The best value stocks allow you to purchase stocks at a discount on their intrinsic value. This implies that you will be able to enter the market at a reduced price. Here’s the list of top 10 best value stock that are available at attractive price and are worth investing.

Before we get into the details of the best value stocks to purchase in 2022. Here’s a quick breakdown of some of the best companies to invest in that can pay off highly:

- SoFi Technologies Inc (NASDAQ: SOFI)

- Ford Motor Company (NYSE: F)

- Target Corporation (NYSE: TGT)

- DICK’S Sporting Goods Inc (NYSE: DKS)

- Bank of America (NYSE: BAC)

- Meta Platforms Inc (NASDAQ: FB)

- Skyworks Solutions Inc (NASDAQ: SWKS)

- FedEx Corporation (NYSE: FDX)

- Caterpillar Inc (NYSE: CAT)

- ViacomCBS Inc (NASDAQ: PARAA)

10 Best Value Stocks Reviewed

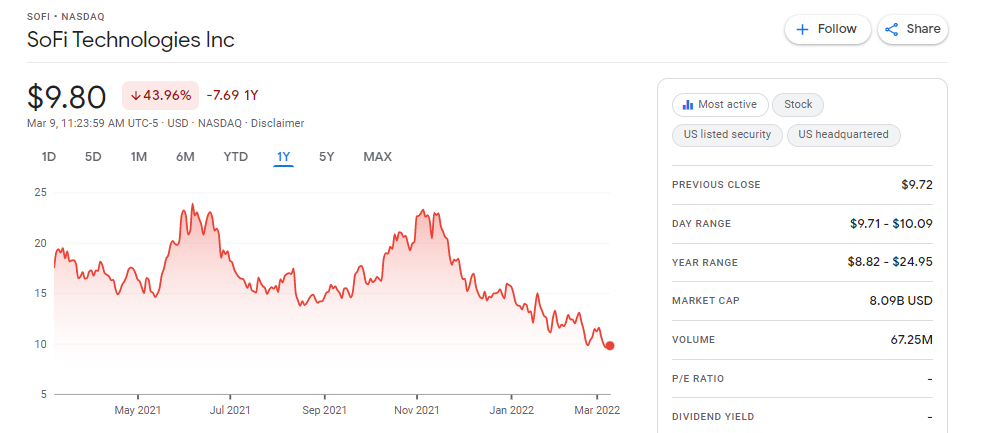

1. SoFi Technologies Inc (NASDAQ: SOFI)

SoFi Technologies is a social finance firm that primarily maintains an online platform that offers a variety of financial services. The company sprang to prominence by providing more inexpensive lending services.

Analysts are beginning to notice that Wall Street may be underestimating SoFi, and it’s past time for retail investors to get their due. At the very least, the company’s most recent quarter implies that SoFi (despite its $8.06 billion market cap) is on the right route. SoFi’s lending division has expanded 14.0 percent year over year, and the company is on the verge of acquiring an actual bank charter.

If you’re seeking a growing firm, 14.0 percent might not seem like much, but SoFi’s Galileo should make up for it. When you factor in SoFi’s growing variety of services, each new consumer will be exposed to multiple additional things, making purchases even more worthwhile.

Sofi has a trading volume of $67 million at the time of composing this article. Its 52-week stock price high stands at $24.95, so at a current price of $9.80 that’s an upside target of 154%.

SoFi has a long path to go, and the financial sector faces stiff competition. But, if they can grow their client base, SoFi will remain one of the top value stocks in the market presently.

