There are many different brokers available nowadays. In 2022, eToro and Trading 212 are two well-known online brokers. Individual investors and newbies can easily access the commercial world thanks to these brokers. By platform, there are different offerings and features. This eToro vs Trading 212 review will help you decide which broker is better in UK.

We will examine each of these online brokers in more detail, paying particular attention to their features, security measures, and customer support. We will also discover more about the financial services they provide and the various rates that are in effect.

eToro vs Trading 212: Overview

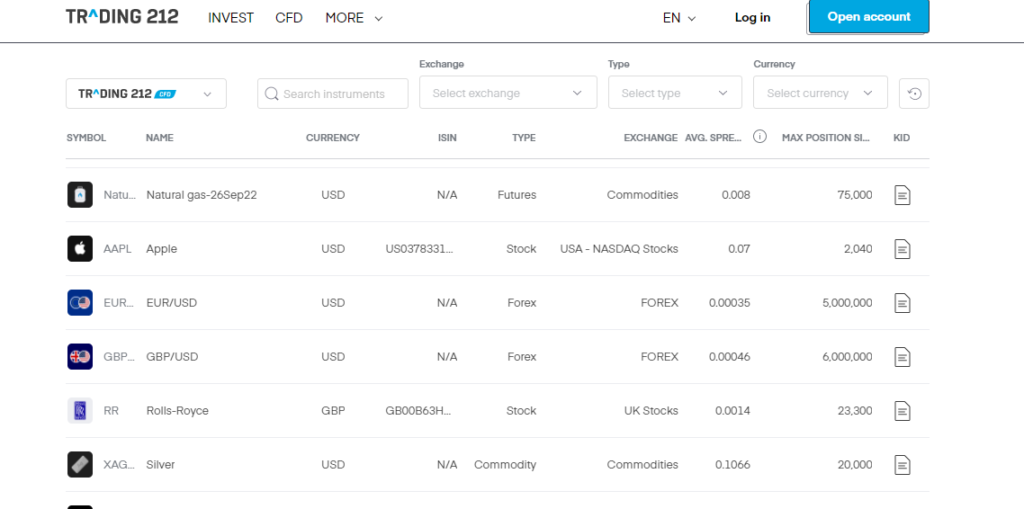

You can invest and trade online with the push of a button thanks to companies like eToro and Trading 212. Both platforms are good for beginning traders because they are clearly geared toward the “Average Joe” investor. Thousands of financial markets are available on Trading 212 and eToro, however, these are normally divided into two main categories.

The typical investment aspect of things comes first. You can purchase shares and ETFs on both eToro and Trading 212 in this regard. You will have full ownership of the corresponding instrument, making you eligible for dividends, if any. Second, both Trading 212 and eToro offer a complete CFD trading platform.

For those who don’t know, CFDs monitor the prices of real-world assets like equities, gold, oil, and currencies. They enable you to trade without acquiring ownership of the aforementioned asset, allowing you to use leverage and engage in short-selling. Later, more on this. The least expensive brokers and CFD trading platforms in the market, respectively, are eToro and Trading 212.

This is so since both platforms provide stocks, ETFs, and other products. Due to this, eToro and Trading 212 have significantly increased their customer base in recent years. In actuality, there are currently over 17 million investors on eToro, and over 15 million people have downloaded the Trading 212 app.

Furthermore, it should be obvious that Trading 212 and eToro are both registered brokers. Both have Financial Conduct Authority (FCA) licenses, while eToro is additionally governed by ASIC and CySEC. eToro and Trading 212 are frequently chosen as the platform for retail investors because of the aforementioned stand-out features.

Learn more in detail: eToro Broker Review UK 2022 – Complete Guide

eToro Vs Trading 212: Assets Offered

This part of our eToro vs. Trading 212 analysis will discuss the many asset classes that may be traded and invested in.

