The year 2023 has been a roller coaster for Nio Stocks, the Chinese electric vehicle (EV) manufacturer, facing challenges and setbacks in the increasingly competitive EV market. Despite a series of obstacles, recent developments have sparked investor optimism. This analysis will delve into Nio’s recent stock performance, the significance of obtaining manufacturing approval in China, and an in-depth examination of the company’s current position, challenges, and potential future outlook.

China’s Approval and its Significance

The pivotal moment for Nio shares came on December 4 when China included the company in its list of approved car manufacturers. This move is a significant milestone for the EV startup, which has been producing electric cars in partnership with Anhui Jianghuai Automobile Group (JAC) since 2018. While the details of the manufacturing license remain undisclosed, this approval addresses uncertainties surrounding JAC’s plans to offload assets from the factories producing Nio EVs.

The Chinese authorities’ decision to grant a production license to Nio signals a departure from their cautious approach towards approving new licenses. China has been wary of overcapacity and a price war involving numerous brands in the EV market. Comparisons with Tesla’s struggles to secure regulatory approval for its Shanghai plant expansion and cautionary warnings to luxury EV maker Lucid Group highlight the significance of Nio’s achievement.

Also read: Tesla Share Price Prediction: Navigating the Road Ahead

Nio Stock Performance:

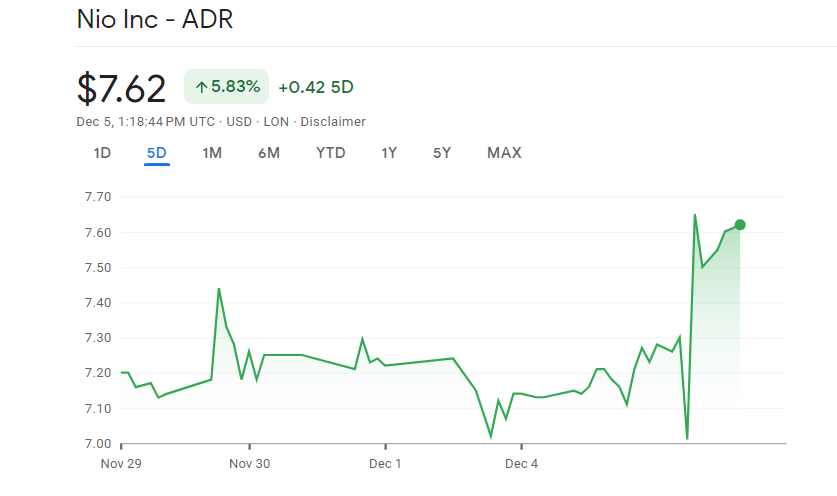

Nio stock has been on a turbulent ride, impacted by global concerns about EV demand, intense competition, and internal challenges. The company’s stock remained in the red for a significant part of 2023, with price cuts leading to a notable drop in gross margins. However, the recent approval in China had an immediate positive impact, causing Nio’s US-listed stock to climb 2.46% to $7.33 at the market open. While this marks a positive turn, it is essential to assess the broader context of Nio’s journey in the EV market.

Challenges and Setbacks:

Nio stock once hailed as a hot EV stock during the peak of the growth and meme stock rally, has faced several challenges that contributed to the erosion of investor confidence. The company initially garnered attention with triple-digit growth in deliveries in 2020 and 2021, defying the pandemic-induced slowdown. However, over the past two years, Nio encountered supply chain constraints, macroeconomic headwinds, and a fierce pricing war in China’s EV market.

The pressure on Nio intensified as its vehicle margins, which had peaked at 20.1% in 2021, dropped to 6.2% in the second quarter of 2023. The company differentiates itself with a network of battery-swapping stations, aiming to address charging time concerns for EVs. Despite this innovative approach, Nio’s operating losses tripled from 2021 to 2022 and widened year-over-year in the first half of 2023. The company ended its latest quarter with substantial total liabilities and a high debt-to-equity ratio.

Future Prospects:

Amidst the challenges, Nio holds potential avenues for recovery and growth. The recent manufacturing approval in China provides a foundation for addressing uncertainties and sustaining production. Nio’s strategic move into Europe and other overseas markets could reduce its long-term dependence on the Chinese market. The company’s focus on battery-swapping technology, though unique, raises questions about its economic feasibility and potential compatibility challenges.

Nio’s financial health, with $4.3 billion in cash and additional funding from convertible notes, offers a lifeline for weathering the current challenges. Analysts still anticipate revenue growth for Nio at a compound annual growth rate (CAGR) of 35% from 2022 to 2025, with expectations of narrowing annual net losses during this period. However, these estimates come with a caveat, urging cautious optimism.

Is It Possible to Become a Millionaire Through Nio Stocks?

Becoming a millionaire through Nio stock is theoretically possible, but it comes with inherent risks. Nio, a prominent player in the electric vehicle (EV) market, experienced significant stock value growth during the industry boom. However, its stock has also faced notable volatility, impacted by supply chain challenges, pricing pressures, and intense competition. To achieve millionaire status, investors would need a substantial initial investment and a substantial increase in Nio stock value over time. Given the unpredictable nature of the stock market, success is uncertain, and losses are possible. Investors considering Nio must carefully assess their risk tolerance, conduct thorough research, and diversify their portfolios to mitigate potential downsides in pursuit of potential gains.

Also read: Unveiling The Top Holdings In Warren Buffett Portfolio In 2023

Why should you invest in Nio stocks today?

Deciding to invest in Nio stocks today involves weighing potential benefits against risks. Here are some reasons why investors might consider Nio as part of their portfolio:

- Growth Potential: Nio operates in the electric vehicle (EV) industry, a sector expected to grow significantly in the coming years. As the demand for EVs rises globally, Nio has the potential to benefit from this trend.

- Innovative Technology: Nio distinguishes itself with innovative technologies such as battery-swapping stations, addressing common concerns like charging times and range anxiety. These unique features could contribute to the company’s appeal in the EV market.

- China’s EV Market: Being a Chinese company, Nio has a strong presence in the world’s largest EV market. With China’s commitment to green initiatives and EV adoption, Nio is positioned to capitalize on the growing demand for electric vehicles in the country.

- Regulatory Approval: Nio’s recent inclusion in China’s list of approved car manufacturers is a positive sign, potentially providing the company with more independence and flexibility in its operations.

- Financial Position: While Nio has faced challenges, including supply chain constraints and pricing pressures, the company’s financial position, including cash reserves and recent fundraising efforts, may provide a buffer to weather industry headwinds.

Conclusion:

Nio’s journey in the electric vehicle market has been marked by highs and lows. The recent manufacturing approval in China is a positive development, but the company must navigate a complex landscape of challenges. The battery-swapping strategy, while innovative, poses economic and logistical challenges that investors should weigh carefully. Nio’s financial resilience and expansion into international markets provide avenues for recovery, but success hinges on its ability to navigate the competitive EV market and deliver sustained growth.

In summary, Nio stock presents an intriguing opportunity for daring investors, but a thorough understanding of the company’s dynamics, risks, and long-term prospects is crucial before making investment decisions in the ever-evolving landscape of electric vehicles.