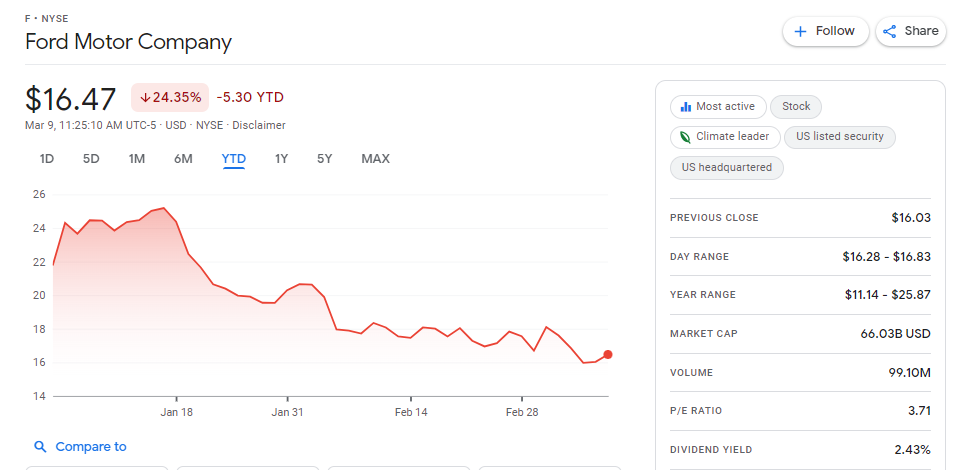

2. Ford Motor Company (NYSE: F)

Ford appears to be one of the top value stocks to purchase in 2022, considering its current success. Its stock is trading below the auto industry’s typical PEG of 0.06x, with a well-priced price-to-earnings ratio. Although competitors such as GM are trading at higher prices, Ford remains the industry leader. The rationale for the reduction could be due to Ford’s previous failures in several overseas markets.

Despite the stock trading at its 52-week high, Ford appears to be one of the best value stocks to purchase currently. Ford is not only a market leader at a lower price than its rivals, but it is also making encouraging progress in the electric vehicle (EV) field. The Mustang Mach-E is already performing well, while the F-150 Lighting has yet to be released.

Ford had to halt Lightning advance orders just months before its delivery due to an overabundance of them, which bodes extremely well for the stock. Preorders are evidence, that Lightning will be a success for Ford and its stock.

At the time of writing this article, Ford had a trading volume of $99 million. Its 52-week stock price high stands at $25.85, so at a current price of $16.47 that’s an upside target of 56%.

3. Target Corporation (NYSE: TGT)

Target Corporation is a national retailer with over 1,897 locations in the United States. From grocery and personal care products to fashion and home decor, the company has just about everything a consumer might want. Target prospered during the pandemic as a one-stop-shop for consumer requirements. Target’s sales increased as shoppers abandoned many of its competitors in favor of the company.

Target closed last year with more than $15 billion in revenue growth, due in part to a technology that was capable of adapting to internet shopping and a strong, loyal customer base. To put things in perspective, last year’s revenues increased by more than the prior eleven years combined.

Despite its position as the industry leader, Target has a price-to-earnings-growth (PEG) ratio of 1.11x. When opposed to the Multiline Retail industry’s PEG of 1.32x and competitors like Walmart, Target’s PEG ratio appears to be low. Target’s stock is also priced at approximately 15 times trailing 12-month earnings, which is extremely low for a firm performing so well.

Target has a trading volume of $4.65 million at the time of composing this article. Its 52-week stock price high stands at $268.98, so at a current price of $215.31 that’s an upside target of 24%.

If Target’s present price isn’t enough to persuade you that it’s one of the best value stocks to purchase right now, the larger market shift away from technology and toward concrete commodities with actual revenue should be enough.

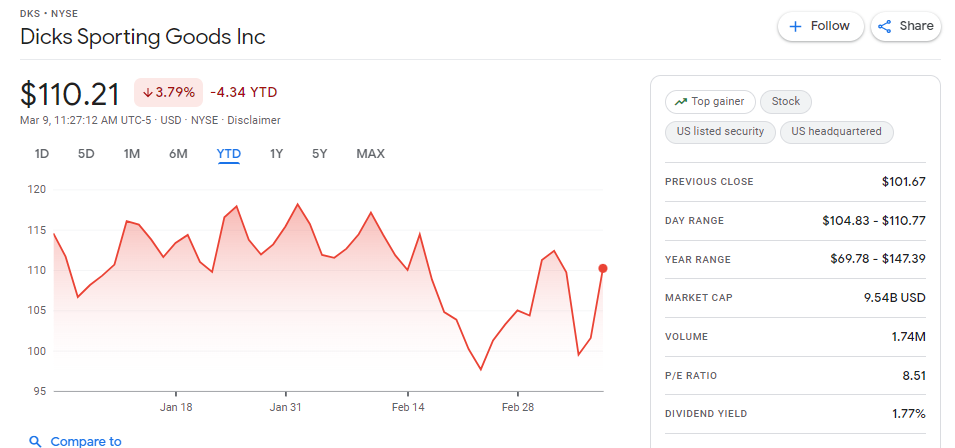

4. DICK’S Sporting Goods Inc (NYSE: DKS)

DICK’S Sporting Goods is a sporting goods shop that sells products and services both online and in stores. Each of its stores around the United States sells sports items, fitness supplies, golf supplies, and hunting and fishing supplies, as the name implies.