Stocks

Most novice investors start with traditional stocks when they first begin investing. If this describes you, you’ll be happy to learn that eToro and Trading 212 both provide a large range of businesses.

eToro presently supports more than 2,400 equities on 17 various stock exchanges. This includes firms listed in the United Kingdom, United States, Canada, Germany, Hong Kong, France, Greece, and other nations. As a result, eToro makes it simple for you to create a diversified portfolio of the most widely traded equities.

On the Trading 212 site, you may also get access to a huge range of stocks. Similar to eToro, this includes not only UK-based businesses but also a number of foreign exchanges. This includes the NYSE, NASDAQ, and Deutsche Börse Xetra in the US and Germany, respectively.

ETFs

Once more, you have access to a wide range of ETFs with eToro and Trading 212. If you wish to invest a huge basket of assets in a single trade, this is helpful. We discovered that both vendors provide ETFs that are supported by well-known vendors like iShares and Vanguard. If you invest in an exchnage-trdaed fund at Trading 212 and eToro, you will be qualified for dividends when the provider pays them.

Cryptocurrencies

As of right now, there isn’t much separating the two brokers in our asset comparison of eToro and Trading 212. However, with regard to cryptocurrencies, this is not the case. Importantly, Trading 212 gives nothing while eToro enables you to purchase more than 16 different digital currencies.

Prior to January 2021, however, Trading 212 did provide bitcoin CFDs, thus this wasn’t the case. Since the FCA banned crypto-derivatives, Trading 212 has deleted this investment vehicle from their CFD portfolio.

On the other side, when you purchase cryptos through eToro, you are purchasing the asset. There are no CFDs available at eToro USA LCC; only genuine Crypto assets are.

Forex

If you’re considering signing up, you can trade foreign exchange on eToro and Trading 212. While Trading 212 offers over 150 different pairs, eToro offers over 50 different pairs. Having said that, we discovered that eToro forex pairs had narrower spreads than Trading 212, so you should be aware of this.

CFDs

As mentioned above, we observed that both platforms—eToro and Trading 212—offer CFD trading services.

This includes a wide variety of CFD asset classes, including Stocks, Hard Metals, Energies, and Indices.

Given that both Trading 212 and eToro have a wide selection of financial instruments to choose from, it was difficult to differentiate between the two in terms of CFD markets.

eToro Vs Trading 212: Fees

Trading platforms fees

One of the most well-known methods that internet brokers to make money and maintain their business operations is by charging a fee for their services. Comparing online brokers to their counterparts that deal in equities and commodities, smaller fees are typically charged.

Flat fee

If you don’t log into your trading account for several months, eToro will charge you an inactivity fee, which is a fixed $10 monthly price. There are no such inactivity fees at Trading212.

Deposit and withdrawal fee

While there are no fees associated with adding money to your trading account at eToro, withdrawals are subject to a flat $5 cost. If necessary, an additional currency conversion fee is also assessed.

For both regular and quick bank transfers, there is no deposit fee in the case of Trading212. For deposits of at least EUR 2000 made by Apple Pay, payment cards, Skrill, and Google Pay, there is a 0.7% deposit charge, nevertheless. Trading212 does not charge a fee for withdrawals.

Broker trading fee

No commissions or trading fees are assessed for trades made through the eToro platform. However, it features something called a “Bid/Ask” spread for each cryptocurrency listed on it, which is simply the distinction between the prices at which they are being sold and purchased. The revenue that eToro makes is from the lower difference in between ask and bid rates. The spreads on eToro for cryptocurrencies range from 0.75% to 4.9%.

Additionally, Trading212 does not impose commissions on trades; rather, it charges competitive spreads across a wide range of marketplaces. Depending on the asset and financial instrument under consideration, these spreads change.

