So, you’ve made the decision to begin investing in shares. But hold on! With so many possibilities accessible, how can you choose the best shares that are worthwhile to purchase? Despite what some industry professionals may assert, it is simply not possible to carefully examine every balance sheet in order to identify companies that are improving their net debt situation and their net margins.

We created this guide to direct you in the appropriate direction in light of this. This guide covers the factors that should be considered while choosing the best shares for 2022.

How to choose the best shares? – Brief Overview

Choosing the best stocks to invest in does not have a single optimal method. It relies on a number of things, including the goal you’re attempting to achieve, how risk-tolerant you are, how much time and money you have, and the outcome you’re trying to attain. To choose the best shares to invest in, follow these brief rules:

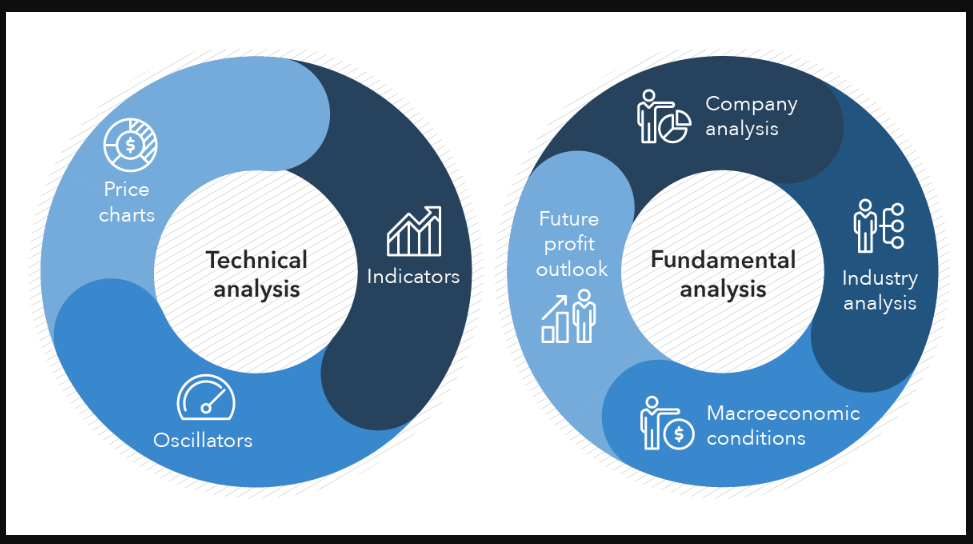

- Study the industry and have an understanding of it. This includes performing fundamental and technical analysis to estimate a stock’s fair value as well as researching a company’s future prospects to make sure they are consistent with your strategy and objectives.

- Utilize both quantitative and qualitative share price assessment to create your portfolio. You can design a strategy that works for you by doing this.

- Keep emotion out of your investment selections. Avoid buying stocks just because they are popular and take your time making buying or selling decisions.

- Make careful to diversify your investments to reduce your risk.

Due to the ability to reinvest dividends to grow a holding, many investors favor stocks that pay dividends. As a result, in addition to capital growth related to the initial amount placed, the return on investment is also dependent on any dividends that are accumulated during the course of the position. Others, who prefer to buy firms with solid fundamentals and invest using Warren Buffett’s value philosophy, are less concerned with dividends.

Fundamental analysis

There are a number of things to undertake if you wish to choose shares utilising fundamental analysis. First, keep in mind that determining a stock’s intrinsic price is the primary objective of fundamental analysis. This implies that you should analyze both qualitative and quantitative components of the economy, as well as the various economic sectors and the individual businesses that comprise each sector.

Qualitative factors

Company news: Stock prices can go up or down in response to news about the business you want to invest in. This is due to the fact that people frequently buy stocks in response to positive news while selling them in response to negative news. The effect on supply and demand ultimately has an impact on stock value.

Personnel changes: Personnel changes, especially management restructures, are crucial for stock investors to understand since they impact how the market perceives them. Any personnel changes could have an impact on the company’s reputation, which directly affects stock prices.

Financial events: When choosing stocks, it’s critical to consider financial events because they might increase market volatility and unpredictability. Interest rate decisions, planned management changes, and significant occurrences like Brexit are examples of economic events.

Quantitative factors

Earnings releases: In conducting their fundamental analysis, traders and investors should pay special attention to fluctuations in corporate earnings. The stock price might not accurately reflect the company’s value if earnings decline and the share price does not react to the new level of earnings.

Balance sheets: The balance sheet will provide a complete list of the investments and liabilities of the business. Because it shows earnings potential, a better balance sheet typically translates into a stronger stock price. As previously noted, earnings have a direct impact on stock prices.

Dividends: A portion of an organization’s earnings that it decides to pay out as dividends to its stockholders. One way a shareholder can profit from an investment without having to sell shares is through these. Dividends are a deciding element in-stock selection since they show that a firm is profitable and has a strong likelihood of generating future earnings.

