be putting too much money at risk because the shares appear to be inexpensive. Additionally, city experts are optimistic about the company’s expected future growth in earnings. We think that as the company expands, Renold shares could offer consistent gains in the long run.

Smiths News (LON: SNWS)

Smiths News is a wholesale distributor of printed materials like magazines and newspapers with headquarters in the UK.

At the time of writing, the Smiths shares are trading at 31p. The shares were trading at 38p at this time last year, a 15% decrease from that point in time. Because of macroeconomic uncertainty and the tragic events in Ukraine, several equities have declined since the beginning of the year.

In the UK, Smiths holds a market share of more than 50% for the distribution of newspapers and magazines. With such a large competitive edge, it ought to be able to deliver reliable performance and generous returns.

It accomplishes this by examining Smith’s core principles. The shares firstly provide a dividend yield of almost 7%. This is unusual for penny stocks, and Smiths’ yield is greater than the 3%–4% range for the FTSE 100. However, we are aware that dividends may be revoked at any time. Additionally, Smith’s shares appear absurdly cheap at the current price-to-earnings ratio of only 3.

Frenkel Topping (LON: FEN)

To give you a brief overview, Frenkel is a specialized financial services company with headquarters in the UK. Small but nimble, the £88 million market-cap company specializes in the expanding fields of client negligence and personal injury. Additionally, it provides wealth management services.

As of this writing, Frenkel shares are trading at 65p. The stock was selling for 58p at this time last year, a 24% increase in value over the previous 12 months.

We enjoy how Frenkel’s performance history appears. However, we are mindful that past success does not ensure future success. Looking back, we can observe that throughout the previous four fiscal years, both revenue and profit have increased. Its strongest year to date was 2021, when compared to 2020, sales and pre-tax earnings increased by 80%.

Frenkel’s growth has come from both organic growth and mergers. These purchases have aided the company’s performance improvement and increased investor returns. We even noticed that it has a 99% client retention rate that it has kept up for 13 years straight, indicating that business is booming. Regarding returns, it delivers a dividend that would increase our source of passive income. The present dividend payout ratio is just over 1 percent. However, we are aware that dividends may be revoked at any time.

We are drawn to buy the stock because of its successful history, remarkable client retention rates, and buy and grow acquisition business plan. It’s an added plus that it pays a dividend.

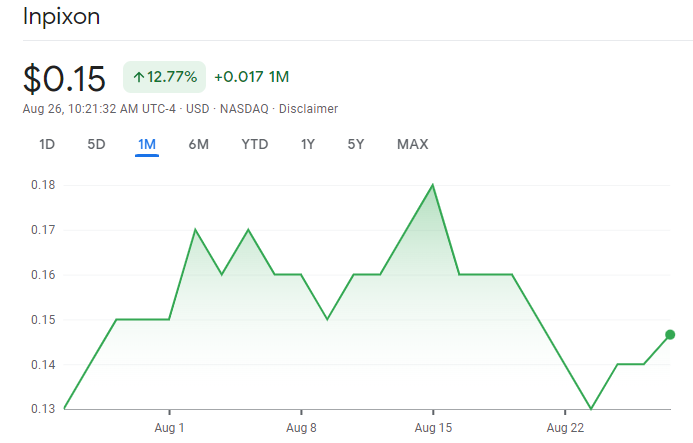

Inpixon (NASDAQ: INPX)

From its Palo Alto offices, Inpixon provides solutions based on locations and big data analytics to a customer across the globe. Customers can employ a variety of sensor solutions from this company to optimise indoor spaces using Wi-Fi and Bluetooth. With 220 workers and a market value of roughly $37 million, the company is run by CEO Nadir Ali.

Over the past year, INPX has seen difficult times with its shares. The price has decreased from over $1.20 to its current amount of $.15 in just a year, a nearly 80% decrease.

