Silver is a precious metal that is utilized in a variety of ways, one of which is as an investment vehicle for investors. Its rarity and volatility increase its value on the world market. Multiple exchanges list silver stocks, and trading the metal can bring you big returns, especially if you consistently do well in a tumultuous market. So this tutorial is for you if you’re looking for strategies to invest in silver.

There are other ways to invest in silver besides purchasing and gaining possession of it as a physical asset. Before you begin investing, it is crucial that you are well familiar with these strategies as a novice investor with little expertise.

You may learn how to invest in silver via an online broker by reading our in-depth guide. Additionally, we suggest the top three brokers in the UK for purchasing silver as a commodity and silver stock. You will have all the information you need to start investing in silver once you have finished reading this tutorial.

How to Invest in Silver – An overview

- Step 1: Choose a Broker – The first step is to locate a reputable broker who also enables you to invest in silver.

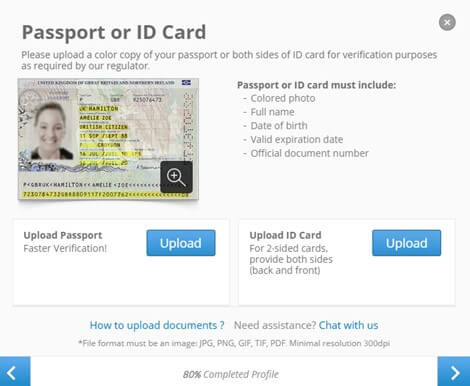

- Step 2: Open an Account – The next step is to create an account with the trading platform of your choice. Users often need to input some personal information and upload evidence of ID and address.

- Step 3: Fund Your Account – Before making an investment, users must fund their accounts.

- Step 4: Invest in Silver – After funding your account, you can complete your investment in silver. Simply input the desired investment amount after searching for any Silver stock in the search field.

Options for silver investment

Silver can be purchased in a variety of ways. However, there are only two main purchasing choices for private investors: physical form and silver securities.

1. Physical silver

A psychologically and emotionally rewarding approach to investing in silver is to have actual silver in your possession, either as coins or bullion. It is in your ownership, and you are free to use it. And in certain instances, getting to it is actually not that difficult. For instance, you can buy old American coins that were struck before 1964 that have a silver content of roughly 90%.

The only way to benefit in this situation is through selling silver bullion and coins if the price of silver increases because, unlike a high-quality firm, physical commodities do not generate cash flow.

You can buy silver from nearby merchants and pawn shops, as well as from internet merchants like APMEX or JM Bullion. More knowledgeable vendors let you buy complete bars rather than just coins.

2. Silver futures

Without the complications of owning physical silver, silver futures are a simple method to bet on the metal’s price going up or down. Although taking physical delivery of the silver is an option, trading in futures markets is mostly done for speculative purposes.

Because futures contracts offer such high levels of leverage, they are a tempting tool to play the silver market. In other words, it costs relatively little money to acquire a sizable position in the metal. You can make a significant amount of money fastly if silver futures are headed in the right direction, but you can also lose it speedily if you’re completely mistaken.

3. ETFs

You can purchase an exchange-traded fund (ETF) that owns physical silver if you want to acquire silver but don’t want to take on the risk of futures. If the price of silver increases, you could profit from possessing it, but there are fewer risks, like theft. A physical silver-owning ETF will provide a return equal to silver prices minus the ETF’s expense ratio.

ETFs also have another benefit. Silver can be sold to you at market value, and the money is quite liquid. So, on every day the stock market is open, you will be able to sell your funds at what is probably the best price.

4. Silver mining stocks

A rising silver market can also be benefited by purchasing equities in companies that produce the metal.

You can gain from owning a miner in two different ways. First, the company’s profits ought to increase if the price of silver increases. All other things being equal, the profits of silver miners will increase more quickly than the price of silver. Second, the miner can gradually increase production, which will also boost its earnings. In addition to wagering on the price of silver, there is another way to profit from it.