Read: Best Dividend Stocks You Should Buy in UK 2022

Ratios

Price-to-earnings (P/E) ratio: The P/E ratio of a company shows how little you will have to spend to make $1 in gain, establishes the stock’s value. The P/E ratio aids in contrasting the worth of several stocks within a certain industry.

Debt-equity ratio (D/E) ratio: The D/E ratio compares a company’s debt to its assets and shows you how the business is doing in comparison to its rivals. A low ratio can indicate that the company’s stockholders provide the majority of its funding.

Return on equity (ROE) ratio: The ROE ratio, which is represented as a percent, gauges a company’s financial performance in comparison to its capital. In relation to the amount of shareholder investment, it demonstrates if the company is profitable enough on its own.

Earnings yield: The earnings yield measures profits by dividing EPS by stock price. Earnings yield is another value indication; the greater it is, the more probable shares are undervalued.

Relative dividend yield: It gauges how much a company’s dividend payout differs from the index overall. When buying stocks, you should take the comparable dividend yield into account because it might indicate if a stock is expensive or undervalued in comparison to its rivals.

Current ratio: Current ratio gauges a company’s debt-paying capacity. It demonstrates whether the available assets are sufficient to meet liabilities. This ratio and the price of the stock are related.

Price-earnings-to-growth (PEG) ratio: PEG ratio is used to measure the P/E ratio to the percentage-based annual EPS growth rate. The PEG ratio should be taken into account when choosing which companies to buy because it may indicate the stock’s fair value.

Price-to-Book (P/B) ratio: The P/B ratio contrasts the book value and present market value of a corporation. Overvalued shares are frequently indicated by a ratio greater than one.

Top-down and bottom-up strategies

When performing fundamental analysis, there are two strategies you can use: top-down and bottom-up. Those with less experience or a preference for the broad picture prefer the top-down strategy because it is quicker. You could want to conduct the best examination of growth in the economy and GDP, bond values and returns, financial policies, and inflation while choosing on a sector and company to focus on.

The bottom-up analysis places more emphasis on how the company is doing in comparison to its rivals than it does on market dynamics and industry fundamentals. If this is your preferred method, you will take into account the numerous financial ratios described above, as well as revenue and sales, cash flow, management, and products.

Technical analysis

Since technical analysis is somewhat varied from fundamental analysis, it is important to pay great consideration to the stock’s price information and movements while selecting stocks utilizing technical analysis. This contains movements and patterns that might be used to forecast future market behaviour. You can use a wide range of technical metrics when conducting technical analysis. Your trading approach will ultimately determine the technical method you choose.

- Moving average: The path of a price movement is determined using MA, which is unaffected by brief price swings.

- Exponential moving average: Significant market movements can be validated and their legitimacy assessed using the EMA.

- Stochastic oscillator: In order to assess movement and trend intensity, this contrasts the closing value of a stock with the historical price range of that asset.

- Moving average convergence divergence: By contrasting two moving averages, MACD can identify changes in momentum. It can be helpful to look for prospective purchasing and selling possibilities near support and resistance positions.

- Bollinger bands: These are effective for identifying when an item is trading outside of its typical range and are used to forecast long-term price fluctuations.

- Relative strength index: Most commonly, RSI is used to help determine market conditions, momentum, and alert signals for potentially harmful price fluctuations.

- Fibonacci retracement: The Fibonacci retracement helps predict how far a market will veer from its current trend.

- Ichimoku cloud: This calculates price momentum, finds support and resistance levels, and gives you indications to aid in decision-making.

- Standard deviation: To determine how likely volatility may affect the price in the future, standard deviation aids in measuring the number of price swings.

- Average directional index: A price trend’s strength is depicted by the average directional index, which can be used to determine whether an upward or negative trend is likely to last.

Fundamental vs technical analysis

When examining possible stocks to trade or buy in, fundamental and technical analyses are both crucial. Both strategies differ significantly from one another, hence none of that is “superior” compared to the other. Your strategy will frequently influence the type of analysis you select. While investors of short-term investments frequently focus on technical analysis, certain long-term investors favor fundamental study. To make sure you do not overlook any crucial information, it is crucial to consider both types of analysis.

How does a stock become valuable?

The link between supply and demand is used to calculate a stock’s value. A greater price will typically follow a larger demand, and vice versa. Furthermore, the return a stock can provide to a trader or investor determines its intrinsic worth. While some investors favor companies with solid fundamentals, others favor smaller, undervalued stocks with the potential for rapid expansion. You can employ a number of valuation tools to determine if shares are undervalued or overvalued.

How to pick shares that are overvalued and undervalued

Start with basic and technical analysis if you want to pinpoint undervalued or overvalued stocks. The eight widely used ratios that are a component of fundamental analysis can be used to identify undervalued or overvalued companies and ascertain their true value. To obtain the most full view of the market, you need to employ both fundamental and technical analysis, though.

Finding inexpensive or costly stocks is not the same as finding undervalued or overvalued stocks. Find high-quality equities that are undervalued or overvalued as an alternative. The idea is that market prices will eventually adjust to represent genuine value, meaning you might turn a profit. To achieve this, you would buy an undervalued stock or sell an expensive one.