Learn more in detail: Trading 212 Broker Review UK 2022 – Complete Guide

eToro Vs Trading 212: User Interface

The user interface (UI) of a trading platform greatly affects the experiences of its users and may be the main factor in determining the platform’s long-term viability. New traders may be easily intimidated by a complicated interface and turn to alternative providers as a result. Fortunately, eToro and Trading212 offer a welcoming user experience that makes both experienced and novice users feel at ease. By enabling you to mimic the strategies of profitable traders, eToro’s copy trading function can give you a significant advantage in the realm of cryptocurrency trading.

eToro ease of use

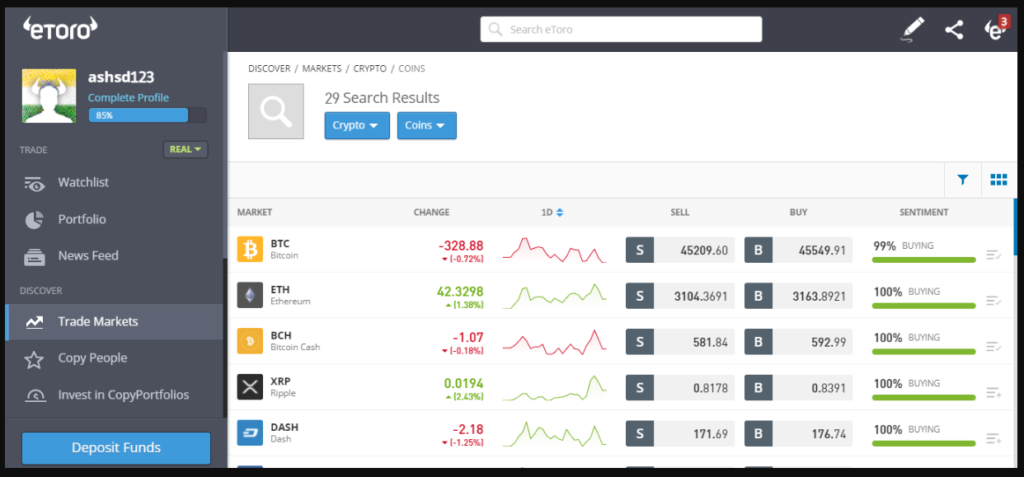

All of the cryptocurrencies that are currently available are listed on one side of eToro’s interface along with their accompanying prices, chart movements, and buy and sell prices. A menu with numerous options, including Watchlist, News Feed, Portfolio, Copy People, Copy Portfolios, and Trade Markets, is located on the left side of the screen and is also quite simple to browse.

Trading212 ease of use

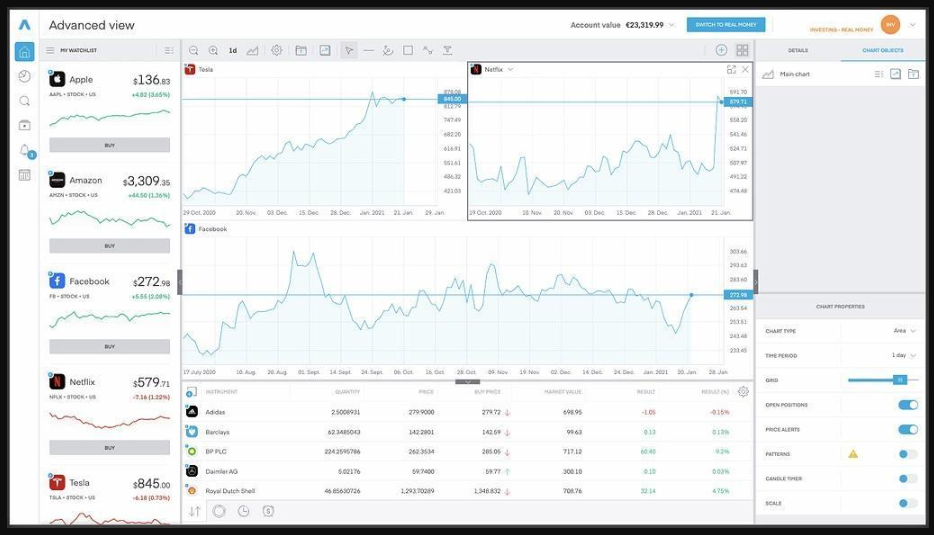

Trading212 offers you an usual representation that provides you a pleasant outline of all of your assets and a thorough look at one’s price movement, as well as an advanced view functionality that enables you to display price charts of various assets and fiddle with the chart attributes to perform a comprehensive technical analysis. The various options can be changed fairly quickly as well.

