Perhaps you want to know more about the stock market. Maybe you’re the type of person who will take a gamble if it means having a chance to outperform the odds. Or perhaps you believe that you or a professional has the intelligence to foresee which stocks will do well. You might be interested in trying active investments if any of these apply to you.

In recent decades, passive investing has been more and more popular, while active investing has become less and less common. Numerous index funds have been introduced since the S&P 500, the first, debuted in 1977.

Twenty percent of equity assets managed in 2007 came from passive funds. Since then, that share has increased by half.

Even if active investing is less popular now, it’s still something to consider. The advantages and disadvantages of using an active investment approach are listed here, along with the best active investment to earn active income in UK in 2022.

What are Active Investments?

Active investments are those that trade often with the aim of beating the returns on average indexes. It’s certainly what comes to mind when you think of Wall Street traders, but thanks to modern technology and apps like eToro, you can now do it from the convenience of your smartphone.

In order to decide the optimal time to buy or sell investments, this form of investing often necessitates a high level of market knowledge and skill, according to Kevin Dugan, investment advisor and senior partner at Dublin, Ohio-based financial planning firm Dugan Brown.

Through actively managed mutual funds and exchange-traded funds, you can engage professionals to handle your active investing for you, or you can do it yourself. These give you access to a pre-made portfolio with many different investments.

Every investment in an active fund manager’s portfolio is evaluated using a wide range of information, from the market and economic trends to quantitative and qualitative information about securities. Using that data, managers make purchases and sales of assets to profit from momentary price swings and maintain the target asset allocation for the fund.

Without that ongoing care, even the most carefully constructed and actively managed portfolio can easily succumb to erratic market fluctuations and rack up short-term losses that could have an adverse effect on long-term objectives.

Due to this, the majority of investors are advised against engaging in active investing, especially when it comes to their long-term retirement funds.

How Does Active Investing Work?

Active investors typically monitor their stocks’ price movements several times every day, as opposed to passive investors who only buy a stock when they are certain of its long-term appreciation potential. Active investors typically seek out quick gains. By taking into account extra factors other than just adhering to a benchmark index, such as building a portfolio solely on company earnings or employing another basic strategy, smart beta ETFs offer a cost-effective approach for traders to profit from active investments.

Pros of Active Investments

Flexibility: An active investor has the ability to switch to a protective position or assets during bear markets to prevent devastating losses. Examples of such holdings are cash or government bonds.

Expanded trading options: Active investments can boost their chances of outperforming market indices by using trading tactics like stock shorting or option hedging to generate profits. However, they can also significantly raise the costs and hazards connected with active investing, thus it is recommended to reserve these strategies for experts and extremely experienced investors.

Tax management: Active investing can be used by a knowledgeable financial advisor or portfolio manager to carry out trades that offset profits for taxation. Tax-loss harvesting is what is meant by this. Even while you can employ tax-loss harvesting with passive investing, active investment strategies may offer more chances and make it simpler to evade the wash-sale rule due to the volume of trading that occurs.

Cons of Active Investments

Higher fees: Nowadays, the majority of brokerages don’t charge trading costs for routine stock and ETF purchases. However, fees might apply to more complicated trading techniques based on derivatives. Additionally, you will be required to pay high expense ratio fees if you invest in active investments. Active investments have relatively high expense ratios, averaging 0.71 percent as of 2020, due to the quantity of research and trading needed.

Increased risk: Active investors stand to gain significantly when they are correct. However, if one item zigs when the others zag, it can negatively affect the performance of the entire portfolio and result in catastrophic losses, especially if you utilized borrowed funds—or margin—to buy it.

Trend exposure: Active investing makes it very simple to follow trends, whether they involve meme stocks or exercise fads associated with pandemics. Consider the investor who bought Peloton for $145 on January 4, 2021, in order to capitalize on the at-home exercise trend. As of July 2022, when the epidemic is all but over, that stock is presently trading for less than $10. Determining whether the trend has reached its top or if there is still opportunity for growth is difficult when investing based on trends.

