The Fisker Stock (NYSE: FSR) is rising in today’s US premarket price action as the company reported that its first SUV, the Ocean, got an integrated WLTP range of up to 707 km, making it the highest-range all-electric SUV in Europe.

According to the manufacturer, a single charge might allow the Fisker Ocean Extreme to go from Paris to Frankfurt or London to Glasgow.

While announcing a range of 630 km for the model, FSR stated during the company’s Q4 2022 earnings call last month that it anticipates it to be “near to 700” but would need approval from the agencies to openly declare so.

The stock is up almost 5% in today’s premarket as a result of the announcement, which has been well received by the markets.

Significantly, a longer range can encourage greater EV adoption by reducing range anxiety, the concern some drivers have that their car might run out of power in the middle of a journey.

Companies like Tesla have made investments in the charging network, which gives them a competitive edge. In the world, Tesla is the company that sells the most battery electric vehicles.

Also read: How To Buy Tesla Shares

Fisker Stock Increases Following Ocean SUV Range Announcement

While the Fisker stock is currently trading higher, it is important to keep in mind that simply having a wider range does not necessarily translate into more sales. Lucid Motors is a prime example of this, as despite having the highest range in the US, sales of its luxury Air sedan have declined.

Lucid Motors estimates that it will only be able to produce 10,000–14,000 cars in 2023, which is fewer than its anticipated capacity and less than one-third of the initial forecast it gave before going public in 2021.

Another way the corporation hinted at the lackluster demand was by admitting that it needs to raise brand recognition in order to boost sales.

Whereas Rivian predicted a production of 50,000 cars in 2023, Fisker intends to create over 42,000 cars, which is more than four times as many as Lucid Motors and only slightly fewer than Rivian.

While this is going on, Rivian’s market cap is comparable to the cash firm has on hand, which some analysts view as a sign of undervaluation.

FSR anticipates positive gross margins

FSR stated that it can potentially become EBITDA positive and anticipates 2023 gross margins between 8 and 12% at the Q4 2022 earnings call.

If the business is successful, it will be a major accomplishment because Rivian and Lucid Motors, for example, still have negative gross margins, and the former only intends to turn a profit in 2024.

Nonetheless, these companies also have different business models. Rivian and Lucid are establishing their own manufacturing facilities, following Tesla’s lead, but Fisker has chosen third-party manufacture.

While Foxconn produces the upcoming car PEAR at the Lordstown plant that it purchased from Lordstown Motors, Magna is constructing the Ocean SUV for FSR. Contract manufacturing for EVs appeals to Foxconn greatly, and the company eventually wants to produce vehicles for Tesla.

Moreover, Foxconn and Saudi Arabia have established a joint venture to manufacture electric cars there.

Budget electric vehicle Fisker PEAR

Fisker plans to sell PEAR for a very reasonable starting price of $29,900. Recently, Volkswagen introduced a cheap electric vehicle, and Tesla is reportedly considering one. EV prices have already decreased over the past few months as a result of price cuts from companies like Tesla, Xpeng Motors, and Ford, which have stoked concerns about a possible pricing war.

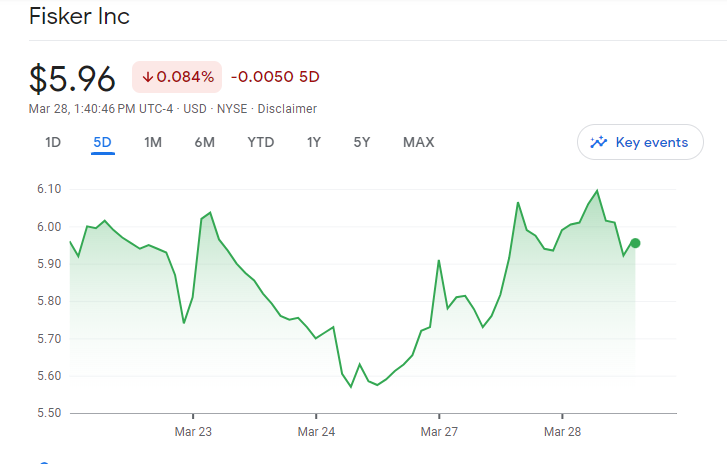

Markets are currently optimistic about Fisker’s prospects with the debut of Ocean’s range. While there has been a bloodbath in the EV startup sector, FSR stock has held up reasonably well and currently trades at just around $6.

Since markets were concerned about their ability to execute, many other EV names, like Canoo, dropped below $1.