eToro vs Trading 212: Mobile App

Mobile trading is currently one of the financial industry’s fastest-growing divisions. After all, the ability to acquire and sell assets while in motion is essential. As an illustration, rather than waiting until you get home, you could wish to cash out your stock investment right now.

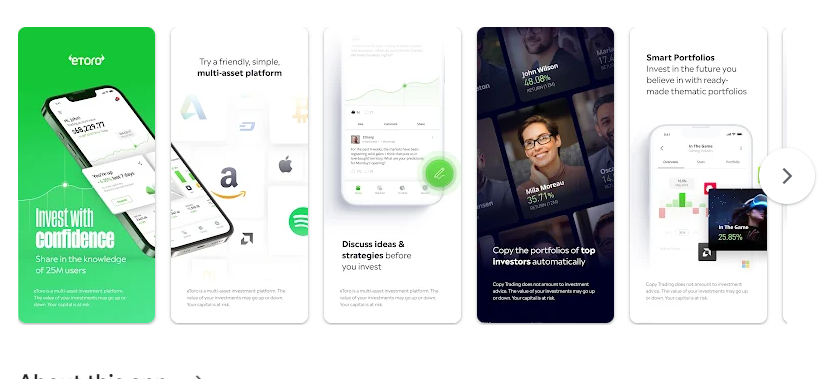

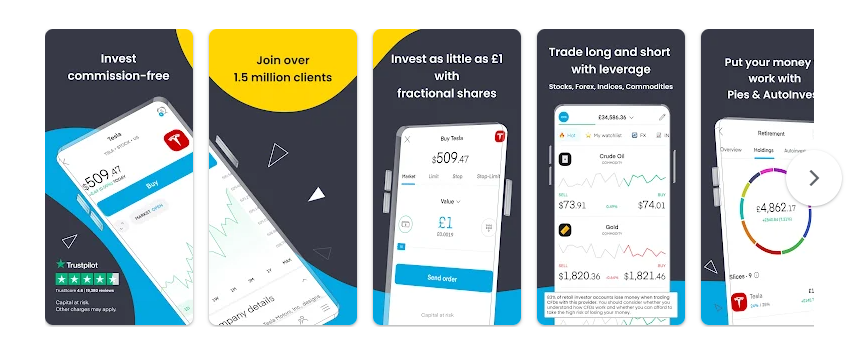

Given this, it makes reasonable that Trading 212 and eToro both provide comprehensive investment apps. Both platforms have a mobile application that works with both iOS and Android devices. Additionally, your desktop device’s desktop account is linked to the eToro/Trading 212 app.

You can buy, sell, and trade all supported markets with a single click using the eToro and Trading 212 mobile stock trading apps, respectively. You can also click the app to examine your portfolio’s value right now. To view your balance in the Trading 212 app, you must first choose the appropriate account (Invest or CFD).

eToro Vs Trading 212: Trading features

The needs of intermediate and experienced traders are fully met by the brokerage platforms Trading212 and eToro. By going one step further, eToro has developed to be a very effective broker for novice traders thanks to its copy trading functionality. While eToro provides both traditional investment vehicles and cryptocurrencies for investments and trading, Trading212 focuses exclusively on being a broker for equities, commodities, and currency markets.

Both platforms include a good selection of value-added services to aid traders in making prompt and well-informed trading decisions. Numerous price charts (with different indicators) and market headlines are among these features.