Best Active Investments for UK 2022

The most promising active investments for 2022 are listed in the below sections:

1. Mutual funds

In order to purchase stocks, bonds, or other assets, a mutual fund collects money from investors. In order to protect themselves from the losses of any one investment, investors can diversify a budget by using mutual funds, which disperse their money across a number of different investments.

If you’re planning for retirement or another long-term objective, mutual funds offer a convenient way to access the greater investment returns of the stock market without having to purchase and manage a portfolio of individual stocks. Some funds restrict the types of businesses they can invest into those that meet specific requirements, such as biotech companies in the technology sector or businesses with strong dividend yields. This enables you to concentrate on specific investing niches.

Where to invest in mutual funds?

Direct purchases of mutual funds can be made via the organizations in charge of managing them as well as through cheap brokerage houses. Nearly all of the mutual fund companies we assess provide no-transaction-fee mutual funds (i.e., commission-free) along with tools to assist you in selecting funds. Be aware that most mutual funds have an initial minimum investment requirement of $500 or more, however, some providers will remove the need if you agree to set up automatic monthly investments.

2. ETFs

ETFs are comparable to mutual funds in that they pool client funds to buy a variety of securities, culminating in an one diversified investment. The contrast is in the manner in which they are marketed: ETFs are acquired by investors in the same manner as individual equities.

ETFs, like index funds and mutual funds, are an ideal active investment if you have a long time horizon. Additionally, since an ETF stock price may be less than a mutual fund minimum, ETFs are ideal for individuals who do not have enough cash to afford a mutual fund’s minimum purchase requirements.

How to invest in ETFs?

Exchange-traded funds are offered by affordable brokerages trading platforms and have ticker symbols similar to stocks. Robo-advisors also employ Exchange-traded funds to create client portfolios.

3. Government bonds

A government bond is a debt you make to a government organization (such as the federal or local government) that will pay investors interest over a predetermined time period, usually one to thirty years. Bonds are thought of as fixed-income securities because to their consistent source of payments. Due to the U.S. government’s complete faith and credit, government bonds are essentially a risk-free investment.

Due to their stable income and low volatility, bonds are a favourite investment among those who are approaching or have reached retirement because their investment horizons are too short for them to endure sharp market declines.

How to invest in government bonds?

Bond funds, which hold a variety of bonds to generate diversification, the government, the underwriting investment bank, brokers, and individual bonds can all be purchased.

4. Corporate bonds

The main difference between corporate bonds and government bonds is that you are lending money to a firm rather than to the government. Since the government does not guarantee these loans, they are a riskier choice. The risk/return profile of a high-yield bond also referred to as a trash bond, can actually be significantly higher and more similar to that of stocks than bonds.

Investors who are prepared to accept a little amount of additional risk in exchange for a fixed-income security that may offer higher yields than government bonds. When it comes to corporate bonds, the yield rises in proportion to the likelihood that the company will collapse. On the other hand, the yield on bonds issued by well-known, significant firms would frequently be lower. The investor is responsible for determining the risk/return ratio that works best for them.

How to invest in corporate bonds?

Similar to how you buy government bonds, you can buy corporate bond funds or individual bonds through an investing broker platform.

5. Stocks

A share of ownership in a corporation is represented by the stock. The most volatile investment is a stock, which also offers the best return on your money.

These words of caution are not meant to discourage you from investing in stocks. Instead, they are intended to direct you toward the diversity that purchasing a group of companies through mutual funds, as opposed to doing so individually, provides.

investors with a well-diversified portfolio who are prepared to take on a little additional risk. Due to the volatile nature of individual stocks, it is a good rule of thumb for investors to limit their individual stock holdings to 10% or less of their overall portfolio.

How to invest in stocks?

The easiest and most economical way to buy stocks is through an online discount broker. Once you create and finance an account, you can choose your order type and become an authorised shareholder. Or you can read our comprehensive guide to invest in stocks.

6. Cryptocurrency

Cryptocurrency is a sort of virtual, electronic-only currency intended to be used as a medium of exchange. Particularly in the last several years, it has grown in popularity as investors poured money into the asset, driving up prices and luring more traders to the market.

