ASOS (ASOS.L), the UK-based online apparel company, terminated CEO Nick Beighton on Monday, citing supply chain difficulties and consumers returning to pre-pandemic behaviour as reasons for a 40 percent drop in profit in 2022.

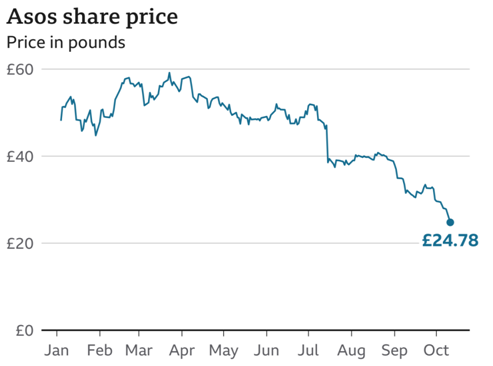

In early trading, ASOS shares dropped more than 15%.

Beighton has been CEO of ASOS for 6 years, and the firm stated his resignation will allow it to find new management to drive global expansion and target $7 billion in annual turnover within 4 years.

“In that discussion with Nick for quite a while now, we’ve sort of just come to the opinion mutually that he’s not going to be around for all of that, so it’s preferable to make the move now,” Crozier told Reuters, noting that the stock’s decline this year was “unhelpful.”

Read our list of Top 10 UK Stocks to Buy Now

While a replacement CEO is chosen, finance chief Mat Dunn will be taking on the additional role of chief operating officer and oversee the company in a day-to-day manner. Katy Mecklenburgh, who is presently the director of group finance, will take over as interim CFO.

Asos has warned that profitability could plummet by as much as 40 percent next year.

Beighton’s departure comes shortly after the company’s chairman, Adam Crozier, declared his departure to join BT Group. ASOS announced on Monday that Ian Dyson will take his place as non-executive chairperson of the board of directors.

“While market fluctuation and global supply chain and cost challenges are expected to hamper our performance in the coming 12 months,” Dunn said, “We remain optimistic in our ability to seize the considerable opportunities forthcoming.”

Disruption of the Supply Chain

ASOS declared a 36 percent increase in modified pretax profit to 193.6 million pounds in the year to August 31, led by a 67.3 million pound bump from the pandemic, when buyers ordered leisurewear instead of partywear for a night out, some of which were then recalled. Revenue surged by 22 percent to 3.91 billion pounds, while the number of active customers increased by 13 percent to 26.4 million.

As client returns normalise, ASOS expects an adjusted pretax profit of 110-140 million pounds for the new fiscal year 2021-22. The midpoint of the range is 35 percent lower than analysts’ average projection of 193 million before Monday’s release.

Sales growth was predicted to be in the region of 10 to 15 percent. Analysts had predicted a 20% increase.

ASOS warned that supply chain difficulties that have hampered the movement of container ships and trucks throughout the world since the outbreak are projected to persist in the first half, resulting in lengthier lead times and limited supply from partner brands.

ASOS also had to contend with rising inbound freight and outbound delivery expenses, as well as Brexit-related duty charges and salary inflation.

Last month, shares in competitor Boohoo (BOOH.L) plummeted 13% after the company reported a slowdown in growth and issued a profit warning for the entire year.

Within four years, ASOS expects to treble the size of its combined US and European company, adding at least 1 billion pounds to the group’s annual own brand revenues.

“If we do the proper things and execute,” Crozier added, “the stock price should take care of itself.”

Where does the ASOS stock price go from here?

The ASOS share price has been drifting lower since reaching 5985p in late March. The price is trading below its 50 and 200 simple moving averages. Early in July, the 50 SMA fell underneath the 200 SMA. Today’s selloff has gained traction.

The RSI has sunk into overbought territory, indicating that there may be some stabilization or a move higher ahead.

The value has dropped through support at 2550p, the April ’20 peak, allowing for a drop to 2300p, the September ’19 low, and a round number of 2000p.

On the other hand, 2550p has become resistance, ahead of 3100p, which is the declining trendline resistance. To offset the near-term downturn and reveal the 50 SMA at 3500p, a rise above 3385p, the late September high, is required. Horizontal support is at 4160p, the late August peak, beyond 50 SMA.