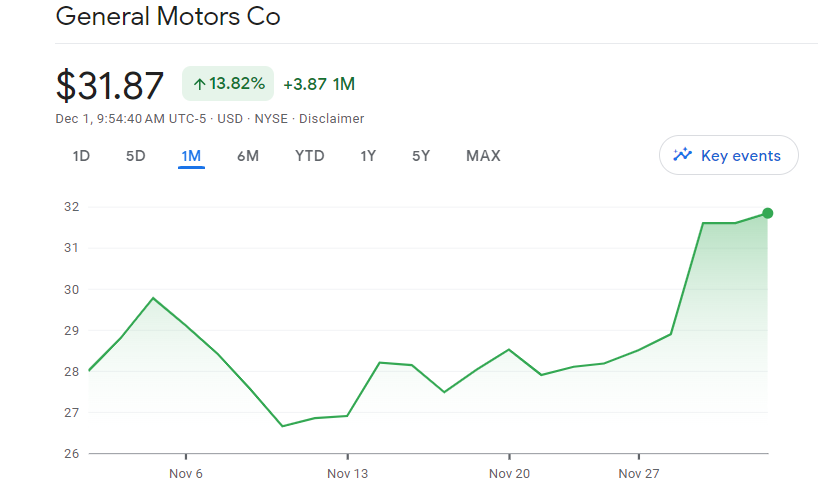

General Motors shares have recently surged, capturing the attention of investors and industry observers alike. The automotive giant made headlines with a bold announcement of a $10 billion share buyback program and a substantial increase in dividends, triggering a remarkable 13.8% climb in its share value.

As General Motors takes center stage with one of the most aggressive buyback plans in recent memory, it propels the company into a critical juncture, prompting a closer examination of the implications for shareholders, labor relations, and the broader automotive landscape.

The Bold Move:

GM’s announcement of a $10 billion accelerated share repurchase program and a substantial dividend increase has sparked both enthusiasm and skepticism. The stock market responded positively, with General Motors shares surging as much as 13.8%, but a deeper analysis reveals a more complex narrative.

The $10 billion buyback, expected to be completed by the end of the year, is particularly noteworthy. This move, one of the most aggressive buyback plans in recent memory, could potentially see GM repurchasing about 17% of the company in a short time frame. The company aims to further solidify its commitment to shareholders, signaling confidence in its financial position.

Optics and Timing:

However, the optics of GM’s decision are questionable, especially in the wake of the UAW strike. During the strike, GM management warned of financial challenges, leading to a lowered guidance for the next year. The subsequent announcement of a significant stock buyback and dividend increase has raised eyebrows, potentially intensifying the rift between management and workers.

The timing of this move, coming on the heels of lowered guidance and amidst ongoing labor negotiations, raises questions about the company’s sensitivity to its workforce and broader stakeholders. The decision to allocate substantial funds to shareholder returns immediately after a labor dispute may be perceived as insensitive and self-serving.

Should you buy or sell General Motors shares?

The buyback move, however, seems to contradict the earlier narrative of financial strain during the strike, raising questions about the timing and implications of such a shareholder-focused decision.

Firstly, the optics of GM’s announcement are questionable. At a time when the company is still dealing with the aftermath of the UAW strike, the decision to lower next year’s guidance and then promptly initiate a substantial stock buyback and dividend increase appears insensitive and self-serving. The $9.3 billion markdown attributed to the strike is overshadowed by the subsequent $10 billion added to the buyback program and a 33% increase in dividends. This move not only contradicts the earlier warnings of financial hardship but also risks intensifying the divide between management and workers, fueling the UAW’s arguments regarding wage stagnation and executive compensation.

Furthermore, there are unsettling business ramifications to GM’s choice. Electric vehicles (EVs) are experiencing a seismic shift in the automotive industry, and GM, like other traditional manufacturers, must manage this transition. But GM’s declaration implies that short-term shareholder gains should take precedence over long-term strategic planning, rather than dedicating resources to address this industry-wide dilemma. Concerns concerning the company’s dedication to innovation and adaptability in the face of changing market conditions are raised by the reduction in spending on the robotaxi business.

Returning value to shareholders is a commendable practice, but timing is crucial. GM’s move comes at a time when the company should be allocating resources to confront the challenges posed by the rise of EVs. Whether through developing their own electric vehicles or adjusting to a potential decline in traditional vehicle sales, GM’s decision to allocate significant funds to stock buybacks and dividends raises questions about their strategic vision and preparedness for industry disruptions.

Although the announcement of the buyback caused the stock market to react favorably at first, with General Motors shares rising in premarket trade, it is still unclear what the long-term effects will be. The sudden increase in the price of General Motors’ stock might be an alluring way out for investors who have survived this year’s market downturns. The sustainability of any prospective recovery is, however, clouded by the larger consequences for GM’s brand, future labor talks, and strategic preparedness for the EV era.

Where Will General Motors Be in 5 Years?

Examining the next five years for General Motors requires an understanding of the broader challenges the company faces. General Motors shares have declined by 21% over the past five years, reflecting a shift in investor sentiment towards pure-play electric vehicle companies like Tesla. Also read: Tesla Share Price Prediction: Navigating the Road Ahead.

Labor issues, recently addressed through a tentative agreement with the UAW, may impact margins, adding to the challenges posed by high-interest rates and the expensive transition to electric vehicles. The company’s third-quarter earnings show a mixed picture, with the traditional internal combustion engine business facing headwinds as GM pivots towards electric vehicles and mobility technology.

GM’s low forward price-to-earnings (P/E) multiple of 4.3 makes it attractive to value investors seeking dividends and share buybacks. However, concerns about profitability and cash flow, coupled with industry volatility and increased production costs due to a unionized workforce, suggest that GM shares may underperform over the next five years.

Conclusion:

In conclusion, General Motors shares find itself at a crossroads, navigating challenges from both internal and external fronts. The bold share buyback and dividend increase may offer short-term gains, but the long-term consequences hinge on GM’s ability to address the seismic shifts in the automotive industry.

The company’s strategic vision, adaptability to EV trends, and sensitivity to stakeholder concerns, especially in the aftermath of labor disputes, will determine its trajectory. Investors must weigh the immediate market response against the broader implications for GM’s reputation, labor relations, and preparedness for the electric future.

As GM bets on itself with an aggressive buyback, the outcome remains uncertain, and only time will reveal whether this move was a masterstroke in a challenging industry landscape or a short-sighted decision with lasting repercussions.