The most widely used cryptocurrency is bitcoin, and due to its high price volatility, it attracts a lot of traders. For instance, Bitcoin shot up to almost $30,000 at the beginning of 2021 from a price of about $10,000 per coin at the beginning of 2020. After that, it increased by twofold above the $60,000 threshold before sharply declining in 2022.

Cryptocurrency has had a particularly difficult year, with the majority of the biggest coins experiencing precipitous declines. Despite the recent decline, people who acquired and held onto their cryptocurrency investments for years (or HODL) may still be sitting on some sizable gains because many cryptocurrencies, including Bitcoin, are currently available at good price after touching all-time highs.

For investors who are prepared to assume some risk in exchange for the prospect of much higher gains, cryptocurrencies are an excellent choice. Investors who prefer secure investments or are risk averse should stay away from it.

How to invest in cryptocurrencies?

Numerous brokers, including Interactive Brokers, eToro, and TradeStation, provide cryptocurrency, although frequently their selection is only comprised of the most well-known coins. In comparison, a cryptocurrency exchange like Binance or Coinbase can have hundreds of cryptocurrencies available, ranging from the most well-known to the relatively unheard-of.

How can I invest in active investments?

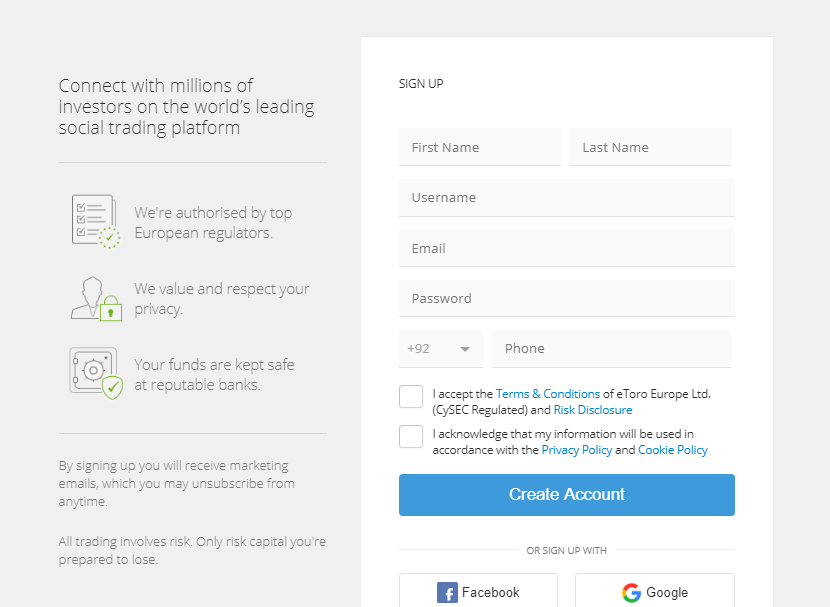

Various methods can be used for active investment. To get started, you can create an account with eToro, a broker that offers a range of alternatives.

Step 1: Open an account

An eToro account can be opened in a matter of minutes. Visit the eToro website, log in, and select “Join Now” to accomplish this.

All that’s left to do is complete the blanks with the necessary information.

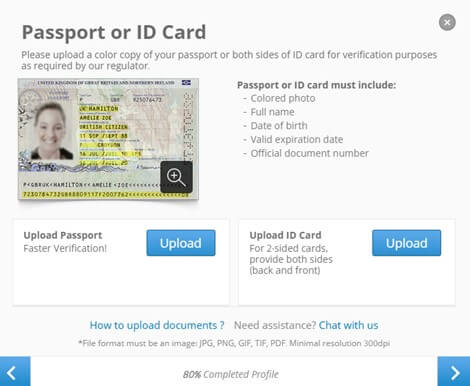

Step 2: Verify your identity

Your identity certificate and a proof of address that is less than six months old must both be submitted at the same time to eToro in order to prove your identity.

