Britain serves as the headquarters for the global oil and gas corporation BP. Due to the recent significant price fluctuations in BP’s shares, there has been an increase in interest in buying BP stock. The London Stock Exchange is BP’s major listing for its shares.

If you’re looking for information on how to purchase BP shares using an online broker in the UK, our detailed guide outlines the steps in detail.

How to Buy BP Shares : A Step-by-Step Guide 2022

- Select a trading platform – See our article on the top trading platforms in the UK if you’re not sure which one to use.

- Open a Trading Account – You will require your social security number, personal details, and bank information.

- Make a Deposit – Use a bank transfer or debit card to fund your new trading account.

- Buy BP Shares – Do a search for “BP.L.” Buy your BP shares right away. If you’re happy to purchase shares of BP, go ahead.

Examine BP stock

This is not to argue that you should buy shares of BP right away. Instead, take a step back and conduct your own research.

In order to guide you in the correct direction, we’ve created a list of the most important elements you should take into account before purchasing BP shares.

BP Overview

One of the seven oil and gas supermajors in the world, BP is a multinational oil and gas company with its headquarters in London and was founded in 1909. The company engages in all facets of the oil and gas sector, comprising research, producing, refining, delivery, advertising, power generating, and even trading, as a result of its vertical integration. Additionally, the business has forayed into a number of alternative energy ventures, including solar panels, wind farms, and biofuel.

It is a large-cap stock on the LSE, FWB, and NYSE and has operations in almost 80 different countries. Additionally, the FTSE 100 includes BP. Due to its direct linkages to larger market patterns, this indicates that it is primarily a cyclical company, and investors should be aware of this. In a bull market, investing in BP will likely be successful; in a down market, the opposite is likely to be true.

Investing in BP is best suited for income seekers who don’t mind modest growth because the company pays dividends. However, there are a few things to consider before making a purchase. During the coronavirus pandemic, which it has since recovered from, it suffered a significant loss of value. The result of the Russian invasion of Ukraine and any potential effects on business are still uncertain.

Boohoo Share Price

The past five years haven’t been very kind to it, and it has experienced many ups and downs. This is probably because environmentalists are putting more pressure on oil and gas producers, and because electric cars are becoming more and more popular. The company’s net profitability has recently taken a significant hit as a result of fluctuating oil prices and an unsettling global environment.

The coronavirus pandemic played a significant role in the decline of BP’s stock price. Lockdowns caused a dramatic drop in the number of persons flying and driving, which eventually reduced the demand for oil. But in 2021, when things gradually returned to normal, BP’s stock price started to climb back up to pre-pandemic levels.

Following the invasion of Ukraine, BP declared in 2022 that it was severing connections with Russia. At the time, BP, the biggest foreign shareholder in Russia, sold its 19.75 percent ownership in Rosneft, a significant oil business. Although it is unclear how the battle will finish, it has mostly been advantageous for the oil and gas industry.

Best trading platform to Buy Boohoo Shares

You must locate a UK broker that gives you access to FTSE 100 shares since BP is listed on the London Stock Exchange. Before registering, you should consider a number of factors, including the broker’s fees, the payment options it takes, and the security of your funds.

You can purchase BP shares from three well-known UK stock brokers listed below as a guide.

1. eToro

eToro is the first platform we have on our list. The best trading platform in the world, it offers a range of financial assets for investment, including shares, commodities, indices, and cryptocurrencies. 800+ Shares are available internationally. You can trade stocks that are listed on the London, New York, and Tokyo markets using this site.

It provides a range of possibilities when discussing equities, including BP shares. You are allowed to use a leverage ratio of up to 1:5 on this platform, and you can even purchase assets the old-fashioned way.

Further oversight of the platform is provided by the FCA, ASIC, and CySEC. Since the platform is also registered with FINRA, US traders can access it as well. However, there will be a 0.5 percent charge for each deposit and a $5 charge for each withdrawal. It is the most affordable trading platform in the UK.

For newbies, eToro provides a copy trading tool. Using this choice, you can mimic the ongoing trades of experienced traders. The copy portfolio feature can be used to diversify your investment holdings as well. On this platform, creating an account takes less time than on other websites. It takes just a few minutes to open an eToro account. You must fund your account after completing the account creation process in order to start your trading career.

For the ease of its customers, it accepts a range of payment methods for deposits, including debit cards credit cards, bank accounts, e-wallets, and more. There is a $5 inactivity fee associated with the platform, which is reasonable given the modest spreads. Other free platforms do not provide the round-the-clock customer service that our trading platform does.

Learn more: eToro Broker Review UK 2022 – Complete Guide

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG is a fantastic platform that also lets you use leverage and gives you access to BP Shares. This implies that you are not required to worry about making further investments if you don’t have a lot of money. Your funds are safe and secure because the FCA is in charge of overseeing them, so you don’t need to be concerned.

You can trade forex using the platform’s access to more than 12,000 assets and leverage of up to 1:200 on currency pairs like EUR/USD, EUR/GBP, EUR/GBP, EUR/JPY, and USD/JPY. That means you could possibly trade with $60,000 with just a $300 balance in your account. The fact that this platform provides access to more than 80 currency pairings is what draws traders to it the most.

