ETF trading and buying have become more common in the UK. This is mostly due to the cost-effectiveness of trading ETFs and the opportunity to diversify your portfolio across a variety of assets. The best course of action is to invest in a reliable ETF trading platform in the UK in order to potentially attract rewards. Therefore, we can meet all of your needs, whether you’re looking for a cheap broker or one with a wide range of services.

This guide will help you identify the ETF trading platform that best suits your requirements. We’ll go through the top ETF brokers for 2022, talk about various ETF trading tactics, and show you how to start trading ETFs right away using the top online brokers.

Best ETF Trading Platforms 2022

The trading platform you select will impact the ETFs you can trade, the services you’ll have exposure to, and the transaction fees. Choosing the ideal trading platform for you can be difficult, but we can help. We’ve analyzed some of the top ETF trading platforms now available so you can choose which one to use to start trading.

1. eToro

Since its founding in 2006, eToro has expanded to rank among the biggest and most well-liked ETF trading platforms. With more than 20 million users worldwide, it aspires to increase the accessibility of financial markets for all investors.

Even if it doesn’t have the most cutting-edge UI we’ve seen, the platform is incredibly user-friendly, making it simple to get started even if you’re a seasoned trader. One of its standout features is social trading, which enables users to clone another trader’s portfolio to replicate their trades after following them to learn what they are buying and selling.

Over 150 stock, bond, commodity, and other ETFs are accessible through eToro’s ETF trades platform and can be bought directly or through CFDs. The company offers both leveraged and non-leveraged index funds and ETFs, as well as the option to buy fractional shares. The best aspect is that it has cheap fees on its ETF CFDs that are already included in its spreads and does not impose any trading charges on its ETFs.

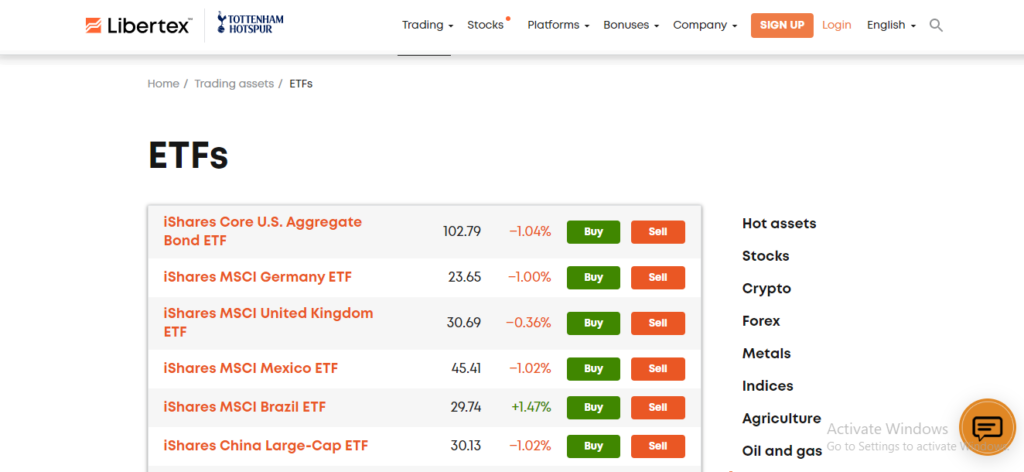

2. Libertex

Libertex, another well-known ETF broker that enables clients to engage in ETF trading, was established in 1997. Over 2 million users in 11 countries use this ETF trading platform, which is renowned for having a low initial deposit requirement for new trading accounts. Although signing up is simple, you must confirm your identity online in order to abide by international money-laundering regulations.

You can trade forex, commodities, cryptocurrencies, stocks, shares, indices, metals, ETFs, CFDs, and more if you reside in the UK. It charges variable commissions starting at 0.006 percent instead of having spreads on any sort of account or instrument. Libertex also provides a variety of teaching tools that may be used to sharpen the abilities of seasoned investors and teach new traders the fundamentals of trading. The fact that this ETF trading platform features MT4 in addition to an automated trading function will please seasoned investors as well.