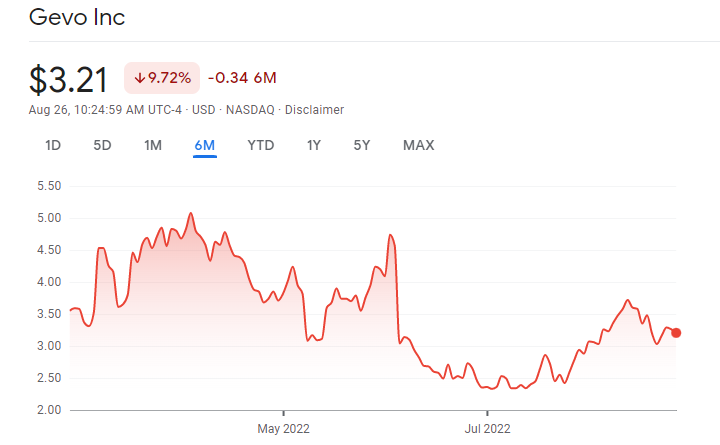

Gevo Inc. (NASDAQ: GEVO)

Gevo, based in Englewood, Colorado, is a leader in the environmental movement. The company creates eco-friendly substitutes for gasoline and diesel, and it excels in supplying the aviation sector with liquid hydrocarbons that are highly energy-dense.

This company is growing even though its price dropped significantly during the course of 2021 from nearly $15 to less than $5.

The stock has increased 40% in just two months, from June 22nd, 2022, when the GEVO price was $2.36, to reach its present price of $3.21.

Also read: Best Renewable Energy Stocks You Should Buy in UK 2022

Nano Dimension Ltd (NASDAQ: NNDM)

The Israeli company Nano Dimensions specializes in 3D printing and offers equipment and software to quicken the production of electronics. The company uses deep learning artificial intelligence to focus on the prototyping phase of traditional manufacturing schedules.

The price of one Nano Dimension share is $3.27 at the moment. From its early-year stunning run to $15.54 to its present level, the stock price has fallen sharply. This is a typical problem for hi-tech businesses entering the market. The purchases of Global Inkjet Systems and Essemtec over the past 12 months haven’t improved the pricing.

The price dropped to slightly under $3 on January 24 and again on March 14, before skyrocketing to more than $3.90.

Sunworks Inc. (NASDAQ: SUNW)

Sunworks is headquartered in California, and is a prominent leader in the renewable energy industry. The overall Sunworks revenues increased by more than 150 percent during 2020 and 2021, from $37.9 million to $101 million.

With over 500 employees and a $66.5 million market capitalization, Sunworks has a high staff-to-market capitalization ratio and may benefit from reorganization as one of many strategies to increase profitability.

Sunworks, a thriving player in the solar energy industry, is based in Roseville, California. From $37.9 million to $101 million, the total Sunworks revenues climbed by more than 150% between 2020 and 2021. But the stock price, which has been steadily declining since its high of almost $25 in January 2021, was unaffected by this. Price hit a low of $1.72 on March 24, but has been above $2 since the third week of February 2022. Sunworks shares currently cost $2.24 per share.

In the end, investing in Sunwork entails placing a wager on a modest solar energy business that might not have the best management or financial performance. The stock price rose above $5 during market hours on March 8 of this year.

Globalstar (NYSEAMERICAN: GSAT)

Globalstar is a US satellite communications firm that was established in 2003 and is headquartered in Covington, Louisiana. Around 775,000 subscribers are served by the company’s network of satellites and ground stations, which spans a variety of industries like forestry, public safety, and energy.

Globalstar, which is unusual for a penny company, has a substantial market capitalization of $2.5 billion. Its fair price-to-earnings ratio is 11.5 percent. In Q4 2021, quarterly sales increased by over 6% to $34.48 and net income rose by 22%.

But with net income losses of over $100 million in 2020 and 2021, Globalstar is obviously having some issues. Globalstar cost hit a 2022 bottom of $0.92 on February 24. After that, the share price skyrocketed, reaching $1.52 on March 29. It has since decreased to its current level of $1.33.

The price bounced on January 24 and February 24 after reaching a level of $0.92. As a result, the price stabilized and started to rise after a gradual fall between Q3 and Q4 2021.

How to buy UK Stocks?

We’ll explain to you how to buy UK stocks in the parts below.

