Listed on the NYSE under the symbol PSO, Pearson is a publishing firm with headquarters in the United Kingdom. It belongs to the Consumer Cyclical industry.

Are you interested in investing in Pearson Shares? In this tutorial, we’ll show you in great detail how to invest in Pearson in the UK right now. So let’s get right to today’s topic without further ado.

How to Buy Pearson Stocks – An Overview

There is no need to search any further if you want to purchase Pearson shares in the UK. You can purchase Pearson shares through a broker authorized by the FCA by performing the four actions listed below:

- Create a Trading Account – Visit the website of your broker, choose to register, and provide the necessary personal information.

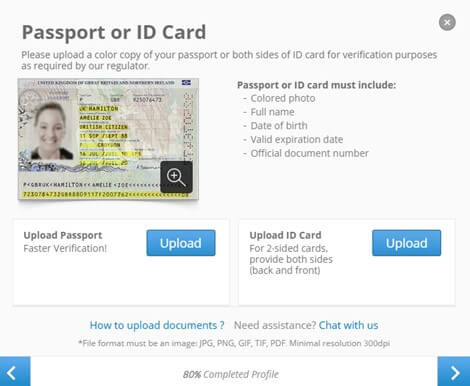

- Upload ID – To verify your account, you must upload a copy of your ID and confirmation of your address.

- Deposit Money – Use a credit/debit card, a wire transfer, or an e-wallet to add funds to your account.

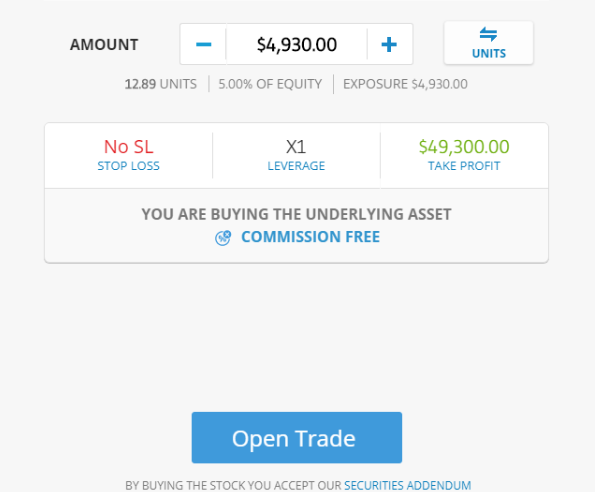

- Purchase Pearson Stock – Type “Pearson” into the search bar and select “Trade.” Enter the appropriate investment amount, select the take-profit or stop-loss level, and then confirm the trade.

Examine Pearson Shares

There are several factors to take into account before investing while trying to locate the most popular shares to buy for your financial objectives. It’s crucial to analyze factors like the company’s business plan, past share price, and other financial data to ensure that any potential investment is profitable.

We go over the fundamentals of purchasing Pearson shares in the UK in the sections below:

Pearson Overview

Pearson is a publishing and academic company with its corporate headquarters in the UK, was established in 1844. The business started out in the construction sector, but in the 1920s Pearson entirely changed its business strategy and started working as a publisher. Over time, Pearson’s brand and business expanded, and in the 1950s, the company even bought the Financial Times and obtained a 50% interest in The Economist.

In the years that followed, Pearson built and purchased a number of well-known brands, including Edexcel, Rough Guides, Dorling Kindersley, Penguin Books, and more. Then, starting in 2011, Pearson started concentrating more on the educational sector and established Pearson College, a private educational degree provider with headquarters in the UK. After a few more years of this, the company declared in 2015 that it would no longer be publishing anything and would instead concentrate solely on teaching and learning.

Today, Pearson offers educational and learning courseware for those pursuing formal schooling, postsecondary education, and careers. In addition to books, these materials also feature online technologies that can be used by both students and instructors. Pearson now has influence over a number of well-known education companies, including BTEC, Bug Club, GradPoint, Schoolnet, and others.

As online learning has spread more widely in recent years, Pearson’s services have grown in popularity. Growth Engineering data indicates that the online learning market is anticipated to grow significantly from its 2019 estimations of $101 billion to over $370 billion by 2026. A growing number of people are becoming aware of Pearson and its technologies as a result of this shift toward digital learning.

Pearson Stock Price 2022

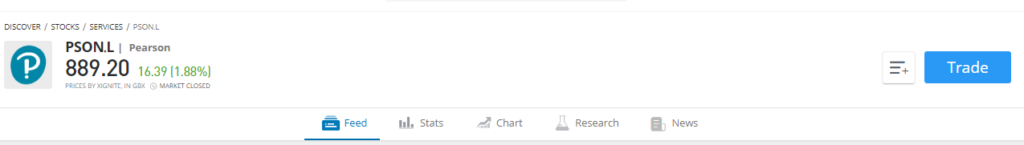

Let’s examine Pearson’s share price and the financial situation now that you are familiar with the company. The Pearson share price is 890.60 pence per share as of this writing. This shows a gain of little over 22% from the start of the year. Notably, the price of a Pearson share has climbed by over 87% from this time last year; as a result, an investment of £5000 made then would now be worth £9350.

It’s usually a good idea to look at a company’s all-time high when trading stocks to get a sense of where the price may eventually return to. When the Pearson share price was trading at 2400p in 2000, the corporation reached its all-time high. In addition, since the value was at its nearest point to these levels in 2015, when stocks were trading at 1514p, these peaks have not been attained.

In 2020, Pearson PLC earned revenues of £3.39 billion, a small improvement over 2019. This translated to a net profit of £310 million for 2020, up £44 million from 2019. These numbers demonstrate how Pearson’s services have been in demand during the shutdown and are impressive given the impact of the Coronavirus pandemic.