If market conditions alter as a result of market dynamics, news, cyclical movements, or incorrect outcomes, stocks may be undervalued or overpriced.

What to consider when picking the best shares

Make a trading strategy

Writing out your objectives is the first step in creating an extensive trading plan and risk management strategy. These objectives must be time-bound, relevant, quantifiable, reachable, and explicit.

Your trading strategy should be tailored to your objectives and include detailed instructions on how to conduct trades. Choose your trading style before anything else. Each style has a different time frame, holding duration, and intensity of trading activity. There are four different types. Your attitude, abilities, and experience should all match the trading style you select. The four various trading philosophies are:

- Position Trading: Buy-and-hold investment or long-term trading with little trading activity are both examples of position trading.

- Swing trading: A form of average-volume, medium-term trading.

- Day trading: A form of high-volume, short-term trading.

- Scalping: trading that is extremely active and very short-term.

Understand the market

People can buy and sell shares more easily when they do so on a stock market, where shares are listed. The share market is impacted by supply and demand. Changes in the stock market are also influenced by the overall state of the economy, interest rates, market sentiment, and industry trends.

Market screener

To search for stocks, utilise the market screener. It is simple to compare stocks to one another thanks to the screener. You can then select the equities based on your risk tolerance.

Always choose stocks that you are knowledgeable about. Take into account all factors, including cost, exchange hours, and volatility.

Manage your risk

It’s crucial to choose equities that complement your risk-management plan. Since equities are constantly impacted by outside forces, all markets involve some level of risk because the trade may not always perform as anticipated.

When choosing equities, you may run into hazards including outdated business models, bad management choices, and new rivals. Additionally, there is general market risk and exchange rate risk, both of which are crucial to take into account if you plan to buy equities from other countries. To help you protect yourself against these dangers, certain online brokers provide various hedging alternatives.

How to buy the best shares?

If you want to purchase shares in one of the aforementioned types of shares, you will need the help of an online stock broker. Although there are many brokers to pick from, it is better to collaborate with a platform that is FCA-regulated and provides both UK- and US-based equities.

The procedures listed below will demonstrate how to buy one of the most well-liked shares using eToro.

Step 1: Create an Account

Visit the homepage of your broker and choose to register. Before generating a username and password for your login credentials, you’ll probably be prompted for your name and email address.

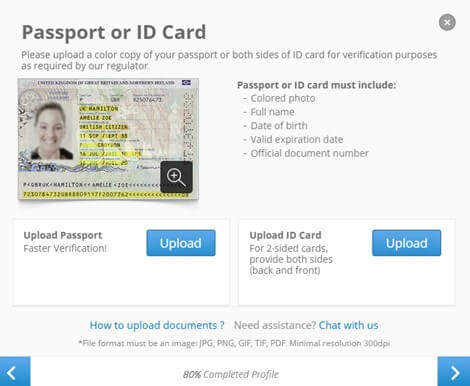

Step 2: Verify your Account

Brokers under FCA regulation will request that you supply documents proving your identity and address. Your broker will let you know when these documents have been reviewed.

Step 3: Deposit Funds

You will now be required to make a deposit of money. Depending on the platform, you might also have to fulfill a minimum deposit requirement or pay a conversion fee.

Step 4: Buy the best shares

You can purchase one of the top UK stocks to watch once your account has been funded. Simply type the name of the company in the search box and select to trade it if you are sure which of the aforementioned businesses you want to purchase shares in.

Your chosen investment amount can then be entered in an order box that appears. The majority of brokers will have a minimum investment requirement, so it’s crucial to do your homework in advance. Before finalizing the deal, you can then choose a stop-loss or take-profit level if you so desire.

Conclusion

Finding the perfect firm for a novice investor who has no prior stock market expertise can be very challenging. Even though we covered every aspect of stocks in this tutorial, you still need to do more study on the topics that could affect your business negatively.

Technical and fundamental analysis, as well as reading and understanding earnings reports, are skills you must possess.

For 20 million traders, eToro is the finest platform for purchasing stocks because it is 100% commission-free. With a $50 initial commitment, eToro offers extremely low trading costs. However, you must examine various best trading platforms to see which ones best meet your needs while investing in stocks.

Frequently Asked Questions

How should dividend stocks be chosen?

Since there are currently ETFs that primarily attempt to focus on those companies with a historical background of paying dividends, there is currently no need to choose the company that permits paying dividends.

How do I discover the top shares?

The best shares cannot be found using a set formula; nonetheless, if you want to invest in the finest shares, you must conduct your own research.

What does “diversified portfolio of stocks” mean?

In order to diversify your portfolio, you must include a variety of businesses. The businesses, however, could come from various industries and nations.

How do I choose equities to buy for the long term?

Whether you want to invest in stocks that pay dividends or you want to achieve growth, you need to concentrate on your investment aim if you want to choose stocks for the long run.