Unilever is a company that makes consumer goods and is centered in London. Unilever offers something for everyone with its broad range of brands, which includes Dove, Persil, Lynx, and others. It’s worth taking some time to consider which brands you’d be a shareholder for and making sure your beliefs line up with theirs as investing in Unilever gives you access to all of the brands it owns. How to invest in Unilever is given below.

The knowledge you must possess before purchasing Unilever shares is explained in this article. We discuss the company’s history, recent market performance, and investing process on this page.

How to Buy Unilever Stocks – An Overview

- Create a trading account – Click “Join Now” on your chosen trading platform’s main page. Select a username and password after entering your information.

- Verify your account – To verify your account, upload a copy of your ID and a recent utility bill.

- Fund your account – Add money to your trading account using a credit/debit card, a bank wire transfer, or an electronic wallet like PayPal or Skrill.

- Invest in Unilever stock – Type “ULVR” into the search box and select “Trade.”

Examine Unilever stock

Before entering the market to trade Unilever stocks, it’s crucial to conduct research. In order to decide whether a firm is a good investment, this procedure entails analyzing crucial components of it, such as the markets it serves and the state of its finances.

We’ll go over every important factor you should take into account when buying Unilever shares in the UK in the sections that follow, enabling you to make a more informed investing choice.

Unilever Overview

The Lever brothers, makers of British soap, and Margarine Unie, a Dutch margarine company, successfully merged to become the corporation in 1929. It presently exports its goods to about 190 countries and controls over 400 companies. The corporation offers nearly every type of consumer item.

Unilever has its main listing on the LSE in addition to being a part of the FTSE 100 index. Due to its vast market capitalization and the variety of brands and goods it owns, the risk is partly reduced because if one brand suffers, others in various industries might make up for it.

Additionally, the business generates a respectable 2.9% dividend yield, which makes Unilever rather exceptional in this regard. As Unilever explores expanding its portfolio of brands, investors can expect possible growth prospects in the form of mergers and acquisitions. They also have access to the value of their assets and solid financial sheet.

Unilever Performance

Although the company’s share price hasn’t increased significantly in recent years, dividend payments have remained stable. This consistency in sales is a good indicator of the company’s financial health; 2020 revenue of €50.7 billion was just 2.4% less than the previous year, and variance has mostly been the same (up or down) throughout the last ten years.

This constancy is expected given the company’s diversity and has made Unilever a strong performance for conservative investors. The main challenge the corporation is dealing with is several of its major brands losing market share to brands owned by supermarkets. Unilever’s ability to modify its business strategy in order to more effectively compete with these retail behemoths is still to be seen.

The best course of action seems to be to spend more money developing new items and establishing brands; while this may temporarily lower dividend yield and share price, it might have long-term benefits.

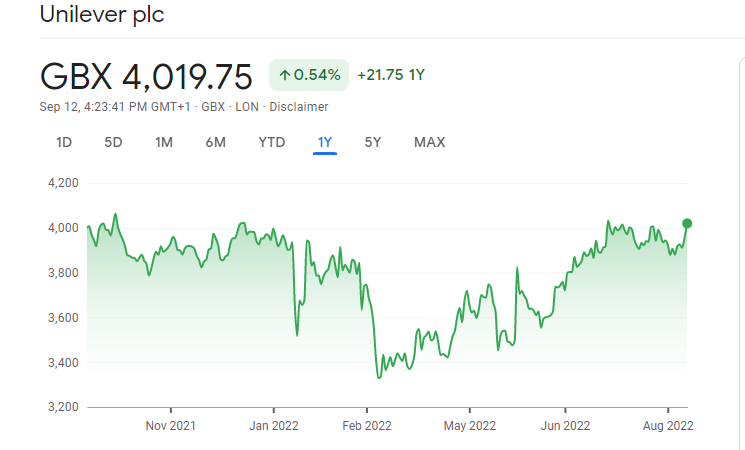

Unilever Share Price 2022

Let’s look at the Unilever share price now that you know who Unilever is. Shares are currently trading for 4019p at the time of writing, down about 5% from the same time last year. The share price of Unilever was actually down over 15% in late February, but it has since increased.

When choosing which shares to purchase, it’s important to consider a few different metrics. These measures include the price-to-earnings (P/E) ratio and earnings per share in the case of Unilever (EPS).

The current P/E ratio for Unilever is 20.25. To calculate this metric, the projected EPS is multiplied by the present stock value. Fundamentally, the P/E ratio may be used to compare the value of one company’s shares to those of other companies; if one company’s shares have a greater P/E ratio than another, they can be regarded as being “more valuable.”

