Trading in commodities is less common in the UK than trading in equities, currencies, or cryptocurrencies. However, it is gradually gaining popularity as traders discover it to be a great method to make money. Therefore, if you want to invest in commodities, you must find a commodity trading platform that meets your needs.

In this guide, we have examined the best commodity trading platforms in the UK in 2022. Also, you may also learn how to invest in them and what factors to take into account when selecting a trading platform.

Best Commodity Trading Platforms in the UK

There are numerous trading platforms that let you do online commodity trading from the convenience of your house.

There are numerous factors you should look into before choosing a commodity trading platform. You must take into account the particular financial instrument you will be trading, such as CFDs, futures, or options, in addition to fees, regulations, supported markets, payments, and customer support.

Below, we examine the top commodity trading platforms for 2022 to spare you endless hours of research.

1. eToro

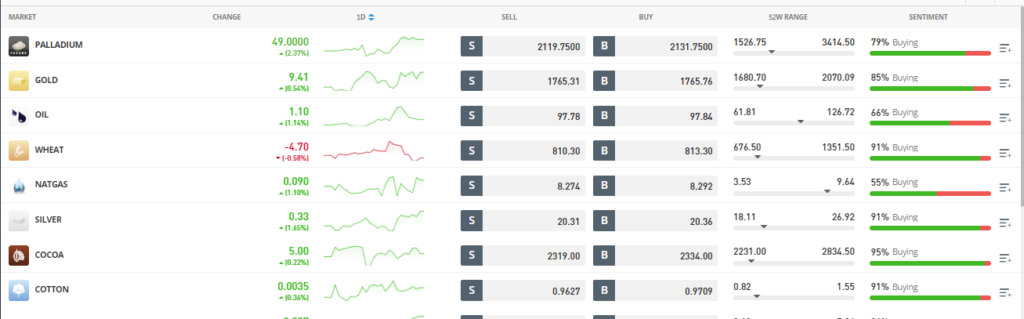

After a deep research we discovered that the best platform for trading commodities available on the internet in 2022 is eToro. You won’t be overwhelmed with options thanks to the backing of more than 45 commodities marketplaces. Hard metals include copper, platinum, gold, and silver, all of which are available for trading.

In the energy industry, there are numerous markets for crude oil and natural gas. This commodity trading platform is also very good when it comes to agricultural products. You can exchange commodities including cotton, wheat, sugar, cocoa, and more at this place.

A 100% commission-free broker is eToro. Additionally, you’ll see that spreads on important commodity markets, like oil and gold equities, are extremely narrow. Deposits are only 0.5 percent and there are no recurring platform costs to take into account.

We appreciate eToro’s automated trading feature in addition to its popular social trading platform. This makes it possible for you to engage in entirely passive commodity trading. Simply choose an experienced commodity trader who uses the eToro platform and choose to mimic their transactions exactly. We should also point out that eToro provides a number of commodity ETFs.

For first-timers, the low minimum deposit of just $200 is fantastic. If safety is a concern for you, which it should be, eToro is highly regulated. Bank transfers, debit/credit cards, and e-wallets like Paypal and Skrill are all accepted forms of payment by this trading platform.

It is home to more than 17 million traders today and holds licenses from the FCA, ASIC, and CySEC. Additionally, for commodity trading markets this broker also provides leverage option. Your restrictions may vary depending on where you are, but you often receive up to 1:20 on gold and 1:10 on other commodities.

2. Plus500

/plus500_source-5c5b58f746e0fb0001ca8550.png)

The Plus500 service provides a wide range of commodity CFDs from different industries. Initially, all forms of energy, such as gasoline, natural gas, fuel oil, and Brent oil, can be traded.

Additionally, you can trade agricultural commodities including cocoa, cotton, soybeans, and live animals. Plus500 offers a number of metals, like gold, silver, and copper, if you’re seeking for hard metals. Even CFD markets on commodities options are provided by Plus500. This applies to commodities like oil, gold, and natural gas, each of which has a different strike price and expiration date.

These financial derivative products give you much greater flexibility and sophistication when trading on the commodities market of your choice. Of course, you can trade with leverage as a reputable CFD provider. The most leverage Plus500 provides is 1:30 in conformity with ESMA guidelines.

We like Plus500 because creating an account and depositing money is a hassle-free process. You must provide identification documentation and have at least $100 in your account. Debit/credit cards, PayPal, and bank transfers are all supported by the platform.

After setting everything up, you can trade commodities on Plus500 or through the company’s mobile app. Last but not least, Plus500 has a solid reputation in the CFD trading industry and holds a number of regulatory licenses.

3. Capital.com

Do you want to invest in commodities, but lack any prior investment experience? If so, you might want to think about using Capital.com’s commodity trading platform, which is user-friendly for beginners.

