Searching for dividend-paying stocks but don’t have enough funds? Don’t worry—there are plenty of cheap dividend stocks that offer attractive yields and the potential for solid returns. These low-cost options not only help mitigate the negative impact of inflation but also provide a steady income stream.

With dividends historically accounting for around 40% of total stock market returns over the past 90 years, investing in these cheap dividend stocks can be a smart move for those looking to enhance their portfolio without breaking the bank. In this post we will list 10 Best Cheap Dividend Stocks to Invest in 2024.

10 Best Cheap Dividend Stocks to Buy Now

Below are the 10 best cheap dividend stocks providing a blend of high yields and growth potential, making them strong candidates for those looking to enhance their investment portfolios with income-generating assets in 2024.

1. Petroleo Brasileiro SA (NYSE: PBR)

Dividend Yield: 19.7%

Petroleo Brasileiro SA, or Petrobras, is a major Brazilian oil and gas producer. With its extensive reserves and significant production capabilities, Petrobras stands out for its high dividend yield. Despite fluctuations in the oil market, the company remains committed to delivering substantial returns to its shareholders. The firm’s strategy includes a robust buyback program and a strong dividend payout, especially when oil prices stay above $40 per barrel, making it an appealing choice for cheap dividend stock-seeking investors.

2. Vale SA (NYSE: VALE)

Dividend Yield: 15.2%

Vale SA, a prominent Brazilian mining company, is one of the world’s largest iron ore and nickel producers. Although its stock has faced challenges recently, leading to a significant pullback, this has resulted in an exceptionally high dividend yield. Vale is actively addressing liability concerns related to past incidents, and its ongoing efforts to mitigate risks suggest that its high dividend yield could be sustained, making it a compelling choice for income-focused investors.

3. Apollo Commercial Real Estate Finance (NYSE: ARI)

Dividend Yield: 12.8%

Apollo Commercial Real Estate Finance is a real estate investment trust (REIT) that provides financing solutions for commercial properties. Its diverse portfolio includes senior mortgages and mezzanine loans across the U.S. and Europe. With a conservative loan-to-value ratio and a substantial dividend yield, ARI offers a high return on investment. The company’s focus on real estate debt investments makes it a reliable choice for investors seeking regular income from cheap dividend stocks.

4. Frontline PLC (NYSE: FRO)

Dividend Yield: 9.2%

Frontline PLC is a leading marine shipping company specializing in oil tankers. Founded in Sweden, it has grown to become one of the world’s largest tanker operators. The company’s stock price has benefited from increased tanker rates, and recent strategic moves, including the sale of older vessels, have bolstered its financial position. With a strong dividend yield and a significant total return over the past year, Frontline is a solid option for investors looking for consistent income.

5. Record (LON: REC)

Dividend Yield: 7.88%

Record is a UK-based firm specializing in currency and derivative management. Despite its smaller size and recent share price underperformance, Record’s high dividend yield of 7.88% and strong financial health make it an attractive option. The company’s zero debt and steady dividend increases over the past decade highlight its financial stability. Although recent insider selling could be a concern, the high yield and solid financials make Record a compelling choice for cheap dividend stock investors.

Also read: Dividend ETFs: Can You Really Earn Dividends with ETFs?

6. Energy Transfer LP (NYSE: ET)

Dividend Yield: 7.8%

Energy Transfer LP operates in the U.S. oil and gas infrastructure sector, focusing on pipelines and storage. It also invests in renewable energy projects. The company’s strong dividend yield and recent positive performance make it an attractive investment. Energy Transfer’s strategic positioning in the Gulf Coast region enhances its ability to capitalize on natural gas liquids export demand, further supporting its dividend payouts and long-term growth potential.

7. Orange SA (NYSE: ORAN)

Dividend Yield: 7.2%

Orange SA is a major French telecommunications company. Despite facing regulatory and operational challenges in Europe, the company’s current stock price reflects these difficulties. However, Orange is exploring opportunities to monetize its valuable assets and reduce costs, which supports its ability to maintain its dividend payments. With a steady dividend yield and potential for future growth, Orange offers an attractive option for dividend investors.

8. HSBC (LON: HSBA)

Dividend Yield: 7.0%

HSBC, the major banking institution, offers an impressive dividend yield of 7%. Despite challenges such as falling interest rates and economic uncertainties in China, HSBC’s strong dividend coverage suggests that its payouts are secure. The bank’s attractive yield, combined with its robust financial health, makes it an appealing choice for those seeking reliable income from dividends in the banking sector.

9. Shell (LON: SHEL)

Dividend Yield: 4.1%

Shell, the global oil giant, currently trades with a relatively low P/E ratio, suggesting that some market challenges are already priced in. With a dividend yield of 4.1% and strong coverage ratios, Shell’s dividends are secure, and there’s room for potential increases. While the company must navigate the shift towards clean energy, its solid financials and expected dividend growth make it a worthwhile consideration for cheap dividend stock investors.

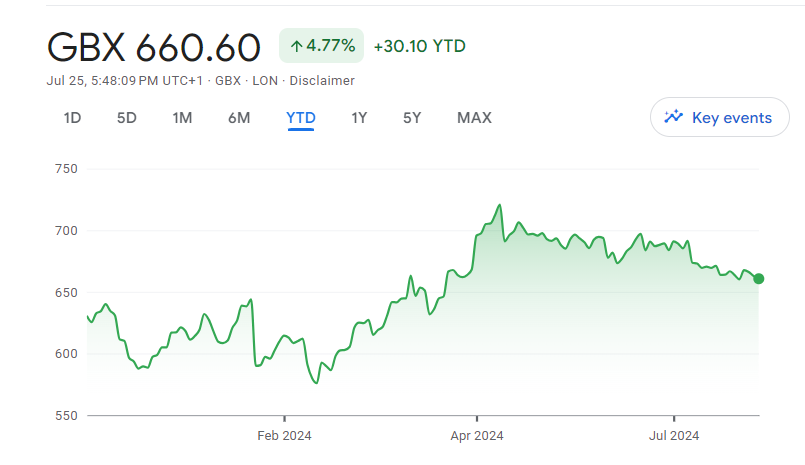

10. Keller Group (LON: KLR)

Dividend Yield: 3.8%

Keller Group, an FTSE 250 engineering company, specializes in ground engineering and construction services. With a solid performance in the U.S. market and positive earnings projections, Keller offers a reasonable dividend yield. Although the yield isn’t exceptionally high, the company’s strong financial outlook and potential for growth make it an interesting option for investors looking for a balance of income and capital appreciation.

Leave a Reply