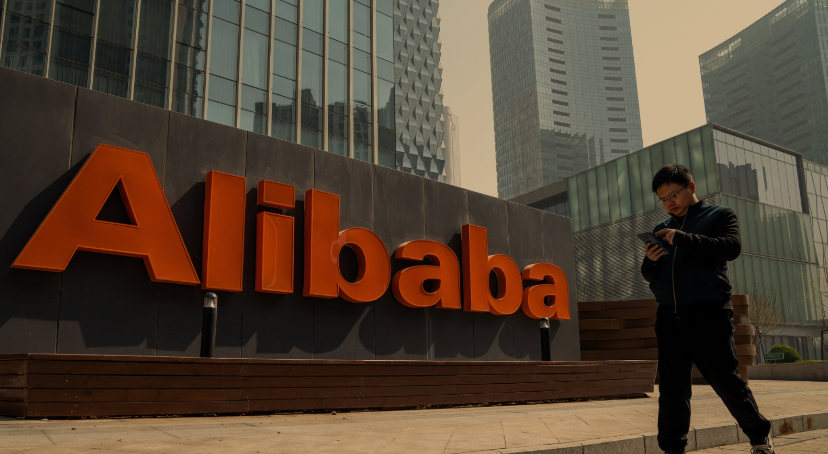

Alibaba stock continues to face challenges in 2024, experiencing a 10% year-to-date drop in its stock value as concerns over the Chinese economy persist.

The latest signs of weakness emerged with an early release of China’s 2023 gross domestic product (GDP) growth, reported at approximately 5.2% by Premier Li Qiang at the World Economic Forum in Davos. However, skepticism surrounds the timing of the data release, as China has a history of manipulating economic information to shape public opinion.

Adding to the unease, Chinese authorities are reportedly urging institutional investors not to sell stocks, but this effort appears to be backfiring, causing a lack of confidence in the market’s ability to accurately reflect genuine interest. Despite these measures, Alibaba stock has only seen a modest 1.5% increase.

While there is no specific company-related news impacting Alibaba on this particular day, the e-commerce giant remains highly sensitive to broader economic trends in China. Alibaba has grappled with challenges since it became a focal point in Beijing’s crackdown on the tech sector, triggered partly by controversial remarks from its founder, Jack Ma, directed at Chinese finance ministers.

The company has had difficulties, including losing market share to rivals like PDD Holdings, the parent company of Pinduoduo, and scrapping plans to spin off its cloud computing division in response to new limitations on U.S. chip exports.

Will Alibaba stock recover?

Despite these challenges, Alibaba remains financially sound and profitable, with its revenue continuing to grow. The stock appears attractively valued with a price-to-earnings ratio of around 10. However, the ongoing pressure from Chinese officials against selling stocks poses a significant headwind for the entire sector.

While Alibaba could potentially recover in the long run, a sudden surge in Alibaba stock is unlikely, given the absence of indications that the broader economic challenges in China are subsiding. Investors should remain cautious and monitor the evolving situation closely.

Also read: SoFi Stock Faces Early 2024 Challenges but Holds Promise for Growth