On its website, the platform has a tonne of guidelines and explainers pertaining to the first. But it’s worth installing the Capital.com InvestMate app if you want to move things along. This is a learning program that walks you through trading lessons and even offers advice on how to achieve financial independence.

You can start making a deposit after spending the necessary time using the demo account feature to understand how to trade commodities. Capital.com excels in this area due to its low minimum deposit requirement of $20. You may trade in actual market conditions thanks to this without having to spend a fortune.

You must use a debit/credit card or an e-wallet to take advantage of this low minimum deposit requirement. In any case, due to their speedy processing, they are recommended payment options. Bank wires are also accepted, however, there is a $250 account minimum.

Capital.com provides many commodity instruments in the form of CFDs as support markets. These include the usual candidates in the group of hard metals, including gold, silver, copper, and platinum. There are also other energy components including natural gas and crude oil. Additionally, CFD futures are supported by the benchmark index for Brent Crude Oil.

Additionally, a wide range of markets for agricultural commodities are covered by Capital.com. Last but not least, we should point out that this highly regulated commodity trading platform is also one of the most affordable. Actually, there are no commissions to pay, and spreads are typically among the greatest in the market.

4. Libertex

Both novice traders and seasoned pros will benefit greatly from Libertex as a platform for commodity trading. There are a number of reasons why you should make this reputable company your go-to commodities broker. Libertex is a CFD trading platform, therefore you’ll profit from extremely low fees right away.

Libertex, for instance, charges minimal spreads. Even less liquid commodities like palladium and platinum are affected by this. Major commodity markets don’t require commissions, even though Libertex charges them for some assets.

Libertex is a commodities trading platform that supports a wide range of hard metals and energies in terms of supported commodity contracts. However, you won’t have access to any agricultural goods. Additionally, you will be able to trade long and short on your preferred market with simplicity as a CFD broker.

However, this is only available to business clients, so if you’re a retail dealer, you should anticipate lesser limits. If you’re interested in trading different asset classes, Libertex is another option to take into account. For instance, this top-rated platform also provides FX, cryptocurrencies, and ETFs in addition to stock CFDs.

You can select between two platforms once you register an account with Libertex, which needs a minimum deposit of $100. The Libertex web-trader is easy to use and makes trading commodities stress-free for beginners.

You may trade commodities while on the go thanks to the Libertex mobile app. Libertex has been operational for more than 23 years in terms of reputation and trust. It is presently governed by CySEC and boasts a clientele of about 3 million traders. Libertex is a safe commodity trading platform, so you can be confident that it will suit your investing demands.

5. Interactive Brokers

Interactive Brokers is a well-known and award-winning broker. It is well-known in the UK and around the world for its low trading fees in commodities trading, which have attracted thousands of traders.

Interactive Brokers is a well-known brokerage firm that specializes in commodities in the form of financial derivatives. This includes not only commodity markets in the United Kingdom but also markets in a variety of other countries. This includes visits to Canada, Europe, Mexico, Australia, and a number of Asian countries.

Therefore, Interactive Brokers has you covered whether you’re interested in hard metals, energy, or agricultural items. The fact that this top-rated commodity trading platform offers competitive costs is probably one of the largest benefits. For instance, Interactive Brokers offers trading starting at just $0.85 a contract, while TD Ameritrade charges a fee of $2.25 per contract.

However, only significant commodity futures listed in the US are eligible for this low charge. If you want to start trading internationally, be ready to pay a higher commission. We believe that experienced traders are the best candidates for Interactive Brokers as a trading platform.

This is due to the trading platform’s high level of sophistication, which includes a comprehensive set of technical indicators and charting tools. Having said that, there is no minimum deposit requirement at Interactive Brokers, so you can start trading commodity futures without having a sizable cash reserve. This is especially the case if you decide to trade with your commodity trading platform on margin.

Factors to consider when choosing a Commodity Trading platform

You must be thorough in your study when looking for a commodity trading broker or you risk selecting the wrong one. Here are some things to think about when you search for the top commodity trading broker.

Regulations

Any top-notch broker, particularly those providing commodity trading platforms, ought to be governed by the most reputable agencies. The most important regulation to consider for in a broker for the UK market is the Financial Conduct Authority.

Assets Available

We think you should already know what you want to trade before looking for a commodity trading broker. Because of this, pick a broker that offers more than just the assets you want to trade. Additional commodities are available, allowing you to test them out and possibly add them to your list of favorite trading tools.

Trading platforms

The platforms offered by UK brokers vary widely, so you should pick a broker with a platform that encourages you to keep trading. New traders should pick a platform with a user-friendly, intuitive user interface.

