Cheap FTSE 100 stocks now have incredible purchasing opportunities thanks to stock market volatility. Are these shares the best ones to purchase in July?

Some of the biggest corporations listed on the LSE are found in the FTSE 100. And given the current economic unpredictability, scale can be a significant asset. After all, the majority of these businesses have established income sources that generate plenty of cash flow.

Compared to some of the changes in the FTSE 250, growth prospects might not be as overstated. However, these market leaders can be perfect for investors trying to create a conservative portfolio with less exposure to unexpected price changes.

3 Cheap FTSE 100 Stocks Right Now

Here are three Cheap FTSE 100 Stocks from the flagship index that we feel can safeguard wealth while still producing long-term gain, even if you just have £100 to invest.

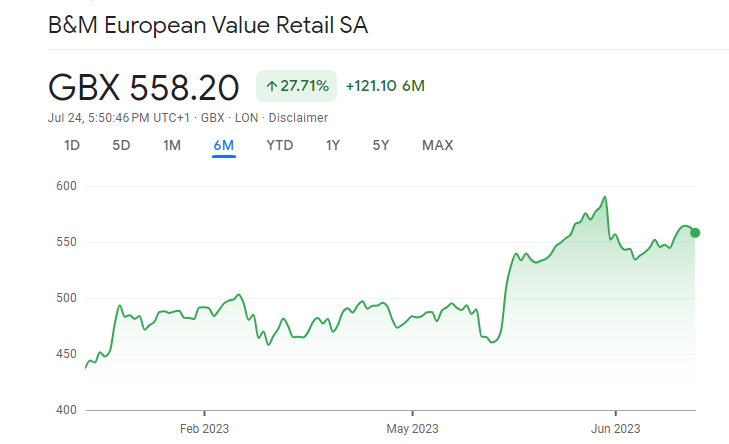

B&M European Value Retail

The effect on consumers is one of the main issues with inflation in 2023. Budgets for households are squeezed as prices rise. And it results in lower spending, which makes it extremely challenging for firms to thrive.

However, B&M European Value Retail (LSE: BME), a company, appears to be gaining from this trend. The company owns and manages a network of discount retail establishments in the UK and France that sell a variety of necessities and luxury goods.

The idea of investing in a retail company is hardly the most attractive one among the cheap FTSE 100 stocks. Results, however, are difficult to dispute. The most recent trading update revealed a double-digit increase in every category as customers look for less expensive shopping options.

While everything is going on, the company is still producing operating margins that are above 10%, which leads the industry. Tesco is only just scraping past 2% as a point of comparison.

Clearly, there are risks. B&M is not the only value retailer in the area; Aldi and Lidl are well-known brands that are fiercely vying for customers’ wallets. While this is going on, the current tailwinds might eventually turn into headwinds if inflation lasts much longer than anticipated.

Nevertheless, even once inflation declines, many households’ spending habits have probably been permanently altered by the realization of possible savings. And this cheap FTSE 100 stock appears to be a fantastic purchasing opportunity in our opinion, with a dividend yield of 4.4%.

Also read: How Buying FTSE 100 Stocks Could Help You Live Well In Retirement

DS Smith

Corrugated cardboard is a commodity that is becoming valuable while being frequently disregarded. The need for packaging of online orders has skyrocketed due to the steady growth of e-commerce. Furthermore, DS Smith (LSE: SMDS) is attaining growth without any difficulty, despite the fact that online shopping is suffering in the current economic climate.

Sales increased by 14% to reach £8.2 billion in its most recent figures, and operating profits more than doubled to £861 million. It appears that the corporation has become the top supplier of choice for order fulfillment due to its dominance in the UK and Europe. Additionally, management has had no issue raising prices to keep up with inflationary input costs because few competitors are able to achieve the scale needed by internet enterprises.

Order numbers have started to drop even while sales are growing. Considering the downturn in digital retail, this is not surprising. Volume erosion, however, can become more pronounced if economic conditions deteriorate and a prolonged recession occurs. Additionally, the corporation might not be able to raise prices further to counteract the unfavorable effects.

However, it appears to be getting ready for such an event. At major locations around Europe, new equipment is being installed to cut down on energy use, and older, inefficient factories are being shut down. Furthermore, we think the market is undervaluing the long-term potential of this company at a P/E ratio of just 8.1.

Howden Joinery Group

Howden Joinery Group (LSE: HWDN) is a stock that has drawn our attention this month. Despite reporting strong earnings, shares have been trending downward as investors pay attention to the near-term challenges. As a result, despite revenue and earnings being about 50% higher, the market capitalization is currently below pre-pandemic levels.

In case you forgot, the fitted kitchen designer and supplier Howden Joinery is vertically integrated. It sells mostly to the home renovation market and works directly with tradespeople out of its network of 885 depots around the UK and Europe.

Investor opinion about this company is currently negative, which is not surprising given how inflation is squeezing consumer finances. A kitchen renovation is not cheap, after all. Additionally, families are more inclined to prioritize other less discretionary expenses given that we are currently experiencing a cost of living crisis.

This worry is legitimate. Howden’s results already show it, with growth sliding from double digits to low single digits. Although rising interest rates and inflation are currently challenges, they might eventually turn out to be benefits.

Mortgages will cost more if interest rates rise. As a result, the practice of using ridiculously low-interest rates to move every few years is beginning to decline. Families are also more likely than ever to remain in one place for an extended period of time, which makes restoration projects more tempting after a while.

Since it continues to make significant investments in its expansion both domestically and abroad, management appears to share this opinion. The company will soon reach its target of 1,000 depots. And despite the difficulties in breaking into new areas, its global network generated 16.8% more sales in the first four months of 2023.

With a P/E ratio of just 9.9, this makes this cheap FTSE 100 stock appear undervalued in our opinion. And it appears that Howden’s management concurs, as the company just started a £50 million share buyback program.

Also read: Best FTSE 100 Brokers in UK

Leave a Reply