Furthermore, unlike eToro, which offers CFDs for both equities and cryptocurrencies, Trading212 only offers CFDs for traditional asset classes; it does not support cryptocurrency transactions at all.

eToro Vs Trading 212: Liquidity and Volume

A broker’s liquidity determines the likelihood that you’ll be able to buy and sell a certain item at the right time. You may get a sense of the volume and number of trades taking place for a given asset by looking at the volume. It would be simpler for you to initiate and close positions on time and without any difficulties if a broker has a bigger trading volume and liquidity.

More than 17 million users on eToro from nearly 100 different countries assure the platform’s high liquidity and large trading volumes for all listed crypto assets. Trading212, on the other hand, asserts that it has 1.5 million clients, £3 billion in client assets, and 1.5 million orders processed daily. All of these numbers indicate a fairly strong volume and liquidity.

eToro Vs Trading 212: Customer Support

Both of these brokers have achieved success in their respective fields to date thanks to their incredibly effective client service.

You can utilize the Live Chat function on eToro to speak with a customer service agent right away and get your issue resolved quickly. Email and fax numbers can also be used to contact customer care. On their website, eToro also offers comprehensive online help that covers practically all of the frequently asked issues about their offerings.

In contrast, Trading212 guarantees an average response time of 29 seconds and provides service around the clock. Through their website or mobile app, you can get this support right away.

eToro Vs Trading 212: Security

Today’s Internet is flooded with hackers and con artists who will stop at nothing to steal investors’ hard-earned money. This makes it extremely important to confirm that the trading platform you use has implemented all practical security measures to protect your interests. Since neither Trading212 nor eToro have experienced any significant security breaches so far, you can conduct business with them without having to fear.

Users can add an extra degree of security to their accounts by using the 2FA (Two-Factor Authentication) services provided by eToro and Trading212. Via this technology guarantees that only you, after confirming your identity using the Google Authenticator app, can access your broker account. Additionally, Trading212 gives you the option to install a FaceID or Passcode Lock function to a mobile device, adding another layer of security.

KYC/AML

Before using their services, nearly all well-known trading platforms around the world, like Trading212 and eToro, need their consumers to confirm their identities through a clear KYC (Know Your Customer) process. Maintaining compliance with the global Anti-Money Laundering (AML) legislation is necessary.

To use eToro’s site with limitless deposits and withdrawals, you must present a government-issued ID and a separate address proof. Trading212 will require you to provide a legitimate ID, address verification, and a selfie in order to completely activate your trading account.

Regulation

eToro has been in the trading business for almost 15 years and has obtained licenses from numerous reputable international financial regulators, including the UK’s FCA, CySEC, Europe’s MiFID, Australian ASIC, and CIF.

Trading212 is governed and authorized by the CySEC in Cyprus, the FSC in Bulgaria, and the UK’s FCA. Additionally, all of its clients’ funds are protected in accordance with FSCS guidelines.

Investors’ trust in eToro and Trading212 has increased because of such thorough oversight of both companies.

eToro Vs Trading 212: Conclusion

To sum up, eToro and Trading212 both provide a variety of user-friendly tools that make it easy and efficient for their consumers to put profitable investment trades with them, but since Trading212 doesn’t currently offer any digital currencies, eToro obviously takes the lead when it relates to a cryptocurrency trading platform.

On the other hand, eToro has been operating in the cryptocurrency market for a while and enables you to both own and engage in speculative crypto trading using CFDs. The feature that allows inexperienced investors to mimic the activities of successful traders and make consistent returns before they get momentum in this fiercely competitive business is its main draw.

Frequently Asked Questions

Does Trading212 offer a copy trading function as well?

No. Similar to eToro, Trading 212 does not offer a copy trading tool.

Will Trading212 ever provide cryptocurrencies?

It is impossible to predict whether Trading212 will resume offering crypto trading in the future. It all relies on how the legal system surrounding cryptocurrencies develops in the future in the UK, Europe, and the rest of the world.