BAE shares has an excellent history of annual dividend growth. Could it be among the top-income stocks available for purchase right now?

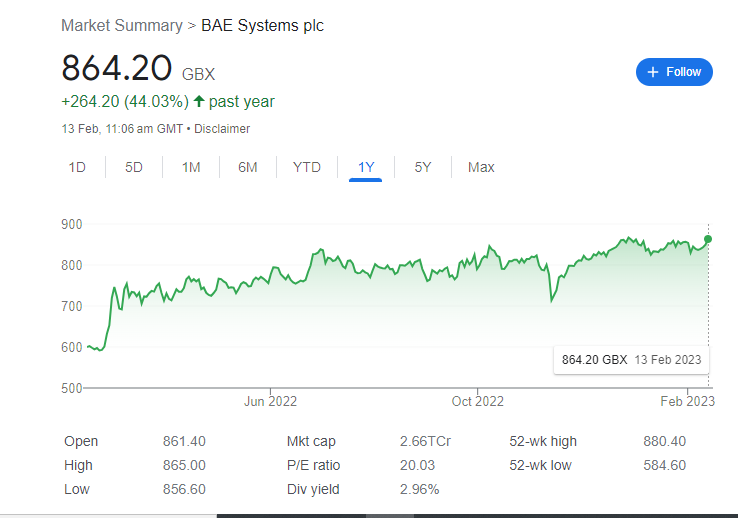

When there are challenging macroeconomic and geopolitical conditions, defense equities are among the most popular. This explains why the share price of BAE (LSE: BA.) increased 44% over the previous 12 months.

The value of the FTSE 100 weapons manufacturer has increased as the war in Ukraine has increased expectations for defense investment. Interest in the company has also increased dramatically due to worries about the state of the global economy. According to historical trends, the state of the economy has little impact on the purchase of arms.

So, if income investors were to choose today, would BAE shares be the greatest option?

Average yields

The first topic to cover is the dividend yield of the company. This shows how big a share’s dividend payout is anticipated to be in relation to its share price. It serves as a useful benchmark for determining a value for the money.

The dividend yield for BAE shares is 3.4% for 2023, which is a little under the 3.5% ahead average for the FTSE 100. The yield rises somewhat for 2024, to 3.6%, but only marginally.

This implies that the company is not a wise choice for generating market-beating passive income at the moment. Numerous FTSE index shares have forward dividend yields that are higher than this.

Also read: Buy These Three FTSE 100 Stocks As Your First Purchases In 2023

Well protected

BAE shares appears to be well-positioned to achieve the City’s payment predictions. In light of the faltering economies of the UK and the world, this cannot be stated for all London shares.

In 2023, analysts expect the company to distribute a 28.8p annual dividend per share. The predicted dividend payment for the following year is 30.5p. The anticipated earnings are 2.1 times greater than these estimated rewards.

For investors, a reading of two times or more offers a respectable margin of safety.

In addition, BAE shares has a solid balance sheet that might enable it to continue paying dividends even if earnings fall short of expectations. In fact, it was prompted by its substantial liquidity to begin a three-year, £1.5 billion share repurchase program during the summer.

Dividend growth

Personally, we would invest in BAE shares due to the company’s stellar record of dividend increases. The wealth of investors can be protected from pressure brought on by inflation by owning income equities that consistently increase the yearly distribution.

Since the early 2000s, this FTSE 100 firm has increased its total dividend each year. Given the company’s strong market forecast and solid financial position, dividends should likely keep increasing for the foreseeable future.

Conclusion

Of course, there is risk associated with owning BAE shares. Industry-wide issues with supply chains could make it more difficult for the company to fulfill orders. For federal contracts, it must contend with other significant US and British defense companies.

But overall, we believe BAE shares to be one of the most reliable FTSE 100 dividend payers. The Stockholm International Peace Research Institute’s latest statistics show that global defence spending first surpassed £2 trillion in 2021.

Additionally, spending is expected to continue expanding rapidly in the wake of Russia’s invasion of Ukraine. A long-term increase in orders is something BAE Systems can anticipate thanks to its strong connections with Western nations. If we had extra money to invest, we’d be happy to purchase this dividend share.

Also read: Best Defensive Stocks