An advanced trading platform should test your abilities. Choose a broker in this situation that has cutting-edge features like charting software and MetaTrader platforms. You might also want to think about the availability of research and educational resources.

Customer Support

It takes time to get familiar with how commodity trading operates, but with a little assistance from a broker’s customer service, you might gain experience sooner than you had anticipated.

Therefore, use a broker’s practice accounts to evaluate its customer support. Check their responses to queries and questions. Additionally, you can verify the channels for communication and availability.

Fees

Have a budget in mind and look for a broker who fits it if you want to enjoy your trading experience. The minimum deposit, commission or spread, overnight fees, transaction costs, and more should all be taken into account.

Demo account

If you are unsure of how a commodity trading platform functions, wait before sinking your toes into an actual trading account. Select a broker who offers a demo account, then go from there. Before making the big move, make sure everything is tested and confirmed.

How to Start Commodity Trading?

Simply follow the illustrated steps to begin trading commodities with eToro in under ten minutes!

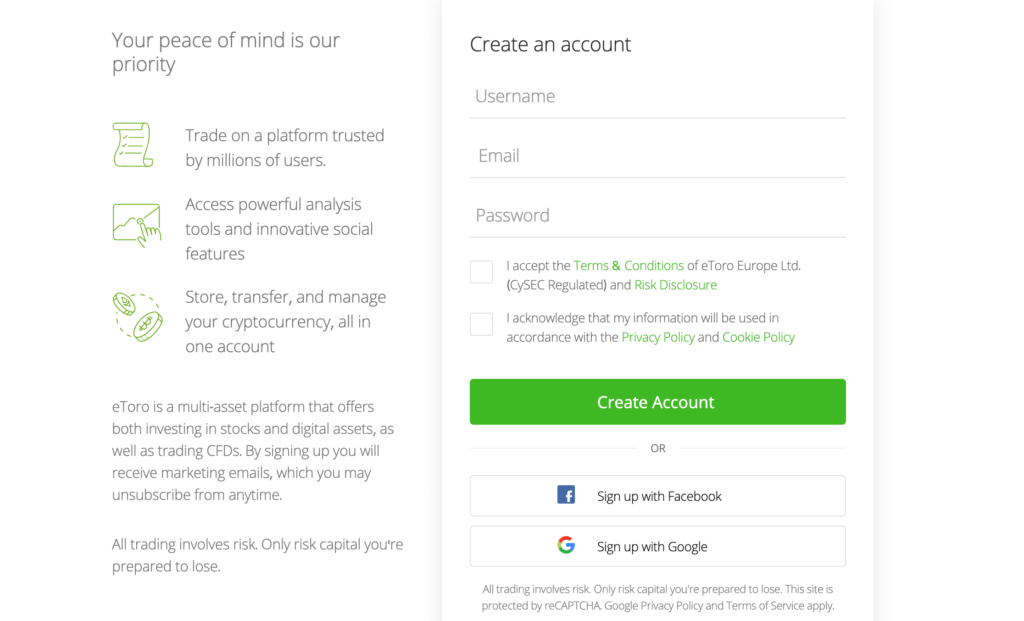

Step 1: Create an account

Go to the eToro website and register. Your name, address, and national tax identification number must be provided.

A username, password, and verification of your mobile number are also required.

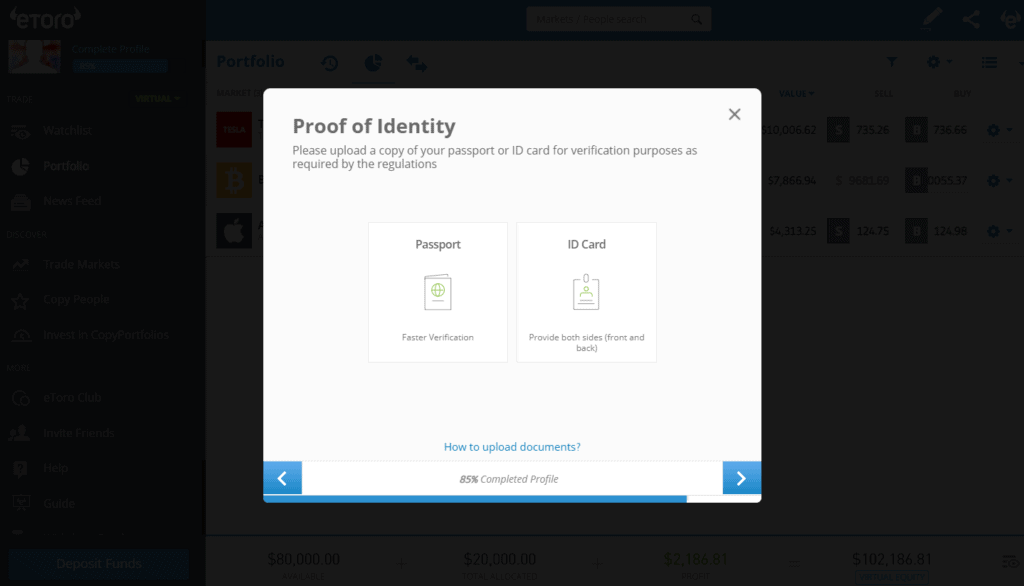

Step 2: Verify your identity

Simply upload the following files to docs.