H But compared to the low of 14.25 it reached in December 2019, this is a significant increase. Unilever’s P/E ratio has been in the 21-24 range throughout the majority of 2020 and 2021. This demonstrates the extent of the company’s recovery and its value growth over the last two years.

By dividing a company’s earnings by the total number of existing shares, the estimated EPS is calculated. This measure is typically used to assess a company’s profitability; the greater the EPS number, the more successful the business is. There are other ways to determine EPS, but diluted EPS is frequently used because it includes all shares that “might” have been issued and provides a more accurate picture.

Dividends

Every three months, dividend payments are issued to the stockholders of Unilever. If you invested today, you would be entitled to the next payment on September 10th because the most recent payment was made on June 17th.

Dividends are essentially the distribution of a part of a company’s earnings to its shareholders. While some businesses provide dividends, others maintain their earnings to reinvest in their core business. Due to their quarterly dividend payment, Unilever falls under the first category.

Unilever’s most recent dividend payment totaled 37.6p per share in terms of dividend payments. This represents an outstanding performance over the previous year and is up almost 3p from the same time last year.

Also read: Best Dividend Stocks You Should Buy in UK 2022

Should I invest in Unilever?

As we just indicated, long-term ownership of Unilever stock may prove wise if periodic dividends and brand expansion pay off. If the instant exponential share price increase is what you are wanting, you would be better off searching at riskier penny stocks. Expecting a rapid exponential increase in the share price is unrealistic.

Unilever shares is considered to be very volatile for short-term investors considering its range and diversity of brands. But you can still trade it profitably if you do good technical analysis. Before making any judgments, make sure you take your time and comprehend the stock market.

Best trading platform to Buy Unilever Shares

Selecting a reputable stock broker is a prerequisite when deciding to buy Unilever shares in the UK. These brokers assist purchase and sell transactions by serving as a sort of middleman between you and the market. However, there are so many possibilities available these days that choosing a partner might be stressful.

The popular brokers listed below enable consumers to purchase Unilever and other equities.

1. eToro

One of the most well-known brokers, eToro is overseen by prestigious regulatory organizations including the Financial Conduct Authority (FCA) and the FSCS. The online trading platform eToro has over 26 million members globally and offers a straightforward pricing structure.

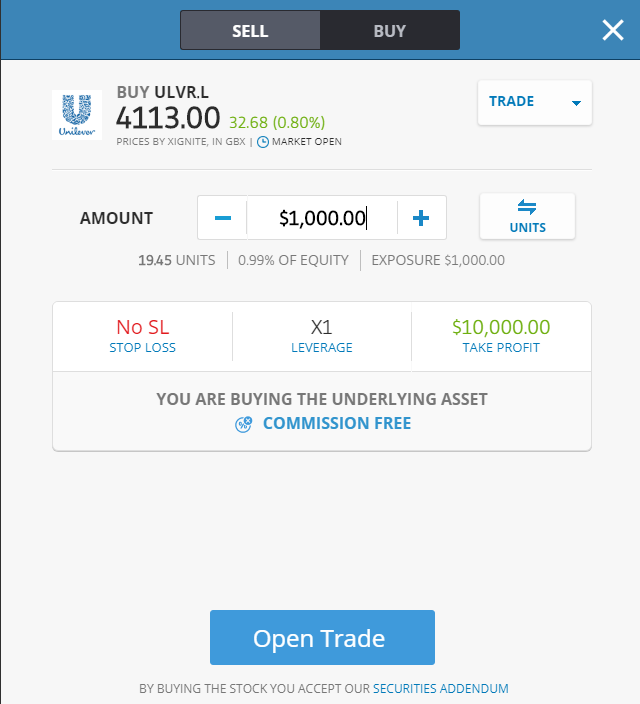

Regarding the former, eToro runs with a 0% commission structure, which means you don’t pay any commissions at all when you buy shares with them. Additionally, traders can save even more money with eToro because there are no monthly account fees or deposit fees.

Additionally, eToro provides fractional ownership when you buy UK-listed Unilever shares. This means that when you trade the equity market, you can buy fractions of a share rather than having to buy a complete share. With the use of this function, traders can invest as low as $10 (about £8) for every trade in the stocks offered by eToro.

Finally, you can use eToro’s cutting-edge “CopyTrader” tool if you’re new to the market and want to gain some experience before buying Unilever shares. You can use this function to automatically copy the positions that skilled traders open while watching their transactions in real time. Beginner traders can use this feature to passively learn the market without taking significant financial risks with their initial investments.

