Private Equity is a sort of viable investing in which funds are not exchanged on an open marketplace. Diversifying a portfolio can help to reduce the risk of losing money in the case of a downturn. One of the key reasons why some investors prefer to engage in private equity is because of this.

In the year 2000, a $100,000 investment in private equity would have increased to $854,984 in 2020. Large, professional, institutional investors, as well as those with the most wealth, have taken notice of these gains.

In this article, we’ll go over the most important things to know about investing in private equity. By the end of this article, you should have a good understanding of how to get started investing.

What is Private Equity?

Private equity is a sort of viable investing in which funds are not exchanged on an open marketplace. Investors in private equity make investments in private corporations or in buyouts of publicly listed firms, with the goal of delisting public stock. Professional and private traders invest in private equity, which can be utilised to encourage technological innovations, execute purchases, increase working capital, and strengthen and stabilize a balance sheet.

Limited Partners (LPs) normally own 99 percent of a fund’s shares and have limited liability, whereas General Partners (GPs) own 1 percent of the shares and have full liability. The latter is also in charge of the investment’s execution and management.

Types of Private Equity

Based on the variety of investments that the private equity firm specializes in, the firm may be able to profit from your contribution in a variety of ways. Four investments are described below:

Venture Capital: Investment in a startup company is referred to as venture capital. It might be startup capital or creation capital, depending on whether the investment is made before or after the start of the activity.

Development Capital: A company seeking development capital is one that intends to increase its production capacity and sales force and is searching for investors to support with its growth strategy and management.

Buyout Capital: The funding of a company whose managers want to assist in the transfer of ownership to new shareholders is known as buyout capital. It frequently takes the shape of a “Leveraged Buy-Out” transaction (LBO).

Turnaround Capital: Turnaround capital refers to money injected into a firm that is having financial or management problems in order to get it back on track..

What is investing in Private Equity?

First and foremost, experience is required in order to target the appropriate company profiles among those seeking to invest. In addition, financial analytical abilities are required in the context of the examination of potential investment files.

Above all, you must have a significant amount of money to entice private enterprises, knowing that it is advisable to diversify your various investments, which raises the total amount of money to be invested.

For the retail investor, all of them provide numerous obstacles. Nonetheless, venture capital companies registered on the stock exchange or specialty funds such as FPS can be used to participate in private equity.

Placing bets on world leaders

Nonetheless, the easiest option is to invest in the global leaders in private equity that is, publicly-traded firms since it allows you to participate in private equity at a lower cost while having considerably more liquidity than a private equity fund because its funds may be accessed at any time.

Buying a company’s stock allows you to profit directly from the unlisted world (private companies), which is often impossible for the “general public” investor to access.

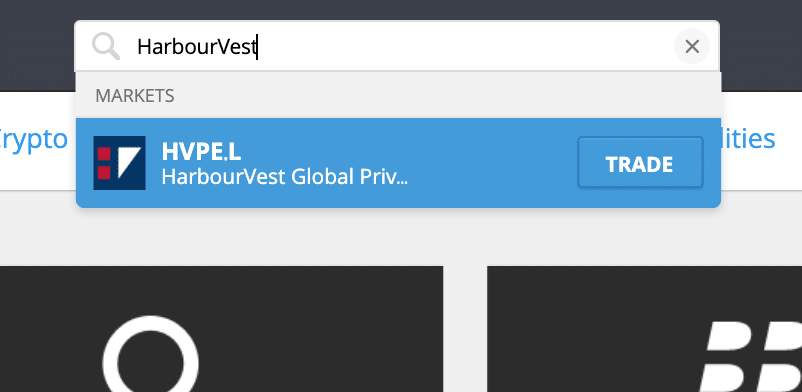

Some of the British companies 3i Group Plc (III), HarbourVest Global Private Equity Ltd (HVPE), Wendel (MF), the American BlackStone Group LP (BX), and KKR & Co Lp are among the leading companies in private equity traded on financial markets (KKR).