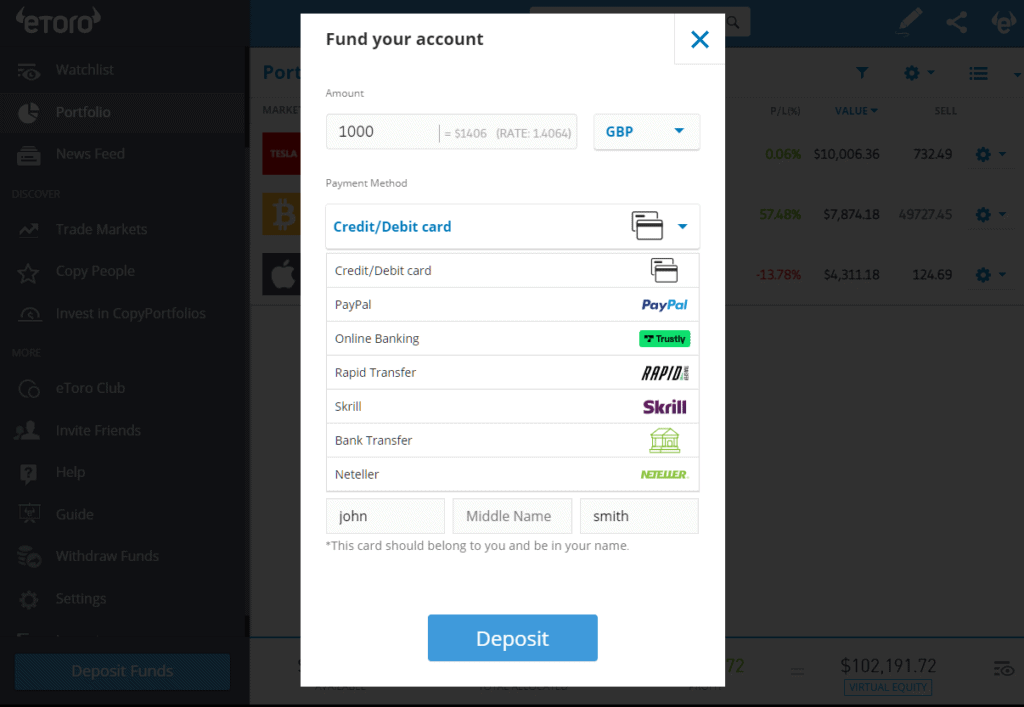

Step 3: Deposit funds

The process of making a deposit into your account won’t be any more challenging.

Select “Deposit Funds,” then input the desired deposit amount and currency before choosing the appropriate deposit method.

A bank transfer, credit/debit card, PayPal, Neteller, Skrill, and other options are available for funding your account.

