We frequently go towards stocks generating big dividends while searching for new stocks to purchase. Both of these two significant UK companies have generous cash payouts.

As a seasoned value, income, and dividend investors, we are constantly searching for fresh stocks to purchase. The ideal shares for us are those with fair prices and big dividends. Thankfully, the blue-chip FTSE 100 index is full of such shares.

The following three stocks offer big dividends:

The FTSE 100 still seems like a good value to us even if it has increased by more than 6% so far in 2023. Here are three equities you should buy in 2023 to provide your family big dividends.

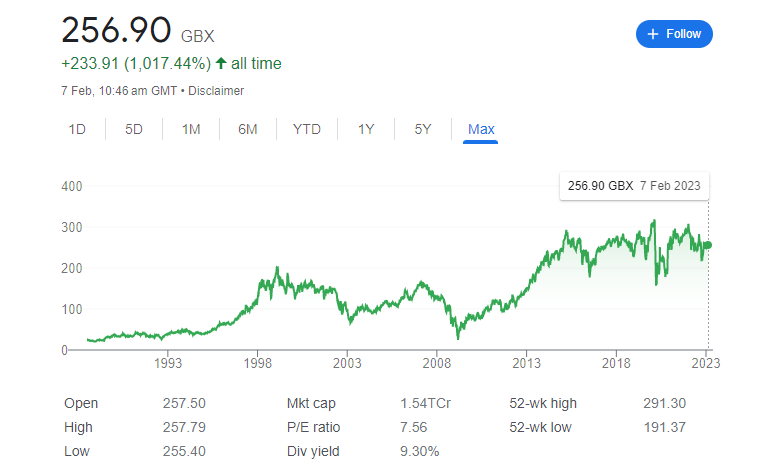

Legal & General

Among UK’s top life insurance, savings, and investment companies are Legal & General Group (LSE: LGEN). The group oversees more than 10 million customers and £1.3 trillion worth of assets.

We’ve long been admirers of this well-known brand, having worked in this field for many years. Additionally, we currently don’t think L&G shares are at all overpriced.

Despite trading far above their 52-week low, L&G shares have decreased by more than 10% over the past year. However, their price-to-earnings ratio is 13%, which is nearly double that of the broader FTSE 100. Additionally, their 7.2% annual dividend yield appears to be rock-solid and is covered by earnings more than 1.8 times. Furthermore, L&G didn’t even reduce these financial payments during the Covid-19 problem in 2020.

However, L&G’s future profits, cash flow, and dividend payments are strongly influenced by the value of its financial assets. L&G’s stock price can decline if markets experience another decline.

Also read: Could A Stock Market Downturn In 2023 Aid In My Financial Growth?

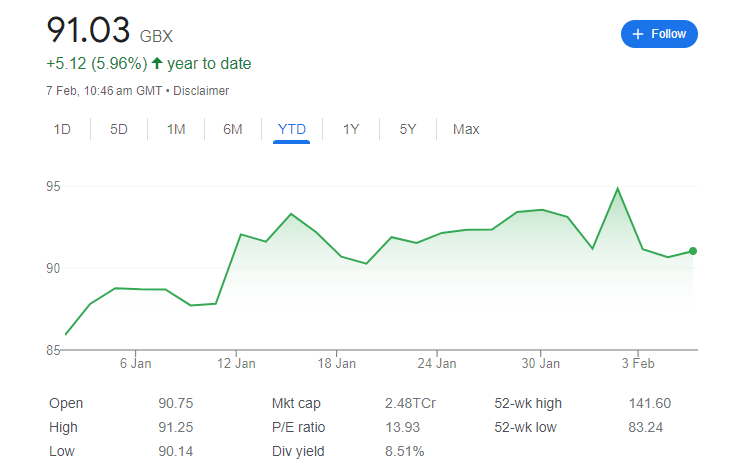

Vodafone

In the UK, Vodafone Group (LSE: VOD) is well-known, similar to L&G. Over 300 million mobile users and 27 million fixed broadband users are its customers worldwide.

Vodafone is the biggest mobile and fixed network provider in Europe. Nevertheless, Vodafone’s share price has been falling for years despite this market strength. Over the previous five years, it has more than half (-53.7%) and reached a 52-week low in December.

On the other hand, the shares now provide a big dividend yield as a result of continued price declines.

The shares offer a very substantial dividend yield despite trading at an earnings yield that is comparable to the FTSE 100 (about 7%). Unfortunately, the 8.5% annual cash return is not entirely covered by trailing earnings. In actuality, the payout is currently just 84% covered. In other words, it might be at risk unless the group’s performance improves.

We purchased this company at a price of 90.2p per share in early December despite our reservations about Vodafone’s dividend. We purchased on the anticipation that price increases in 2023 would help to increase group earnings. Since 2021, the stock has dropped too far in our opinion, and a recovery is due. So, while we wait for the share price to increase, we will relax and enjoy our big dividends!

BP

One of the biggest energy companies in the world, BP (LSE: BP), has historically concentrated on the hydrocarbons sector. Although they have not yet contributed significantly to the company’s revenue, renewables may do so in the following decades.

By 2025, more environmentally friendly energy will receive nearly half of the $15 billion energy giant’s capital expenditure budget. According to some estimates, BP’s renewables division could produce underlying cash gains of $9 billion to $10 billion by 2030.

We find this to be interesting, however, there are also rumors that BP CEO Bernard Looney is worried about the returns on his company’s investments in renewable energy sources like wind and solar. According to reports, he wants to prioritize money over the green agenda.

Given that solar and wind energy are frequently the least expensive methods for generating power, we do find this report to be fascinating. Evidently, other companies are turning a profit.

Given that BP has been on something of a bull run, we are not currently buying any. However, we are closely monitoring it.

Also read: How To Buy Shares UK