Although the majority of cautious investors believe it is safer to remain with reputable blue chips, they may also find safe and sound options among small-cap stocks.

Although it differs greatly from investor to investor, risk tolerance is an essential quality for an investor. Certain investors want to play it safe, and the risk they are willing to take is purchasing dependable, blue-chip stocks in fragile markets (at reduced prices and valuations). Others pursue a completely other path and take a chance on unproven or extremely volatile stocks, playing a high-stakes game with great rewards.

The middle ground between the two extremes is probably the most sensible course of action. Although it is a good idea to look beyond the blue-chip pool, you do not have to plunge into perilous waters. There are three small-cap stocks you should be watching this month, and tiny caps can also contain safe and respectably performing equities.

Enghouse Systems

Enghouse Systems (TSX: ENGH), which has a market size of roughly $1.65 billion, is among the top the small-cap stocks. This valuation was made possible by a severe downward spiral that cost the corporation almost 61% of its original price.

The stock may eventually become even more cheap and more enticingly valued because it is still declining. But an upward trend might be equally likely given the buoyant tech sector.

It is a software and services company that works in a variety of industries, such as video communications, interactive services for call centers, and transportation-related services.

This company may have several growth opportunities given the wide variety of business categories it operates in, and if those opportunities result in a significant revenue increase, the stock price may move accordingly. It has the potential to quadruple your investment simply by reaching its peak value.

Extendicare

Extendicare (TSX: EXE) is another small-cap stock that you should consider purchasing. With a 50-year history in this market, Extendicare has established itself as a pioneer and a dependable service provider, maintaining a steady business as the number of seniors in Canada increases. It provides services to more than 100,000 seniors in 103 communities, more than half of which it directly controls.

There is not much potential for capital growth with this stock. The stock’s growth over the previous ten years was only 5%. However, it pays out big dividends and is currently providing a delicious 6.6% yield, which is ideal for beginning a strong passive income stream. Since 2014, the corporation has continued to make regular payouts.

Clairvest Group

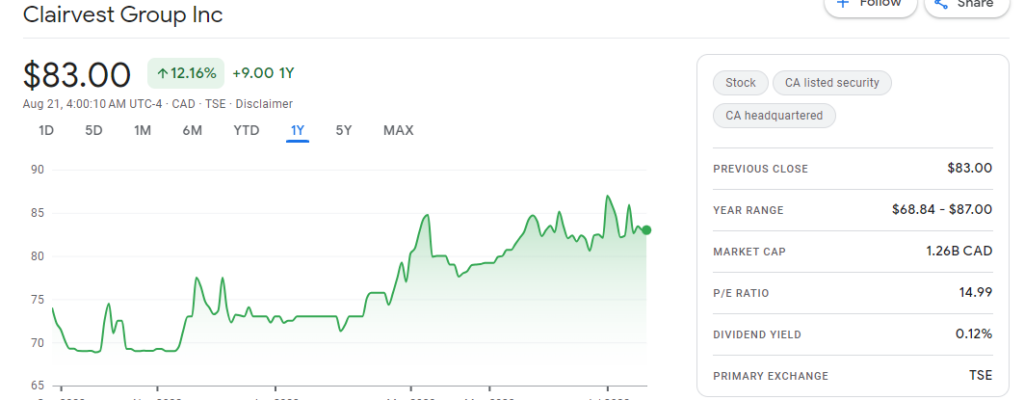

Small-cap growth stock Clairvest Group (TSX: CVG) has shown consistent growth over the past 20 years, increasing by over 1,000%. Over this time, the rise has not been particularly steady, and there have been numerous periods when the stock fell or just remained unchanged, but overall, the trend has been upward.

With 24 firms in its portfolio that it now owns or has a part in, the organization has executed over 380 acquisitions over the years. It also provides dividend returns, however, the yield is essentially nonexistent. The possibility for long-term, consistent capital appreciation makes it a good choice, nevertheless.

Also read: 3 Cheap FTSE 100 Stocks Under £100

3 important parameters to know before purchasing small-cap stocks

Small-Cap Stocks are infamously hazardous and unpredictable. However, the possibility of extremely high profits continues to draw growth investors to this sector of the stock market.

After all, it only takes one successful company to provide triple-digit, if not quadruple-digit returns, erasing the majority, if not the whole loss caused by the companies that failed to live up to expectations.

Finding these winners, however, is much easier said than done. Small-Cap Stocks sometimes rise on excitement before collapsing a few weeks or months later. While it is possible to make some money by anticipating this cycle, doing so successfully is extremely difficult. Remember that trying to time the market is a losing endeavor.

Finding prospective businesses that have the potential to go off in the long run without requiring miracles is where the real money is to be found. And there are three important factors you should pay particular attention to when looking for such chances.

1. Recognizing opacity

On the London Stock Exchange, small-cap companies are subject to different regulatory requirements than large-cap businesses. The reporting requirements are far less stringent. Additionally, management teams are not required to present investors with as much information transparency.

Of course, this raises a possible issue. According to our experience, businesses that purposefully exclude important financial statement information or are deliberately unclear can raise a red flag. This is especially true if the company litters its annual report with useless adjectives.

It is a great approach to generate buzz and momentum to use terms like machine learning, modifying genes, or blockchain technology. But all too frequently, it serves to cover up a subpar operation by posing as a next-generation disruptor.

Simply put, it is usually a tip to stay away if a company is more focused on short-term stock price growth than on acquiring further funds through equity.

2. Track record

A poor predictor of future success is history. However, a company’s past performance might give important information about the caliber of its leadership. A company that consistently meets or exceeds its goals shows that the CEO has skill in capital allocation, which is a desirable quality.

However, if a group keeps making promises but never follows through, or keeps blaming the macroeconomic climate, it raises the possibility that they are not as skilled as they believe.

Smart leadership can make the difference between which small-cap companies successfully enter a market. We, therefore, seek businesses that under-promise and exceed expectations as opposed to the reverse.

3. Liquidity of stock

Even if we find one of the top Small-Cap Stocks to purchase right now, chasing this investment may still be a bad idea if there is little trading activity. This suggests a lack of liquidity, which makes it far more difficult to acquire and sell shares.

We will probably need to sell the stock at a significant discount to its present market price even if the stock price has significantly increased and the typical trading volume is too low.

A Small-Cap Stock’s examination goes beyond these three variables. However, by employing them as a filter, we can rule out a lot of subpar investments.