For individuals who want to trade forex but lack sufficient funds, this trading platform is ideally suited.

Creating an account on this trading platform is also very easy. However, there is an upfront fee of £8. The good news is that if you trade regularly, this entry-level price will drop to £3. To begin trading on this platform after opening an account, you must deposit a minimum of $250. This minimum deposit does not indicate a fee for the platform, but rather the operating capital that new investors will require to start their investment journey.

How to buy Boohoo Shares?

You may now be asking what steps you need to take on the trading platform to purchase shares after learning all there is to know about the finest trading platforms to purchase BP Shares. You can purchase BP shares on our preferred platform, eToro, by following the step-by-step instructions provided below.

The purchasing and account creation procedures are essentially the same regardless of the platform you use, so this instruction is still useful. However, we do suggest the eToro platform because it offers a fantastic trading feature that will make trading easy for you.

Step 1: Open an account

Making a registration for an account on the main eToro website is the initial step in buying BP shares. You must first register by completing a registration form with your basic information, including your name, phone number, and email address, as well as choosing a secure password. Upon inputting all of your information, be sure to click the “I accept” button.

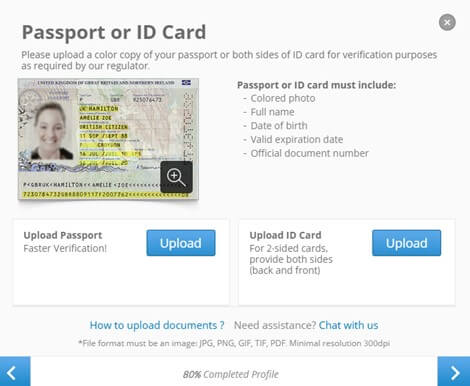

Don’t worry, since your documents are completely protected on this site, even though eToro will require you to upload some of your documents to prove your identification. You won’t have to go through verification, though, until you deposit more than $2,250 or make a withdrawal request.

Step 2: Deposit Funds

You are now prepared to fund your account on our platform with a minimum deposit of £160 after successfully established one.

Step 3: Buy BP Shares

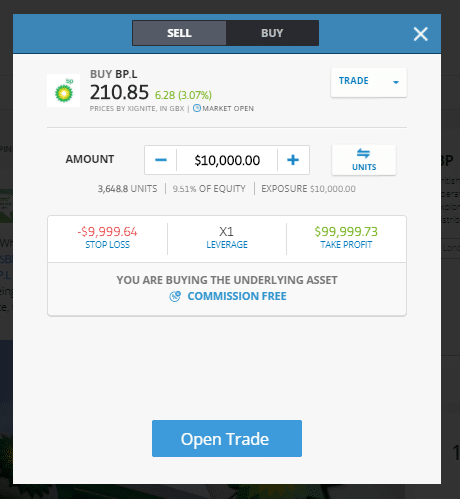

You are now prepared to purchase BP Shares after successfully registering and funding your trading account. To achieve this, all you have to do is type “BP” into the search box at the top of the website and then click on the resulting link that pops up. Then, to purchase your BP Shares, select the “Trade Button,” enter the necessary amount, and then click “Open Trade.”

If your transaction totals at least £40, you can buy or sell BP shares on this platform. You also have the option of using leverage, and you may use the order form to select a stop loss or take the profit level for your trade.

Conclusion

A strengthening balance sheet and a recovering market might make BP attractive. The company is also aiming to move away from oil in favor of a hybrid energy business model that is better suited to the new era of energy.

Recently, renewable stock prices have performed well, and BP has emphasized this as a sector with tremendous development potential. Some people believe BP is trying a lot of different things to see what sticks, while others see this as an exciting stage in the company’s progress, suggesting investing now could be wise before the company experiences significant growth in other areas.

Now that you’ve made up your mind to purchase BP shares, go ahead and do it with eToro, our top-recommended trading platform.

Frequently Asked Questions

Is now a good time to purchase BP stock?

Undoubtedly, this is a terrific time to purchase BP stock. The company’s new business model is helping it to adapt to the hybrid environment. That indicates that eventually, BP shares will soar to their pre-pandemic levels or even much higher in the near future.

Therefore, it is a fantastic time to get BP shares at a reduced price since you never know when in a year or two or maybe more or less its share price could reach an unaffordable price.

Which broker is best for purchasing BP shares?

The best platforms available are all of those listed above. But if we had to pick only one of the alternatives listed above, we would suggest utilising eToro. Due to the FCA’s regulation and the fact that it provides you with a range of assets to build a diversified trading portfolio, it is the ideal and most popular trading platform for UK traders.

What is the smallest amount of BP stock I can buy?

Although BP Shares are currently trading at 461p per share, which is a discountable price, many traders still find this price to be out of their price range. As a result, trading platforms like eToro are helpful since they provide fractional ownership, which lets you purchase a portion of anything rather than the entire thing. This means that you can purchase a portion of BP shares on the trading platform for as little as $50.

Are dividends paid by BP?

BP does indeed pay dividends. Actually, it has a track record of consistently producing double-digit dividends. Its yield of 10.2% in 2019 was higher than that of the great majority of FTSE 100 firms that pay dividends.