According to Pearson, the EPS for 2022 is listed as 41p. When you compare this to the EPS figures for 2021, which were 34p, you can see that the business has become more profitable over the past year.

The expected EPS for the company is divided by the share price to get the P/E ratio numbers. At 24.90, Pearson’s P/E ratio is at its highest point over the previous 5 years. It was at 13.16 at this time last year, demonstrating how well the business has done.

Dividends

It might be worthwhile to look at Pearson’s shares if you’re interested in investing for income. Whenever you buy Pearson stocks, you will get two dividend payouts per financial year: an interval payout in September and a final payout in May. The sum of these determines your annual dividend payment.

In terms of particular, Pearson paid a 6.00p interim dividend per share in September 2022, and a 13.50p final dividend per share at the beginning of May 2021. Investors received a total dividend of 19.50p per share as a result, matching the amount from the prior year. Dividend yields have still increased significantly since 2018 and 2017, when they were, respectively, 18.50p and 17.00p.

Find out more dividend paying stock from our previous guide to the Best Dividend Stocks You Should Buy in UK 2022.

Best trading platform to Buy Pearson Shares

The selection of a trustworthy broker who can help you with your investment is one of the most crucial aspects of the purchase of Pearson shares in the UK. These days, you have a wide range of brokers to select from, and they’re all trying to tempt you to join by providing different cost structures and advantages.

However, this section will highlight two of the most well-liked UK brokers for purchasing Pearson shares; both are discussed below.

1. eToro

When it comes to investing in Pearson, eToro is one of the most well-known brokers. Regarding the former, eToro is subject to regulation by both the FCA and the FSCS in the UK; as a result, they are required to adhere to the most stringent security measures to secure their customers’ funds.

eToro features a 0% commission structure, so aside from the spread, you won’t be charged any more money when you trade stocks. In addition to not charging any fees, eToro also enables you to purchase shares for as little as $10, or about £7.60.

In addition to the price schedule, eToro provides a wide range of tools, with its CopyTrader feature being the standout. With the use of this technology, you may automatically imitate the trades made by other eToro users, many of whom are experienced and successful traders. Even if you are a newbie, you can start investing automatically with the help of this application.

Finally, creating an account with eToro is quick and takes less than ten minutes. You only need to provide identification and proof of address to proceed. Notably, all deposits are free to make, albeit there is a 0.5% conversion fee for deposits made in currencies other than USD. To learn more about what this brokerage app has to offer, read our in-depth eToro Broker Review UK 2022 – Complete Guide.

2. Capital.com

Capital.com is another well-known broker worth looking into. The trading platform at Capital.com also has reasonable share trading commissions.

Users of Capital.com can employ leverage when trading because it primarily provides CFD trading choices. Since you are essentially “borrowing” money from the broker while using leverage, you may essentially expand the size of your position without adding more money to your account. If you purchased $1000 in Pearson shares and utilized 20x leverage, your position size would be £20,000. Despite the fact that this significantly raises possible gains, trading with caution is advised since it can also raise potential losses.

Because the minimum deposit amount at Capital.com is $20 (about £14), you can start off small and gradually increase the size of your investment. Capital.com offers more than 3000 equities to trade in addition to 142 currency pairings, 34 stock indexes, and 87 ETFs. They also offer choices for exchanging cryptocurrencies.

Last but not least, Capital.com provides a wide range of deposit options, including credit/debit cards, bank transfers, and other e-wallets. Their platform is simple to use and has a few extra charting options that can aid in performing technical analysis. To learn more about what this brokerage app has to offer, read our in-depth Capital.com Broker Review UK 2022 – Complete Guide.

How to buy Pearson Shares?

If you’re determined to purchase Pearson shares, you’ll need to open a broker account to make your investment easier. In this section, we’ll explain how to start buying Pearson shares online with eToro.

Step 1: Open a Trading Account

Go to the homepage of the broker of your choice and select “Sign Up.” After entering your email address, choosing a username, and creating a password, you can proceed to the next step.

Step 2: Verify your Account

Choosing an FCA-regulated broker will require you to authenticate your identity prior to trading. To accomplish this, you simply need to supply proof of identification and an address. After that, your broker will confirm these documents and let you know when the checks are finished.

Step 3: Make a Deposit

New users often need to make a minimum deposit, and the permitted payment methods include credit/debit cards, bank transfers, PayPal, and more.

Step 4: Search for Pearson Shares

On your trading dashboard, click the search bar and enter “Pearson.” When it does, decide to trade.

Step 5: Buying Pearson Shares in the UK

Simply input the amount you wish to invest, as long as it complies with your broker’s minimum investment requirement, to complete your investment.

Conclusion

Pearson has benefited greatly from the expansion of online learning, and as this trend is predicted to continue in the next years, the company has a bright future. With annual growth anticipated in both revenues and profits, Pearson appears to stand to gain from these macroeconomic dynamics.

If you’ve already made up your mind and want to purchase Pearson shares right now, you can do so through a FCA- regulated broker.

Frequently Asked Questions

How much do shares of Pearson cost to purchase?

The price of Pearson shares at the time of writing is 842.80p. In order to facilitate the acquisition of shares, many brokers will add a commission; however, many brokers also provide a commission-free trading system.

Who is the owner of Pearson?

Being a public limited company, Pearson is owned by its shareholders. The company’s management team includes American businessman Sidney Taurel, who has served as CEO since the company’s founding by Samuel Pearson in 1844.

What is the preferred method for purchasing Pearson shares?

Buying Pearson shares through a registered and accredited broker is the safest option. It is advised to work with a broker who is FCA-regulated since this will offer direct investor protection in the UK.