Step 1: Choose a broker

It can be time-consuming to find the Best Stocks Trading Platforms in UK 2022 from the numerous available to purchase these penny shares. The platform should excel in KPIs like payments, fees, commissions, and regulations in addition to offering penny shares. Let’s examine these stockbrokers in more detail as we move along with these considerations in mind.

1. eToro

It is the best online broker in the UK overall if you wish to invest in penny shares. It first attracted attention in 2006 and operates online. eToro supports more than 500 crypto pairings and more than 120 coins. This lets you keep several CFDs and buy any form of conventional share as well as trade shares. Minimum deposits in eToro begin at $50, or 36.26 Euros.

You may instantly mimic any investor’s portfolio on eToro. Nevertheless, eToro includes a number of earlier-made duplicate portfolios. Many investors always choose eToro first. This is the primary cause of this platform’s popularity in the UK, where it has more than 15 million members. It is licensed by three important organizations: ASIC, CySEC, and FCA.

No other brokerage platform can match with eToro in terms of fees. You can buy shares from eToro for nothing at all because of the company’s 0% commission policy, which extends to all of its users. It only permits investments of 0.75%. Additionally, eToro provides automated mechanical trading options.

The ability to routinely invest tiny sums of money is eToro’s key feature. The best thing about eToro is that anyone who wants to invest can use it, even if they are brand-new to the market. No prior experience is necessary to trade Cryptos with eToro. You must create an eToro account in order to save money in your account.

Learn more: eToro Broker Review UK 2022 – Complete Guide

2. Capital.com

You won’t be able to own the asset through this broker; instead, you can just trade, as it is a CFD broker. It gives you the flexibility to start a business that you can afford. You will have distinct options to buy and sell. Not only can you invest while shares are rising, but you may also earn when shares are falling.

Leverage is a tool that can be used when trading an item. Traditional shares do not allow for this. On the other hand, if you view yourself as a professional client, it will rise even further. You can purchase and sell assets on Capital.com without paying a commission.

More than 2,000 shares are available on Capital.com, many of which are among the best ones to purchase. Since Capital.com has an FCA license, you don’t need to be concerned about security. A 20 euro minimum deposit can be initialed. You can trade using your phone with Capital.com’s stock trading app.

Few of its rivals’ trading platforms use artificial intelligence as effectively as Capital.com. Capital.com’s artificial intelligence discovers a market and potential trading setups and alerts us to them. You will get access to a charting interface with about 75 technical indicators on this platform.

Despite being varied, Capital.com is quite user-friendly; the platform can be customized, and there is a useful trading app for iOS and Android that you can use on your phone. Capital.com is the greatest broker for trading and investing services and offers a tonne of materials for beginners. The UK’s Financial Conduct Authority has authority over it. All UK accounts are protected for up to 85k Euros through the Financial Service Compensation Scheme.

Learn more: Capital.com Broker Review UK 2022 – Complete Guide

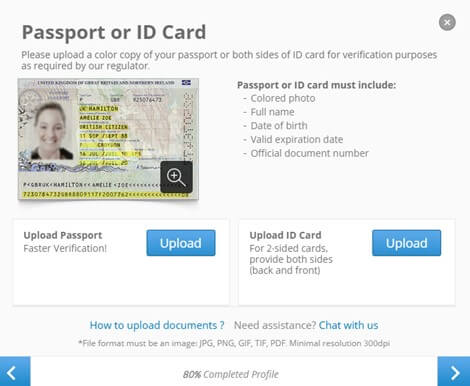

Step 2: Open your account

After selecting a broker platform, you must create an account before you can begin trading penny stocks. The process of creating an account is the same across all brokerage platforms; however, you will need to supply some personal information, such as your nationality, date of birth, full name, National Insurance number, residential address, contact information, etc.

Using an FCA-regulated brokerage platform to purchase penny shares requires you to verify your identification. If you are utilizing eToro, this procedure would be finished in a short amount of time. A copy of your driver’s license, passport, and a utility bill or bank statement must only be provided by you.

