Within the constantly changing financial landscape, Tesla stock has become not only a leader in the electric vehicle (EV) industry but also a powerful force in artificial intelligence (AI).

Investing in Tesla stock back in 2010, during its initial public offering (IPO), would have been a game-changer for early investors. Despite facing financial struggles and skepticism about its future, Tesla stock has defied expectations, transforming into one of the world’s most valuable companies. Let’s explore how a modest £1,000 investment at the IPO would have performed over the years.

Tesla’s IPO in June 2010 was significant for several reasons, notably marking the first time a U.S. carmaker had gone public since Ford in 1956. At the time, Tesla was unprofitable and faced 26 consecutive quarters of losses, accumulating $3.2 billion in the red.

Since its initial public offering (IPO) in 2020 at a price of $17 per share, Tesla has had two stock splits: a three-for-one split in 2022 and a five-for-one split in 2020. Once these splits are taken into account, the IPO price effectively drops to $1.60 per share. Tesla stock was trading at $240 per share in mid-December 2023.

If an investor had put £1,000 into Tesla at the adjusted IPO price, they would have purchased approximately 625 shares. With Tesla’s recent stock price, that initial £1,000 investment would now be worth around £150,000—a staggering 14,900% return.

Elon Musk, Tesla’s controversial CEO, has played a pivotal role in the company’s success. While opinions about him may differ, there’s no denying the impact of Tesla’s innovation in electric cars and battery technology. Musk’s net worth, largely tied to his ownership stakes in Tesla and SpaceX, has soared to around £200 billion.

Looking ahead, Tesla’s growth prospects extend beyond its electric cars, with technologies like Powerwall and Megapack contributing to its success. As investors contemplate allocating £1,000 today, it’s essential to consider the long-term potential and the role of emerging technologies in Tesla’s future growth.

The experience of investing in Tesla serves as a reminder that well-thought-out, long-term wagers can result in impressive profits. Even while historical performance does not guarantee future outcomes, Tesla’s success story highlights the potential benefits for investors who are prepared to weather market ups and downs.

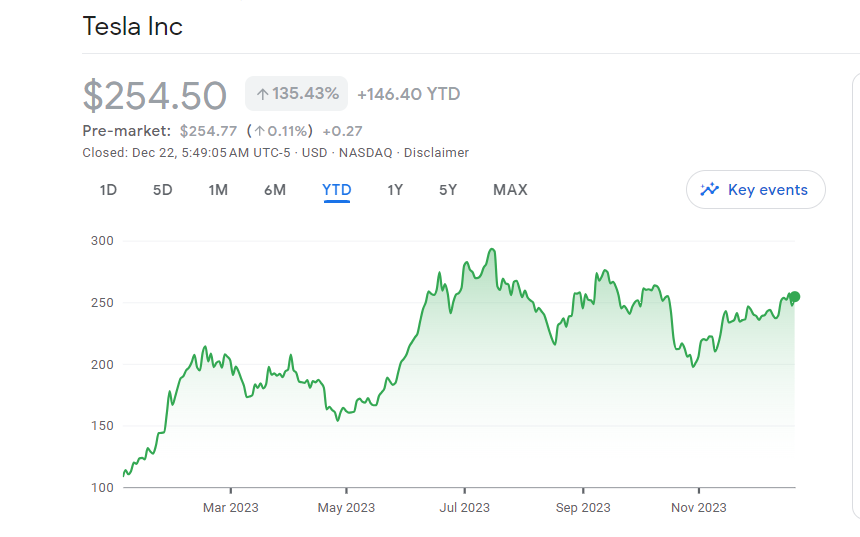

Current Value of Tesla Stock:

As of the latest data, Tesla stocks continue their impressive rally, surging by 135% this year, investors are left wondering if this momentum will carry into 2024. This significant increase follows a challenging 2022 when Tesla stock experienced a 65% decline. Given Tesla’s position as the leading electric vehicle (EV) manufacturer globally, investors are now faced with the question of whether to take the stock more seriously.