- Valid passport or driver’s license

- Bank statements or utility bill

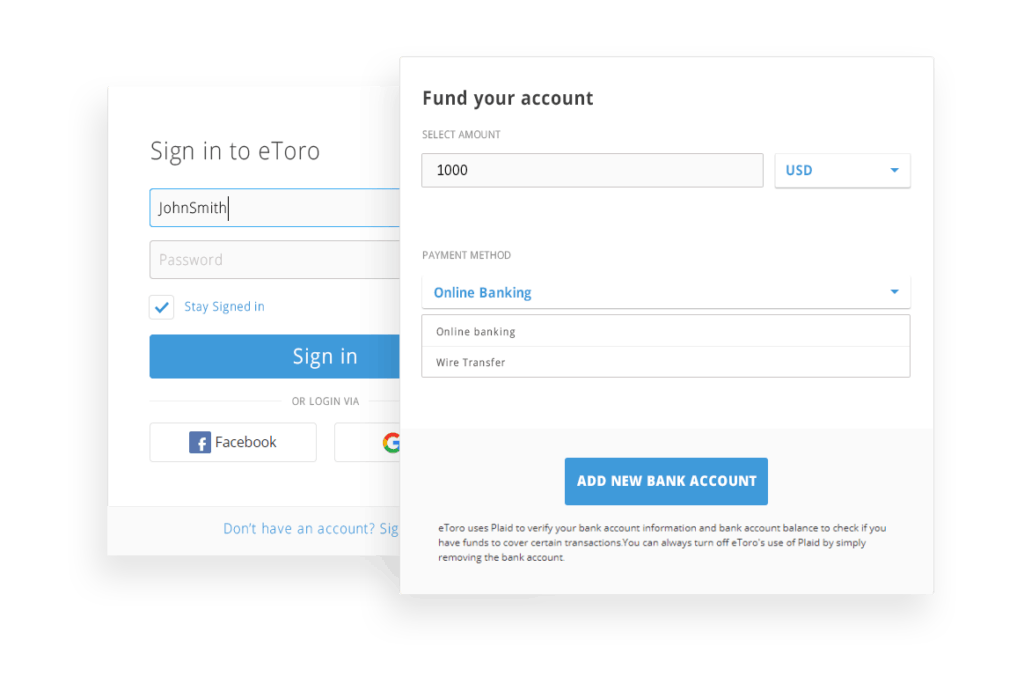

Step 3: Make Deposit

It’s time to deposit money, and eToro just requires a minimum of $200. Debit cards, credit cards, e-wallets, and bank wires are your options at this trading platform.

Step 4: Search for the Commodity Market you’re interested in

With this trading platform more than 45 commodity markets are available, you may trade anything from hard metals, energy, and agricultural products.

Search for the commodity you wish to trade if you already know what it is. We are looking to trade hard metal i.e. gold in our example.

Step 5: Place your Trade

You must create an order in order to execute your commission-free commodity trade. Click the “Open Trade” button to place your gold trade.

Conclusion

In conclusion, it’s critical to pick the best commodity trading platforms for your requirements. The provider must not only support the market, such as gold, silver, or natural gas, but also your desired instrument, such as CFDs or futures.

Of course, the commodity broker must also offer cheap fees and commissions and be subject to the proper authorities regulation.

In our opinion, eToro is the top platform for trading commodities in 2022. On a commission-free basis, you will have access to more than 45 commodities markets. The licensed broker also provides leverage, Copy Trading, and a wide variety of payment options.

Frequently Asked Questions

Which online trading platform for commodities is the best?

We think eToro is the best commodities trading platform since it provides a huge selection of hard metals, energy, and agricultural sectors without charging any commissions. You will be trading on a secure platform because it is also very regulated.

What is the best trading platform for commodities for beginners?

Again, we believe that eToro is the ideal platform for beginners to trade commodities. The platform is extremely user-friendly, the minimum bets are small, and you have access to a wealth of instructional resources.

Which trading platforms for commodities accept PayPal?

Many of the top commodity trading websites we found allow PayPal deposits. This includes Capital.com and eToro.

What commodities are available for online trading?

You get access to a wide range of marketplaces with the greatest commodity trading platforms. This group may include items like gold, silver, oil, wheat, copper, natural gas, corn, and so on.