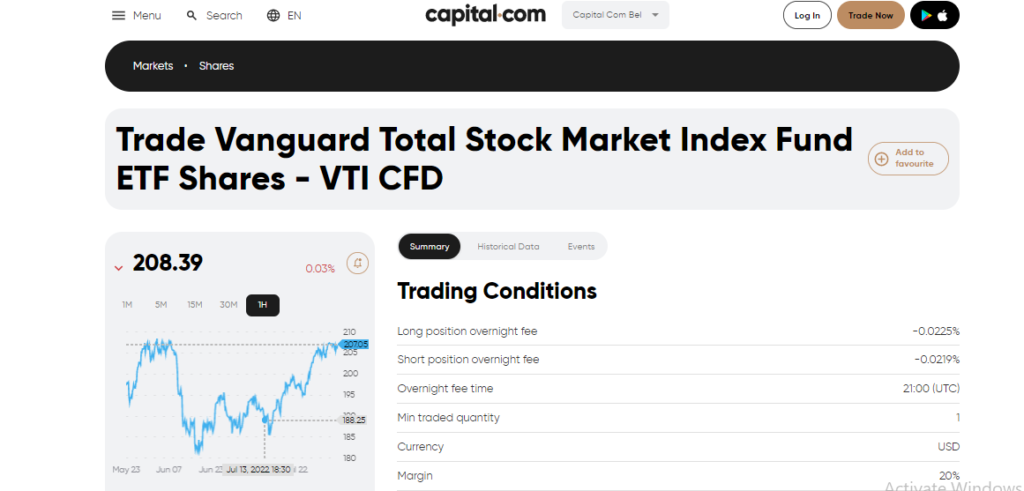

3. Capital.com

Over 1 million customers use Capital.com, a cutting-edge ETF CFD trading platform that was launched in 2016. It is a multinational CFD trading platform with operations in Belarus, Cyprus, and the United Kingdom. It is regulated by the Financial Conduct Authority and the Cyprus Securities and Exchange Commission, and it is permitted to conduct operations in Belarus by the National Bank of the Republic of Belarus.

The first AI-powered CFD trading platform in the world, available on Capital.com, gives you individualized trading insights and allows you access to over 3,000 markets. The software is quite simple to use, and switching between the online and mobile platforms is effortless, demonstrating a clear focus on the user experience. If you’re wanting to trade ETFs, please be aware that this company specializes in CFDs; you won’t be able to buy shares in a conventional way, only ETF CFDs.

4. Plus500

Plus500 is a worldwide CFD trading platform that was established in 2008 and is presently trading on the London Stock Exchange. The business is governed by a number of financial regulators, and because it frequently exposes its financial information, traders have confidence in it. Although it is not open to investors in the US or Canada, its products are used by customers in many other nations.

You can invest in a variety of ETF CFDs through Plus500, a company that specializes in CFDs, but you cannot directly buy shares of ETFs. It has a solid reputation for making it simple for investors to start trading thanks to its mobile trading platform, account opening procedure, and customer assistance. For experienced traders or investors searching for a complete trading platform, it might not be the greatest choice because of its limited product selection and worse research features than those of its rivals.

5. Fidelity

Fidelity is a Boston, Massachusetts-based financial services provider that employs over 35 million people worldwide and was founded in 1946. It is also regulated by the SEC and FINRA, offers commercial services that serve over 13,000 financial institutions, and has a very strong reputation. To strengthen and protect its clients’ financial well-being, Fidelity offers a range of financial products and financial advice solutions to 12 different places throughout the globe.

The ETF trading platform from Fidelity does not include CFDs, in contrast to some of the other suppliers, but it does provide a wide range of ETFs and other financial instruments. However, it boasts a very user-friendly website, zero commissions on a number of trading products, and an extensive learning center that attempts to assist investors in making more educated selections. Recently, Fidelity joined with iShares, the largest provider of ETFs in the world, to provide 0% commission on more than 350 ETFs.

6. Vanguard

Based in Malvern, Pennsylvania, the Vanguard Group is an investment management and trading organization that was established in 1975. It has a longstanding experience and is regulated by the Securities and Exchange Commission and the Financial Industry Regulatory Authority, earning it a reputation for security. Although Vanguard is well recognized for being one of the largest ETF providers in the world, it also provides brokerage account services, allowing you to trade ETFs through its real-time ETF trading platform.

