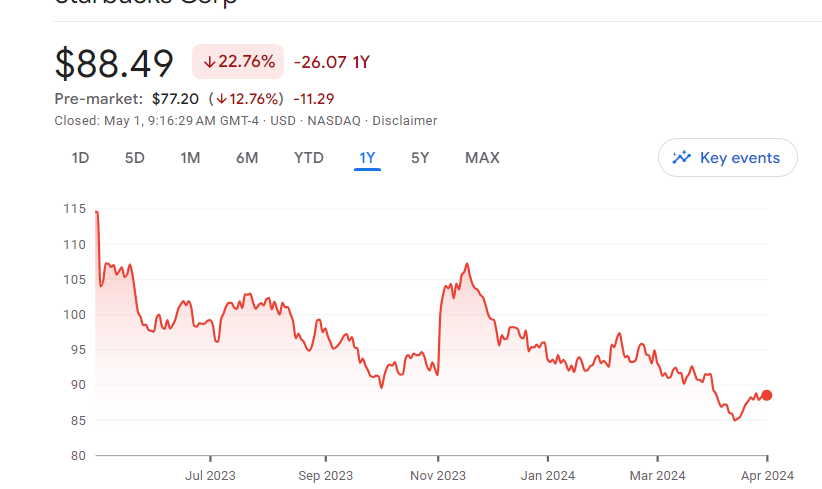

Starbucks stock, once a powerhouse in the restaurant industry, has shown signs of stagnation in recent years. Its stock performance has been lackluster, and internal challenges like sluggish comparable sales growth and labor disputes have tarnished its reputation.

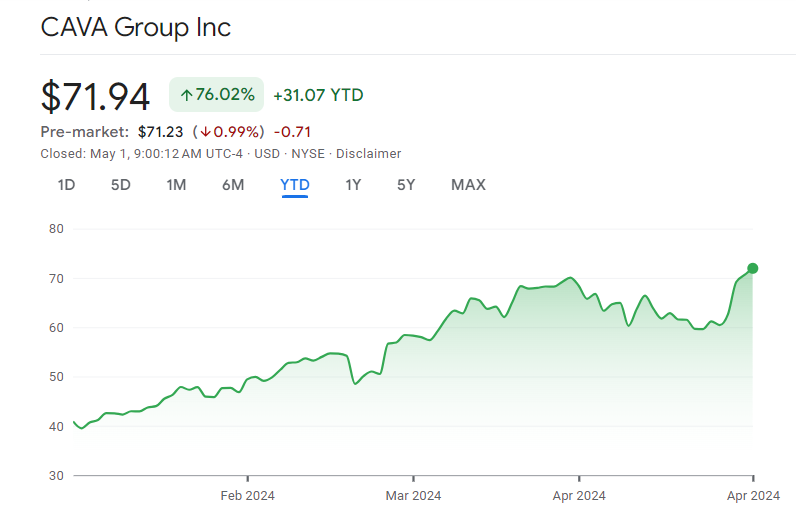

Investors seeking dynamic growth opportunities need to look beyond Starbucks stock (NASDAQ: SBUX). Cava Stock, a Mediterranean fast-casual chain, is positioned to outshine Starbucks stock in 2024 and beyond.

Also read: Is Starbucks Stock A Promising Growth Stock Amidst Market Volatility?

Cava’s Strong Fundamentals

Cava Group (NYSE: CAVA) represents the future of fast-casual dining with its Mediterranean-inspired menu and innovative approach to customer experience. Comparable sales surged by an impressive 18% last year, demonstrating strong consumer demand for its offerings. Unlike Starbucks, which has faced challenges in recent years, Cava is positioning itself as the next big player in the restaurant industry. with over 300 restaurants and a revenue increase of 60% to $717.1 million. Furthermore, its acquisition and rebranding of Zoe’s Kitchen have expanded its footprint and enhanced its market presence.

Key Factors Driving Cava’s Success

Cava’s success can be attributed to several key factors. Firstly, its aggressive expansion strategy, evidenced by the opening of 72 locations and the acquisition of Zoe’s Kitchen, has fueled revenue growth and bolstered its presence in the market. Additionally, the company’s adeptness in the digital channel, with digital orders comprising 36% of revenue, reflects its ability to adapt to changing consumer preferences and capitalize on technology-driven trends.

Furthermore, Cava benefits from the guidance of industry veteran Ron Shaich, founder of Panera Bread and Au Bon Pain, who brings invaluable experience and insight to the table. Shaich’s involvement underscores the potential for Cava to replicate the success of his previous ventures and solidify its position as a leading player in the fast-casual segment.

Final Thoughts

In conclusion, Cava Group offers investors a compelling alternative to Starbucks stock, with a promising growth trajectory, strong fundamentals, and strategic advantages. With robust growth prospects, a proven business model, and visionary leadership, Cava has the makings of the next great restaurant stock. While Starbucks may have been a titan in its heyday, Cava’s resilience and momentum signal a shift in the market, making it the preferred choice for investors seeking sustainable long-term returns.