The Nasdaq is a well-known stock index for investors that specializes in technology. One of the most well-known indices in the entire globe, the index contains brands like Tesla, Amazon, and Microsoft. If you’re wanting to invest in the Nasdaq 100 index and are wondering who the best brokers are, you’ve come to the right spot.

We’ll explain how to find the broker who best meets your financial goals in this guide. Additionally, we’ll talk about the best trading platforms that give you access to the Nasdaq 100.

What is the Nasdaq 100?

The Hundred largest non-financial companies make up the Nasdaq 100 index, also referred to as the US Technology 100. All of th ese businesses are valued based on their market capitalization and are traded on the NASDAQ stock exchange. The businesses that make up the Nasdaq 100 index work in a wide range of fields.

How can you invest in Nasdaq 100?

To benefit from the increasing price variations of the Nasdaq 100 index, investments are made. Since you can simply purchase the Nasdaq 100, you can invest in exchange-traded funds or the stock of the index’s 100 non-financial constituents.

Anyone interested in investing in the Nasdaq 100 must put up the whole value of the stake because leverage is not available for investment positions.

Using ETFs to Invest in Nasdaq 100

Exchange-traded funds, in this case the Nasdaq 100 index, keep track of the value of the underlying asset. ETFs typically consist of shares of the non-financial companies that make up the Nasdaq 100 index. As a result, buying ETF shares will be similar to the exposure you would expect to get from buying Nasdaq 100 shares.

Using Stocks to Invest in Nasdaq 100

Buying individual shares of the firms that make up the Nasdaq 100 index is another effective way to invest in the index. Stocks constitute your ownership whenever you purchase them. When aiming to enhance their exposure to the Nasdaq 100, investors frequently concentrate on the giants stocks like Apple and Microsoft. Price movements at these significant technology companies will have a stronger impact on the performance of the Nasdaq 100 as a whole because of the index’s market capitalization-based weighting.

Using Tracker Funds to Invest in Nasdaq 100

Increase exposure to the index by investing in Nasdaq 100 tracker funds. Tracker funds monitor the progress of the underlying instrument, much like index funds do. Generally speaking, changes in the price of the actual Nasdaq 100 will have an impact on the value of your investment in a Nasdaq 100 tracker fund. In essence, the tracker fund’s value rises together with the cost of the Nasdaq 100 index.

Best Brokers for Nasdaq 100 2022

We have compiled a list of the top ten brokers for the Nasdaq 100 because it might be difficult to choose a broker that suits your trading objectives. You must consider the markets that each trading platform provides, the costs involved in trading and not trading, as well as other crucial investing factors.

The in-depth study of the leading online brokers for the Nasdaq 100 in 2022 provided below can help clear up any misunderstandings.

1. eToro

More than 20 million traders are members of the top-rated online trading platform eToro. This is in part due to its wide range of zero-commission trades, which include trading in stocks, ETFs, CFDs, and Bitcoin in addition to other financial instruments.

eToro is renowned for its Copy Trading and Social Trading features, in addition. Simply said, copy trading allows you to duplicate the transactions done by more seasoned platform users. By doing this, you can mimic every buy or sell decision made by your favorite expert trader in your own investment portfolio. Additionally, there are no extra costs for selecting this alternative, but a $200 minimum commitment is required.

For new traders entering the online trading community, eToro is a fantastic trading platform. eToro offers a demo account with a $100,000 paper fund balance, together with a user-friendly interface and instructional resources, so you may practice online trading risk-free.

When it comes to the essentials, the account opening process is swift and easy, typically taking only a few minutes. In addition to bank transfers, credit/debit cards, and e-wallets like Skrill and PayPal, eToro now allows a number of other payment methods. Ultimately, important financial regulators like ASIC, FCA, and CySEC oversee eToro.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

Since its founding in 1974, when it has grown to be a well-known CFD broker, IG has a long history. Due to its LSE listing, IG is bound by the rules and guidelines of numerous financial regulators, including the FCA and BaFin.

Over 10,000 stock CFDs and 1,900 ETF CFDs are available, which is a spectacular assortment thanks to its position as a leading worldwide CFD trading platform. Additionally, IG’s trading assets are not just CFDs. There are numerous financial instruments, including forex, cryptocurrencies, commodities, indexes, options, and many more.

If you’re reading this guide, it’s probable that you’re looking for a trustworthy broker to assist you in trading and investing in the Nasdaq 100 index. You can start investing in the Nasdaq 100 with just 1 point and select from some of the most popular indexes in the market. Including its Smart Portfolio, IG offers traders looking for a relatively passive method of investing a solution. In simple terms, clients in the UK who use this robo-advisory service receive iShares exchange-traded funds portfolios that are managed by the investment management organization

3. Libertex

Launched in 1997, Libertex is a CFD trading broker with access to more than 200 instruments. Libertex is the stockbroker for you whether you’re interested in stocks, cryptocurrency, commodity, exchange-traded funds, and indices, Libertex is the broker for you. Libertex distinguishes itself from other CFD brokers by giving its clients access to trades with a minimal spread.