Given that Vanguard is a major provider of ETFs, it is not surprise that its ETF trading site provides a wide range of ETF products. Its platform is made for long-term investors who want to buy and keep their investments and are committed to financial planning, therefore it is devoid of some of the more widely available tools and services that other online brokerages provide. Having said that, it provides excellent tools for novice investors, a fantastic mobile trading app, and even commission-free ETFs.

Factors for choosing the best ETF trading platforms

ETF traders vary widely from one another. Everyone has different trading needs, so before you start investing your money, you should research what an ETF trading platform has to offer. Making sure to look at the following elements will help you find the finest ETF trading platform.

License

Before selecting your ideal broker, you should first look into the broker’s regulatory status. Consider trading with it if it is governed by the FCA. Trading with a FCA-regulated broker is legal and ensures the protection of your money.

ETF Instruments

We suggest that you look up a broker’s website to learn what kinds of financial marketplaces are available to you. Your best bet should be a broker with a wide variety of services.

Fees

While some brokers like spreads, others charge trading commissions. All of these expenses have variable costs, so think about what a trading platform’s fees or commissions are and see if they are all within your budget.

ETF Platform

Trading ETFs can be difficult, especially for beginners. Because of this, you require a trading platform with a great user interface. Additionally, the site must provide a range of trading resources, including reading, study, and analytical materials.

Payments

Select an ETF trading platform that offers convenient payment options without interfering with your trading activities. Additionally, a variety of currencies should be used for transactions.

Customer Service

You can be sure that you’ll receive the essential support when you need it if your broker has dependable customer service. Additionally, customer service should be accessible through a variety of modes of communication, including live chat, email, and phone.

How to Start ETF Trading?

Since all brokers operate under FCA supervision, they all follow the same registration process, which is rather simple to complete. Despite some minor differences amongst brokers, the concept is the same.

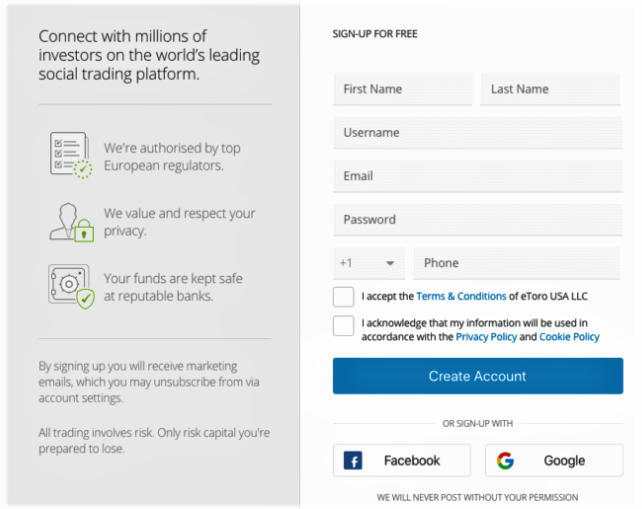

You may find a step-by-step tutorial for opening a trading account and purchasing an ETF from an eToro broker in this area.

Step 1: Open an account

To open an account, you must first complete a short registration form. Additionally, a username and password that will be used to log you into the eToro trading interface will be requested of you.

You can access the eToro platform once you have finished these steps. After that, you will receive access to a demo trading account with fake money where you may practice using the platform without running the risk of losing money.

Step 2: Verify your account

Verification is the next phase of account opening. You will initially be questioned about your finances, market experience, and investment goals. This promise applies to all regulated brokers who must make sure that their customers are fully aware of the risks associated with their trades. You must provide your official identification for verification.