However, concerns over valuation persist, with a price-to-earnings (P/E) ratio of 81.7, well above the NASDAQ average. A critical evaluation of Tesla’s P/E ratio, earnings per share (EPS), and analyst forecasts suggests a potential target price of $180, indicating a 28% decline from the current price of $250. Institutional analysts, such as HSBC, share this caution, slashing their target price to $146. Persistent inflation and heightened competition in the EV space pose additional risks.

Also read: Tesla Share Price Prediction: Navigating the Road Ahead

Long-Term Potential and AI Innovations:

Investing in Tesla stock appears to offer a compelling long-term opportunity, driven by the global shift towards carbon neutrality and the increasing adoption of electric vehicles (EVs). While the UK’s delay in banning combustion engine cars is a temporary setback, the overall trend towards sustainability remains strong.

Tesla’s leadership in the EV market positions it as a key beneficiary of this transition. Beyond electric vehicles, Tesla’s foray into artificial intelligence (AI) presents additional growth prospects. Ark Invest CEO Cathie Wood has labeled Tesla as the “biggest AI play in the world,” indicating the transformative potential of the company.

Two notable AI initiatives by Tesla highlight its commitment to innovation:

- Robotics and Tesla Optimus: Tesla’s secret AI project, Optimus, focuses on humanoid robots capable of enhancing workforce productivity in its factories. Elon Musk’s vision of producing 20 million cars annually by 2030 necessitates efficiency improvements. Optimus, with its ability to work continuously and handle delicate tasks, could revolutionize manufacturing processes. Beyond Tesla’s own operations, there’s potential for Tesla to commercialize these robots, disrupting the broader labor productivity market.

- Autonomous driving and Tesla Dojo: Tesla’s leadership in autonomous driving technology is underscored by the vast amount of data its vehicles collect through cameras and sensors. This data feeds into the Dojo supercomputer, enabling machine learning and enhancing the sophistication of Tesla’s self-driving software. The potential for autonomous driving extends beyond individual car sales, with the prospect of robotaxi fleets representing a significant revenue stream. Estimates suggest that robotaxis could generate $9 trillion in sales by 2030, further diversifying Tesla’s income sources.

These AI-driven initiatives position Tesla not merely as a car manufacturer but as a technology company with the potential to disrupt multiple industries. As the world increasingly values sustainability and technology, Tesla’s strategic investments in AI could propel its growth, making it a compelling long-term investment.

Also read: Forget AI Stocks! It’s Time To Purchase These Dividend Stocks

So is Tesla stock a buy?

Tesla stock, traditionally associated with electric vehicles (EVs), is increasingly investing in advanced technologies such as robotics and autonomous driving. While the commercialization of these innovations may be a few years away, the glimpses of Tesla’s progress are remarkable.

Despite its strong association with EVs, Tesla’s potential as an AI stock is often overlooked. The company’s advancements in AI, particularly through projects like robotics and autonomous driving, suggest a broader technological prowess. This underappreciation presents an opportunity for long-term investors to include Tesla in their AI portfolio allocation.

With substantial institutional support and considering the vast addressable markets for robotics and autonomous driving, Tesla seems poised not only to replicate its dominance in the EV sector but also to emerge as a leader in these burgeoning AI applications. Investors with a forward-looking perspective may find Tesla’s multifaceted technological ventures an attractive addition to their portfolios.

Conclusion:

To sum up, Tesla’s journey from a trailblazing producer of electric cars to a dominant force in artificial intelligence reveals a story of tenacity and vision. The increasing demand for electric vehicles (EVs) and the worldwide push for sustainability created the conditions for Tesla’s innovative approach to technology, which presents a special investment opportunity. Thanks to its diverse range of technologies, Tesla is positioned to grow at a sustained pace as more countries make commitments to being carbon neutral. For investors who have an eye on the future, investing in Tesla stock represents not just the growth of electric vehicles (EVs) but also a step into the vast and revolutionary field of artificial intelligence. Tesla offers a diverse range of opportunities that goes well beyond its electric vehicle line for investors who are looking for exposure to AI over the long run.