5. ETFs with silver mining holdings

You can use an ETF that owns silver miners if you don’t want to spend a lot of time researching silver miners but still want the benefits of owning a mining firm. Compared to holding only one or two mining stocks, you’ll have a more diversified exposure to miners and less risk.

Best Silver Stocks

The finest electrical and thermal conductor among metals, silver is also a well-known jewelry-making material. Its great value, particularly in electrical applications, drives up demand for it in the industrial sector. Since it can be used as an inflation hedge, silver is seen by investors as a safe-haven commodity.

There are numerous businesses that mine silver. These businesses, nevertheless, are mostly involved in the mining of other metals and minerals, like gold, lead, zinc, and copper. Only a small fraction of the earnings for the companies will come from silver as it is only a byproduct of these other metals.

Now that we know this, let’s look at the best silver stocks for 2022.

1. First Majestic Silver

Investors in precious metals are fond of this silver stock. The company is Canadian, however the bulk of its services are in Mexico. This is so that the corporation has more opportunities as Mexico has the biggest silver production in the world.

First Majestic anticipates that silver will account for more than 55% of its overall revenue in 2021, making it the main source of income. In order to grow its business, the corporation even bought the Jerritt Canyon Gold Mine in Nevada in 2021. The corporation is now more exposed to silver than other companies as a result.

2. Wheaton Precious Metals

This business does not run actual mines; rather, it streams precious metals. Instead, Wheaton gives up-front cash to mining firms in need of money to pay for their operating expenses. It has the biggest exposure to silver among streaming and royalty companies. At the moment, Wheaton operates more than 21 mines in several foreign countries.

3. Pan American Silver

One of the biggest silver producers in the world is Pan American Silver. It has working mines in Canada, where its headquarters are located, as well as in Bolivia, Argentina, Mexico, and Peru. The Pan American firm also manufactures gold, lead, zinc, and copper in addition to silver. With daily trading of more than three million shares, it is worth almost $4 billion. You can increase your retirement fund by receiving yearly dividends if you own its shares.

4. Fortuna Silver Mines

The world’s leading silver mining company, Fortuna Silver Mines, with operations in Africa, Mexico, Argentina, and Peru. It also runs lead, zinc, and gold mines, and in 2021 it expects to make more than $16 million in net income. This is a result of its metals’ large sales quantities.

5. Endeavour Silver Corp

Endeavour Silver engages in the analysis, purchase, research, production, and mining of precious metals. It mostly operates in Mexico, where three silver-gold mines are located in several cities. The business is also active in Chile.

Best trading platforms to invest in Silver

Find a trustworthy broker whether you wish to purchase silver coins or bars, trade the commodity as a stock or use derivatives. It follows that the broker should be able to accommodate your trading requirements and have access to the appropriate futures exchanges where silver is listed. Additionally, the broker should permit you to trade derivatives of silver, such as CFDs, ETFs, indexes, spread betting, mutual funds, futures contracts, etc.

The top three brokers for silver trading in the UK are shown below. You can be confident that they contain all the features and tools necessary to provide you with the finest experience because we have tested and reviewed them numerous times.

1. eToro

You have access to a variety of silver stock chances on eToro. The popularity of eToro, which was founded in 2006, is largely attributable to its nimble social and copy trading platforms. A broker is a good option for both novice and experienced traders because it includes outstanding research and skill-development tools.

A minimum deposit of £50 is needed in order to use eToro and purchase silver stocks. You can trade silver as CFDs, ETFs, and futures contracts on eToro as well. Even though there are no commission fees for silver stocks on eToro, spreads are still quite wide. Most traders may find it pricey to use the copy trading platform because a £300 minimum investment is needed. It also has a $500 minimum trading amount.

2. Capital.com

Silver CFD trading is permitted through the FCA-approved broker Capital.com. The broker provides traders with high-quality resources for a better trading experience and does not impose a commission on silver CFD trading. Spreads are also reasonable, which draws money-conscious investors to trade silver. In addition, Capital.com hosts the MT4 platform for traders seeking cutting-edge equipment.

Unfortunately, Capital.com does not allow you to purchase silver and own the underlying asset. Additionally, there aren’t many analytics tools, which are essential for developing the finest trading strategy.