Golf Galaxy, Field & Stream, additional specialist concept stores, and a youth sports mobile app are all owned by DICK’S Sporting Goods. DICK’S Sporting Goods is one of the most reputable sporting goods retailers in the country, thanks to a statewide network of locations.

Read Also: Best Growth Stocks UK

The company has done well, and the stock is still inexpensive. DKS is selling substantially below industry peers, with a price-to-earnings ratio of 8.70x. If that wasn’t enough, DKS has a PEG of 0.47x, which is lower than the Specialty Retail industry median PEG of 0.83x.

There’s no denying that DKS appears to be a bargain, especially when compared to how most companies are now performing. Furthermore, the company appears to be benefiting from a number of secular tailwinds.

DICK’S has a trading volume of $1.74 million at the time of composing this article. Its 52-week stock price high stands at $147.39, so at a current price of $110.21 that’s an upside target of 33%.

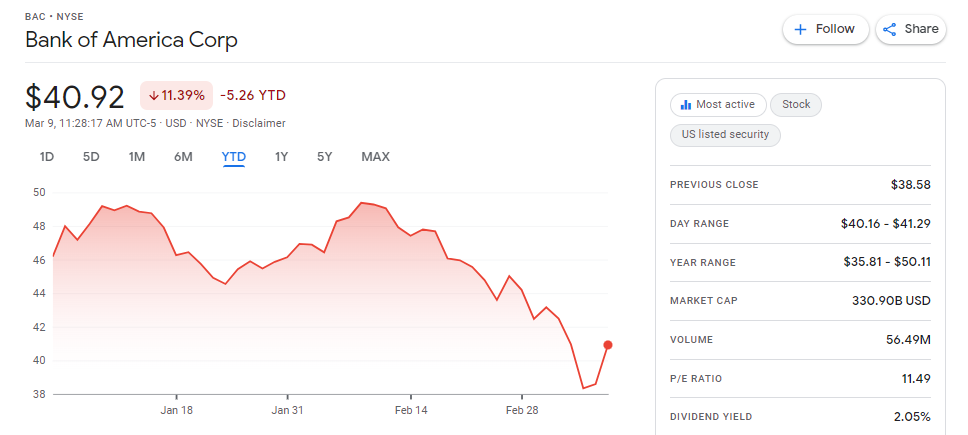

5. Bank of America (NYSE: BAC)

Bank of America is a financial services conglomerate based in the United States. It is, in fact, one of the world’s largest financial institutions, catering to both individual consumers and small and mid-sized businesses.

Its products and services cover a wide range of banking, investment, asset management, and other financial and risk management needs. With over 4,000 retail financial centers and approximately 17,000 ATMs, it serves approximately 66 million consumers and small businesses.

BoA has a trading volume of $56.49 million at the time of composing this article. Its 52-week stock price high stands at $50.11, so at a current price of $40.92 that’s an upside target of 22%.

On January 19, the company released its fourth-quarter financial results. Taking a closer look, the company’s net income for the quarter increased to $7 billion, or $0.82 per diluted share. Revenues grew faster than expenses, indicating strong operating leverage. The company’s revenue for the quarter was $22.1 billion, up 10% year over year.

The Consumer Banking segment, which brought in $3.1 billion this quarter, accounted for a significant portion of the company’s revenue. This follows a 16 percent increase in deposit balances to more than $1 trillion. Consumer investment assets increased by $63 billion, or 20%, to a new high of $369 billion. BAC stock is one of the top value stocks to purchase right now, based on strong fundamentals.

6. Meta Platforms Inc (NASDAQ: FB)

Meta Platforms, Inc.has become one of the best value stocks to purchase in 2022. This is the parent company of Facebook, Instagram, WhatsApp, and a slew of other subsidiaries, rose to prominence by making social media a requirement for nearly a third of the plant’s population. The impact of Meta Platforms on every aspect of our lives is undeniable, but the stock has fallen out of favor.