Important terms to understand

- Carried interest: it is a type of incentive designed for private equity firms that allow investors’ and investment teams’ interests to be linked.

- Leverage Buy-Out: a financial transaction in which a company is purchased through a loan method, with the monies borrowed to finance the LBO being repaid from the targeted firm’s profits.

- Letter of intent: This financial tool is commonly used in the event of a company sale or an equity investment in a development capital or venture capital transaction.

- Postmoney value: the value of a company after it has been added to a Private Equity investor’s capital.

- Preferential liquidation: Certain classes of shares (known as “preference,” acquired by investors) have terms that allow them to be paid before the founders who own “ordinary” equities when the firm is sold.

How to Start Investing in Private Equity?

To invest in private equity by purchasing shares of publicly traded firms, follow the steps in the order described below:

Step 1: Select a Broker

Now that you have a better understanding of what private equity firms may provide as an investment, it’s time to move on to the first step in the process: selecting a reputable best stockbroker.

In this section, we’ll look at two of our preferred trading platforms for investing in private equity funds, so you can figure out which one is right for you.

1. eToro

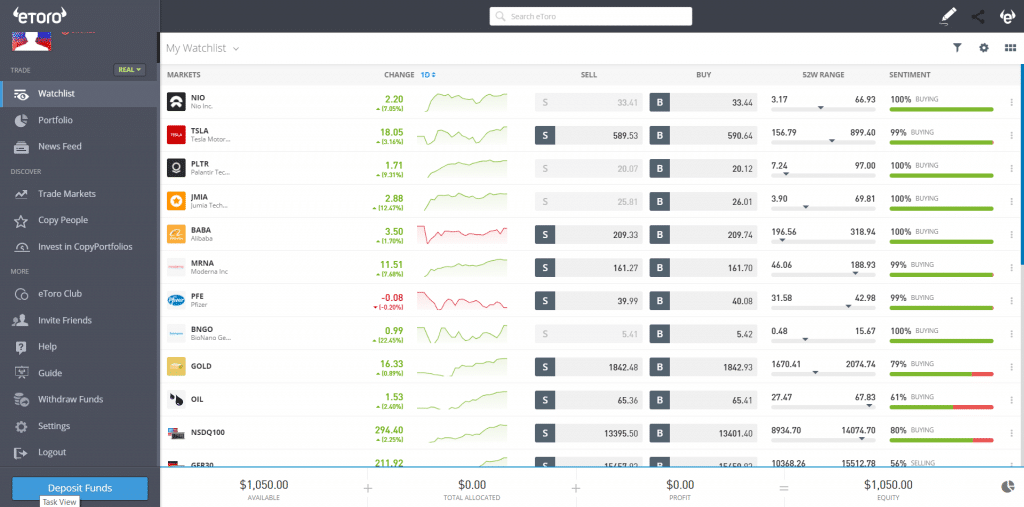

eToro is our preferred broker for investing in private equity. eToro, an FCA-regulated broker with over 20 million active users globally, is a favorite of many sorts of investors due to its affordable pricing structure and large asset range.

When investing in funds, you must take into account the charges involved. Many other forms of fees might arise depending on who you invest with, making it an expensive procedure. eToro, on the other hand, allows you to participate in private equity firms without paying any commissions. You can also start trading for as low as $50 per trade!

Another fantastic feature of eToro is how simple it is to open an account and start investing. You may open an account with eToro in as little as ten minutes! You can also fund your account using a variety of methods, such as credit/debit cards, bank transfers, and numerous e-wallets.

Finally, if you want to diversify your portfolio outside private equity funds, eToro can help. eToro ensures that you have a large pool of assets to pick from when developing your portfolio by offering over 2000 stocks, hundreds of ETFs, commodities, and even cryptocurrency trading.

