A UK-based brokerage company called Trading 212 is committed to democratizing trading by making it available to everyone.

Trading 212 has put a lot of effort into growing from a startup company to one of the top online brokers in the market. The organization has been able to grow significantly over the years thanks to well-developed trading platforms and a strong back-end engine.

We will go over all the information you require about Trading 212 in our review, including the assets offered, fees, security, and more.

Trading 212 Overview

The business was established in 2004 and has offices in London and Cyprus, the latter of which serves as the company’s hub for international clients.

Since Trading 212 was introduced as a platform for FX trading, it has been a crazy ride. Since that time, it has developed into a strong force that safely connects millions of traders to various financial markets every day across the globe.

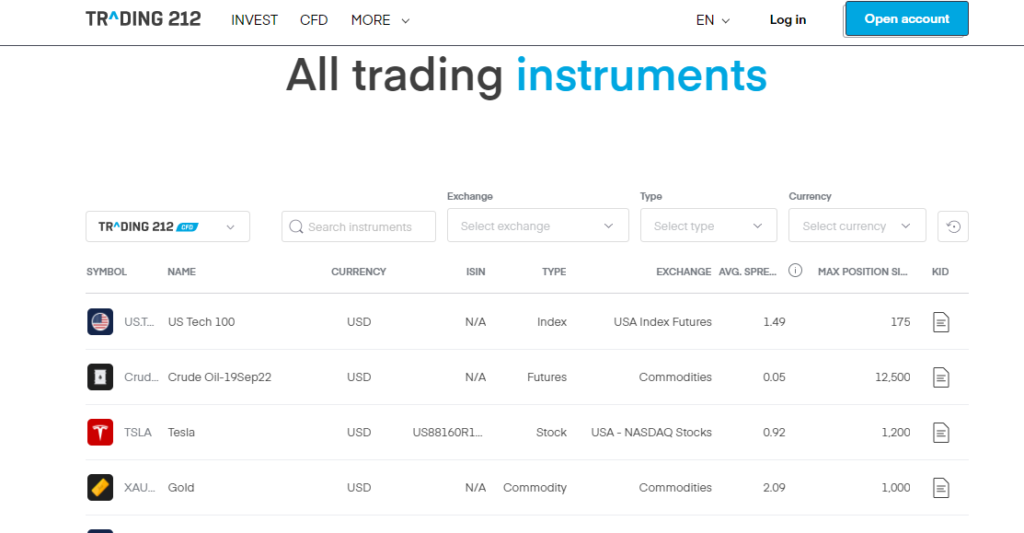

Using the MT4 platform, clients can leverage their investment and trade on more than 1,800 instruments. The platforms of Trading 212 have access to a wide range of financial instruments, including numerous commodities and the main stock exchanges in the EU and the world. The broker is an online trading platform where you may trade futures, currency pairs, commodities, stocks, indices, and more.

The broker provides a wide variety of practical tools, including thorough and understandable research tools. They offer open access to all of their research, in contrast to many other investment firms.

Trading 212 does not demand retail consumers to make substantial capital deposits, in contrast to typical brokers; as a result, individuals and small businesses can begin trading with as little as £1.

Assets offered by Trading 212

First and first, you should be aware that before making any investment, it is essential to obtain professional guidance. This is due to the possibility of losing your funds and possibly not receiving back as much as you invested when utilising a brokerage account like Trading 212 to make any sort of transaction.

Keeping this in mind, here are some investments you can make using Trading 212 in the UK:

- Forex: For foreign exchange CFDs, there is a 3.33% margin limit for more than 150 major, minor, and exotic forex markets, including the US dollar, euro, British pound, and Canadian dollar.

- Stocks: You can purchase thousands of stocks listed on the biggest stock exchanges around the world, including the London Stock Exchange. You can choose your preferred firm using this broker, decide how much to invest, and instantly receive your shares.

- Indices: More than 10,000 stocks and ETFs are available through Trading 212’s Invest and CFD accounts. If you buy stocks and shares, that are free of taxes up to your threshold, you can purchase the UK 100 and maintain a £20,000 ISA account without paying any administrative costs, transaction charges, or reinvestment charges.

- Commodities CFDs: With a minimum order size ranging from 0.001% to 1% and USD as your primary currency, you can access a broad range of commodities, such as energy sources, metals, and agricultural commodities.

Types of Trading 212 Accounts

Trading 212 just requires a $1 minimum investment, yet it nevertheless offers three different account options. These account types are excellent for clients who want to begin trading on a small scale before investing substantial sums as professional traders. A professional account is available through Trading 212 if you are a high trader and long-term investment.