In particular, Meta’s most recent earnings report hinted at slower growth in the first half of 2022. According to the report, Q1 revenue is expected to be between $27 billion and $29 billion, implying an 11 percent increase. Apple’s ad-tracking transparency initiative, as well as a slowdown in user growth, were cited as headwinds in the report. As a result, Meta’s stock is rapidly declining.

Meta Platforms emerge to be inexpensive objectively, at least from the perspective of traditional valuation criteria. The stock is presently trading underneath the Interactive Media & Services industry’s median PEG of 4.05x, with a PEG ratio of 0.76x. Meta Platforms appears to be trading at a discount to its peers, based on this disparity.

Meta Platforms has a trading volume of $47.95 million at the time of composing this article. Its 52-week stock price high stands at $384.33, so at a current price of $196.10 that’s an upside target of 95%.

If Meta Platforms can keep even a tiny fraction of the metaverse’s market share in the future, its current price puts it firmly on the list of best value stocks. With nearly limitless potential, it seems unavoidable that Meta Platforms will return to, if not surpass, its all-time high sooner rather than later.

7. Skyworks Solutions Inc (NASDAQ: SWKS)

Skyworks designs develop, manufactures, and markets proprietary semiconductor products for global distribution in collaboration with its subsidiaries.

As an outcome, Skyworks is currently trading at a PEG ratio of 1.29x, which is below the industry average. Skyworks appears to be a good buy at a PEG ratio of 1.60x in the semiconductor industry. When linking Skyworks’ P/E ratio to the industry average16.35x and 23.11x, respectively—it appears to be even more undervalued.

Skyworks has a trading volume of $2.16 million at the time of composing this article. Its 52-week stock price high stands at $204, so at a current price of $133.38 that’s an upside target of 52%.

Skyworks appears to be undervalued from a genuine pricing point of view. Long-term current patterns in the semiconductor industry, as well as Skyworks’ leadership position, indicate the stock is one of the best value stocks to buy right now.

Skyworks will remain to grow at a rate that investors can stomach as more technology relies on semiconductors. Experts predict revenues and earnings to grow exponentially, along with stock values, once the chip shortage is resolved and the auto industry rises orders.

8. FedEx Corporation (NYSE: FDX)

FedEx is well-known e-commerce, logistics, and business services company. It operates in a variety of markets. FedEx Ground, FedEx Express, FedEx Services, and FedEx Freight are just a few of the company’s verticals.

The company’s supply chain presently includes over 166,000 direct suppliers in the United States. They collaborate to deliver more than 10 million shipments per day around the world.

FedEx had a good quarter in terms of financials. The company made $23.5 billion in revenue in the most recent quarter. This is a 14 percent increase over the previous year’s revenue of $20.6 billion. In addition, the company earned $1.6 billion in operating income. This represents a 9% increase over the previous year’s total of $1.47 billion. EPS also blew investors away, coming in at $4.83, vs. consensus estimates of $4.28.

Our assumption is that companies like FedEx will be top of mind for investors looking for high-quality blue-chip value stocks to move into.

FedEx has a trading volume of $2.44 million at the time of composing this article. Its 52-week stock price high is $319.90, implying a 49 percent upside target at the current price of $214.27.

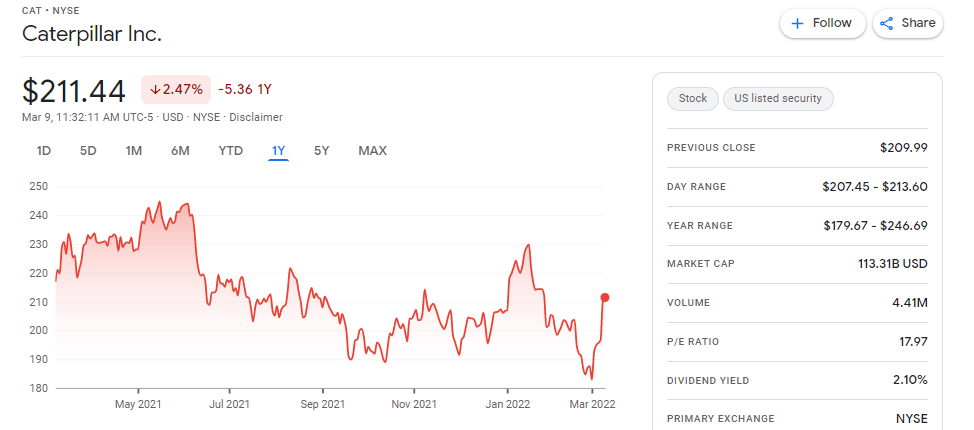

9. Caterpillar Inc (NYSE: CAT)

Caterpillar, the world’s largest manufacturer of heavy machinery, is one of the best value stocks to watch right now. For beginners, the business builds, develops, and manufactures a wide range of construction-related products. It also provides customers with construction-related investment instruments and insurance solutions. It’s no surprise that Caterpillar is the world’s largest construction manufacturing company, given its global network of operations.