Step 4: Invest in your favorite active investments

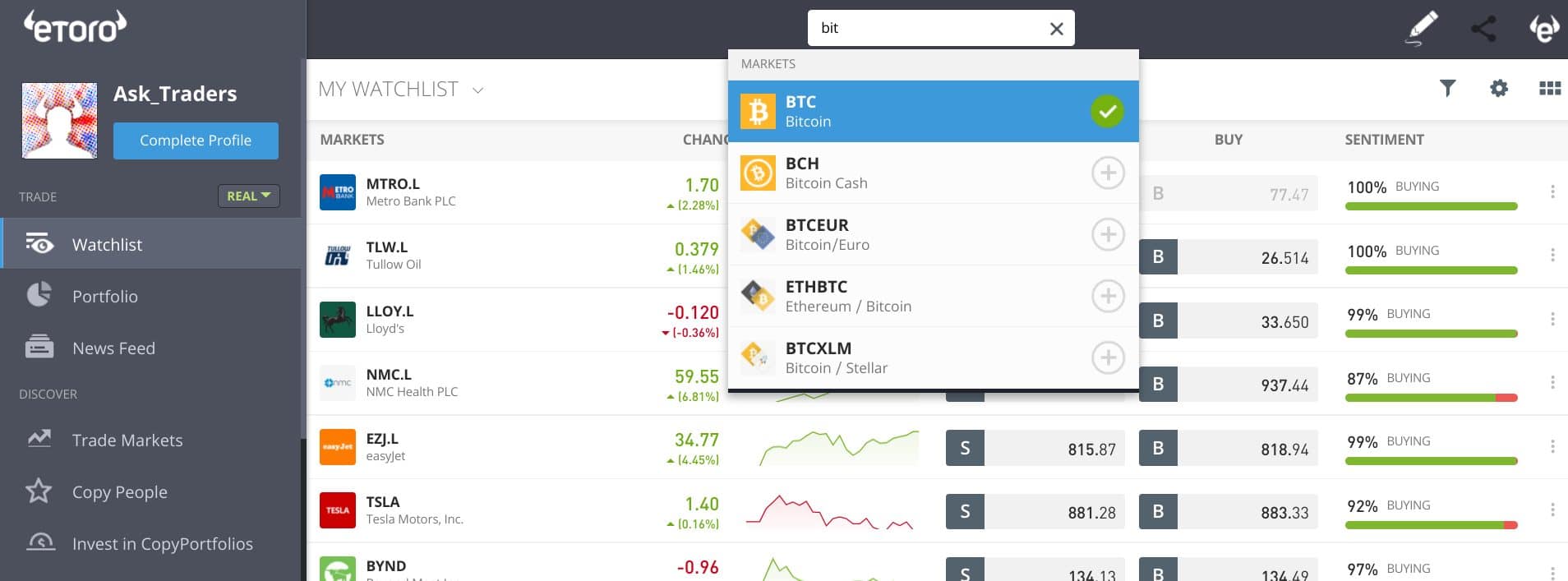

Now is the moment to look for your preferred active investment. In our example, we’re looking to buy Bitcoin.

In the search bar, enter “BTC” or “Bitcoin,” and then click “Trade” next to the first selection in the drop-down menu.

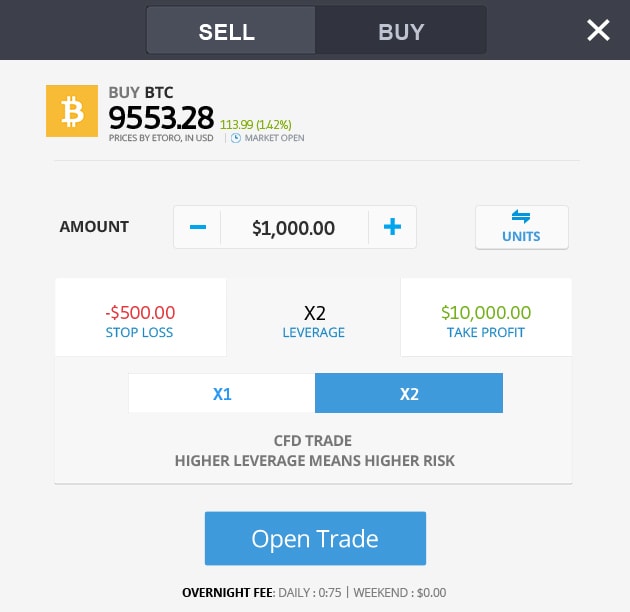

Then, an order box similar to the one below will show up. Enter your desired transaction size in this box, make sure all the information is accurate, and then click “Open Trade.”

Conclusion

Active investments can be a great method to steadily enhance your wealth because they vary from safe, lower-returning assets to risky, higher-return ones. This implies that in order to make a sensible choice, you must be knowledgeable about the benefits and drawbacks of each investment option as well as how they relate to your entire financial strategy. Even while managing one’s own assets may initially seem difficult, many investors do it.

But establishing a brokerage account is the first and easiest step in the investment process. Consider investing in active investments using a trading platform such as eToro. It’s an excellent choice because you may use it to buy stocks, ETFs, or even Bitcoins or other cryptocurrencies.

Frequently Asked Questions

What is active investing?

Trading individual stocks or bonds in an effort to outperform the market is known as active investing. You can create a plan for active investing that is suited to your interests, objectives, and risk tolerance.

What distinguishes active investing from passive investing?

Unlike active investing, which enables you to purchase and sell on your own, passive investing allows you to place your money in a group of stocks, such as an index fund, and largely sit back.

What benefits do active investing offer?

By selecting higher-performing investments rather than simply waiting it out over the long term, active investing may help you to outperform average market returns.