Some argue that the greatest approach to think about risk as an investor is to think about volatility rather than debt, however, Warren Buffett famously stated, “Volatility is far from equivalent with risk.” We usually prefer to look at a company’s debt utilisation when determining how dangerous it is, because debt overflow can lead to ruin. Taylor Wimpey plc (LON:TW.) has debt on its balance sheet, as well. Should investors, however, be concerned about the company’s debt use?

How much money does Taylor Wimpey owe?

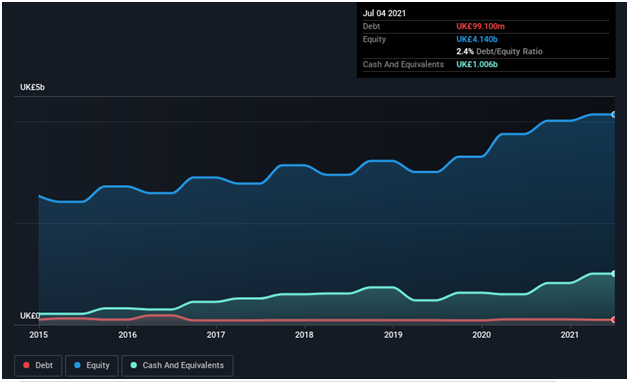

Taylor Wimpey’s debt was UK£99.1 million in July 2021, down from UK£104.5 million the previous year. However, its financial sheet shows that it has £1.01 billion in cash, implying that it has £906.5 million in net cash.

Also Read Investors Guide on Value investment in the UK

The Liabilities of Taylor Wimpey

Taylor Wimpey has liabilities of UK£1.12 billion due over the next twelve months and liabilities of UK£895.5 million due beyond that, according to the most current balance sheet data. It has UK£1.01 billion in cash and UK£154.8 million in receivables due in the next 12 months to offset this. As a result, its liabilities are UK£857.0 million more than its cash and (near-term) receivables.

Considering Taylor Wimpey’s market valuation of UK£5.56 billion, these liabilities don’t appear to represent a significant risk. Having said that, it’s evident that we need to keep an eye on its balance sheet, should it deteriorate. Taylor Wimpey has net cash despite its notable liabilities, therefore it’s safe to conclude it doesn’t have a lot of debt.

Furthermore, Taylor Wimpey’s EBIT increased by 40% in the prior year, making it simpler to manage its debt. The balance sheet, without a question, teaches us the most about debt. But, more than anything else, future revenues will decide Taylor Wimpey’s capacity to maintain a solid balance sheet in the future. So, if you’re curious about what the experts say, this free study on analyst profit estimates might be of interest.

But there’s one more factor to consider: a corporation can’t pay its debts with phantom profits; it requires genuine cash. Despite the fact that Taylor Wimpey has net cash on its balance sheet, it’s still worth looking at how well the company converts its earnings before interest and taxes (EBIT) to free cash flow, as this will affect both its need for and ability to handle debt. Taylor Wimpey’s free cash flow was 48 percent of its EBIT in the most recent three years, which is lower than we’d expect. When it comes to debt repayment, that’s not ideal.

However Taylor Wimpey’s financial sheet isn’t very robust due to total liabilities, the fact that it has net cash of UK£906.5m is plainly positive. We also liked the look of last year’s EBIT growth of 40% year over year. As a result, we do not believe Taylor Wimpey’s use of debt is dangerous. The balance sheet is the obvious starting point when looking at debt levels. However, every organisation can, in the end, manage risks that lie outside of the balance sheet. As a result, you should be aware of the two red flags we’ve discovered with Taylor Wimpey.

Of course, if you’re the kind of investor who loves to buy shares of companies that are debt free, don’t miss out on our unique list of Top 10 UK Stocks to Buy Now, which you can find right now.

What are the hazards of debt?

Debt becomes a major issue when a corporation can’t readily pay it off, either through raising capital or through its own cash flow. If things get truly bad, the lenders have the option of seizing ownership of the company. However, a more common (but still expensive) situation is when a corporation is forced to issue shares at rock-bottom prices, permanently diluting shareholders, in order to shore up its balance sheet. Of fact, many businesses use debt to fund expansion with no negative implications. When assessing a company’s debt levels, the first step is to combine its cash and debt.