Pros

- The online trading platform is extremely user-friendly

- Invest without spending a commission

- Stocks, indices, commodities, currencies, and other CFDs are available to trade

- 2,400 stocks listed on the worldwide stock exchanges

- More than 150 exchange-traded funds

- You can use a debit/credit card, an e-wallet, or a UK bank account to make a deposit

- Copying other users’ deals is possible

- Protections under the FCA and the FSCS

Cons

- Not for intermediate investors who prefer conducting technical analysis

- There are no ISAs or SIPPs

2. Fineco Bank

If you’re seeking a substitute for eToro, Fineco is our second favorite broker for investing in private equity. Fineco Bank is listed on the Italian stock exchange and is regulated by FCA.

Fineco’s minimal trading fees are one of the benefits of employing them for your investments. Fineco charges a fixed cost of $3.50 per investment in US-based stocks and £2.95 per investment in UK-based stocks if you want to invest in private equity companies to gain exposure to their funds. Even when high investment amounts are used, the commission level remains constant.

You can deposit funds into your Fineco account for free via bank transfer, which takes about 2-3 days. Additionally, if you make a profit from your private equity investment, you can withdraw it for free via bank transfer or credit/debit card. Fineco’s withdrawal process is quick, and funds are normally available in your account within one business day.

Finally, Fineco allows you to trade a wide range of asset classes, including shares, stocks, bonds, the top ETFs, and foreign exchange. This option is ideal if you want to build a wider asset portfolio in addition to your private equity fund investment. Fineco offers 13 stock markets and over 5000 ETFs, ensuring that there is something for everyone.

Pros

- When investing in funds, there are no transaction fees

- Thousands of UK and worldwide shares are available

- License from FCA

- The company is listed on the Italian stock exchange

- ISAs and SIPs are available

- All personal information is kept private

Cons

- When holding funds, there is a 0.25 percent yearly fee

- Debit/credit cards not accepted

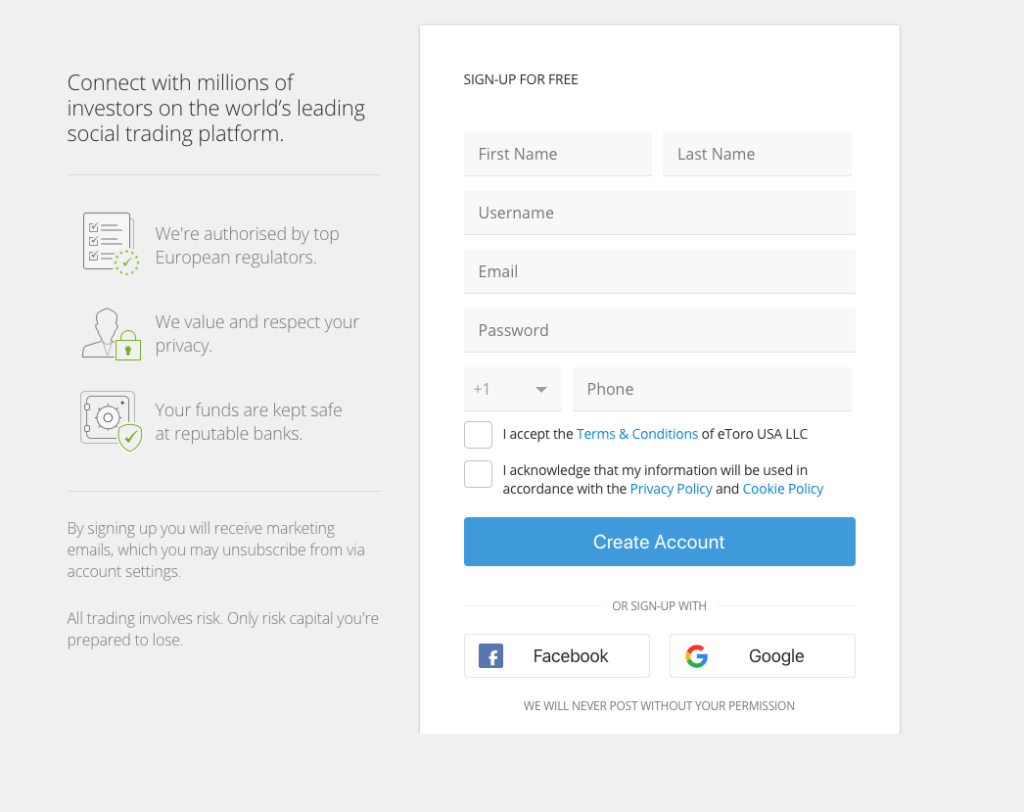

Step 2: Open an Account

You must choose an online broker to create a trading account. Make sure you find a broker who offers venture capitalist stocks. As a result, we recommend eToro, which allows you to register an account in only a few minutes.

