BP is vying to have its shares recognized as “green” and “ESG-friendly,” but our portfolio has better options with greater profit potential and impactful policies.

BP (LSE: BP) may tout itself as a wise investment for our portfolio’s environmental, social, and governance (ESG) sector. But from our perspective, its shares have clear problems.

BP’s current goal is for all of its operations to have net-zero emissions by 2050. As of 2019, it has set goals to cut emissions by 20% by 2025 and 50% by 2030 to assist the global transition to net-zero emissions. The company’s objectives include the proliferation of electric vehicle (EV) charging stations and the reduction of carbon emissions.

We are concerned about the company’s capacity to achieve profitability and share price rise in light of the new ESG approach and the decades of underperformance for BP stocks that have come before. The stock has decreased since 1999 by about 25% as of this writing.

Investments

There are advantages to think about. By 2030, the corporation wants to invest up to $8 billion in Transitioning Growth Enterprises (TGEs). BP is not ignoring the oil and gas industries, allocating up to $8 billion to them by 2030.

In the upcoming years, BP intends to invest up to twice as much in oil and gas projects as it does in renewable energy. This naturally raises concerns about the company’s commitment to ESG as well as if ESG investing is profitable for the business.

Problems with ESG

A “green” portfolio’s investments must strike a balance between two factors: profitability and morality. In terms of ESG investing, one without the other is a bad investment.

With BP, there is a chance for “greenwashing,” in which businesses overstate or make deceptive claims about being ecologically beneficial. ESG currently carries a cultural stigma, and if it is not implemented properly, it is likely to be both unethical and unsuccessful.

ESG investing has been referred to as “the devil” by Elon Musk, who also stated that ESG evaluation techniques lack real-world impact.

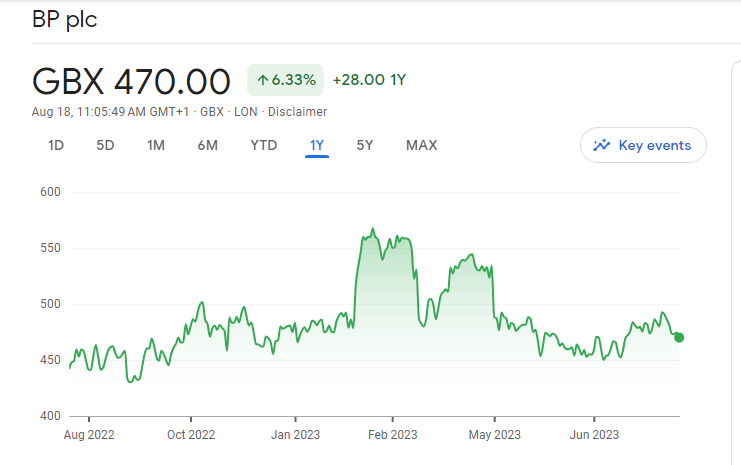

BP stock price Development

BP’s stock price increased 20% in February when the firm chose to scale back its ambitious renewable energy goals. That demonstrates the view of the market that BP’s short-term profitability depends on its traditional non-renewable revenue sources.

It does not follow that the long-term will be the same as the current short-term perception of BP and ESG initiatives about its share price. According to the Kellogg School of Management, ESG practices can raise stock values.

To gain meaningful increases in its share price from its renewable activities, BP would also require more favorable ESG ratings. BP ranks 56 out of 300 on Sustainalytics’ ranking for large oil firms, with one being the lowest risk, while having the highest Bloomberg ESG transparency score for global oil organizations (the company is open about its projects).

Also read: Best AI Stocks You Should Buy In UK 2023

Is its dividend safe?

Investors looking for income have been drawn to the BP dividend for years. And with good cause. The oil company’s stock is trading at about 472p, so the yield on future investments is about 5%. And in the past, it has frequently been at a comparable level.

Is the shareholder dividend secure, though? It might be, but there are problems with the company.

Cash flow

In the past, cash flow has been consistently good, and things could stay that way. And since dividends must be paid in cash, that may be excellent news.

Another factor to consider is debt. It has changed throughout time and is currently extremely high. That may not come as a surprise given that operations are cyclical and affected by the price of oil and gas. And that is despite the company’s nascent efforts in other fields, like renewable energy.

For the business, earnings are prone to change. Additionally, the balance sheet’s net debt amount might occasionally increase during hard times. However, debt has been decreasing recently.

Here is a recent track record for the business:

| Year to December | 2017 | 2018 | 2019 | 2020 | 2021 |

| Operating cash flow per share ($) | 0.955 | 1.14 | 1.26 | 0.601 | 1.17 |

| Capex per share ($) | 0.836 | 0.831 | 75.6 | 0.609 | 0.537 |

| Free cash flow per share ($) | 0.12 | 0.307 | 0.507 | (0.007) | 0.628 |

| Dividend per share ($) | 0.4 | 0.397 | 0.41 | 0.315 | 0.214 |

There has been erratic cash flow. And considering the epidemic and the extreme changes in commodities prices we have seen, that is not surprising.

The free cash flow line in the table is significant in the meantime. What is left over after capital expenditures is free cash. Companies should pay dividends to shareholders from free cash flow.

Unbacked dividends

However, the table demonstrates that BP’s dividend payments have only sometimes been funded by free cash flow. And that, in our opinion, is a crucial aspect that highlights a weakness in shareholder payments.

Why, therefore, if the cash flow statement does not justify paying shareholder dividends, might business directors do so? It is a wise inquiry. But expectations’ pressure is probably the main factor.

After all, a large number of pension funds and other institutional investors probably keep BP stocks due to the dividends the business pays out. And any reduction or cessation in dividend payments could harm BP’s reputation; at least, that is what we suppose corporation directors could occasionally consider.

The significant capex (capital expenditure) numbers, however, demonstrate how capital-intensive the business is. And that raises the risk level.

The most successful companies in our opinion are capital-light and enormous cash machines. Additionally, they frequently have net cash on the balance sheet or low amounts of debt.

Analysts’ projections for the BP dividend, however, point to significant single- and double-digit percentage growth over the following few years. Additionally, the stock can turn out to be a profitable income investment for investors.

It is important to keep in mind the possibility of a catastrophic corporate collapse that could change the course of the industry. For instance, it occurred in 2010 after the Deepwater Horizon oil spill struck the Gulf of Mexico.

Overall, BP stocks can be a wise choice for a “green” investment portfolio but, we do not think investing in BP stocks for a long-term dividend is especially safe.

Also read: Five Benefits Of Dividend Paying Stocks For Our Financial Well-Being