The secret to generating lifetime passive income may lie in investing in elite businesses through a Stocks & Shares ISA. As to how Zaven Boyrazian explains.

A Stocks and Shares ISA is a fantastic tool for increasing stock market wealth. This is due to the gains—rising share prices and dividend payments—being tax-free.

The power of an ISA is growing as annual tax allowances are sharply reduced starting in 2019. And to maximize its potential, investors ought to try to invest as much as the £20k annual cap.

Even if an investor has £20,000 to spare a year, the next problem is deciding where to invest it. So, this is how you should approach creating an income ISA portfolio from scratch today.

The superiority of quality over quantity

Targeting the businesses with the highest dividends makes sense if your objective is to create a lifelong secondary income through the stock market. After all, a higher yield will result in a higher return and faster ISA growth.

It is not that easy to invest in income. There are few exceptions, but in general, a high dividend yield is cause for concern. Why? Because a fast declining stock price, as opposed to a rise in shareholder dividends, can readily influence this statistic.

As a result, income traps are created where an investor purchases a dividend stock in hopes of generating passive income only to discover a few months later that payments have been reduced or completely stopped. What then, if yield is not the solution?

Free cash flow to equity (FCFE)

This is the cash that is still available after a business has paid all of its operating, reinvestment, and debt servicing costs. In other words, it is the money that a company has on hand to use for dividend payments, share buybacks, and cash accumulation on the balance sheet.

Investors can rapidly determine if a company is producing enough revenue to support its payouts by comparing the dividends paid to the FCFE. What if payouts were to approach or surpass the FCFE? If cash flow is impeded in that instance, they can be in danger of being fired.

Increasing diversity in a portfolio

There is no guarantee that a great firm with dividends that appear to be sustainable will remain that way. Disruptions from without can occur suddenly. Even the finest cash-generating companies may become far more cautious about paying out dividends to shareholders as a result.

Because of this, diversification is essential when creating an income portfolio. The impact of one company being disrupted is lessened by the others because they together own a range of top-tier businesses across numerous industries and regions.

Even the best risk-adjusted ISA in the UK carries some risk. Valuations can be destroyed by stock market gyrations and crashes. But historically diversified portfolios with high-quality stocks typically do better and bounce back more quickly.

The vast number of billionaires who have amassed their wealth through ISAs demonstrates just how generous the benefits can be for investors who make sensible investment decisions.

However, several funds are worthwhile a look at on platforms like Hargreaves Lansdown and AJ Bell. These investment funds have produced appealing returns over the long run.

In light of this, we present three top performers that might be appropriate for an ISA and contribute to portfolio diversification.

Three excellent ISA funds to generate passive income

1. Blue Whale Growth

Stephen Yiu is the manager of this growth-oriented global equities fund, which has about £850 million in assets under management at the moment.

We believe that this product is a wise choice for growth investors because Yiu has a proven track record of spotting and profiting from strong growth themes.

For instance, he recently staked a lot of money on businesses that were affected by the artificial intelligence (AI) surge, such as Nvidia and ASML. And it has been profitable. Nvidia’s growth over the past year has been roughly 160%.

The volatile nature of this fund is a drawback. For instance, it had a -27.6% return the previous year when tech stocks plummeted.

It has, however, produced a return of roughly 50% over five years, which is a remarkable accomplishment.

2. Stonehage Fleming Global Best Ideas

The main investment fund of wealth management Stonehage Fleming is this one. It presently manages about £2.3 billion in assets under the direction of portfolio manager Gerrit Smit.

Due to its emphasis on high-quality companies, we believe that this fund may be an excellent option for “quality” investors. Its objective is to make investments in businesses that trade for attractive prices and have strategic advantages.

The portfolio presented here is excellent. The top 10 holdings include well-known companies like Microsoft and Alphabet. There are several less well-known businesses as well, like the pet health expert Zoetis and the electronic systems software company Cadence Design Systems (which is gaining from the AI boom).

It is important to keep in mind that this fund is highly concentrated (it only holds 20–30 stocks). It increases risk.

However, long-term performance has been outstanding. It has returned roughly 52% during the past five years.

3. Royal London Global Equity Select

This less well-known fund concentrates on quality and valuation and has around £790 million in assets under management. It was established in 2017 and is run by a group of investors who have been collaborating for almost 20 years.

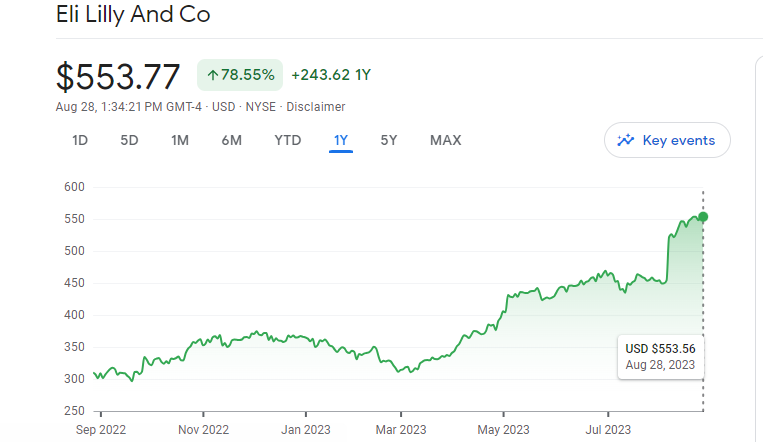

The fund contains investments in the pharmaceutical behemoth Eli Lilly, which has recently flourished due to the demand for diabetic medications and interest in its obesity-related medicines.

We believe that people looking for something a little unusual could find this product to be a suitable option.

The track record of this fund is undoubtedly impressive. It has generated around a 95% return over five years.