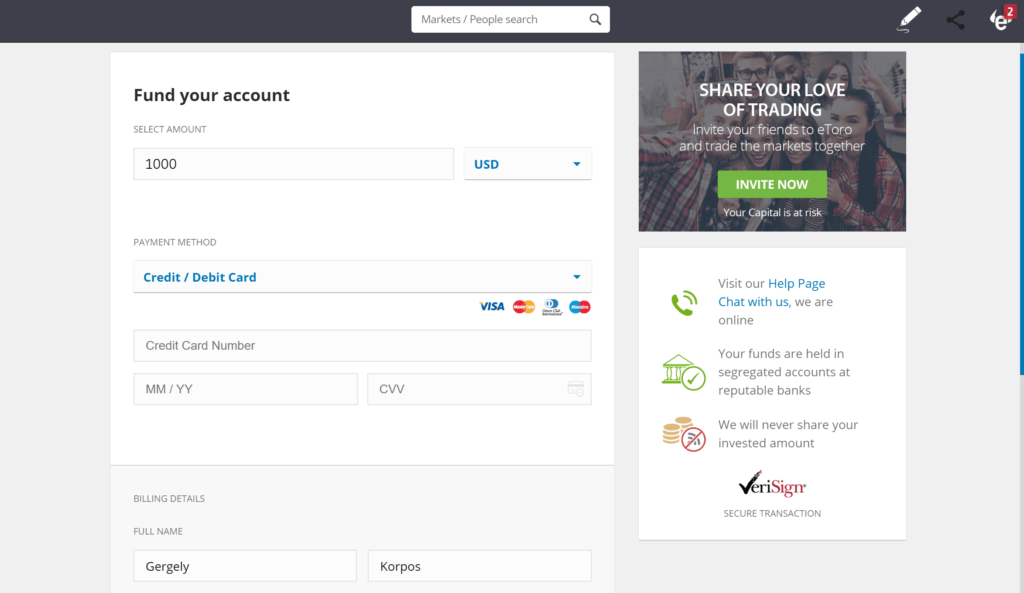

Step 3: Deposit the funds

You must click “Deposit” on the eToro platform’s lower-left corner to accomplish this. You must specify the information provided, choose a payment method, and enter the amount that will be put into your account on the following page.