3. Plus500

Silver CFD trading is available at Plus500, just like it is at Capital.com. With as little as £100, you can begin trading the commodity while taking advantage of outstanding trading tools. The spreads are among the lowest in the market, and the broker does not charge a commission for trading silver. Additionally, you won’t be charged any transaction fees when making deposits or withdrawals.

The drawback is that Plus500 can only be used by active traders or investors. This is due to the fact that if you don’t even check in to your trading account after three months, an inactivity fee will apply. Additionally, there is just one proprietary platform, which restricts traders looking for more sophisticated platforms like the MT4 and MT5.

How to invest in Silver?

It is now time to discover how to buy silver stock utilizing the three brokers you now know about for investing in silver shares. The processes for buying silver with the aforementioned brokers are comparable, albeit they do differ significantly based on the criteria of a broker.

Following that, here are the steps for using eToro to purchase silver stock.

Step 1: Visit the Broker’s Website

eToro requires a trading account in order to purchase silver stocks. To open a trading account, click on one of the links on this page to go to the broker’s website. Before opening a trading account on eToro, make sure you have read, comprehended, and agreed to its terms and conditions. For usage on mobile devices, eToro also has a mobile app. Therefore, make sure it is convenient for you before signing up whether you use a desktop or mobile computer.

Step 2: Registration

There isn’t much to this process, and no instructions are needed. You will merely need to comply with the instructions and offer the required data. Users should be aware that eToro will ask for personal information from you, such as your name, residential area, date of birth, phone number, email, and more. You will also provide information about your income source and create a log in.

Step 3: Complete the Knowledge Test

eToro chooses a package for you depending on your level of trading expertise and experience. In this context, a simple knowledge exam will be administered to you to ascertain your eligibility for specific eToro features. For instance, eToro will be able to determine your eligibility for copy and social trading tools based on how you respond to these questions.

Additionally, eToro offers silver CFD trading, which has significant risks, particularly if you use leverage. Because of this, a margin trading test is further offered to establish your leverage cap.

Step 4: Verification

Before completely activating traders’ accounts, the FCA requires all the brokers it oversees to confirm the traders’ identities. This process safeguards trader accounts and deters traders from using fictitious identities.

Due to this, eToro will ask to see a copy of your passport or ID card as identification.

In order to confirm your jurisdiction, you will also need a current utility bill or bank statement (not older than three months). After reviewing your papers, a notification email will be sent after they have been authorized and the account has been fully enabled.

Step 5: Deposit Funds and invest in Silver

To access silver stock on eToro, a $50 minimum deposit is needed. Once your deposit has been received, the broker will direct you to the exchange market where silver stock is traded.

With eToro, you may trade silver as a CFD, ETF, futures contract, and index. Always choose the appropriate number of silver shares to purchase and be aware of the hazards before engaging in trading.

Conclusion

You have a wide range of investment alternatives in the silver market, including buying the metal physically and investing in its stocks, ETFs, and other securities. However, make sure you are familiar with the silver market and the dangers of trading the commodity in its many forms before taking any action. The good news is that most silver trading brokers offer top-notch trading tools that you can utilize to your advantage.

Frequently Asked Questions

What silver stock is the most well-liked?

The top five silver stocks for 2022 are among the many available on the market now. They are a wise investment because of their popularity and rising profits.

Is silver a wise investment to make?

Yes. Due to its high volatility, silver’s demand experiences frequent fluctuations. Even though it appears to be a very dangerous asset, trading it can be profitable if you have the necessary information and analytical skills.

Can you profit from purchasing silver?

Yes. As long as you are aware of where to sell it, you can profit by purchasing silver. Make sure you have the greatest broker with the right tools to maximize your potential for a successful trade.

Which is a riskier investment: silver or gold?

Both gold and silver are secure assets, so which one you trade will depend on your preferences and your level of commodity knowledge.

What is the silver stock symbol?

There are numerous symbols used to symbolize silver stock on different exchanges. For instance, silver’s stock symbol in the UK is XAG.