As a result, you additionally pay a small transactional commission that is subtracted from the order’s value. Libertex estimates that there are about 2.9 million traders operating there brokering service, and the Cyprus Securities and Exchange Commission currently has supervision over it.

Its in-house developed mobile and web trading tools give you instant access to more than 200 assets with no spreads. However, you’ll be happy to know that this CFD broker also offers the MT4 trading platform if you’re a trader who prefers it.

Libertex is an excellent option for new traders looking for a Nasdaq 100 broker with a variety of educational resources because it provides a demo account and has a trading school that talks through the principles of online trading.

4. TD Ameritrade

One of the largest trading platforms, TD Ameritrade, was established in 1975. Among the important financial regulatory organizations that keep an eye on TD Ameritrade are the SEC, CFTC, and FINRA. Additionally, it trades under the symbol AMTD on the Nasdaq Stock Market.

A wide range of cutting-edge research and charting tools, as well as affordable non-trading charges, are available to TD Ameritrade customers. You may trade anything from stocks to options from the comfort of your home for just $0.65 per contract. If you’re interested in futures contracts and other more complex products, you can use TD Ameritrade’s desktop trading tool, Thinkorswim.

The Thinkorswim trading platform provides additional tradable instruments, including foreign exchange and futures, and a greater selection of technical analysis tools than its web-based counterpart. Additionally, traders of all skill levels who wish to learn more about trading can find a wide variety of educational resources. These offerings range from lectures to instructional videos to a mock account with $100,000 in phony funds and more.

5. XM

XM, a popular CFD and forex trading broker, offers over 1,200 stock, 28 stock index, forex trading and commodities trading. This broker offers tight spreads on various currency pairs that are as low as 0 pip.

XM provides commission-free CFD trading, albeit spreads may vary according to the asset class you select. XM’s spreads are typically far tighter than those that the rest of the market offers. A 2 pip spread is charged by XM for the Nasdaq 100 equities index.

XM also charges reasonable account fees. Creating an account, getting withdrawals, or placing deposits are all free of charge. However, after a year of inactivity, there is indeed a £15 inactivity charge.

XM is distinctive among trading platforms in that it does not provide a platform that was developed in-house. In its place, it provides well-known and trustworthy MT4 and MT5 third-party trading platforms. The key distinction between the two is that the MT5 trading platform only allows trading in stock CFDs.

How to invest in Nasdaq 100?

Now that you’ve determined the finest brokers for Nasdaq 100, it’s time to take the first steps with one of the best broker you can rely on. When it comes to investing in the Nasdaq 100, we recommend eToro because it is an FCA-regulated broker and offer 100 percent commission-free trades on a wide range of instruments.

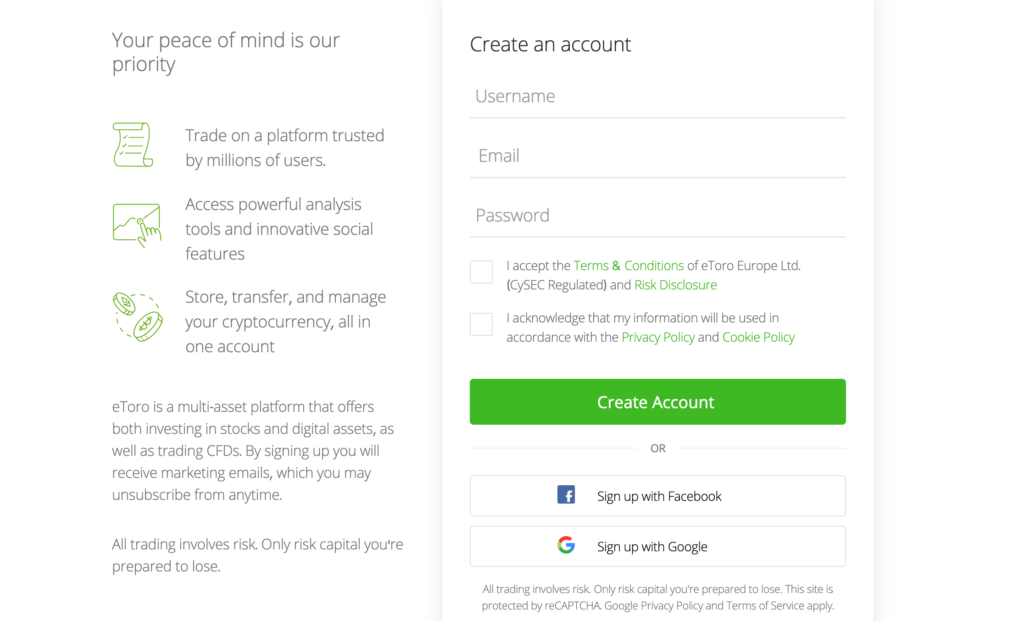

Step 1: Open an Account

Setting up a new account with eToro is really simple. Just browse to the trading interface and select “Sign up.” You will next be asked for personal information just fill it and move to the next step..