Step 4: Find and Buy ETFs

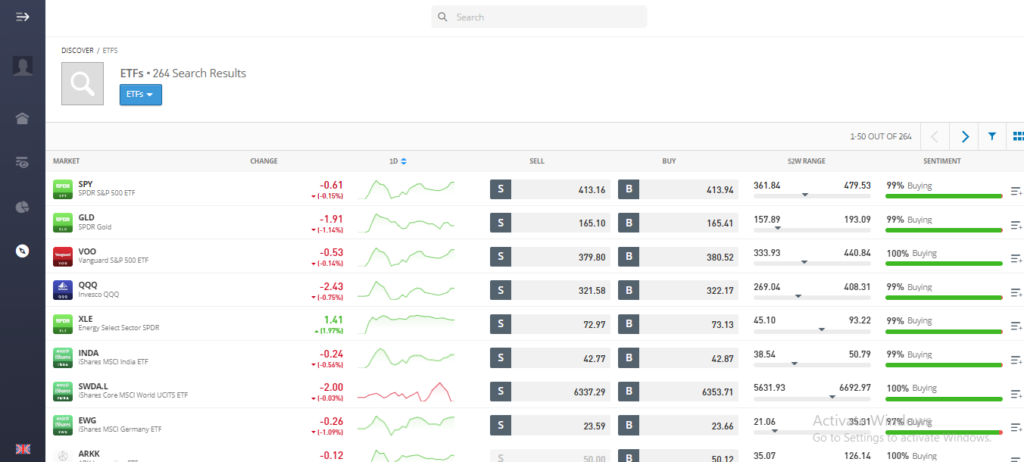

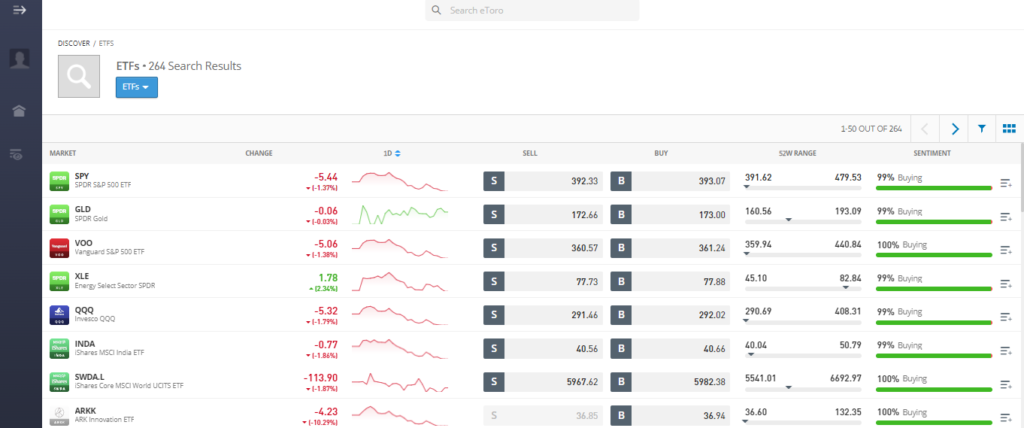

By typing the name of the ETF you’re looking for into the search box at the top of the site, you can access the list. By selecting “ETFs” at the platform’s top, you may browse a list of 264 available ETFs and learn more about eToro’s ETF services.

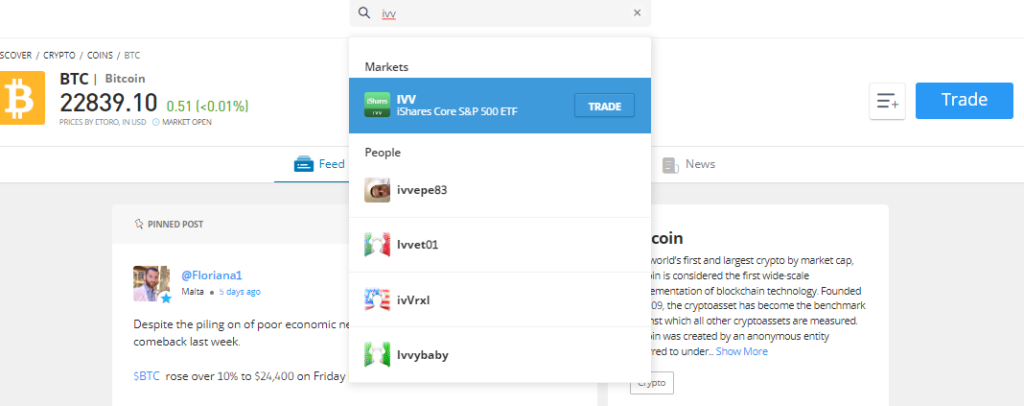

You can even conduct a search for an ETF if you already know what it is.

We enter “IVV” into the search box and choose “Trade” because we wish to trade iShares Core S&P 500 ETF, as seen in the example below.

Step 5: Place your order

Lastly, select “Open Trade” to commence your commission-free ETF trade on eToro.

Conclusion

For traders and investors, ETFs offer a variety of benefits. This makes adopting sophisticated diversification techniques simple and economical. Access to markets that are typically challenging to access is also made possible through ETFs and trackers. Additionally, it is the most effective technique to lower your risk when investing in the stock market.

If you want to take advantage of ETF trading, you must first choose a trustworthy ETF trading platform. Six of them are introduced in this article. But it is really noteworthy. It’s eToro. Investors interested in this market with various qualities will find it to be an ideal ETF trading platform thanks to its user-friendly platform and a vast variety of over 264 ETFs.

Frequently Asked Questions

Which benefits of an ETF trading platform stand out the most?

Diversification is really what ETFs and ETF trading platforms offer as a benefit. A bundle of stocks makes up an ETF. You can easily buy a number of stocks at once with a single purchase.

Which ETF trading platform is the best?

This guide has demonstrated that eToro is the most potent ETF trading platform. The broad range of ETFs, and a user-friendly interface, is noteworthy. Importantly, there are no fees associated with buying an ETF through the broker.

Are ETF trading platforms more advantageous for trading or investing?

ETFs’ diversification will appeal to long-term investors. ETFs, however, are also appropriate for day traders because they may be exchanged in real-time.

What aspects should I consider while choosing an ETF trading platform?

Although the magnitude of the available ETF supply is a crucial factor, you should first confirm that you are trading ETFs with a regulated broker. This is particularly true of the other ETF trading platforms covered in this article, such as eToro.

Are platforms for trading ETFs suitable for beginners?

Beginners should use ETF trading platforms and ETFs because they are less hazardous investments than buying diversified stocks. However, like with all investments, little experience is necessary to invest successfully with ETFs.