- CFD Account: Users from all supported countries can access the CFD Account, one of the account types. It is mostly employed for trading CFDs only. The bare minimum deposit is one dollar.

- Invest Account: This account type is available worldwide and allows trading in real equities and exchange-traded funds (ETFs) with a $10 minimum deposit. The ability to track share prices on international exchanges is provided by Trading 212 accounts.

- ISA Account: This account is only available to UK citizens and allows genuine stock and ETF trades with a $10 minimum deposit. Investments up to £20,000 are tax-free in the UK, similar to ISAs.

Also read: Best Stocks and Shares ISA in UK 2022

Trading 212 Fees

Due to the fact that all supported instruments are commission-free and the CFD broker makes the majority of its revenue from trading spreads, the broker is well-known among investors as a free trading platform.

Spreads at Trading 212 are noticeably higher than normal when compared to those at other online brokers. When compared to other platforms, their spread for trading the primary currency pair EUR/USD is 1.4 pips, which is a little higher. Spreads for United States and United Kingdom stock transactions will be 0.50%; however, spreads for lower liquidity stock CFDs with Trading 212 can approach 10%.

There are no spread fees when buying stocks using an Invest account. As a result, the majority of traders can trade for free with the Trading 212 Invest account. Furthermore, fees for non-trading services are remarkably low. With a £1 minimum withdrawal amount, there are also no withdrawal or account fees, which is perfect for long-term trading.

Trading 212 UK Features

Demo Account

Even if Trading 212 offers a demo account that is completely free to use with fake money, you can still see how Trading 212 is a preferable platform in regards of the demo account it gives. The demo account can be reset at any time and opens with £50,000.

AutoInvest

The Trading 212 platform includes the trading tool AutoInvest as one of its integrated products. This product facilitates the purchase of fractional shares. The investment minimum for the product is $1. With this, Trading 212 enables novices and small-time traders to buy a small portion of expensive and high-value shares of businesses like Amazon, Apple, and Google. They are able to multiply their investment by 100 times thanks to these top stocks.

Trading 212 Pro

The only difference between switching between demo and real mode with this broker is whether or not you want to fund your account. All trades are commission-free. All transactions are fee-free. A Trading 212 Pro account can be made available to you with a CFD account. Trading 212 Pro allows regulated consumers to access higher amounts of leverage in exchange for sacrificing regulatory safeguards. As a Pro account requires cash, trade regularity, and trading expertise, you must have some prior trading knowledge in order to enjoy higher investment levels and risk with this broker.

Trading 212 Deposit Methods

The deposit and withdrawal methods accepted by this platform include Apple Pay, Bank Transactions, Credit Cards, Debit Cards, eBanking, Google Pay, PayPal, and Skrill.

Bank transfers do not incur any deposit fees, although there is a 0.7% fee if your total deposit exceeds GBP 2,000.

There are varying minimum deposits and withdrawal limits that exist based on the type of account you possess. For example, £1 for Invest – £10 if you use a bank transfer, £10 for CFD, and £1 for ISA – £10 if you use a bank transfer You should also be aware that while payments are made using a credit card, debit card, or e-wallet are immediately credited to your account, bank transfers normally take two to three business days.

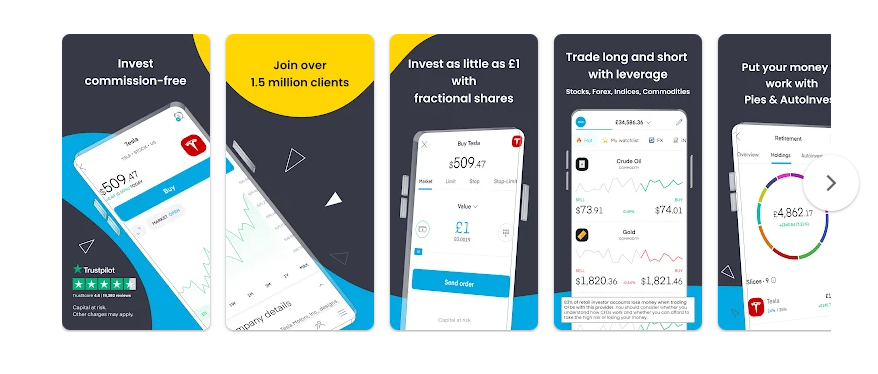

Trading 212 Mobile trading apps

The Trading 212 app has over 10 million downloads in the Google Play store, proving its undeniable popularity. Although the program includes instructional video content for novices, experienced traders will be disappointed by the absence of advanced capabilities, especially when compared to the best trading applications for mobile devices.