All you have to do now is fill out the registration form and give proof of identification and address to finish the account opening process.

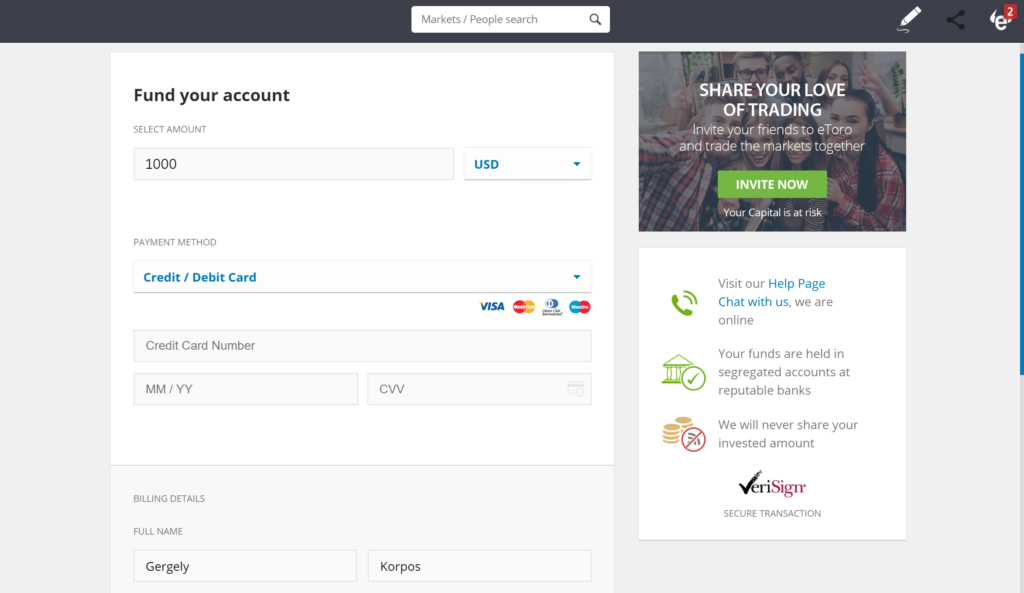

Step 3: Deposit funds

After you’ve created your account, go to “My Account” and then “Deposit funds” to make a deposit. After that, you’ll need to input the amount, currency, and payment method you’d like to use to make a deposit. The following are the payment methods available on eToro to make a deposit:

- Credit/debit card

- PayPal

- Neteller

- Skrill

- Quick Transfer

- Bank transfer

Step 4: Buy Private Equity shares

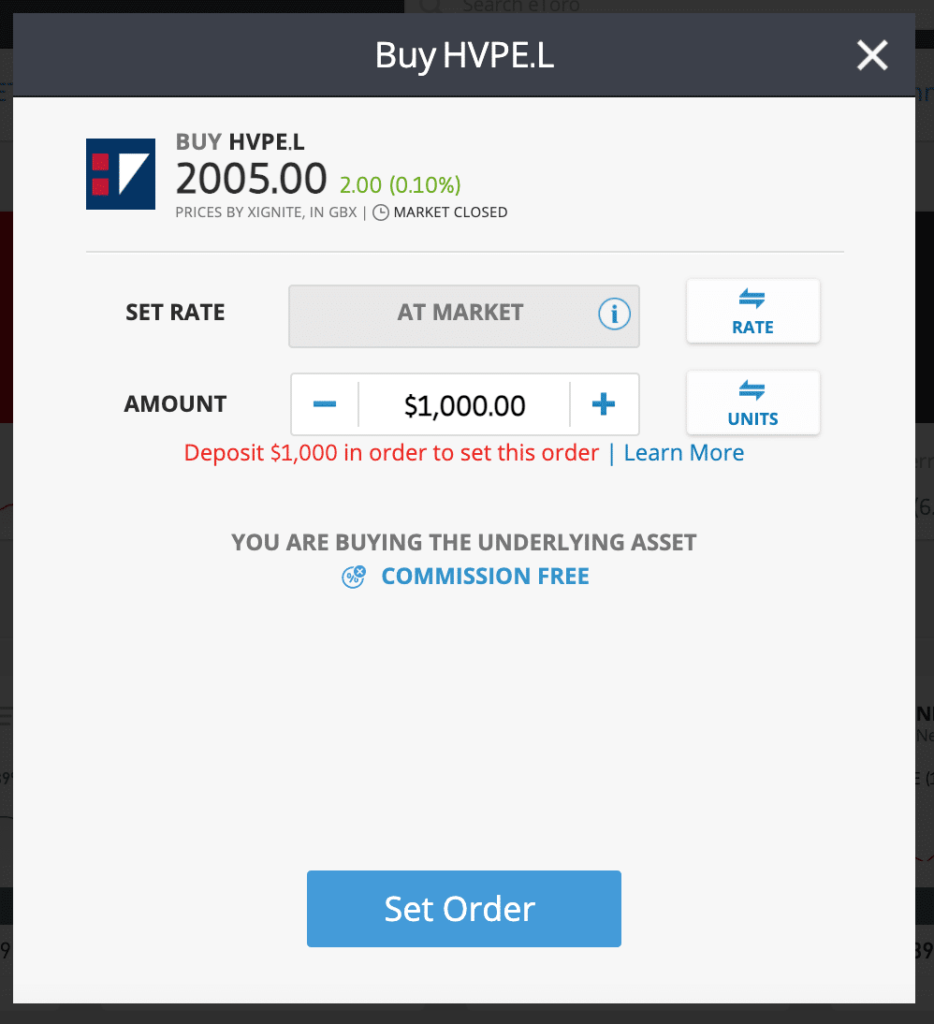

After you’ve funded your eToro account, you can invest in firms. To gain an overview of the many markets and securities accessible, go to the left-hand tab and select “Search.” You may also directly type the name of the object you’re looking for into the search field. Then select “Invest.”

Step 5: Place your Order

The purchase order must then be completed. To do so, follow these steps:

- Indicate the amount of money you’re willing to put up

- Set a stop loss, take profit, and leverage

- Tap “Open position”

Why invest in private equity?

The reasons provided are varied and vary depending on the investor’s risk profile. However, below are a few reasons to explain why investors are investing in 2022.

Support businesses

You contribute to the evolution of the company’s activity by contributing to finance its start-up, expansion, sale, transfer, or recovery, and thus the economy in general, by purchasing a stake.

Diversify your holdings

By diversifying your financial investments you can avoid placing all of your eggs in one basket. It’s a chance to follow a different cycle, one that’s more in step with the real economy. Diversification is a favored technique for investing.

Aim for long-term capital growth

Long-term investment returns are a strong possibility, especially when listed investment firms take tax benefits in the process of their operations, increasing the prospective investment returns.

The goal is to make a capital gain at the exit, which is usually after 5 to 8 years, depending on how long the investments have paid out. The investment solutions utilized and their taxation will also affect your goals and results.

Untapped Potential

Private equity investments in companies offer a lot of untapped potentials. Investing in unlisted privately-owned companies with high development potential might yield decent returns for investors. Investors can also invest in companies that aren’t doing well on the stock market but will eventually go private.

Risks of investing in private equity

Illiquidity

To receive a profit on your private equity investment as a limited partner, you’ll most likely need to keep it in a private equity fund for a long time, sometimes as long as 10 years. Limited partners in private equity funds must often contribute a fixed amount of money that the firm can spend as needed within a specified period, which differs from other prevalent fund forms (such as mutual funds). A capital call occurs when a company asks its investors for a specific sum of money.