Step 3: Deposit funds

You will be required to deposit money into the broker’s account after completing the verification process. The minimum deposits vary depending on the broker you have chosen. 100 Euros and 200 Euros are needed for Plus500 and eToro, respectively.

Step 4: Buy Penny Stocks

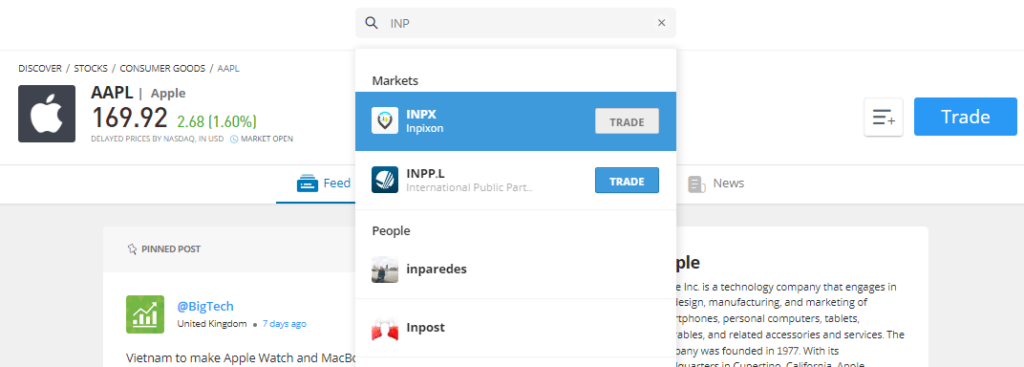

After you have finished adding funds to your account, we will walk you through the steps involved in using eToro to purchase Penny shares in the UK.

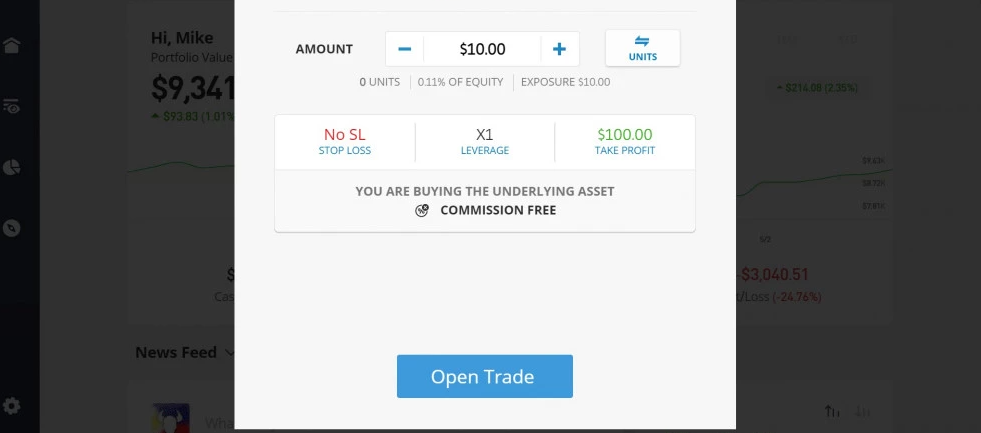

You must first choose the stock you want to purchase. then click the “Trade” button after entering the stock name in the search box at the top of the page. As a result, a penny stock is now defined as the price of shares in the order box that is less than £1.

A pop-up box will then open, asking you to fill out the information about the penny share before entering the amount you wish to invest. Finally, click the “Open Trade” button to finish the transaction.

Conclusion

Penny stocks can be a good addition to your investment portfolio since they are inexpensive, allowing you to purchase a large number of shares for a modest investment. However, they can also be hazardous. Keep in mind that your portfolio still needs to be diversified and that you should only invest money that you are willing to lose.

Frequently Asked Questions

How can Penny shares be sold in the UK?

You must return your Penny shares to the broker you used to purchase them in order to sell them.

What does the term “penny shares” mean in the UK?

Most people agree that penny shares are any stocks with a value of one pound or less.

What is the minimum investment you can make in penny stocks?

As we are aware, the minimum investment into each stock varies from broker to broker and is, for instance, $50. This implies that you could purchase Penny shares in 100 different firms for $5,000.