Apps Overview: An exceedingly user-friendly mobile app is available from Trading 212 for iOS and Android smartphones. It is simple to sort across markets like stocks, currencies, indices, and freshly added symbols using the basic watch list screeners.

The absence of significant research capabilities in the Trading 212 app is its main flaw. There is a useful economic calendar that clearly displays forthcoming activities for each specific symbol.

Ease of use: The platform may be quickly accessed from within the browser thanks to Trading 212’s own Google Chrome plugin, which is unique among the brokers we have studied. Notable features include its configurable watchlists and automatic syncing with the web platform. In our yearly evaluation, Trading 212 received a Best in Class grade for Ease of Use (top 7).

Charting: The app’s charting capability has been impeccably integrated with 45 indicators and 19 sketching tools. The mobile app and equivalent web version are almost functionally identical.

Trading tools: There are currently no good-till-date order expirations available; instead, good-till-cancel is used by default. These small particulars highlight how much space there is for the software to enhance its personalization capabilities.

Upcoming events: Observing forthcoming events when viewing the symbol attributes of a certain instrument, such as the EUR/USD, is one element that shines out in the Trading 212 mobile app experience. The event is shown along with its likely effects, anticipated prediction, and precise timing.

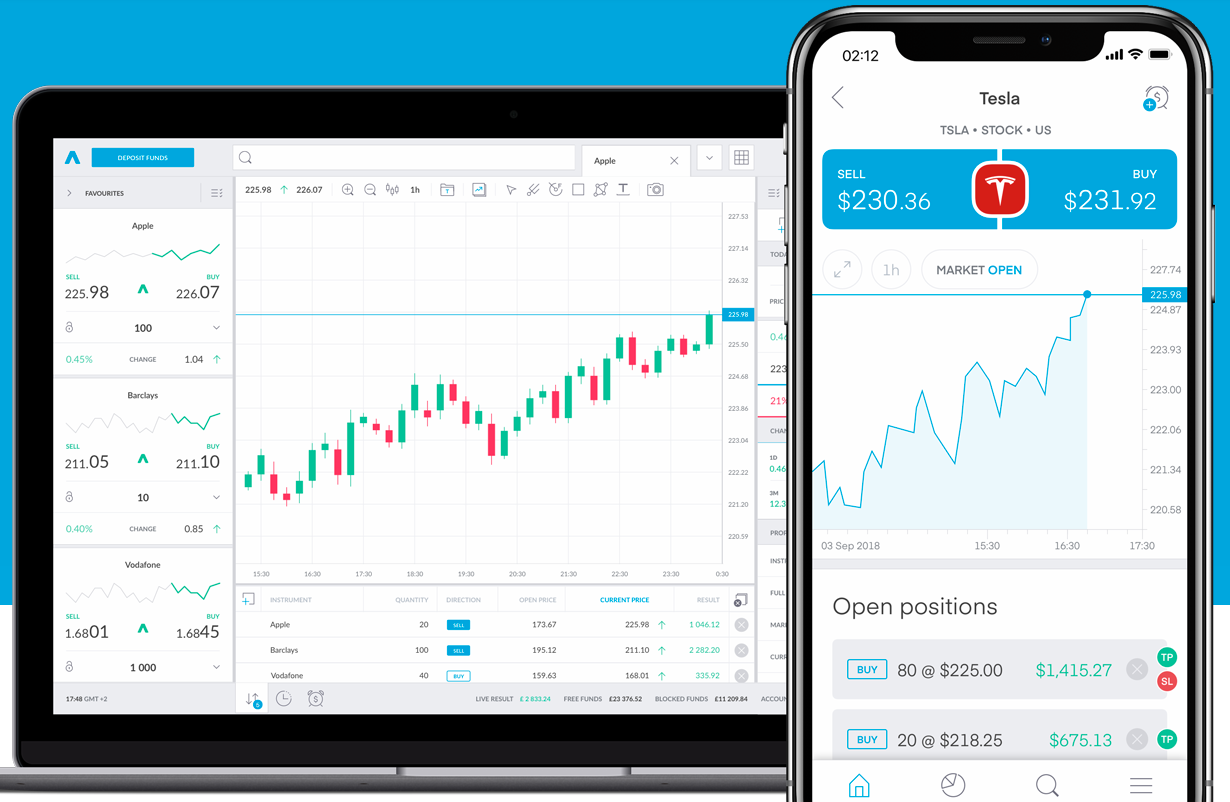

Web trading platform

Platforms overview: In addition to its multi-asset offering, Trading 212 also provides a web-based trading platform. Similar to its other platforms, you will also have exposure to each of its accounts, CFD and Invest, in addition to their individual marketplaces. The platform’s majority of features are simple to use, and it boasts a clear, straightforward style with powerful infographics and integrated news headlines.