Caterpillar appears to be revving up its engines across the board. Last week, the company released its latest quarterly earnings report, which showed strong results. Caterpillar reported $2.69 earnings per share (EPS) on $13.8 billion in revenue for the quarter, beating Wall Street’s expectations.

Caterpillar, for example, attributes the increase in demand for construction equipment to rising commodity prices. You should have CAT stock on your watchlist right now because the company is still making significant profits despite supply chain pressures.

Caterpillar has a trading volume of $4.41 million at the time of composing this article. Its 52-week stock price high stands at $246.69, so at a current price of $211.44 that’s an upside target of 16%.

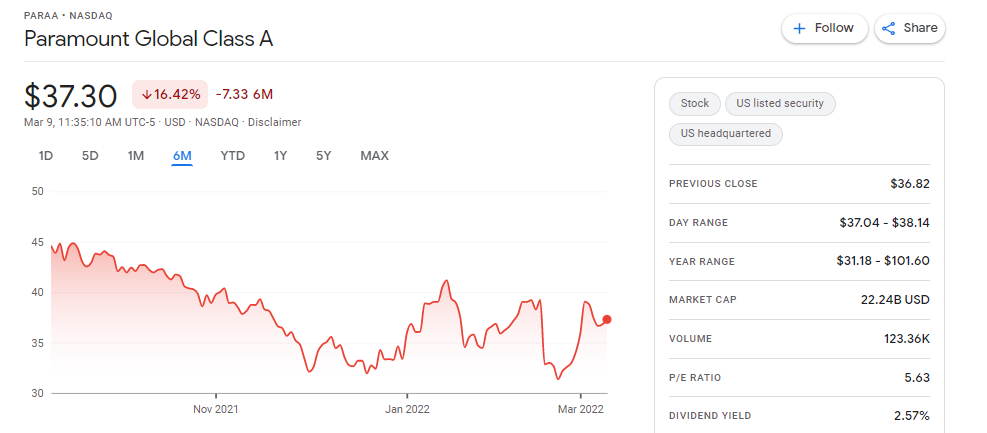

10. ViacomCBS Inc (NASDAQ: PARAA)

ViacomCBS is a media and entertainment company that owns the wildly popular CBS Television Network as well as one of the best value stocks on the market today. However, ViacomCBS recently launched its own streaming service, Paramount+.

Viacom’s new streaming service will compete with Disney+ and Netflix, among others. The move boosts revenue while also reducing the risk of “cable cutting.” Despite this, Viacom’s stock did not rise in response to the Paramount+ news. Instead, the stock was harmed by what amounted to a botched margin call.

Financial institutions operating as Archegos’ broker made a mistake in asset allocation in the first half of last year, selling Archegos Capital Management’s large position in ViacomCMS rather than adding funds to personal accounts. The large sale caused an artificial drop in the company’s stock, which fell more than 60% from its Q1 highs.

The price cut coincided with Viacom’s launch of Paramount+, and it appears to be an unjust correction. If none of that, Viacom’s price-to-earnings ratio of 7.18x is significantly lower than the media industry’s median PE of 12.50x. Viacom, like every other stock on this page, has long-term patterns in its favor, and the current valuation doesn’t appear to reflect that.

ViacomCBS has a trading volume of $123.36 thousand at the time of composing this article. Its 52-week stock price high stands at $101.60, so at a current price of $37.30 that’s an upside target of 172%.

You must conduct your own research in order to find the best value stocks in the United States. This includes P/E ratios, trailing dividend yields, and free cash flow levels, among other things.

Currently, the market is offering some of the best discounts available. Those mentioned above have already paid off handsomely, but identifying the best value stocks in the future will help new investors build profitable positions.