Transparency, regulation, and data

Because private equity funds are not obligated to publicly publish information about their funds because they are not registered with the Securities and Exchange Commission, private equity firms are not required to do so (unlike, a mutual fund, which is subject to public disclosure requirements).

Furthermore, private-equity investments of privately held enterprises are not subject to public examination. The private equity firm is responsible for identifying companies with sound, full, and accurate balance sheets. As a result, the private equity universe has a wide range of risk levels: In a takeover, mature corporations may disclose clarity on years of earnings and operations data, whereas an early-stage startup will have very little of this data. As a result, venture capital investing in an unknown startup is intrinsically riskier than investing in a growth-stage company with proven revenue and market dominance.

Tips to consider while investing in Private Equity

Here are some of the most important considerations to keep in mind when investing in private equity:

Only invest what you can lose

Investing in private equity carries the risk of significant losses. As a result, it’s critical to keep a safety net in place and not put all of your money into this form of investment.

Define your investor profile

Private equity is typically a long-term investment that lasts at least a few years. We recommend that you mix throughout many holding periods in order to put the chances in your favor, always with risk diversification in mind.

Know what you’re getting yourself into

A private equity firm’s mission is to invest in private enterprises on your behalf. Before you begin, learn the terms employed by these companies (we’ve mentioned in the above sections).

How Much Should You Put Into Private Equity?

There are three investment thresholds in general:

1. Make an initial investment of £100

- If you’re a newbie with limited funds, a £100 investment could be a good place to start.

- If you opt to invest £100 in private equity, however, you must consider the long term. It’s useless to invest €£100 on something only to resell it for a modest profit a few weeks later.

- You must contemplate this level of investment across several years in order for it to be profitable.

2. Invest £1,000 in private equity

The earnings will naturally be bigger if you invest £1,000 than if you merely invest £100. Your benefits are also more likely to be realized sooner. Another benefit is that you will be able to begin diversifying your investments by purchasing shares in a number of venture capital firms on the market.

3. Invest £10,000 for Insiders

- If you want to invest a greater quantity, we recommend diversifying your assets to reduce risk and avoid placing all your eggs in one basket.

- If you want to invest between £5,000 and £10,000, make sure it doesn’t account for more than 5% of your overall portfolio.

Investing in Private Equity vs. Public Stocks: What’s the Difference?

- Private equity firms generally pay a premium for controlling holdings in the companies they invest in.

- A controlling position allows owners and managers to be more aligned, something that isn’t always possible in publicly traded companies.

- In a publicly listed firm, the board of directors is frequently chosen by management, resulting in inadequate oversight.

- Private equity businesses are exempt from disclosing their financial results to the public on a quarterly basis. Companies can focus on the long term while making decisions with less regular reporting.

- Because the risk appetite of the investment opportunities is high, private equity ventures use leverage aggressively. Publicly-traded corporations, on the other hand, operate with less debt since investors are often more risk adverse.

- PE-backed company investments are less liquid than publicly traded stocks, which can be exchanged for cash during market hours. In contrast, a private entity’s liquidity occurs only when the entire business is sold, often after a 5-year holding term.

Conclusion

Due to their benchmark-beating performance and excellent diversification benefits, private equity funds are becoming a more popular asset. Before making an investment decision, make sure you do your homework and cover all of your bases.

If you’ve made up your decision and want to get involved in investing in private equity, we recommend starting with eToro. eToro is a platform that allows you to invest without paying any commissions. You can even spend as little as $50 (about £36), allowing you to gradually build up your position rather than needing to pay a significant sum right away!

Frequently Asked Questions

How can I purchase a share in a private equity firm?

To begin, you must first open a trading account with a stockbroker in order to become a shareholder of that firm. We recommend eToro as a broker.

Why should you use eToro to invest in private equity firms?

Choosing eToro means choosing a reputable and licensed broker with the added bonus of not having to pay fees on purchases or resales, as well as the possibility of leverage via CFDs offered on their trading platform.