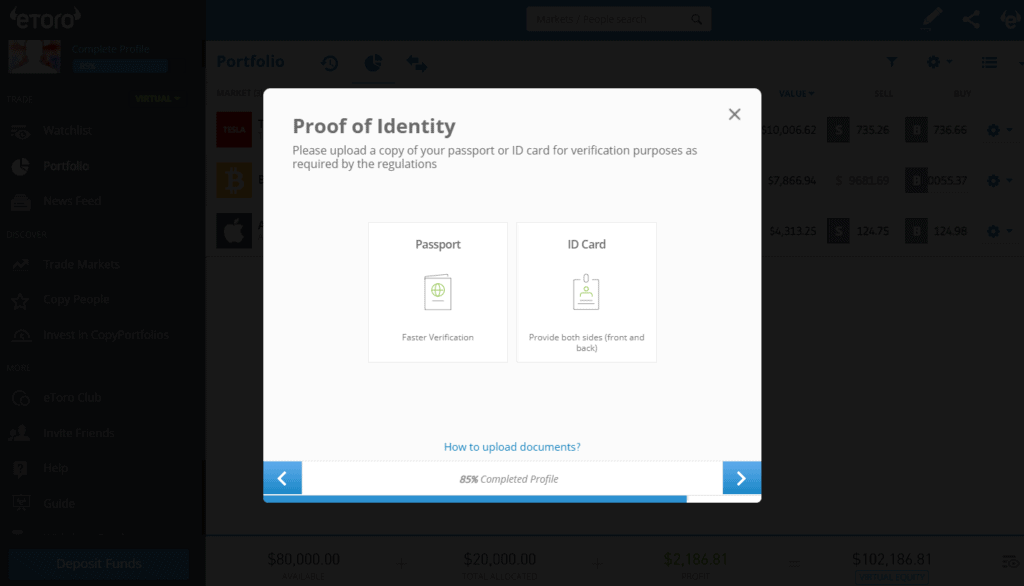

Step 2: Verification

As a condition of being governed by the FCA, a prominent financial regulatory organization, you must confirm your identity and address with eToro. This is for improved security as a result of the prevalence and sophistication of internet phishing attempts and scams. The verification process is easy and entirely digital.

The verification process at eToro simply includes a copy of your driving license or passport and a utility bill or bank statement.