Charting: Like the mobile app, Trading 212’s web platform has reliable charting. There are five different categories to select from, and there are 45 indicators and 19 sketching tools available to you. You may design and store your own chart templates, which I’ve found to be useful for applying settings to different charts. One notable, albeit minor, the drawback is that while you can switch between and open many charts, you cannot remove a chart from the platform.

Trading tools: The helpful feature of the mobile app, which enables you to find forthcoming events by quickly scanning the symbol of a certain instrument, is absent from the web platform. To view certain events, you must manually access the economic calendar the old-fashioned way.

Research tools

A little bit more than the bare minimum is all Trading 212 offers in terms of research, which is not particularly impressive. Users get access to a hotlist of popular trading symbols, news headlines and commentary, and an actual helpful economic calendar.

Research overview: In its web trading platform, Trading 212 offers daily market analysis for a variety of assets. The research, however, is scant, and what is available just seems to be out-of-date.

Market news and analysis: The Trading 212 website provides news highlights as well as around a dozen technical analysis snippets, each of which contain price comparisons for popular CFD markets like currency, commodities, and metals.

Education resources

Over 170 instructive films from Trading 212 are accessible on its YouTube account, which offers a good selection. Furthermore, it only contains a few in-depth blog posts and advanced resources, and there are no video webinars.

Learning Center: Videos, many of which are included in Trading 212’s web and mobile platform, make up the majority of the company’s educational material. Trading 212 does not provide instructional articles; the only content it offers are a few posts in its community forum and FAQs in its assistance area.

Room for improvement: We’ve discovered educational tools on the platforms of the best brokers, such as articles arranged by experience level and quizzes for assessing and tracking your progress, that Trading 212 may benefit from adding.

Trading 212 Customer Service

Customer assistance at Trading 212 can only be reached by phone, email (info@trading212.com), or even through the website’s contact page, where you can submit your message and include any supporting documents you may have. The website also has live chat if you wish to talk to a representative. The Trading 212 customer care team is available around-the-clock and offers rapid, accurate assistance in 16 different languages, but you should be aware that the platform has been restricted and all live support has been temporarily suspended due to the COVID 19 epidemic.

Trading 212 Licenses and Security

Trading 212 is a secure choice due to the fact that it is authorized and governed by both the Bulgarian Financial Supervision Commission and the UK’s Financial Conduct Authority.

Your money is maintained apart from the broker’s money by being kept in separate bank accounts from all other customer assets. Segregating client funds is essential to protecting client cash in the event that Trading 212 liquidates its shares. Additionally, if the broker filed for bankruptcy, you would be covered up to £85,000 under the FSCS compensation and up to 20,000 euros under the ICF Bulgaria compensation.

Additionally, Trading 212 provides negative balance protection, which ensures that your losses will not exceed your account amount. To prevent any flaws and guarantee that consumers are safeguarded, this broker also has a number of security measures in place. Thus, for all of your assessments, you can ultimately have some amount of safety.

How to begin with Trading 212?

The steps listed below are to sign up and create an account at Trading 212.

- Visit the website, then select “Open Account.”

- Enter your home country in the dialogue box.

- Include your name, email address, contact information, and birth date.

- In the following stage, include tax information as well, specifically mentioning the nation in which the user pays taxes. Giving a tax ID is also crucial.

- The next step is to choose the account type and the base currency for deposits and withdrawals.

- Answer a few questions regarding your financial situation, and mention your employment situation and trading background.

- After confirming residency and identification documents, activate the account by checking the “Accept the Terms and Conditions” box and then clicking “Submit.”

Conclusion

After carefully examining Trading 212, we have come to the opinion that beginning traders would benefit more from using the trading platform. It is advantageous to start honing your trading skills with a minimum deposit of £100. The ideal tool for in-depth market research and testing trading platforms is its free demo account.

Fantastic customer service is available from Trading 212, and money withdrawals are simple. It provides intuitively navigable trading interfaces that are simple to use and understand. The Trading 212 educational resources are also excellent. They provide a range of practical content, including inexpensive YouTube videos.

Frequently Asked Questions

What is Trading 212?

Although it is primarily a CFD and forex broker, users can also access commission-free stock and ETF trading. The brokerage firm was founded in 2015 and is accredited and governed by the FSC in Bulgaria and the FCA in the UK.

Can I use leverage when trading with Trading 212 UK broker?

In contrast to an Invest or ISA account, a CFD account is necessary if you want to trade a lot of units. This is because a CFD account allows you to deposit more money, but it also carries a bigger risk of losing it.