2. Capital.com

Capital.com was established in 2016 and is subject to regulation from reputable agencies including the FCA and CySEC. The broker offers consumers a flexible platform to trade in a wide range of markets with its wide variety of CFDs.

You’ll buy a contract based on the value of the underlying asset; when that value increases, so will your contract’s worth. Leverage is another feature of CFDs; Capital.com provides stock CFD leverage up to 1:20.

Capital.com does not charge commissions; rather, it just levies a tiny spread, which is the difference between the purchase and sell prices of an asset. Additionally, Capital.com does not impose monthly account fees, fees for deposits or withdrawals, or fees for inactivity.

Last but not least, setting up an account can be done quickly online. After signing up, you can fund your account in a number of ways, including with a debit/credit card, a bank transfer, or a number of e-wallets. Only a £20 minimum deposit is needed; however, if you utilize a bank transfer, the amount increases to €250 (or about £215).

How to buy Unilever Shares?

You have the choice of making an investment in the Unilever stock in a few easy steps.

You will need to finish a typical account creation process before investing in the stock after selecting your preferred brokerage.

Step 1: Open an Account

To purchase shares of Unilever, you first should create an account with your preferred broker. Normally, less than ten minutes are needed to finish this. Start the sign-up procedure by visiting the platform’s website.

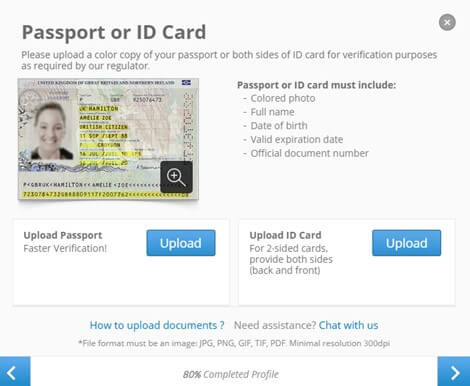

Step 2: Verification

You must authenticate your account after providing your email address, selecting a username, and setting a password before you can start trading. Upload identification documentation to prove your identity and also to prove your address. Your documents should be verified by your brokerage in a few minutes.

Step 3: Deposit Funds

Following the verification of your documentation, you can fund your trading account. Users might be able to start making deposits with just $10, depending on the broker they choose.

Enter the desired amount of cash after selecting your preferred payment option.

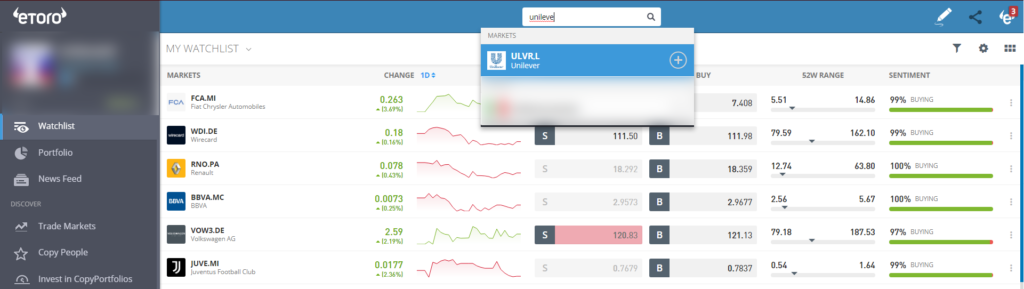

Step 4: Purchase Unilever Stock

You can immediately start purchasing shares of Unilever and other stocks after your deposit has been satisfied. Enter after conducting a search for the stock’s name in your navigation bar.

Fill out the order form after you see it with the amount you want to invest in the stock, then submit it to complete the transaction.

Conclusion

With sales expanding twice as fast as cosmetics, Unilever’s care brand appears to be appealing to customers. Additionally, Unilever has the chance to keep increasing its earnings while delivering high dividends to its shareholders because these areas account for a growing portion of the company’s sales and margins.

Always remember to pick a trustworthy and regulated broker when you’re prepared to purchase ULVR on an exchange because they can satisfy your needs by offering a safe and competitive trading environment. For instance, eToro offers a straightforward stock investment with no fees and is regulated in several nations.

Frequently Asked Questions

What is the cost of one share of Unilever?

One share of Unilever stock will cost 3633p as of September 2022.

Remember that you can purchase a portion of shares of stocks and ETFs using eToro’s fractional share buying feature. Even with just $10, you may purchase 0.219 shares of UL.

Is it time to buy Unilever stock right now?

One Wall Street analyst who follows Unilever reports that the stock is generally recommended to be held.

How can I buy Unilever stock the best way?

The best place to purchase Unilever stock is through an eToro brokerage account.