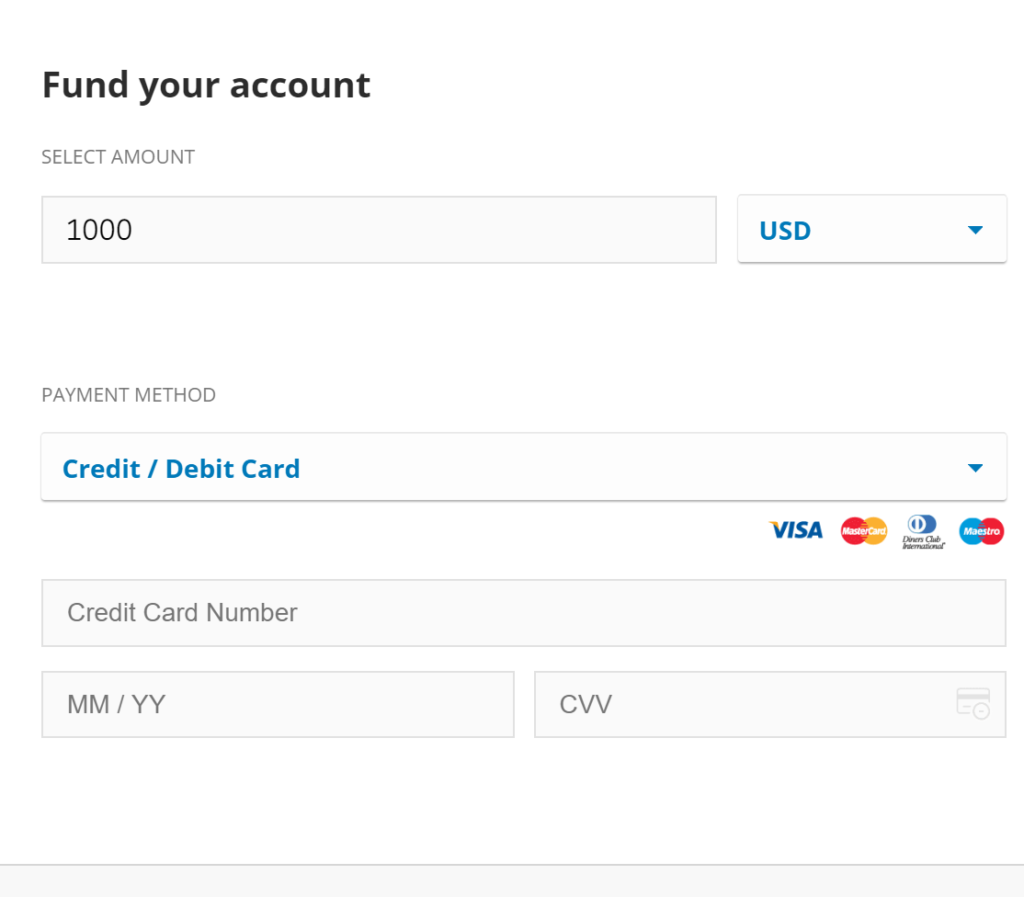

Step 3: Deposit Funds

Once you fund your account, you’ll be one step closer to trading the Nasdaq 100. eToro accepts a variety of payment methods, including bank transfers, electronic wallets, credit/debit cards, and others.

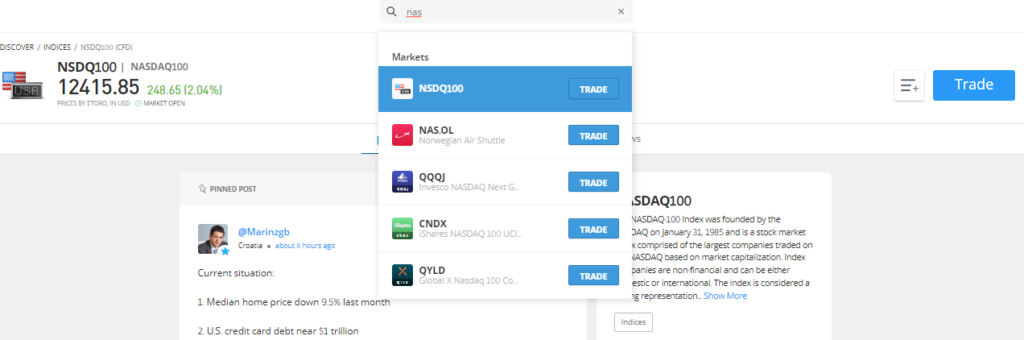

Step 4: Search for Nasdaq 100

Enter Nasdaq 100 in the search box then choose the top option from the drop-down menu.

Step 5: Make Your Trade

Once you’ve found the Nasdaq 100 you want to invest in, all you need to do is click the trade button. Following that, you will be required to confirm your options, enter the investment amount—which has a $200 minimum—and click the “set order” button.

Conclusion

There are many ways to gain exposure to the well-known Nasdaq 100 index, including ETFs, stocks, tracker funds, cash indices, and index futures trading. Nevertheless, with so many options available, picking the best broker could be difficult.

In order to practise trading the Nasdaq 100 without running the risk of losing your actual money, eToro also provides paper trading accounts with an initial deposit of $100,000. You can also use its Copy Trading capabilities to use a more passive approach to online trading.

Frequently Asked Questions

What is Nasdaq 100?

The Nasdaq 100 is an index that evaluates the performance and price movements of the top 100 non-financial corporations based on market capitalization.

What companies do the Nasdaq 100 index comprises of?

The index, as its name implies, consists of 100 companies. The largest companies by market value include Amazon.com, Alphabet, Facebook, Microsoft Corporation, NVIDIA, Qualcomm, and others.

What does the Nasdaq 100 measure?

The Nasdaq 100 is a market capitalization-weighted index, meaning that the performance of the largest companies will have a bigger influence on its performance and price changes.

What does trading on eToro cost?

With eToro, you may register for a free account and trade stocks and other tradable assets commission-free. Some of the narrowest spreads for CFDs and cryptocurrencies are available on eToro.

How does CopyTrader on eToro operate?

Just create an account and make a deposit to start copy trading. Use the eToro search option to start copying the trades of the top social traders. The buy-and-sell spread is eToro’s main source of income. The spreads don’t change whether you use CopyTrader or just do it manually, which is a wonderful feature.